Summary:

- Amazon’s 2023 fundamental performance exceeded probably the most optimistic investor expectations.

- Although there could be short-term challenges to this, 2024 could be another exceptional year.

- Current valuation doesn’t seem to reflect this properly. This makes shares a good long-term investment opportunity at current levels despite 75% YTD rally.

Hulton Archive/Hulton Archive via Getty Images

Introduction and investment thesis

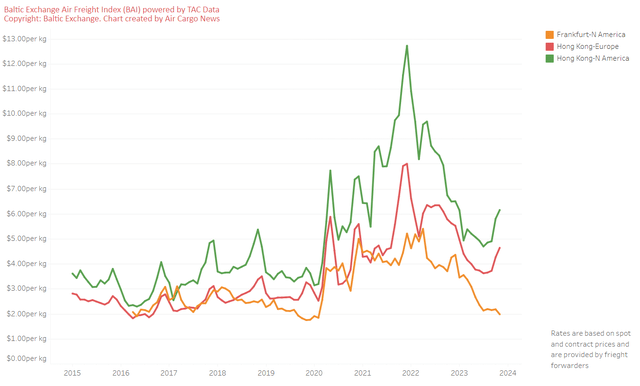

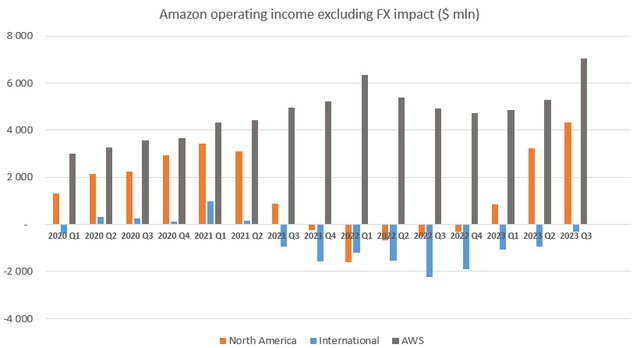

After a rough 2022, I believe Amazon (NASDAQ:AMZN) surprised even the most optimistic analysts with its 2023 bottom line performance. AWS operating income reached an all-time high in Q3, with AI-related revenue streams only in the early innings. The North America segment reached also record levels of profitability demonstrating the success of the company’s regionalization efforts in its fulfillment network. Finally, the International segment almost managed to reach breakeven after several quarters of burning significant amounts of cash:

Created by author based on company fundamentals

From the chart above I think it’s obvious that Amazon managed to demonstrate its earnings power this year, even in a somewhat fragile economic environment. The question arises: Has this trend further room to go?

In the following analysis I want provide a quick overview of the main drivers behind this trend, and examine, whether there could be more upside remaining for 2024. In general, I believe there is more to come, however, there are few important question marks, where Amazon must show more convincing performance in the upcoming quarters.

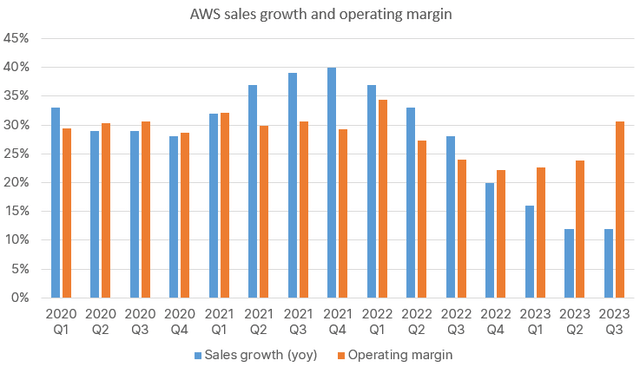

AWS margins reloaded

Amazon’s cloud business, the sole profit engine of the company through 2022 began to face growth headwinds resulting from cost optimization efforts from customers. Although based on management commentary from recent earnings calls these efforts began to recede, there is still pressure on AWS topline growth. Meanwhile, margins significantly increased over Q3 mainly resulting from headcount reduction efforts undertaken in Q2 and disciplined spending. I have summarized these important trends in the following chart:

Created by author based on company fundamentals

On the margin side, I think it was a significant positive surprise that AWS demonstrated, it can operate at 30%+ operating margin again. Management hasn’t called out any important one-offs, which is good news for the long-term. As annualized revenues of the segment slowly approach $100 billion; a 1% improvement in operating margin equals ~$1 billion in additional profits. In that light, Amazon recorded its highest ever quarterly operating income of $11.2 billion in Q3; these additional billions of dollars are quite significant.

