Summary:

- Some people ask me why I buy Amazon.

- And at about 70 times forward earnings estimates, Amazon appears costly.

- However, Amazon should be valued relative to its future earnings potential.

- Recent marked-down results and depressed estimates do not accurately represent Amazon’s longer-term growth and profitability prospects.

- Amazon could recover quickly, robustly boosting its bottom-line profitability. Amazon remains one of my top stock picks for 2023.

hapabapa

I often hear: Why would you own Amazon’s (NASDAQ:AMZN) stock here? It’s not a growth company anymore, and Amazon’s stock is expensive at about a 70 forward P/E ratio. And yes, from a traditional P/E perspective, Amazon appears costly. However, Amazon should be valued relative to its future earnings potential, not recently marked-down results and depressed earnings estimates. Recently lowered projections do not accurately represent Amazon’s longer-term growth and profitability prospects. Amazon’s revenue growth and profitability could recover quicker than anticipated, robustly boosting its bottom line. Therefore, Amazon is one of my All-Weather portfolio’s most significant holdings and remains one of my top stock picks to accumulate on pullbacks in 2023.

The Technical Image – Sigalling More Upside Ahead

AMZN: 2-Year Chart

AMZN (SrockCharts.com)

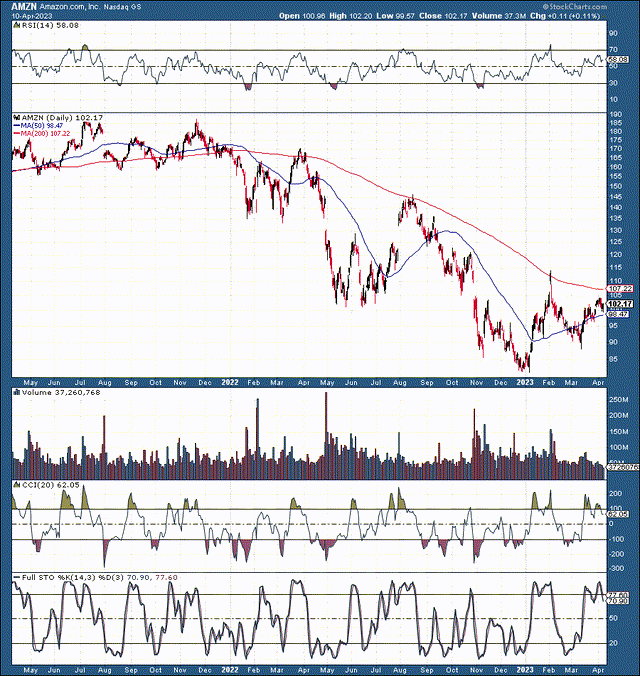

We witnessed enormous selling pressure in Amazon’s share in 2021 and 2022, as Amazon went through a tremendous decline of about 58% from peak to trough in this time frame. Whether the dominant e-commerce giant deserved such a thrashing remains in question, the stock made a significant long-term low in the $80-90 range. And despite Amazon’s stock trading around $100 now, it’s still very cheap.

We have a highly constructive and bullish reverse head and shoulders forming, and Amazon’s price may surge past the neckline resistance zone ($100-115) soon. Generally, we have a constructive new uptrend developing, delivering a series of higher lows and higher highs since 2023 began. Amazon’s uptrend should continue, and the stock may appreciate considerably before year-end and in the coming years.

Amazon Stock: Do I Buy, Sell, or Hold here?

Amazon is an exciting company, yet some market participants require clarification about whether to buy, sell, or hold its stock. I can tell you from experience that the best thing you can do with Amazon’s stock after a massive selloff is to “buy and hold” with a long-term outlook. Amazon has been among the best-performing stocks in my All-Weather Portfolio for years. Now that Amazon’s stock has gone through a massive selloff, of course, I want to own its shares. My Amazon position is nearing 4% of portfolio holdings, and I will add more Amazon stock if it goes lower in the coming months.

