Summary:

- Amazon’s net sales show slow growth and concentration risk in its major market, North America.

- The company’s AWS business is performing well, but faces competition from Google and Microsoft in the cloud computing market.

- Amazon’s outstanding shares are increasing, impacting its profit, and its ability to dominate in new markets is a major risk.

tigerstrawberry

We are wrong. All the time. Yet, our 74% success rate has resulted in us still beating out many other analysts, according to TipRanks. Last November, we discussed how we were wrong on Amazon (NASDAQ:AMZN), switching our recommendation to a ‘BUY’. Since then, as the stock has gone up 20%, we’ve changed our recommendation.

As Jeff Bezos has sold billions of shares, we recommend selling Amazon stock, just as the CEO, Andy Jassy, also has.

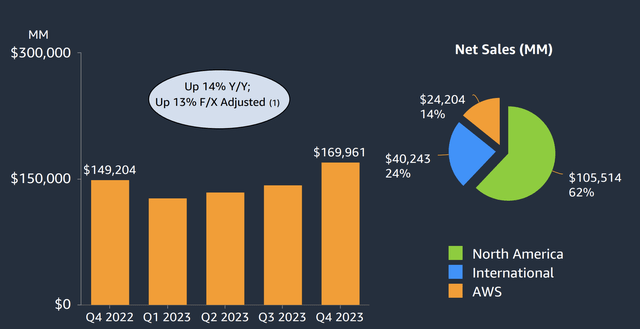

Amazon Net Sales

Amazon has worked to ramp up net sales, and the company has seen just over 10% YoY growth.

The company’s net sales of just under $170 billion were more than 60% North America, showing the company’s continued concentration risk in its most major market. That’s some of the company’s slowest growth, and while it shows a resilient portfolio, it also shows some concerns in what is an incredibly tight margined industry.

For perspective, Costco has $75 billion in sales in the same quarter, and Walmart had $105 billion in sales for the quarter, for a $320 billion and $480 billion market cap each. Those numbers of $4.3 billion market cap / $1 billion in sales for the quarter and $4.7 billion for Walmart would give Amazon a value for this business of $800 billion.

That’s ~44% of Amazon’s current market capitalization.

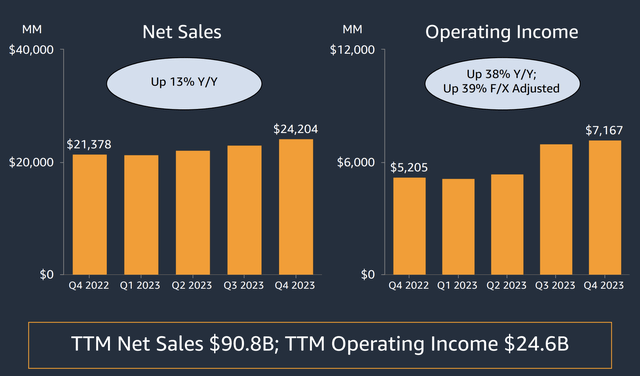

Amazon AWS

The company’s AWS business is the bright spot in operating income, with operating income up almost 40% YoY.

The company saw net sales increase to just over $24 billion on the back of strong demand. That helped operating income grow even faster. However, that’s also slower than the growth rate of cloud computing. Google Cloud, for example, saw almost 26% growth. Microsoft Azure saw 30% YoY growth. Both are taking Amazon’s lunch.

There are a few key reasons in our view. The first is Google and Microsoft compete with other tech companies. Amazon competes with the entire world of shopping across numerous product lines. Amazon competitor’s will be much less likely to utilize AWS. The second is artificial intelligence. It’s the fastest growing source of demand in computing.

Open AI is tied to Microsoft, and Google has some massive models that it’s building up. Amazon is missing from this picture without a consumer facing technology business. That will put pressure on the company’s cloud business growth going forward.

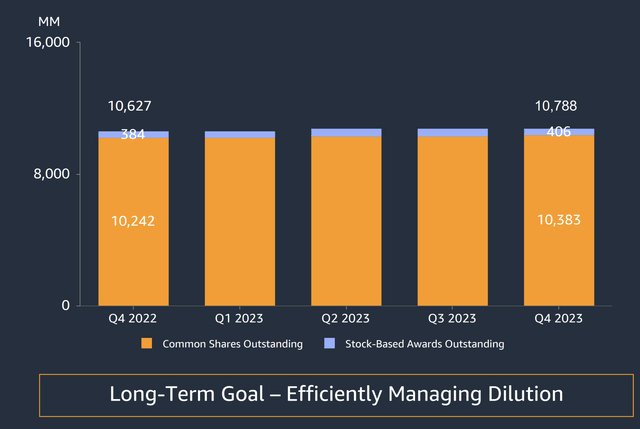

Amazon Outstanding Shares

A concern for Amazon is the continued growth in its outstanding shares which is a noticeable impact on its profit.

The company’s stock-based awards outstanding has grown by the mid-single digits. The company has just under 10.8 million shares outstanding, which has grown by 160 million shares YoY. It might not look like much on the above chart, but to keep its share dilution constant, the company would have had to spend a massive $28 billion on share buybacks.

The 406 million shares outstanding currently have more than $70 billion of value. The company’s TTM FCF was just under $37 billion, a FCF yield of just under 2%, which would have been <0.5% if the company had stayed at a constant share count.

Thesis Risk

The largest risk to our thesis is Amazon’s ability to dominate in new markets. The company is expanding and working to grow its profits. In its core business, a minor margin increase could dramatically improve margins. That, combined with a tough market for software engineers, could result in a decline in stock based compensation. That could help overall profits.

Conclusion

Amazon is a strong company, but the thesis has changed with the company’s 20% price appreciation since our last article. The company does have a strong ad business, but YoY growth in its core shopping business has slowed down. More so, the company’s cloud business faces additional threat from the computing growth of artificial intelligence.

That combination of threats has changed our thesis. Amazon will continue to make minimal cash flow while diluting shareholders. Its current FCF is less than 1%. That, combined with slowing down growth rates, can hurt the company’s ability to drive long-term returns. That makes it a poor investment. Let us know your thoughts in the comments below!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.