Summary:

- Amazon is making significant investments in robotic companies to increase automation in their warehouses and reduce fulfillment costs.

- The company has already deployed over 750,000 robots in their warehouses, leading to increased efficiency and worker safety.

- The automation drive is starting to show results, with fulfillment costs growing less than overall revenue and potential for significant cost savings in the future.

jetcityimage

Investment Thesis

Amazon (NASDAQ:AMZN), in an attempt to increase their automation within the production process has made notable investments in robotic companies for the purpose of warehouse automation. While many investors know about some of these automations I think its key for us to dive in as I believe we are on the precipice of seeing the upside. From recent examples such as Amazon’s founder and Executive Chairmen, Jeff Bezos, making a personal bet in companies like Figure AI last round of funding, to the company proclaiming in February that their $1 billion corporate venture capital fund was going to heavily dive into robotics I believe the company sees the ChatGPT revolution that has been underway since December 2022 as a unique opportunity to accelerate their automation plans leading to huge potential cost savings.

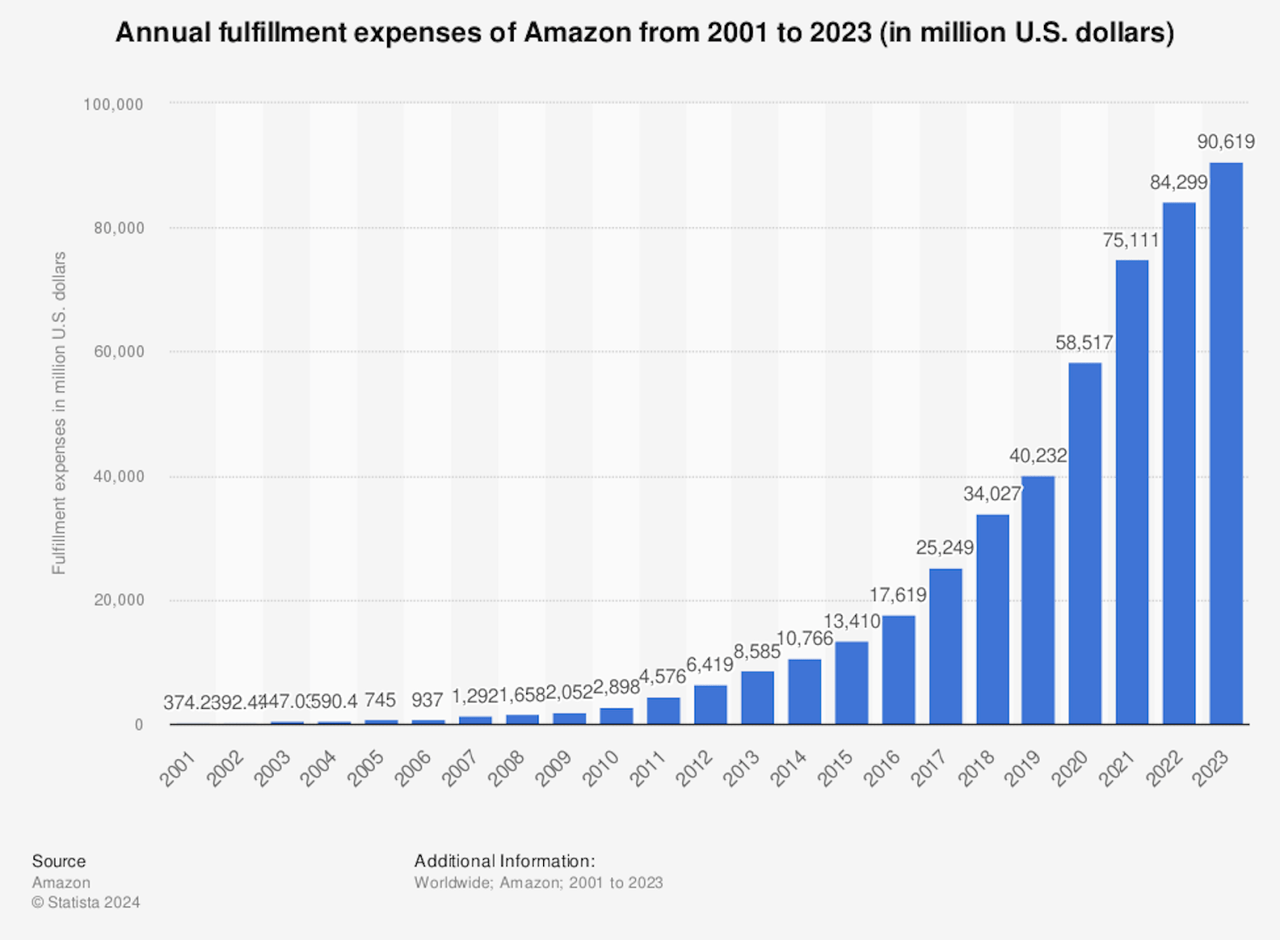

Already, Amazon is seeing exponential growth in their warehouses, with the e-commerce giant deploying over 750,000 robots in their warehouses to date helping to deal with the heavy costs of order fulfillment, a lingering issue for all e-commerce companies and retailers. Since 2001, fulfillment expenditures have been on the rise for Amazon, seeing a drastic increase in the last 5 years.

Amazon controlling fulfillment costs is key to the company’s long run story. I think we are near this point, which is why I continue to believe Amazon is a Strong Buy.

Why Am I Doing Follow-up Coverage?

In December, I wrote about how Amazon was going to be able to use Amazon Prime to help get increased traffic to Amazon’s retail division because Amazon Prime helps keep people at home (and shopping on Amazon) vs. going in store to buy products.

Recently, Amazon walked away from its AI-enabled self checkout technology coined “Just Walk Out” at the local Amazon Fresh grocery stores that they had been piloting.

Coupled with Amazon-backed startup Agility Robotics conducting layoffs last week and it would look like that the automation trend is slowing.

I think this is hardly the truth.