In the case of sales growth at AWS I am not so convinced that there will be a similar quick turnaround to what investors experienced in the case of margins in the Q3 quarter. It’s good news that at a ~12% yoy growth rate the slowdown in the headline growth figure seems to come to an end. Besides, management seems also optimistic:

“And while we still saw elevated cost optimization relative to a year ago, it’s continued to attenuate as more companies transition to deploying net new workloads. Companies have moved more slowly in an uncertain economy in 2023 to complete deals. But we’re seeing the pace and volume of closed deals pick up and we’re encouraged by the strong last couple of months of new deals signed.” – Andrew Jassy, CEO on Q3 earnings call

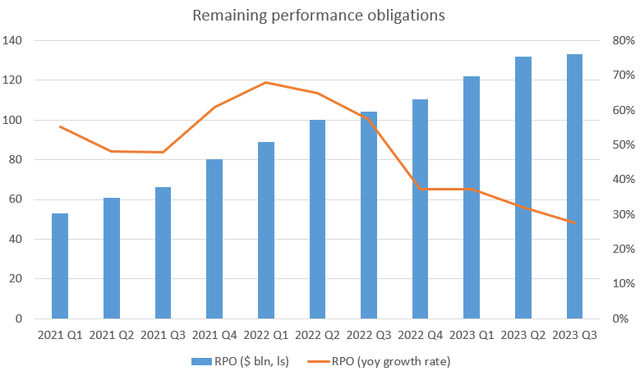

However, if we look at remaining performance obligations (RPO) at Amazon, which primarily relate to the AWS segment, it doesn’t give reason for optimism yet:

Created by author based on company fundamentals

I believe this data contradicts to the CEO’s comments to some extent, so it will be a key in the next earnings release, whether there will be a meaningful improvement on this front. I have no doubt, that the recent surge in demand for AI-based solutions like LLMs will provide a significant boost to AWS ‘s business in the close future, but investors are eager to see this in the company’s financial data. Microsoft (MSFT) managed to turn the tide in its cloud business already this quarter, so Amazon has not much time to waste.

The freshly introduced Graviton4 and Trainium2 processors are an important step in this direction. Based on management comments many AWS customers started to use Graviton chips instead of Intel or AMD chips recently enjoying the benefits of better price performance. If this trend holds, the processors used for training AI models could be an important contributor to AWS revenues in the upcoming years.

Besides, Amazon Bedrock – the unique service of AWS enabling customers building personalized AI-apps – has been made generally available to AWS customers, which should be also an important contributor to AI-related revenues in the close future. So, 2024 will be a very exciting year from the perspective of AWS, which should be visible in financial numbers sooner than later in my opinion.

Opposing forces in the Retail business

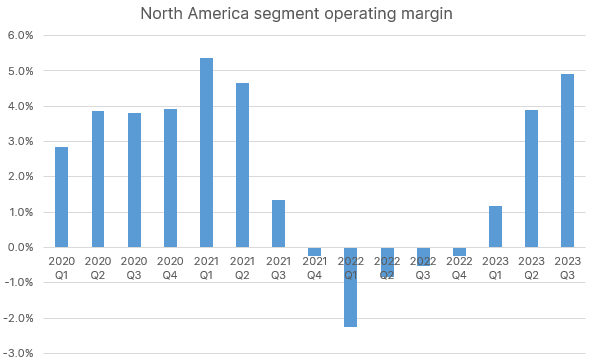

Another key element of Amazon’s 2023 turnaround has been the successful transformation of its previously centralized fulfillment network into a regionalized one. This consisted of the establishment of 8 regional fulfillment hubs, which now enable faster deliveries at lower costs than before. According to management these changes have been more efficient than thought, which can be witnessed in North America segment margins as well:

Created by author based on company fundamentals

The segment reached an operating margin of almost 5%, reaching the artificially inflated levels at the beginning of 2021, where sales jumped suddenly after the pandemic, while costs haven’t kept up with this pace for a while. As the overhaul within the fulfillment network has still more room to go this could support margins in the upcoming quarter as well.

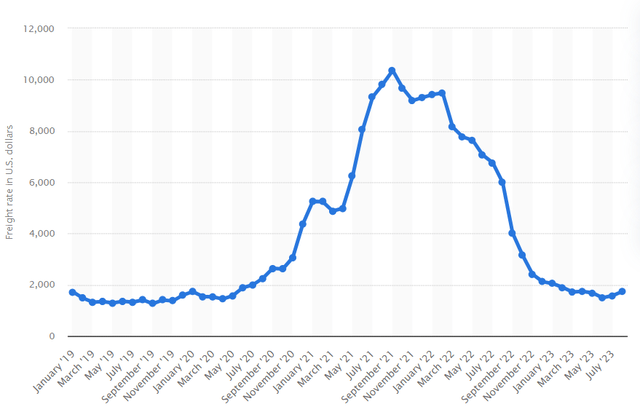

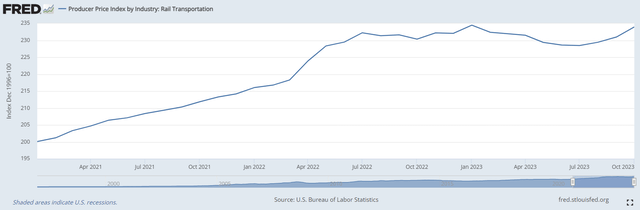

However, on the other hand inflation related costs seemed to pick up in recent months, which could offset these benefits already in the Q4 quarter. These are mostly related to different forms of transportation, here are a few examples:

- Airfreight rates

- Container freight rates

- Rail transportation prices

- Trucking prices

If these trends hold until the end of the year, I believe there won’t be another material increase in Retail margins in the Q4 quarter. So, it’s worth to follow them closely.

