Summary:

- Amazon.com, Inc.’s excellent position is revealed in the Federal Trade Commission suit, which highlights the unique considerations that position Amazon well against other retailers.

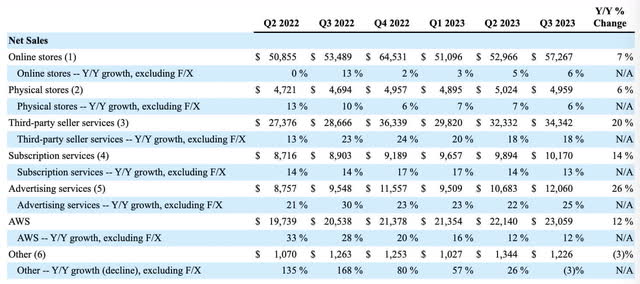

- The advertising segment has the highest Q3 2023 year-over-year growth at 26%, and 3P retail also shows significant growth at 20%.

- Amazon Web Services’ operating income has improved dramatically, and its potential for high margins in the future makes it a valuable asset for Amazon.

Lawrence Glass

Introduction

Per my August article, Amazon.com, Inc. (NASDAQ:AMZN) is lowering the cost to serve in their U.S. retail businesses as fulfillment and transportation are transitioning from a single national network to regional networks. This is one of many ways in which Amazon is laying down the groundwork for the days ahead. My thesis is that Amazon is in an excellent position which enables them to excel in the future as they allocate capital to the right segments.

Excellent Position Revealed By The Federal Trade Commission (“FTC”) Suit

The FTC filed a suit on September 26th which reveals Amazon’s excellent position. I like to reference the updated filing from November 2nd as it has fewer redactions than the original version. The FTC suit explains how online superstores like Amazon offer shoppers a unique set of features which position them nicely against other forms of retail:

1. A single destination for shoppers to browse a large and diverse selection of goods.

2. Open 24/7.

3. Purchases can be made from anywhere.

4. Filtering and discovery tools.

5. Detailed product info including user reviews.

6. Familiar and convenient checkout.

7. Convenient and consolidated post-purchase experience.

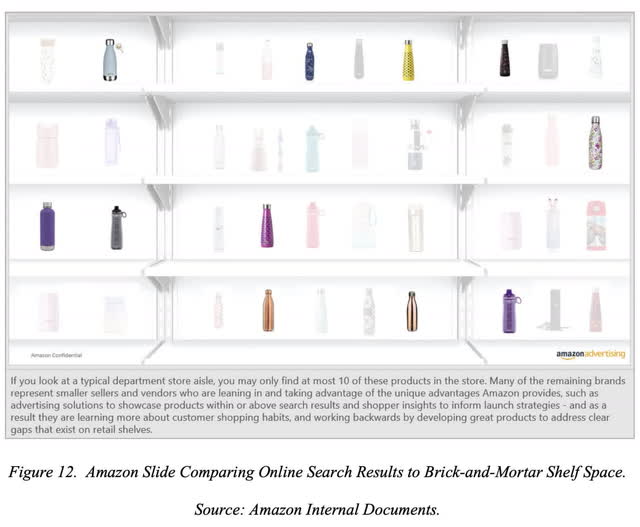

Supporting #3 above, the FTC suit goes on to say 126 million people in the U.S. visit Amazon from a mobile device each month while “only” 42 million do so on a desktop computer. Regarding #1 above, shelf space is unlimited online whereas offline retailers have to curate due to limited space. Per the suit, 92 million unique products were sold to U.S. consumers in 2020. The suit cites an internal presentation which illustrates what is seen at Amazon as opposed to typical department stores:

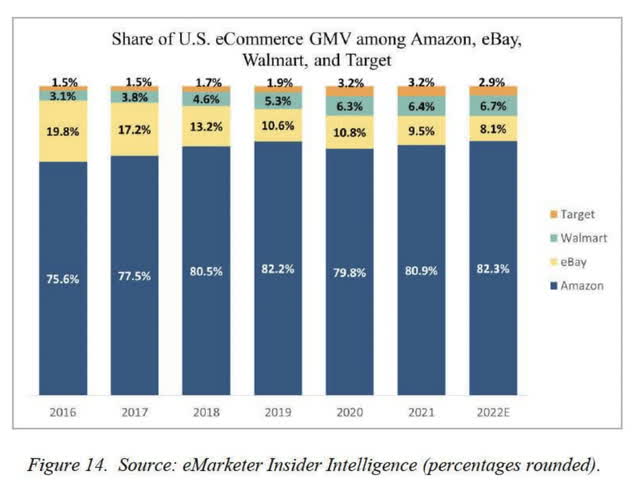

Multiple sources show Amazon’s advantaged position with respect to online gross merchandise volume (“GMV”) in the U.S., although there can be some slight differences depending on factors such as whether groceries are included. The FTC suit shows a graph from eMarketer which lets readers visualize the way Amazon’s share has increased while eBay Inc.’s share (EBAY) has decreased:

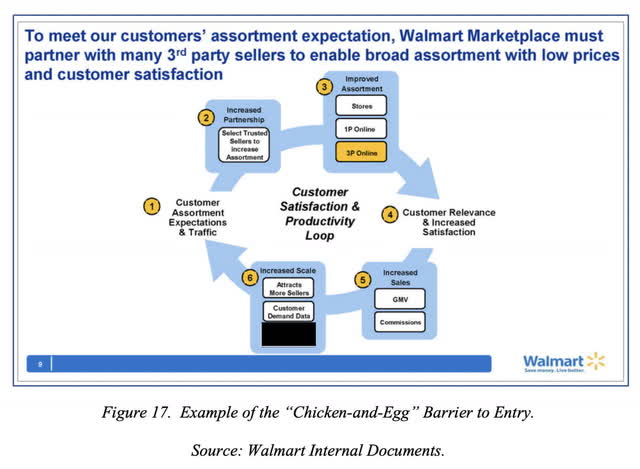

Per the FTC suit, Fulfillment by Amazon (“FBA”) fulfilled more than 5.5 billion units in 2020 which would average out to nearly 17 boxes for every person in the U.S. The suit references a Walmart Inc. (WMT) presentation which shows their productivity loop increasing GMV and scale, but it is the Amazon flywheel which has been successful in making these increases for many years:

The FTC suit explains how Amazon is well-positioned in terms of keeping prices reasonable. Originally Amazon had contractual requirements which barred sellers from undercutting prices with other channels. These requirements were removed in Europe after regulators looked into things and the requirements were also removed in the U.S. in 2019. Despite the lack of contractual control, Amazon can still make sure prices on their site are fair because they incentivize sellers to act rationally and remain eligible for the “Buy Box” position in the online store:

Amazon knocks these sellers out of the all-important “Buy Box,” the display from which a shopper can “Add to Cart” or “Buy Now” an Amazon-selected offer for a product. Nearly 98% of Amazon sales are made through the Buy Box and, as Amazon internally recognizes, eliminating a seller from the Buy Box causes that seller’s sales to “tank.”

Q3 2023 Results And Future Outlook

The segment revenue numbers from the Q3 2023 release show substantial year-over-year (“Y/Y”) increases with advertising and 3P retail:

Segment revenue (3Q23 release)

The advertising segment has the highest Y/Y change at 26%. Amazon started breaking out ad revenue in Q4 2020, and because they show 6 quarters in their releases, we know Q3 2020 ad revenue was $4,982 million. It has climbed prodigiously, up to $12,060 million for Q3 2023. Per the FTC suit, advertised items at Amazon are 46 times more likely to be clicked on compared to non-advertised items, and Amazon ads reach 96% of all Americans between the ages of 25 and 54 each month. AI can definitely make the ad platform more efficient in the years ahead. This tweet made me chuckle when thinking about how much better AI can make the ad experience with respect to things like weekly recommendations:

Amazon advertising (X/Twitter)