Behind the scenes, I believe that Amazon’s focus on specific warehouse automations is honing in, and I think this is the biggest place they could see the benefits of reducing labor costs. For example, while Agility robotics laid off a handful of individuals, the company is laser focused on what they call “extraordinary demand for bipedal robots across industrial use cases.” We already know Amazon uses their robot line in their warehouses. I am writing this follow up piece because I believe recent media reports are doing a poor job of accurately showing where their automation progress is. I expect this automation progress to manifest itself exponentially soon. I think investors should pay close attention so my goal with this research is to do a deep dive on where Amazon actually stands currently.

As I was writing this, Morgan Stanley put out a note saying much of the same, with Seeking Alpha editor Clark Schultza paraphrasing the note, writing that Morgan Stanley believes that we are early “in the company’s retail profitability improvement efforts as it uses leverage to lower the impact of shipping, fulfillment, payment processing, inbound shipping, returns, and inventory shrinkage costs.”

The goal of this research is to do a deep dive into this.

Background

As of 2023, Amazon’s fulfillment (largely warehouse) expenses (demonstrated in the chart below) reached $90.6 billion, up from about $84.3 billion the previous year. Over the last five years, Amazon has allocated more than $10 billion to hourly wages in an attempt to maintain competitive compensation practices. In 2023 alone, Amazon invested $1.3 billion in pay rises for its customer fulfillment and operations staff, with the average pay now exceeding $20.50 per hour.

Amazon Fulfillment Expenses (Statista)

As for Amazon’s warehouse workforce itself, the company has been receiving pushback regarding their wages. The National Employment Law Project (NELP) notes a wage disparity that has grown since Amazon’s expansion into local economies, with warehouse worker wages now 30% below the area median, compared to 10% in 2005. Despite Amazon raising their average hourly wage in the U.S. to $18, other companies in similar sectors feel pressure to increase their wages, thus creating this wage gap . Research indicates that a 10% increase in Amazon’s advertised hourly wages results in an average wage increase of 2.6% among other employers in the same commuting zone, highlighting Amazon’s influential role in the labor market. On top of this, in recent years Amazon has also faced pressures from labor unions. Unionization efforts within Amazon have sparked a response from the company, with a significant investment of about $14 million in 2022 on labor consultants to combat these efforts.

