Summary:

- Amazon could be summarized with one word: leader. Leader of e-commerce and cloud space. Both worlds facilitate its top-tier business model. However, competition from MS Azure is rising.

- The Company once again proves its effectiveness in navigating a relatively harsh consumer environment and keeps on growing the revenue scale even when faced with noticeable ASP contraction.

- The dynamic rise of generative AI tools demands substantial computing power, driving the AWS market.

- On top of that, AMZN’s valuation is detached from its long-term ability to generate cash flow. Amazon is not ‘overvalued’ as many claim – here’s why.

- Amazon has already proven its cash flow generation potential, but I believe that the best is yet to come.

hapabapa

Amazon (NASDAQ:AMZN) doesn’t need an introduction. It is the king of e-commerce, the leader in cloud computing, and the ever-growing marketplace. The ‘Earth’s Most Customer-Centric Company’.

Each title applies. I’ve been an Amazon shareholder for quite some time and have been amazed by the numerous voices stating that the Company is overvalued, a ‘sell’, or failing to meet expectations.

From time to time, it’s worth taking a step back and reviewing whether the investment thesis has changed, either through the business financials, strategy, model, or valuation. That’s what we’re going to do today; enjoy the read!

Cloud Computing Innovator With Leadership Position

Revolutionary beginnings set the ground for robust growth

Let’s kick it off with the segment that provided the highest growth dynamic out of all AMZN’s operating segments – Amazon Web Services (AWS).

Whether you’re looking for generative AI, compute power, database storage, content delivery, or other functionality, AWS has the services to help you build sophisticated applications with increased flexibility, scalability, and reliability

AWS has the leadership position (globally) as the most complete cloud platform with over 200 services, facilitating the resignation from on-premise devices for millions of customers. AWS offers computing power, storage, databases, security, machine learning and AI features, as well as broad developer, content delivery, and networking tools.

When the platform launched in 2006, it proved highly innovative, being the most advanced solution of that time. AWS revolutionized the industry with:

- highly scalable and flexible infrastructure

- pay-as-you-go pricing model, allowing customers to pay just for the computing power they used

- easily expandable outreach (from a geographical perspective) – AWS quickly expanded and gained market share abroad

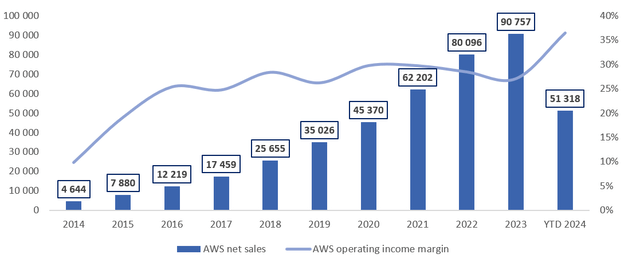

Amazon’s efforts to provide the best possible features and tools through its AWS environment proved effective, as they are reflected in the robust sales growth. Since 2014, AWS recorded a 23% revenue CAGR, growing from $4.6B to nearly $90.8B in 2023 and $51.3B in 2024 YTD. It’s also worth mentioning that AWS proved to be by far the most profitable segment from the operating income margin perspective, reaching 37% margin in 2024 YTD. Please review the chart below for details.

AWS has the highest market share, with only one serious challenger

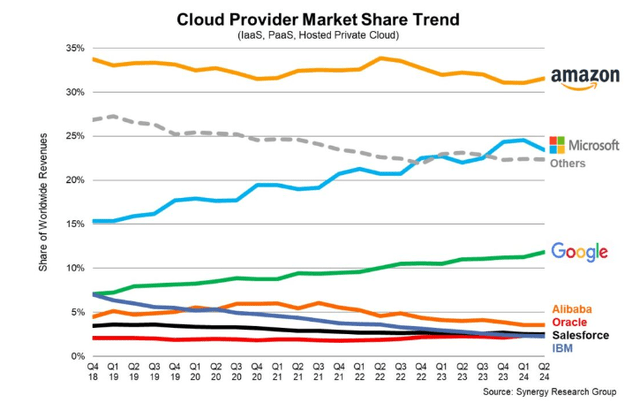

According to Synergy Research Group, AWS remains the leader in the cloud computing landscape, with an outstanding market share exceeding 30%. However, one can’t ignore the fact that Microsoft’s (MSFT) Azure keeps on dynamically increasing its market share and has the potential to overthrow AWS:

Although Microsoft’s Azure is not the global leader in cloud services, it can certainly be considered a strong challenger with the potential to overthrow Amazon’s AWS, as MS Azure has regularly gained market share since ~15% in Q4 2018 to close to ~24-25% in 2024 YTD.

Nevertheless, the cloud industry keeps on recording dynamic growth rates, so there will be more than enough room for AWS even with the more prominent development of MS Azure, which (perhaps) will benefit more from the ongoing AI boom.

Regardless, the whole industry shows growth, picking up its pace since a modest slowdown in Q2-Q3 2023, thanks to the dynamic rise of generative AI tools that demand substantial computing power. With MSFT certainly leading the way in this area, Amazon is not sleeping on the AI revolution.

As Amazon states, over 100,000 customers chose AWS or its AI features. AMZN’s investment orientation around generative AI has been pretty evident, as the Company launched twice as many ML (machine learning) and generative AI features into its AWS environment as other major cloud providers.

We remain very bullish on the medium to long-term impact of AI in every business we know and can imagine. The progress may not be one straight line for companies. Generative AI especially is quite iterative, and companies have to build muscle around the best way to solve actual customer problems. But we see so much potential to change customer experiences.

Amazon: The E-commerce King. The Core Business Keeps on Growing

What I really like and have always liked about Amazon’s core business (e-commerce and retail operations), which is divided into two operational segments (North America and International), is its ‘flywheel’ characteristics.

What do I mean by that? First, let’s mention some of Amazon’s key revenue sources derived from North America and International segments:

- Seller fees (incl. referral, subscription, advertising fees)

- First-party sales – Amazon also operates through the Amazon Vendor channel. AMZN buys merchandise in bulk from other entities and then sells it through its own profile as a reseller

- Warehouse fees

- Logistics services

- Currency conversion fees

- Amazon Prime Membership

- etc.

Let’s return to the ‘flywheel’ comparison. I believe that the development of each area of AMZN’s marketplace environment facilitates the development of other revenue sources. For example, the more sellers you have on the platform, the more fees related to sales, advertising, logistics, etc. Amazon will generate. The broader the offer, the more consumers will be attracted to using Amazon in their day-to-day shopping experience, increasing Amazon’s negotiating position and the demand from sellers to operate on the platform. That goes on and on.

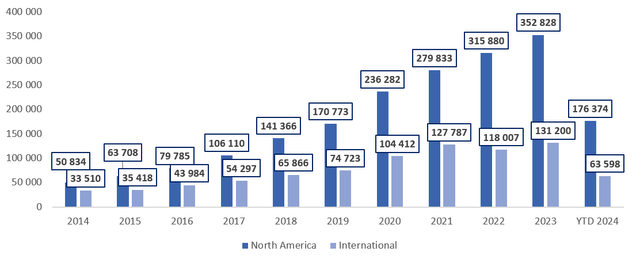

That’s how Amazon keeps on delivering double-digit growth rates within both segments and recorded CAGR of 20% and 15% (during the 2019 – 2023 period) in its North America and International segments, respectively. Please review the chart below for details.

Recent developments – lower ASP, higher unit sales, higher profitability

Amazon remains the unchallenged leader of e-commerce. The world of online sales is characterized by high price elasticity (as consumers have ‘one-click’ access to the pricing data across the market) and a focus on fast deliveries. Amazon doesn’t fail to deliver on both fronts.

For instance, in 2023, AMZN increased same-day or overnight deliveries by 65% (based on item count). While this may not seem like a major factor contributing to AMZN’s business to some investors, it allows Amazon to ensure consumers’ loyalty by providing them with the utmost convenience and secure substantial growth within everyday-use products that rely on such a quick delivery time.