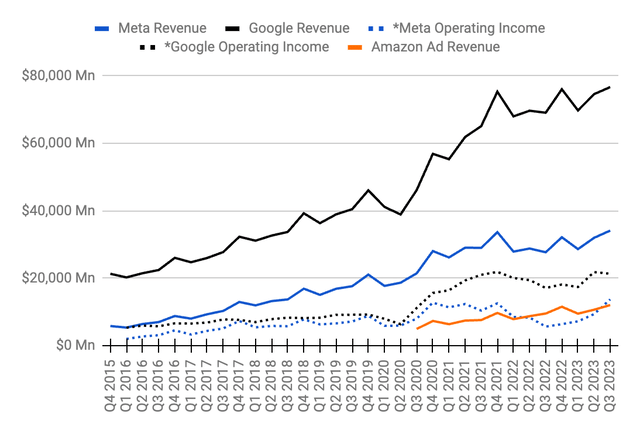

Most of the revenue for Alphabet Inc. (GOOG, GOOGL) and Meta Platforms, Inc. (META) comes from advertising, and Amazon’s latest quarter had more ad revenue than what was reported at Meta/Facebook for 3Q17:

Amazon ad revenue (Author’s spreadsheet)

I like showing the operating income figures along with the revenue above for Google and Meta because they illustrate the potential for high margins in the ad segment.

After advertising, the next highest segment for Amazon in terms of Y/Y growth is 3P retail which came in at 20%. The WSJ shows the way in which Amazon’s shipping speed has improved over the years and this is one of the drivers behind 3P revenue growth:

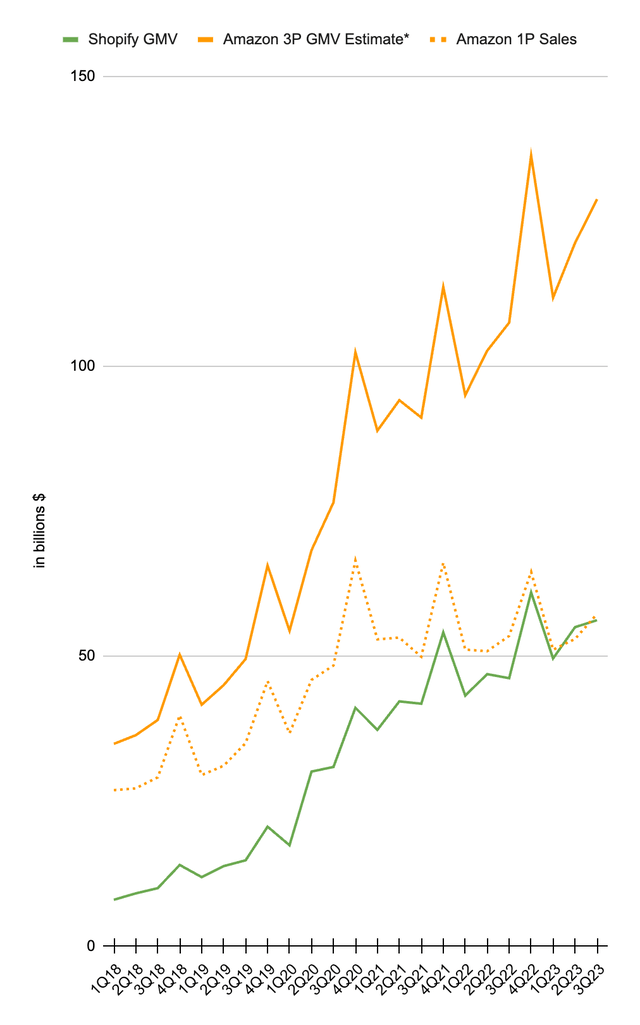

Per the suit, Amazon fulfilled almost 92% of all 3P and 1P orders in 2021. As for delivery, Amazon has contracts with third-party delivery companies but they now make more deliveries themselves in the US than any other company. 3P is clearly a higher priority than 1P retail whose Y/Y growth was only 7%. The apex for Amazon 1P retail was 4Q20, a quarter where the revenue figure reached $66.5 billion. Meanwhile, 3P revenue moved up nicely from $27.3 billion in 4Q20 up to $34.3 billion in 3Q23, and I estimate 3P GMV to be about 3.75 times revenue:

Amazon GMV (Author’s spreadsheet)

The FTC suit says there were over 560,000 active sellers on Amazon’s 3P U.S. marketplace as of 1Q21.