In other words, Amazon has been facing a tug and pull with local markets on labor costs and supply due to their massive influence on the labor market (because they are such a big employer in some regions). With this, some journalists have noted (through research) that Amazon could run out of workers this year (2024) due to burnout of current employees and the need to replace them. This, in part, has led to unionization attempts at many of the warehouses throughout the US.

To sum this up, Amazon has a huge labor problem in their warehouses. They face continual wage pressures, unionization attempts, and workforce burnout. They need automation to remain agile and feed their growing demand for order fulfillment.

Current Progress

In an attempt to reduce pressures from their workforce, Amazon has introduced advanced robotic systems like Sequoia and Digit (Digit is the system developed by Agility Robotics). These robotic systems aim to help employees complete production tasks. As of now, the number of robots in fulfillment centers is over 750,000 units. Sequoia, operational in Houston, Texas, not only enhances production efficiency, but also increases worker safety as indicated by a 15% lower recordable incident rate and an 18% reduction in lost-time incidents at Amazon Robotics sites compared to non-robotics sites. Sequoia integrates robotic arms, gantry systems, and mobile robots to expedite inventory handling, reducing the time for storing and processing items by up to 75% and 25%, respectively. This system improves the efficiency of workstations, aligning tasks within the employees’ optimal work zone, thereby reducing physical strain associated with reaching or squatting.

Amazon’s Sparrow robot also aims to make production more efficient, as it plays a significant role in automating the consolidation of inventory, taking on tasks such as organizing and preparing items for storage and shipping.

And, like I touched on before, through their collaboration with Agility Robotics, Amazon is also exploring the potential of humanoid robots, testing the Digit robot for tasks like tote recycling. Digit’s design allows it to navigate the human-centric environments of Amazon’s facilities, handling items in ways that traditional robots cannot.

Considering this drastic increase in fulfillment expenses, it’s not a shock that Amazon is looking to slow the growth of fulfillment cost growth (and even ideally shrink it). According to Amazon, these robots are meant to work on two thirds of the simpler packaging tasks, the rest will be handled by human employees (for now). Although this may be the case now, a full robot takeover within Amazon is not out of the picture. According to Amazon’s director of robotics fulfillment in 2019, Scott Anderson, this would not occur for at least 10 years. We are now 5 years into this prediction. I expect the fruits of this automation drive will soon start to show up exponentially in their financial reports. In fact, (and I will dive into this below) I believe they already have.

