Summary:

- Amazon’s AWS growth is driven by general compute and AI demand outstripping compute capacity.

- Amazon’s retail sales accelerated in Q3’24, with budget-conscious consumers increasing purchase volumes of Amazon’s private label brands.

- AWS growth continues with a 19% YoY increase, driven by cloud migration and AI services, supported by new data center investments and a strong interest in Amazon’s custom silicon.

iLexx

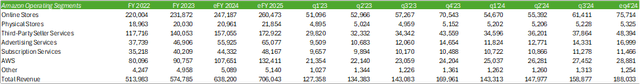

Amazon (NASDAQ:AMZN) accelerated the growth of its AWS services as demand for AI compute continues to outstrip supply of AI infrastructure. This paired with an acceleration of consumer sales driven by Amazon’s private label brands as consumers remain budget-conscious, trading down in terms of price while buying in larger volumes. With an upbeat outlook for the final quarter of eFY24 and an extended holiday sales season, I am reiterating my BUY rating for AMZN shares with a price target of $232/share at 18.57x eFY25 EV/EBITDA.

Amazon Operations

Retail

Amazon realized an acceleration in online and retail store sales in q3’24 despite consumption headwinds as consumers rotate into budget-friendly items. Management noted that many customers are turning to Amazon’s everyday essentials in order to realize better pricing, resulting in stronger volumes and more frequent purchases. As a result of this, unit volumes are outpacing revenue growth. Amazon also hosted its most successful Prime Day in q3’24 with consumer spending reaching $14.2b.

Amazon is also extending its Black Friday & Cyber Monday deals from November 21st through December 2nd, potentially leading to stronger consumer sales to close out eFY24. Amazon may leverage its curated AI shopping assistant during this sales event and may result in more robust results than in previous years.

Management is continuing to focus on optimizing its warehousing capabilities by regionalizing products to minimize the supply chain, allowing for the firm to both save on costs and improve customer pricing. Amazon recently opened 15 inbound buildings to improve the US inbound network. With the ongoing changes, management anticipates that they will have the bandwidth to improve inventory placement, improve shipping times, and lower transportation costs. Management is also focusing on improving its same-day delivery facilities as part of their cost-improvement initiatives.

Amazon added unlimited grocery delivery as part of its Whole Foods Market, Amazon Fresh, and local 3rd party grocer partners for a $9.99/month subscription. Amazon also expanded Rufus, its GenAI shopping assistant, to multiple geographies to help customers improve their searches and see real-time pricing and deal information. Amazon also launched Project Amelia to provide sellers business insights to help boost productivity.

Amazon is also expanding its pharmacy in the US to 20 new cities, bringing deliveries to customers within 24-48 hours of order placement.

To help optimize operations, Amazon is further leveraging robotics at its fulfillment facilities. The firm launched its 12th-generation fulfillment center design that incorporates its newest robotics for stowing, picking, packing, and shipping, reducing time to shipment by 25%. The new facility is expected to generate a 25% cost improvement during its peak run rate. If successful, I suspect Amazon may begin retrofitting other facilities to improve operations and costs across the fulfillment network. Aside from an improved operating environment, implementing robotics removes a lot of the risks related to staffing these facilities, including compensation, insurance, the risk of unionization and strikes, and reduced incidents, amongst others.

One major risk Amazon must consider as it rolls out additional autonomous facilities is the risk of work stoppage, similar to what we saw at the US ports as a result of the International Longshoremen’s Association union strike primarily because of the risk of job loss due to automation. Unionization at its warehouses may add some pressure to the firm to quietly implement and retrofit facilities with robotics as Amazon may risk a broader work stoppage.

Advertising

Advertising growth remained strong in q3’24, resulting in an 18.83% year-over-year increase in revenue to $14,331mm. Much of the growth can be attributed to sponsored products, which are intended to drive consumers to the product upon search. Amazon is now entering its first broadcast season for Prime Video advertising that will leverage GenAI creative tools across display, video, and audio. Its GenAI feature can create a video from a single product image. I believe that this feature may drive advertisement sales going forward as the velocity and volume of content generation accelerates.

Amazon Web Services

AWS continued to accelerate in growth, driving a 19% year-over-year increase to $27.452mm in q3’24. This growth is primarily being driven by more enterprises both expanding and transitioning their cloud presence. I believe enterprises may further their cloud migration efforts given the cost-savings potential as well as the ability to constantly improve infrastructure with minimal capital investments; i.e. when an enterprise seeks to undergo a refresh cycle, the firm must invest and implement all the infrastructure and networking equipment rather than upgrading through its cloud provider, leading to a large capital outlay for IT equipment.

Migrating to the cloud environment will also allow enterprises to leverage AI applications at scale without the need to invest in additional real estate to house the GPUs necessary to run these applications. Amazon is also developing AI applications for customers to leverage, allowing for faster deployment to the production environment through Amazon Bedrock. Amazon recently added Anthropic’s Claude 3.5 Sonnet model, Meta’s Llama 3.2 models, and Mistral Large 2 models, amongst others.

As part of its AI efforts, Amazon will be ramping up Trainium2 in q4’24. Trainium2 is part of Amazon’s custom silicon that will compete with Nvidia’s (NVDA) H200 and Advanced Micro Devices’ (AMD) MI300x GPUs in terms of price & performance. Management noted that customer interest is beyond their initial expectations and consequently they are increasing the chips manufacturing beyond what was originally planned.

SageMaker, Amazon’s model builder platform, is realizing strong growth as the firm continues to add new features. SageMaker’s hyperpod capability is said to improve training time by 40%, balance workloads across 1,000+ AI accelerators, prevent interruptions, and automatically repair faulty instances.