One of the reasons I think Amazon is focusing on 3P as opposed to 1P is because 3P allows hundreds of thousands of local sellers to increase efficiency whereas 1P requires central planning which can be inefficient with respect to considerations such as inventory. The FTC suit says the 3P marketplace accelerated Amazon’s growth by allowing the expansion of products without the risk of unsold inventory as 3P sellers ultimately bear that risk. The FTC suit reminds us that 3P sellers have gone up from 55% of unit sales in 2021 to 60% in 2Q23, and it notes that 3P sellers offered more than 80% of the unique items available for sale in 2020. The Capitalist Manifesto book by Johan Norberg @johanknorberg criticizes central planning with respect to countries and we know the dollar amount of goods sold through Amazon’s U.S. online store in 2021 is larger than the GDP of 145 countries per the FTC suit. Here are Norberg’s words on the problems with central planning:

No one in central authority can know whether it is better to direct a little more steel to containers or to refrigerators, or whether the salary for chemists who develop pheromones is reasonably high, or whether it is better to manufacture more powerful tractors at a higher price, or smaller, cheaper models. No bureaucrat can know if it’s worth experimenting with a lid on the cardboard mug that lets through a little more aroma, or how much the lifting of bags of beans should be automated. We can only test different solutions, observe the results, learn from them, and adapt. The free market is based on Socratic wisdom – that the most important thing is to be aware of what we do not know.

[The Capitalist Manifesto Kindle Book Location: 814.]

AWS Valuation

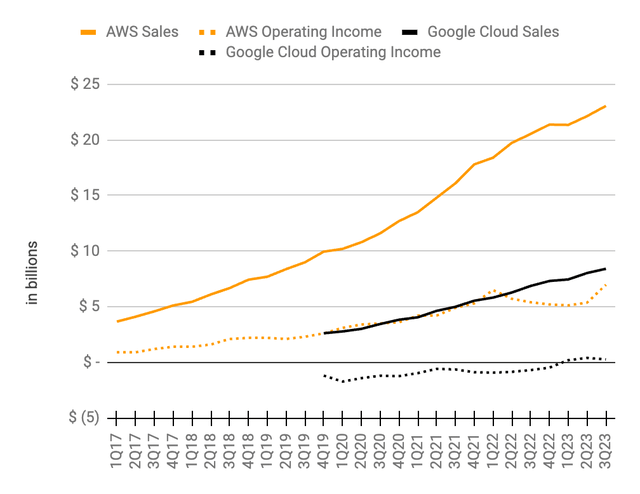

I like to do a sum of the parts valuation because AWS is disparate from the other segments. AWS had 12% Y/Y revenue growth but it was the operating income which improved dramatically in 3Q23, coming in at $6,976 million as opposed to just $5,365 million for 2Q23 and $5,403 million for 3Q22:

AWS operating income & sales (Author’s spreadsheet)

I believe Amazon Web Services (“AWS”), Microsoft Corporation (MSFT) Azure, and Google Cloud are all well positioned to harness AI in order to boost both operating income and revenue in the years ahead. CEO Andy Jassy said he is very optimistic in the 3Q23 call, saying the very substantial gigantic new generative AI opportunity should add tens of billions of dollars to AWS over the next several years: (emphasis added):

Again, I have seen a lot of different numbers publicly. It’s really hard to measure apples-to-apples. But in our best estimation, the amount of growth we’re seeing in the absolute amount of generative AI business we’re seeing compares very favorably with anything else I’ve seen externally. So I think that you can see that in the deals that we’re doing, too.

Later in the 3Q23 call, CEO Jassy singled out Bedrock as having early resonance and traction on the AI side, saying it makes it easier to get generative AI applications built:

And so Bedrock just takes so much of the difficulty out of those decisions in those variables that people are very excited about Bedrock. They’re using it in a very broad way. They’re extremely excited about not just the set of models in there. But if you look at a leader like Anthropic, and the ability for our customers in Bedrock to have exclusive early access to models and customization tools and fine-tuning which gives them more control. There’s just — there’s a lot of buzz and a lot of usage and a lot of traction around Bedrock. I would also say our chips, Trainium and Inferentia, as most people know, there’s a real shortage right now in the industry and chips, it’s really hard to get the amount of GPUs that everybody wants. And so it’s just another reason why Trainium and Inferentia are so attractive to people. They have better price performance characteristics than the other options out there, but also the fact that you can get access to them. And we’ve done, I think, a pretty good job providing supply there and ordering meaningfully in advance as well. And so you’re seeing very large LLM providers make big bets on those chips. I think Anthropic deciding to train their future LLM model on Trainium and using Inferentia as well is really a statement. And then you look at the really hot start-up perplexity.ai, who also just made a decision to do all their Trainium and Inferentia on top of Trainium and Inferentia.