At the same time, Amazon concentrated its efforts on optimizing the cost-to-serve metric, which decreased by $0.45 per unit in the US in 2023 (the first time since 2018).

Lowering cost-to-serve allows us not only to invest in speed improvements, but also afford adding more selection at lower average selling prices or ASPs and profitably.

We have a saying, that it’s not hard to lower prices, it’s hard to be able to afford lowering prices. The same is true with adding selection, it’s not hard to add lower ASPs selection, it’s hard to be able to afford offering lower ASPs selection and still like the economics.

While 2024 brought some issues, the Company has a positive outlook on these trends, especially given the fact that it recorded 9% growth y/o/y in the North America segment and 10% in the International segment. The most prominent ‘issues’ were:

- lower average selling prices (ASP), as customers keep looking for value in their shopping journeys

- seller fees below expectations due to the response to the recent fee changes

Nevertheless, AMZN remains optimistic, as the lower ASP is somewhat offset by substantial unit growth due to Amazon’s focus on broad, low-price selection and delivery. Moreover, the Company keeps its eyes on lowering the cost-to-serve ratio:

We have a number of opportunities to further reduce costs, including expanding our use of automation and robotics, further building out our same-day facility network, and regionalizing our inbound network. With more optimal inbound inventory placement, we expect to enable faster speeds, consolidate more orders in one box, and reduce inventory transfers once items reach a fulfillment center.

(…)

As we lower our cost to serve, we can add more low ASP selection that we can support economically, which coupled with our fast delivery, puts Amazon in the consideration set for increasingly more shopping needs for customers.

Amazon: ‘Future’ Cash Flow Beast?

I put the word ‘future’ in quotation marks, as Amazon has already proved its ability to generate cash flows. However, I believe its true potential still lies ahead, as its profitable AWS segment keeps growing its share in its total revenue, and AMZN takes many initiatives to improve its profitability in the e-commerce business (which has already been evident with improved operating margins in 2024).

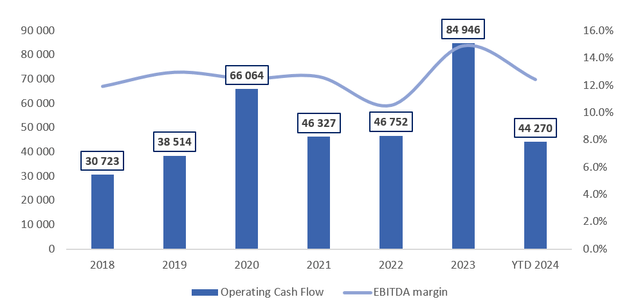

AMZN’s EBITDA margins, typically 12-13%, facilitate its cash flow generation potential, which drives operating cash flows. It’s worth recognizing how the operating cash flow increased in 2023 and is likely to reach even higher in 2024. Please review the chart below for details.

Let’s remember that AMZN realizes significant capital expenditures (CAPEX), which I believe will support its future business and cash flow potential. However, its substantial CAPEX weighed down on its free cash flow, as operating cash flow wasn’t always enough to finance AMZN’s investments. Despite spending as much as $48B in 2023, the Company recognized $36.8B of free cash flow.

Amazon’s cash flow generation has certainly shifted in a positive direction, and I believe that’s due to the significant investments realized in previous years. With so much more to be attained thanks to Amazon’s cutting-edge approach within this ever-changing environment, I can only believe that the cash will keep on piling up.

The Company intends to invest over $60B in total during 2024, as it has announced during the Q2 2024 Earnings Call:

For the first half of the year, CapEx was $30.5 billion. Looking ahead to the rest of 2024, we expect capital investments to be higher in the second half of the year. The majority of the spend will be to support the growing need for AWS infrastructure as we continue to see strong demand in both generative AI and our non-generative AI workloads.

‘Amazon Is Overvalued’ – By What Standards?

As an M&A (fancy name for buying and selling businesses) advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. It allows for accessible and market-driven benchmarking.