I believe AWS growth will largely be driven by the expansion of AI services and the migration of general compute workloads as enterprises seek to manage down costs and expenses.

As part of its expanding data center footprint, Amazon is investing in small modular reactors [SMRs] to provide dedicated baseload capacity to the sites. Accordingly, Amazon signed 3 agreements to support the development of nuclear energy projects in partnership with Energy Northwest. These facilities will be constructed, owned, and operated by Energy Northwest and are expected to generate 320MW of capacity in the first phase of the project. Long-term, the partnership may expand to 960MW of total capacity. Amazon also invested in X-energy to develop the SMRs that will be managed by Energy Northwest. In addition to this, Amazon partnered with Dominion Energy to develop an SMR project that will provide at least 300MW of power to the Virginia region.

Amazon Financial Position

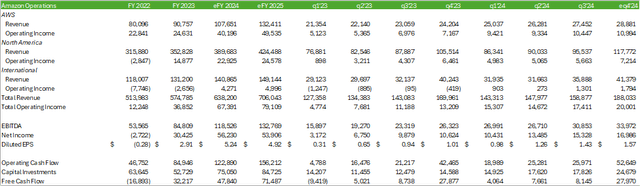

For eFY24, I’m forecasting Amazon to generate $638b in net revenue with a diluted EPS of $5.24/share. I’m forecasting AWS growth to continue to accelerate as more capacity is built out for its Trainium2 and Nvidia’s H200 & potentially the ramp-up of Blackwell GPUs. Amazon realized significant improvements to profitability in its international footprint, bringing its operating margin up from 86bps in q2’24 to 363bps in q3’24.

North America also experienced a strong 1% improvement to its operating margin, growing to 5.93% in q3’24. Given the extended holiday sales events, I’m forecasting margins to continue to improve across these two segments.

Amazon reported stronger-than-expected q3’24 earnings results as online and physical store sales experienced accelerated growth in the quarter. Both domestic and international store sales expanded, growing on a year-over-year basis by 9% and 12%, respectively.

Amazon also realized accelerated growth for its AWS services as growth continues to accelerate on a sequential basis. Margins will likely remain at the elevated range due to the strong top-line growth, cost management through more restrictive hiring practices, and the recent extension of useful life of the servers. Management’s guidance for their capital investment outlay remains unchanged at $75b for eFY24. Capital deployed will primarily be towards expanding its data center infrastructure. Andy Jassy, CEO of Amazon, suggested that the capital investment outlay for 2025 will likely be stronger than 2024 as demand continues to outstrip supply.

Risks Related To Amazon

Bull Case

Growth for cloud services for both IT & AI workloads continues to outstrip demand, resulting in justified capital spend for additional data center capacity. Consumers are rotating into budget-friendly items, resulting in increased volumes and larger, consolidated shipments and leading to improved operating margins for Amazon’s consumer-facing business.

Bear Case

I believe that IT spend will continue to be relatively constrained with minimal major projects, resulting in only priority projects to be deployed in the coming quarters. I also have reason to believe that consumers remain stretched as a result of inflationary pressures and may result in potentially lower overall spending on the non-necessities. Amazon may also run into challenges at its warehouses are more facilities are further automated and may result in potential work stoppages as seen at the ports with the International Longshoremen’s Association.

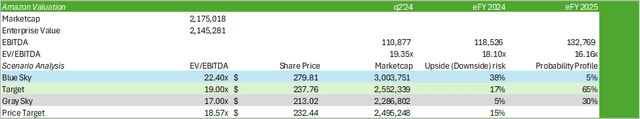

Valuation & Shareholder Value

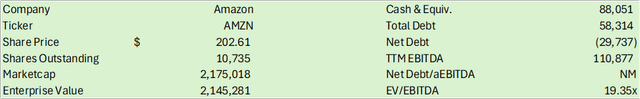

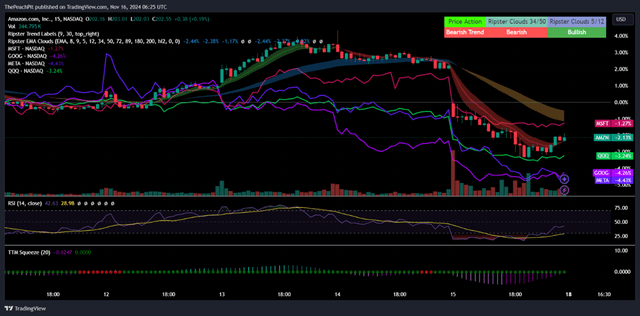

AMZN shares have sold off in the last week with the broader market, holding no fundamental rationale behind the price action.

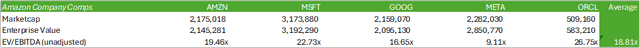

Comparing AMZN shares to its peers, AMZN shares trade at a relatively higher premium at 19.46x EV/EBITDA when compared to the average hyperscaler cohort of 18.81x.

Despite this large premium, I have reason to believe that AMZN shares will likely maintain this higher premium and may even migrate higher to more closely match Microsoft’s (MSFT) premium at 22.73x given the profitability of AWS.

Both Microsoft & Amazon command a significantly stronger cloud operating margin when compared to their peer hyperscaler Alphabet (GOOG), whose cloud margin is closer to 9-10%.

Valuing AMZN shares using an internal model based on my forecast for eFY25 EBITDA and the firm’s historical trading premium, I believe the recent price dip provides shareholders a good buying opportunity. I am reiterating my BUY rating for AMZN shares with a price target of $232/share at 18.57x eFY25 EV/EBITDA.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.