A recent WSJ article by @IsabelleBiscuit says AWS is opening a New York City “Builder Studio.” I believe AWS will continue to find new ways like this to increase operating income and revenue. Per the 3Q23 release, AWS had elevated 3Q23 operating income of $6,976 million on revenue of $23,059 million for a much improved margin of 30%. Annualized operating income is $27.9 billion and I think AWS is worth 20 to 25x this amount, implying a range of $560 to $700 billion when rounding to the nearest $5 billion.

Non-AWS Valuation

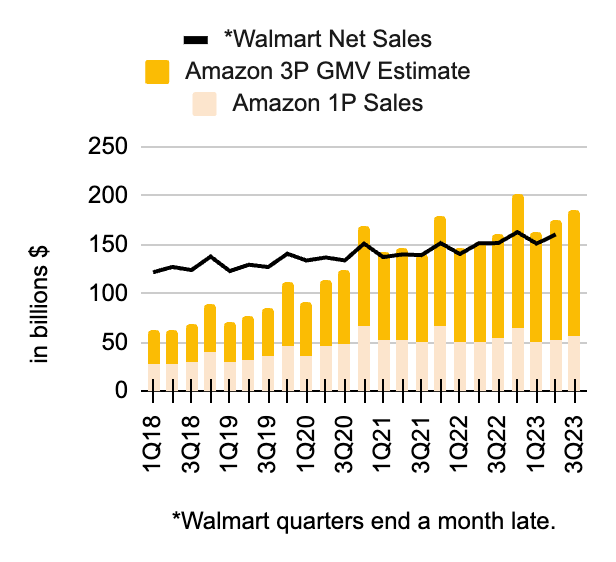

Amazon already moves a little more volume through their online 3P and 1P stores than all of Walmart Inc. (WMT), and I expect Amazon to continue having a higher growth rate in the future:

Amazon vs Walmart (Author’s spreadsheet)

A substantial majority of Walmart’s sales above are in-store, and the FTC suit illustrates the challenges for retailers like Walmart in terms of switching to an online mindset:

Amazon’s CEO, Andy Jassy, has publicly emphasized that “the things you think about in physical retail” from an operational perspective, like “lighting,” “parking,” and “physical merchandising,” are “radically different things than you think about in an online retail environment where technology is really driving the entire experience.”

Amazon is better positioned for the future than Walmart and the FTC suit says Amazon’s U.S. 3P marketplace is “enormously” profitable:

Sellers have also made the Marketplace enormously profitable for Amazon. Amazon’s internal documents show that profits from its U.S. Marketplace totaled more than [redacted] in 2021 – nearly [redacted]% of its total reported net income for that year.

We don’t see the U.S. numbers itemized in public filings but we do know Amazon’s North America segment had 3Q23 operating income of $4,307 million on revenue of $87,887 million. This compares to quarterly operating income of $7,316 million on revenue of $161,632 million for all of Walmart in the period through July 2023. Despite my frustrations with Amazon’s International segment, I think the non-AWS segments of Amazon are worth about two Walmarts. The 10-Q for Walmart through July shows 2,691,563,850 shares as of August 30th. Multiplying by the November 10th share price of $166.20 gives us a market cap of $447 billion. As such, I believe Amazon’s non-AWS segments are worth $895 billion when rounding to the nearest $5 billion.

Overall Valuation

$895 billion non-AWS.

$560 to $700 billion AWS.

———————————–

$1,455 to $1,595 billion total.

Per the 3Q23 10-Q, there were 10,334,030,586 shares outstanding as of October 18th. Multiplying by the November 10th share price of $143.56 gives us a market cap of $1,481 billion. The market cap is near the lower end of my valuation range and I think the stock is a buy for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG, GOOGL, META, MSFT, TSM, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.