This method comes to the rescue of investors relying too much on the stock price alone. Let me remind you that relying solely on the development of the stock price will likely mislead you, as:

- it doesn’t reflect the changes in the number of shares outstanding

- it doesn’t factor in the changes in the scale and profitability of the business

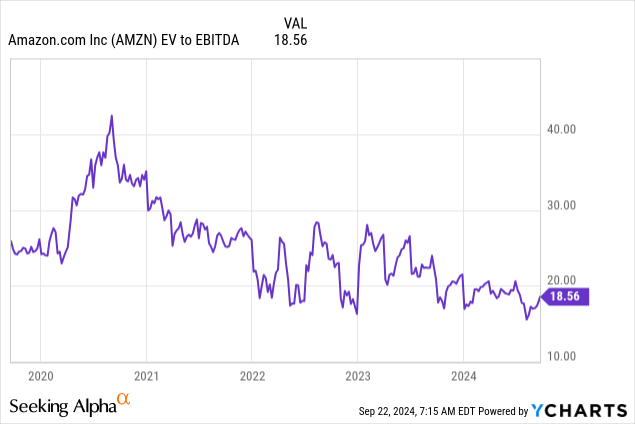

With that said, please review Amazon’s EV/EBITDA multiple (a rule of thumb for most sectors in the transactional market) development in the chart below.

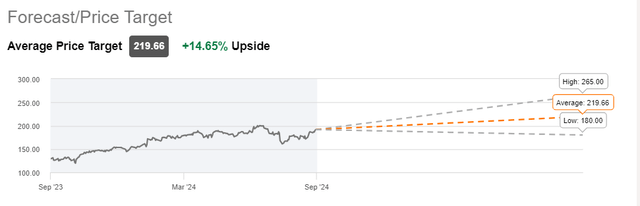

As we can see, its EV/EBITDA multiple is near its 5-year low, which doesn’t support Amazon’s overvalued thesis. Considering that its forward-looking EV/EBITDA amounts to ~15.3x, the margin of safety is quite attractive given the valuation for such a quality business.

I believe Amazon can witness the abovementioned multiple expand into the ~17.5x range, which I consider a highly realistic scenario. Such expectations somewhat align with Wall St. average expectations. Nevertheless, I am certain that Amazon has more to offer and has a double-digit upside potential resulting from the multiple expansion.

Investment Thesis and Risk Factors

The last time I added to my Amazon position was at the beginning of September 2024. I’ve had my skin in the game for a long time, and I don’t intend to change that.

Amazon is an undisputable e-commerce leader with plenty of room to grow and optimize its core business further. The Company once again proves its effectiveness in navigating a relatively harsh consumer environment and keeps on growing the revenue scale even when faced with noticeable ASP contraction. Amazon keeps its orientation on providing the best customer value, which was the approach that helped it build its kingdom in the first place. On top of that, Amazon has built a leading cloud computing environment that keeps growing, improving its profitability, and adding even more up-to-date features.

If I were to highlight some points keeping me reinvesting in Amazon:

- ongoing growth of the scale of its business

- outstanding negotiating position

- ‘flywheel’ characteristic of its core business with many revenue sources mutually supporting each other

- leadership position in the cloud space

- significant, strategic investments in the up-to-date technology related to the AI revolution and further AWS development

- already proven cash flow generation potential with much more ahead of us

With that in mind, I consider Amazon a ‘strong buy’. The Company keeps on improving its market position and business model, building on top of its outstanding infrastructure and delivering a top-tier customer experience. The stock price increases still leave AMZN’s multiple detached from its long-term ability to generate cash flow. That leaves me with a strong bullish stance and a belief that Amazon will greatly benefit its existing and new shareholders.

However, one has to keep in mind that each stock market investment is accompanied by market and company-specific risk factors, which in the case of Amazon, include:

- dependency on geopolitical tensions

- exposure to the FX development

- reliance on the technological infrastructure with any potential data leakages or blackouts significantly lowering its market stance

- the risk of below expectations effectiveness on its robust investment activity

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.