The True Potential Of Automation

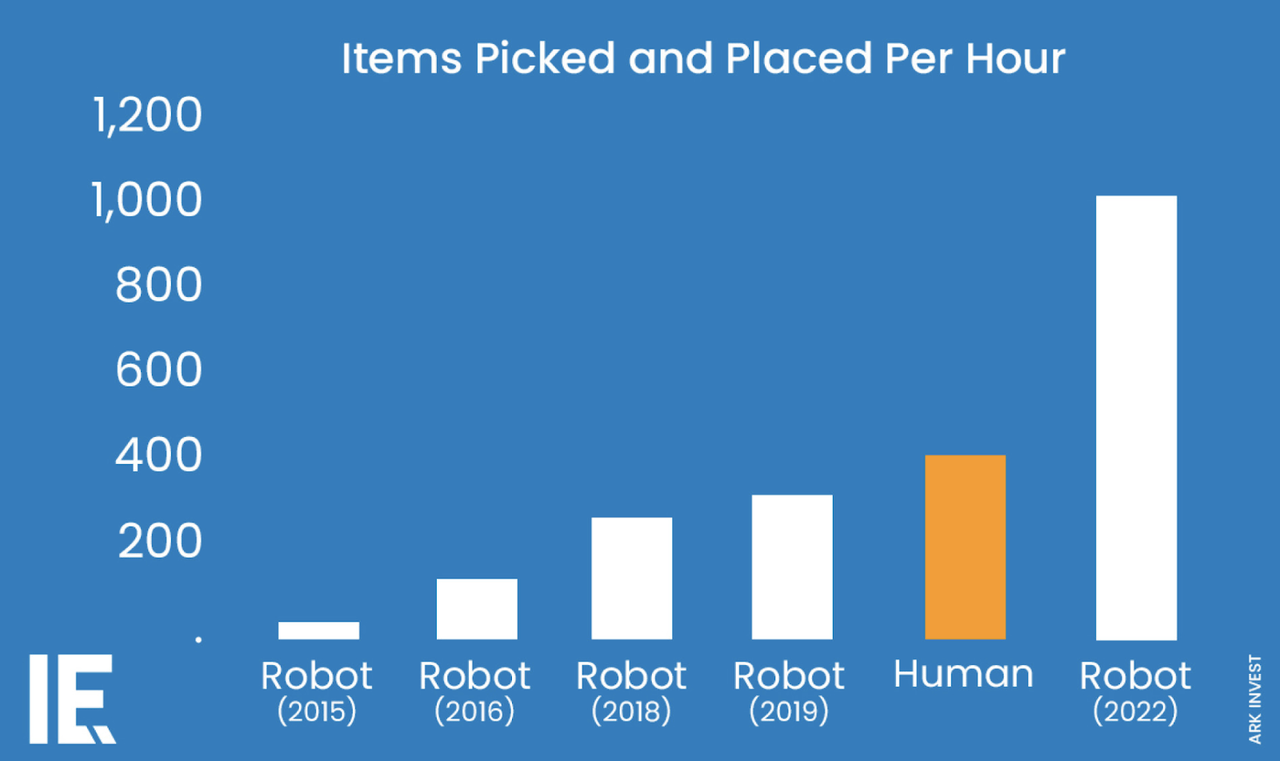

Within US warehouses only a fraction of the labor is automated. I predict this will soon change, as the robots being produced today can move 333.333 units from the shelves and place them onto the packaging station within 20 minutes, whereas this would take a human worker almost an hour and a half. The chart below is another example of how much the efficiency of robotic solutions has increased, and just how far behind humans are. This curve is exponential growth. I think under the surface we are beginning to see this in Amazon warehouses.

Robot Packing Rates (Ark Research)

With the increased efficiency of these robots, I believe that once Amazon decides to cut warehouse workers (likely not replace workers after they are burning out) they will drastically save on labor costs.

What Is Management Hinting So Far?

To be clear, Amazon will likely not be super up front about how much exactly their automation pursuit will save them. This is because of public outcry and concerns that workforce automation will disrupt millions of jobs (not just at Amazon but at other e-commerce fulfillment companies as well).

However, with Amazon’s increased investment, this topic was brought up a bit in the recent Q4 earnings call a bit more on the consumer convenience side for delivery, vs. the workforce automation side. As revealed in the call, Amazon plans on continuing to allocate funds towards same-day delivery sites and automation technologies:

In the fulfillment center and logistics area, I would say it’s more incremental capacity at this point based on additional demand, although we are seeing some additional investments for same-day delivery sites and automation, robotics. But the trend for most of the large percentage of the spend will be in infrastructure is going to continue into 2024. -Q4 2023 Call

For all of 2023, revenue hit $574.8 billion, a 12% year-over-year increase and operating income was $36.9 billion, tripling year-over-year (Q4 Presentation).

