Summary:

- Phenomenal growth and growing margins make a strong investment narrative for the retailing giant, but dig a little deeper and there is more to Amazon’s story.

- Underlying cash profitability for Amazon is inconsistent and sometimes negative, and its skinny margins make the firm sensitive to financing operations.

- We explore how bond traders currently view Amazon to get a sense of how risky the long-term debt issuances are seen to be.

- While Amazon is a well-run firm, investors should note bond pricing of Amazon as higher-risk than typical AAA-rated bonds, and the scale of debt being issued.

- Prices, yields, financials all accurate as at 28th January 2023.

Julie Clopper/iStock Editorial via Getty Images

Amazon’s (NASDAQ:AMZN) growth story is undeniably nothing short of phenomenal, and the retailing giant has worked hard to fund and manage this growth carefully.

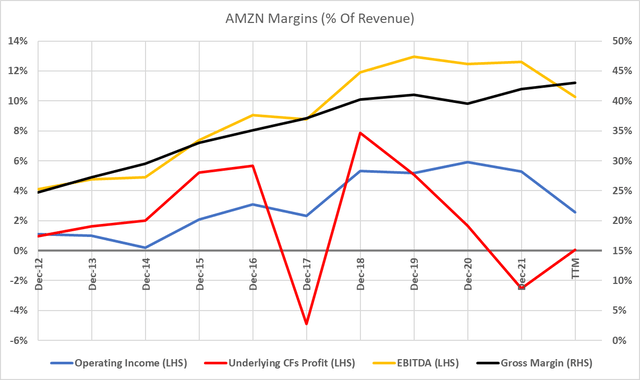

Browsing the firm’s financials, both operating margins & gross margins have grown consistently over the last 10 years, revenues have grown exponentially and the Amazon offerings have greatly been diversified.

However the headline margins are not the whole story, and it’s worth looking a little more closely at the debt Amazon has issued to get a sense of how bond traders are viewing Amazon.

Underlying Cash Profit Nowhere Near The Headline Rates

While EBITDA, operating margins and gross margins for AMZN are reasonably solid (given the size of Amazon), the underlying cash profitability of AMZN is quite poor, inconsistent and occasionally negative.

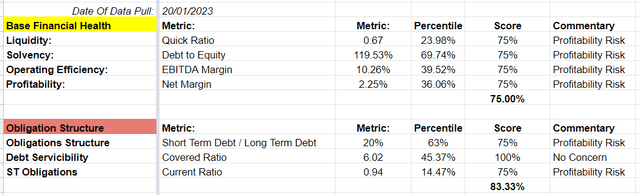

Firstly, EBITDA margins of 10.26% put AMZN in the 39th percentile compared to the entire US stock market, making AMZN not a particularly profitable business by this standard.

The firm’s gross margin of 43% is quite middling, right on the 50th percentile compared to the US stock market.

An operating margin of 2.58% puts Amazon in the 30th percentile of profitability, again, not a largely profitable business by this measure.

But by calculating the underlying profitability of the firm (by taking the Cash from Operations figure and adding/subtracting Cash from Investing) we get a better understanding of the firm’s profitability, untouched by finance operations. This shows us just how much the finance operations of Amazon affect profitability (finance operations includes repayment/issuance of debts, stock issuances/repurchases, & foreign exchange rate profits/losses).

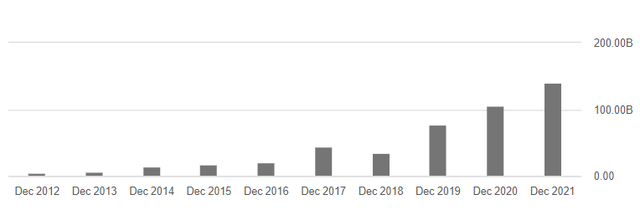

Below, we visualise how these margins and profitability appear over the last 10 years.

(I’ll acknowledge here that yes, Amazon is a company that is profitable based on its scale, not large margins. But low margins mean greater sensitivity to large-scale costs, like debt financing, which will discuss below)

But we need to account for how these operations are financed (through debt and equity) and look closely at how the debt risk is being priced by the market to get a sense of how investors view the profitability and financial health of Amazon.

Amazon Bonds – Trading At A Discount To Face Value

I have a lot of respect of bonds traders in their assessment of companies and their risk, after all, if a bond coupon payment isn’t made, the issuing firm is insolvent. So bonds traders are the best group to take a pulse from on a firm and its financial health.

Using my own metrics to assess a firm’s financial health, I would rate AMZN a 79% overall financial health, given a poor showing on the quick ratio, a significant debt-to-equity score, low margins and a large short-term debt component.

But I’m only looking at the financial reports publicly available, whereas bonds traders have access to a lot more than I do.