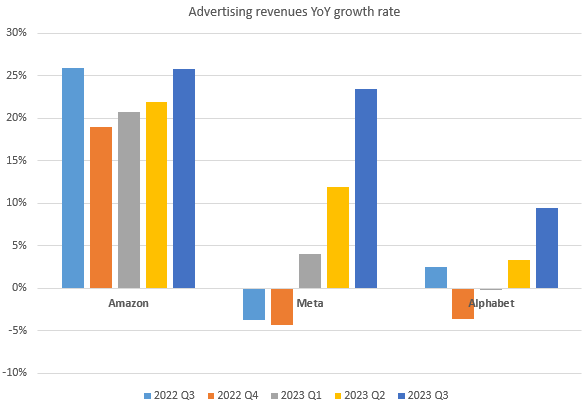

Another important segment within Retail is the performance of ad revenues, which have been consistently growing around 20-25% yoy in recent quarters. This has been especially impressive during times when great rivals struggled. However, Meta (META) and Alphabet (GOOG) (GOOGL) experienced a significant uptick in ad revenue growth rates recently, which hasn’t been mirrored by Amazon to a similar extent:

Created by author based on company fundamentals

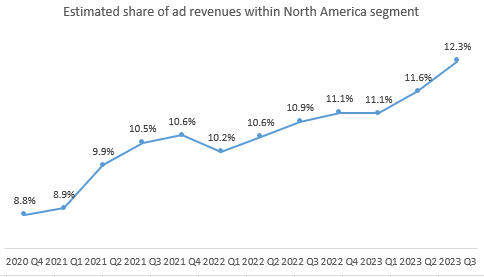

This shows that the organic growth of Amazon’s ad business is less dependent on economic cycles, which is a strong advantage during downturns. However, it seems that during upswings there is less upside, which could have been a slight disappointment for investors. Nonetheless, as long as the share of ad revenues continues to grow within the North America segment, it could provide a natural boost to margins. Based on the assumption that 90% of ad revenues are tied to the North America segment their share should be above 12% for the end of Q3:

Created by author based on company fundamentals and own estimate

If we assume that 50% of ad dollars make it to the bottom line a 1%-point increase in the share of ad revenues should equal approximately a 0.5% increase in operating margin. This should be another strong tailwind going into 2024.

Based on the information presented until this point I believe that fundamentals at Amazon have still significant room to improve even after a strong rebound during the year. The most critical risk factors to look out for in my opinion are the slowing growth in remaining performance obligations at AWS and increased pressure from cost inflation in the Retail segment.

In light of continued improvement in fundamentals I have updated my valuation framework for the company, which I want to present in the following section.

Valuation still compelling after 75% YTD rally

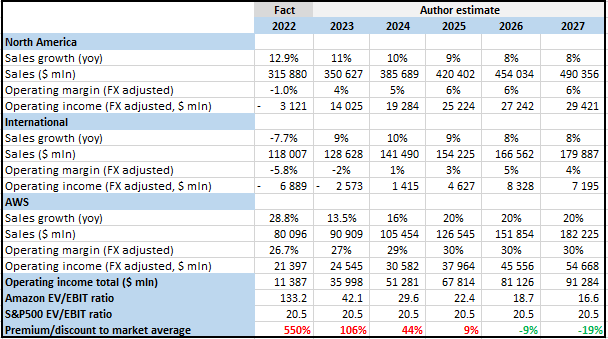

Compared to my previous valuation framework presented three months ago I want to highlight the most important changes I have made after the Q3 earnings release:

- I increased my margin assumptions for AWS from 24% to 27% for 2023 and by a further few percentage points in the following years. As Amazon demonstrated in Q3 that the company is able to reach ~30% cloud operating margin this is still a conservative assumption in my opinion.

- I decreased sales growth rates for AWS to some extent as the turnaround in cloud cost optimizations seems to take longer than I previously expected. However, as AI related revenue streams begin to increase there could be significant upside to these assumptions in my opinion.

- In case of the Retail segment, I only finetuned growth and margin assumptions slightly

After these changes my relative valuation framework looks as follows:

Created by author based on company fundamentals and own estimates

Based on 2023 estimated EBIT Amazon shares trade at an EV/EBIT ratio of 42.1, which is significantly above the ratio of 20.5 for the S&P500. However, after factoring in continuous improvement in fundamentals over the upcoming years this valuation premium almost entirely diminishes for 2025. In light of encouraging long-term fundamentals, I believe the valuation gap between Amazon and the S&P500 won’t close for 2025, a ratio of ~30 for 2025 and 2026 could be still realistic for AMZN. This would mean a ~40-60% overperformance compared to the S&P500 over a 2–3-year time horizon, which sounds compelling in my opinion.

Closing thoughts

Amazon made an unexpectedly strong comeback this year. This could continue into 2024 fueled by cost rationalization efforts and the revival of the AWS business. I believe this isn’t properly reflected in the share price providing a good long-term investment opportunity with favorable risk/reward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.