What I’m Seeing In The Financials

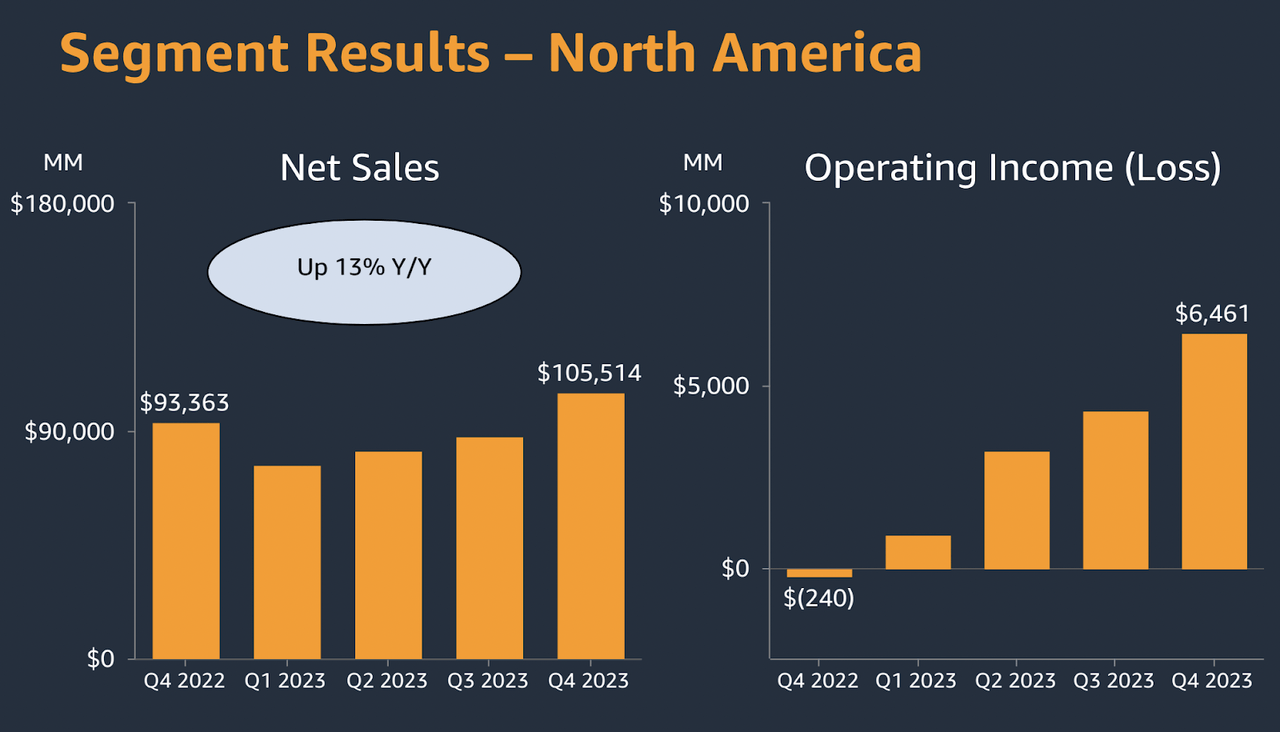

In the company’s 10K filing, Amazon noted that the core North American market swung to a profit but saw an increase in costs related to fulfillment. I think what is key here is that these costs are starting to grow less than the company’s overall revenue.

The North America operating income in 2023, as compared to the operating loss in the prior year, is primarily due to increased unit sales and increased advertising sales, partially offset by increased shipping and fulfillment costs and increased technology and infrastructure costs. -2023 10K

While revenue in the North America division grew 13% in 2023, the division saw itself swing from a $240mm loss in Q4 2022 to a $6.461 billion profit in Q4 2023 (Q4 Presentation).