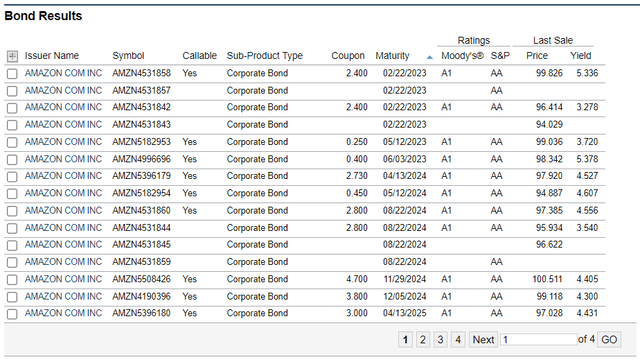

Looking on FINRA, we can see all the bonds issued by Amazon currently (44, not including Whole Foods bonds).

These bonds have an average coupon of 3.07%, priced at $93.434 and yielding investors 4.342% to expiry.

This information needs some context however so we can understand these figures in comparison to alternatives.

FINANCIAL INDUSTRY REGULATORY AUTHORITY, INC.

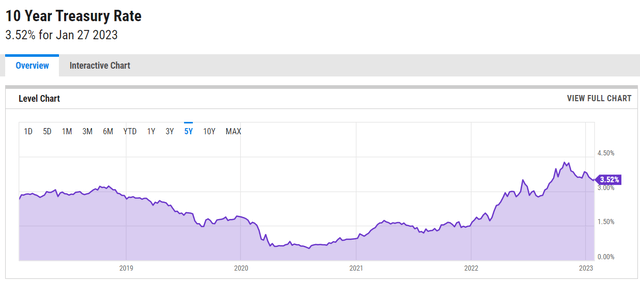

For comparison’s sake, US 10y treasury bonds are trading at around 3.52%, giving us a good “risk-free rate”. Amazon bonds by comparison are trading a full 82 basis points higher, indicating the level of risk vs the risk-free rate investors are pricing in.

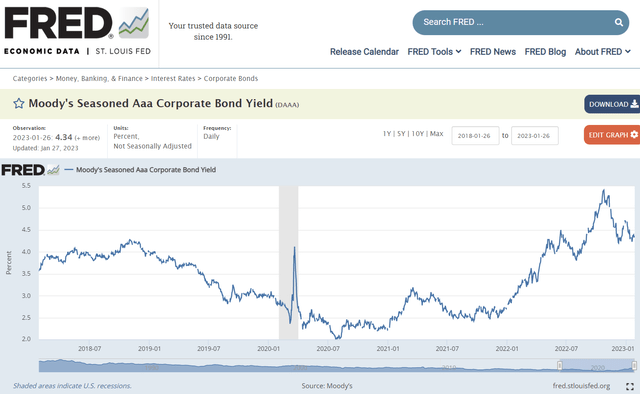

The average Moody’s Seasoned Aaa Corporate Bond Yield currently trades at 4.34%, almost exactly the average AMZN bond yield.

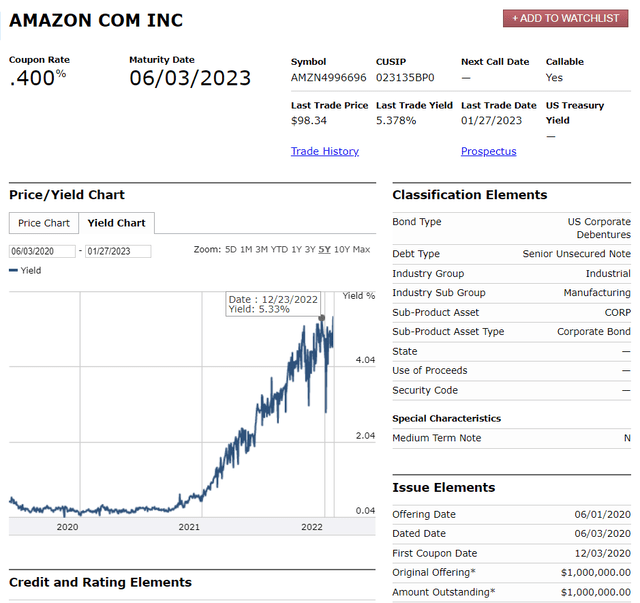

While having bond yields sitting almost exactly at the AAA bond yield average is an acceptable result for any firm, AMZN bonds, even with near-term expiries can be acquired with yields above 5%, well in excess of the AAA yield average.

FINANCIAL INDUSTRY REGULATORY AUTHORITY, INC.

This paints a picture of a bonds market that has some concerns for the firm and inflationary/interest rate environments (not to mention a potential recession).

So why raise this? Well, Amazon’s growth requires some pretty hefty funding, to cover day-to-day operations as well as acquisitions and capital expenditures. And Amazon has been issuing immense levels of debt.

Total short-term + long-term debt has grown 3,727% from $4.409 billion in 2012 to $164.334 billion in 2023, and grown from 38% debt-to-equity up to 57%, greatly increasing the leverage and risk/reward profile of the firm.

Closing Thoughts

Overall, I’m not going to suggest that Amazon is at risk of failure, insolvency or faces issues covering its debts. I believe it is an extremely well-run firm (financially speaking), managing its growth and its debts well, using leverage to keep the exponential growth story going.

2023 will throw some challenges at the firm, but I believe it’s important to take note of bond markets pricing some AMZN bonds as higher-risk assets than typical AAA-rated bonds.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.