Amazon – A Very Special Company

Revenues Continue Exploding

Amazon revenues (Businessquant.com )

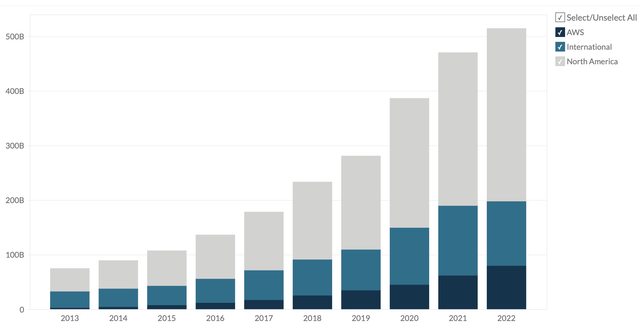

Amazon’s revenue explosion has been phenomenal over the last decade. The company has become the dominant e-commerce giant of the Western hemisphere, with revenues surpassing $500 billion last year. Moreover, we see continuous growth in the company’s highly profitable AWS segment.

The AWS unit’s revenues came in at a staggering $80 billion last year and may arrive at around $100 billion this year. Putting a modest valuation of five times sales on Amazon’s dominant cloud service provides a roughly $500 billion valuation for this unit alone (about 1/2 of Amazon’s total valuation).

We recently saw an announcement to break up Alibaba’s diversified empire to unlock shareholder value. This strategy should be successful and will probably illustrate the undervalued nature of Amazon’s sprawling empire. I don’t consider that Amazon will pursue a similar path as Alibaba, but Amazon’s shares are relatively cheap here.

As the company continues growing, Amazon can adjust its profitability due to its various advantages, economies of scale, and other factors that should enable it to remain ahead of the competition. Therefore, as Amazon’s revenue growth returns after the transitory slowdown, it should become increasingly profitable as it focuses on shareholder returns again.

What Some Analysts Anticipate – I Expect Better

Revenue Estimates – Should Rebound Sharply

Revenue estimates (SeekingAlpha.com )

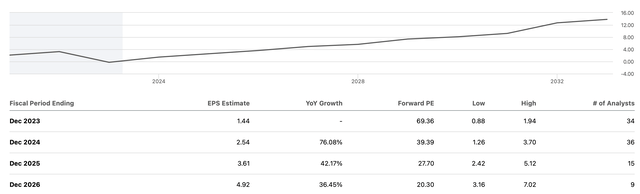

Revenue-wise, consensus figures point to revenues of approximately $700-750 billion in 2025. While the consensus figure is around $707 billion, I suspect Amazon can achieve higher-end results as its businesses begin operating on all cylinders again in the coming years. Therefore, Amazon’s 2025 revenues could come in at around $750 billion. Moreover, Amazon should become more profitable than current analysts’ EPS estimates imply.

EPS Estimates – Amazon Gets No Respect

EPS estimates (SeekingAlpha.com )

Amazon gets no respect regarding its earnings potential. However, the company should continue providing growth and significant profitability potential in the coming years. Furthermore, Amazon doesn’t need to be highly profitable, as its various businesses have strong growth and profitability potential and should be worth much more on their own. If Amazon went Alibaba’s route, splitting the company up into various businesses would unlock significant value for shareholders at this time. Again, I am not implying that Amazon will or should break up its empire. I emphasize that the company is worth much more than the market perceives.

Where Amazon’s stock price could be in several years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $570 | $680 | $750 | $862 | $965 | $1.07T | $1.18T | $1.3T |

| Revenue growth | 11% | 19% | 10% | 13% | 12% | 11% | 10% | 10% |

| EPS | $2 | $3.75 | $5.50 | $7.50 | $10 | $13 | $16.25 | $20 |

| EPS growth | N/A | 56% | 47% | 37% | 33% | 30% | 25% | 20% |

| Forward P/E | 27 | 28 | 29 | 28 | 27 | 25 | 23 | 20 |

| Stock price | $100 | $154 | $218 | $280 | $351 | $407 | $450 | $500 |

Source: The Financial Prophet

We should see a robust revenue recovery next year, and my $750 billion revenue estimate for 2025 may be modest. Nevertheless, Amazon’s sales should continue increasing into 2030. Moreover, its cloud business should continue appreciating, and its other units’ value should increase. Then, it would make sense to spin off several company divisions to unlock shareholder value.

However, Amazon’s stock price should increase significantly as the company advances in the coming years. Using a relatively modest 20-30 forward P/E ratio should elevate Amazon’s share price considerably as the company grows more profitable and valuable in the coming years. Amazon is one of my All-Weather portfolio’s top holdings, with a year-end price target range of $120 – 150 per share (20-50% potential upside, with minimal downside risk).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!