North American Results (Amazon Q4 Presentation )

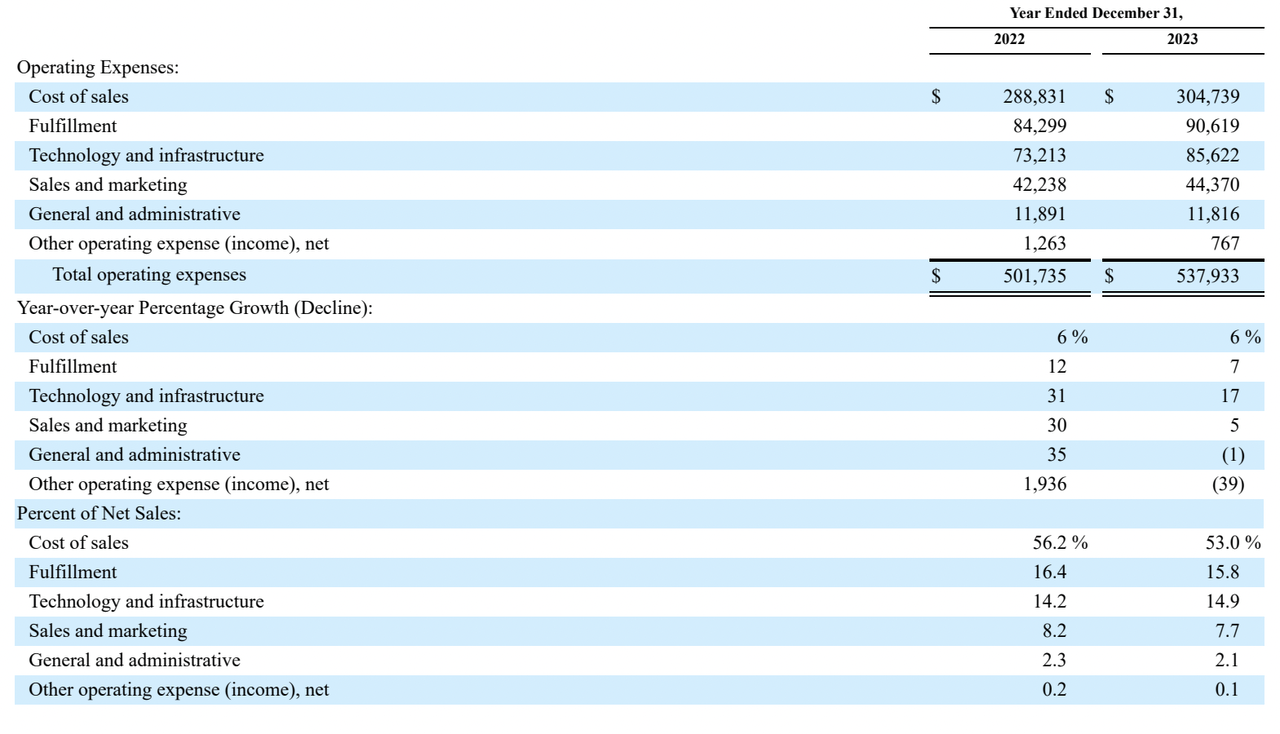

As I mentioned before, A key part of this was the slowing costs of fulfillment growth. Fulfillment costs only grew 7% last year compared to 12% growth in 2022 (10K). They now account for 15.8% of sales (vs. 16.4% in 2022). In essence, because fulfillment costs only grew 7% instead of 13% last year to match revenue growth (or compared to 12% in 2022) this means the company saved about 6% of $84.229 billion in cost savings in 2023. This equates to about $5.05 billion in margins profits (making up most of the net income we saw from the North America division in 2023).

Operating Expenses Breakdown (Amazon 10K)

In essence, while hidden, these fulfillment automations are beginning to bear fruit. I think what we will see in 2024 will be just as powerful.

Valuation

In the most recent quarterly call, CEO Andy Jassy said:

We’ve challenged every closely held belief for our fulfillment network and reevaluated every part of it, and found several areas where we believe we can lower costs while also delivering faster for customers.- Q4 Call

In essence, the company expects to see further cost savings. In the TTM, North America produced operating income of $14.9 billion (Q4 Presentation). In Q4 alone, the company did $6.461 billion in operating income in the region alone (so about $25 billion annualized).

In essence, we assume no Q/Q net income growth in 2024, net income for the company as a whole (if every other division has the same results as in 2023) will be ~$10 billion higher than the net income run rate of 30.425 billion in 2023 just by having North America have the Q4 run rate annualized. This would imply ~33% net income growth on its own (and assumes no cost cuts/reductions like Amazon’s CEO hinted at).

This is also significantly higher than the market expectations for 23.27% compounded EPS growth over the next 3-5 year horizon. This tells me that there is ample upside potential in the stock and tells me this is not priced in.

If the company earns another $10 billion in net income in 2024, and by applying the current forward non-GAAP P/E of 43.92 we get an upside potential of $439.20 billion in market cap upside. Given the current market cap of $1.92 Trillion, this represents approximately 22.875% upside in the company’s market cap (and approximately 22.8% in the company’s share price) from current levels. I arrived at this valuation by taking the estimated new market cap equity I believe the market will reward Amazon stock ($439.2 billion) and dividing it over the current market cap (1.92 Trillion) to estimate that each share of Amazon stock should receive upside potential of ~22.8%.

This compares well to the Morgan Stanley target for shares to reach $215/share (16% upside expectation) under this same growth opportunity.

How This Compares To My Previous Price Target

The crux of my thesis in December was that increased Amazon Prime Video usage was going to cause consumers to buy more products on Amazon increasing the stock price. In my valuation analysis, I assumed there was about 11.9% upside in the stock price. Since then the stock is up 20.87% beating my upside estimates.

This opportunity with Fulfillment automation has even more potential. So I believe that the fair value of the stock is currently 22.8% above current trading levels.

Risk To Thesis

My biggest concern with increased automation in the workforce is the displacement of jobs and the challenge of retraining the workforce (this would actually be a symptom of automation working really well). While Amazon and other companies may benefit financially from automation, the societal impact of potential job losses and the speed of workforce transformation may be an issue. The ability to reskill workers and provide safety nets during transitions is crucial to offset the negative effects of rapid automation. A study conducted by the World Economic Forum predicts that by 2025, automation will create 12 million more jobs than it displaces. While these numbers are promising it is crucial that Amazon is able to provide educational programs to prepare their workforce for new or adjusted roles. If Amazon faces government pushback from automation (or multiple successful union petitions) this could force many of the roles in their warehouses to stay manual or non-automated. This could cause costs to stay permanently higher.

As a mitigant for this risk, I think Amazon will be able to roll off many of their hourly warehouse workers simply by not replacing the ones that quit and filling the positions with automation solutions such as Digit. For example, one study done on California warehouses showed that turnover in California warehouses was over 100% annually. In other words, “more workers leave their warehouse jobs each year than the total number of warehouse workers employed in those counties [where Amazon warehouses operate].”

Worker protests related to automation have been centered around workers losing their jobs vs. workers leaving a job voluntarily. In essence, if Amazon simply automates current positions as people leave and make them vacant, I do not expect any major public pushback that can thwart these efforts.

Bottom Line

Amazon’s investment in AI and robotics, through numerous ventures, had led to a deployment of over 750,000 robots within their warehouses aimed to not only increase worker efficiency but also create a safer work environment. The substantial capital funneled into robotics is also aimed to address wage disparities and labor union pressures Amazon has been facing. The introduction of advanced robotics like Sequoia and Digit have already shown the impact automation can have in Amazon warehouses.

Given the slowing growth in fulfillment expenses, I believe that their automation drive is working and the efforts are about to show up significantly in financials this year. While the retailer faces continued labor union risks that could thwart these efforts, I believe that Amazon will be able to overcome these risks. Amazon is automating jobs that people are quitting because people do not like working in these jobs. I do not believe that these automations will lead to strong public outcry. With this (and the immense cost savings we are seeing Amazon just begging to capture) I think the stock is a strong buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.