Summary:

- Amazon’s sell-off has been overly done, with FQ2’24 still bringing forth robust performance metrics and FQ3’24 guidance implying a profitable growth trend.

- With advertising opportunities growing, international segment returning to profitability, and AWS still market leading, we believe that the stock is extremely cheap at current levels.

- Combined with the healthier balance sheet and raised consensus forward estimates, AZMN continues to offer a compelling Buy opportunity for investors looking to buy the dip.

- While AMZN bulls have continued to defend the $150s/$160s support levels during the market-wide correction, indicators suggest that the pullback may not be over yet.

- We shall discuss further.

tazytaz

We previously covered Amazon.com, Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA) in May 2024, discussing why we had maintained our Buy rating then, thanks to the ongoing cost optimization and intensified investment efforts, or also known as the “Two-Pizza Teams” and “Day 1 Culture,” respectively.

Combined with the raised consensus forward estimates, growing balance sheet, and accelerating advertising opportunities, we believed that the company remained well-positioned for growth.

Since then, AMZN has charted new heights at $200s, before drastically pulling back as the market rotates from high-growth stocks and sentiments worsen from the delayed Fed pivot.

Even so, with the stock now trading at extremely cheap valuations as the company remains highly profitable and AWS generating robust metrics, we believe that the recent sell-off has triggered extremely attractive entry points for opportunistic investors who are looking to dollar cost average.

We shall further discuss.

AMZN Is Inherently Undervalued – Offering Opportunistic Investors With An Improved Margin Of Safety

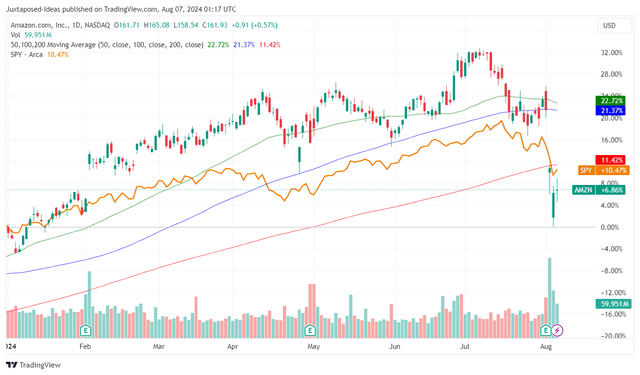

AMZN YTD Performance

TradingView

While initially outperforming the wider market, AMZN has returned most of its 2024 gains while entering oversold territory.

While part of the correction is attributed to the ongoing market forces, it is undeniable that the market has been disappointed about its mixed FQ2’24 performance, with a top-line miss at revenues of $148B (+3.2% QoQ/+10.1% YoY) and operating income beat at $14.7B (-3.9% QoQ/+90.9% YoY).

Sentiments have also been worsened by the supposedly lower FQ3’24 midpoint guidance, with revenues of $156.25B (+5.5% QoQ/+9.1% YoY) and operating incomes of $13.25B (-9.8% QoQ/+18.3% YoY).

Even so, we believe that AMZN’s selloff has been overly done, since the FQ2’24 numbers overlap a tougher top/bottom-line YoY comparisons at +10.8%/+131.6%, and FQ3’24 at +12.6%/+343.1%, respectively.

If anything, we believe that numerous pockets of great execution have been observed in its FQ2’24 earnings report, as follows:

For one, AMZN’s AWS remains the bottom-line growth driver with revenues of $26.27B (+4.9% QoQ/+18.6% YoY) and operating margins of 35.5% (-2.1 points QoQ/+11.3 YoY).

Its market leading position cannot be denied as well, based on the robust cloud computing market share of 32% (+1 points QoQ/in line YoY), compared to Microsoft’s (MSFT) Intelligent Cloud at 23% (-2 points QoQ/+1 YoY) and Google (GOOG) Cloud at 13% (+2 points QoQ/YoY).

Combined with the high growth observed in AWS’ multi-year backlog to $156.6B (+18.5% YoY), compared to that of Google Cloud at $78.8B (+30% YoY) and Intelligent Cloud at $23.11B (+7.1% YoY), we believe that the giant has demonstrated robust monetization during the generative AI boom.

These developments further underscore why AMZN’s elevated capex of $59.61B over the LTM (+1.6% sequentially) across data centers and warehouse locations have borne great fruits.

This has allowed the company to deploy “a quarter million Graviton chips and 80,000 of its custom AI chips to handle the surge in activity across its platforms (during the recent Prime Day),” with FQ3’24 likely to bring forth great top-line sales, thanks to Prime Day generating “a record $14.2B in sales, according to Adobe Analytics.” This is despite the lower ASPs from the changing customer behaviors during an elevated interest rate environment.

If anything, AMZN’s improved warehouse locations/higher speed of delivery have already triggered higher annualized subscription revenues of $43.44B (+1.3% QoQ/+9.8% YoY).

Combined with the “twice as many machine learning and generative AI features into general availability than all the other major cloud providers combined” and Blackwell coming by 2025, we believe that the additional AI-related capex will continue to boost its long-term AWS prospects.

Secondly, AMZN has proven itself as a force to be reckoned with during a robust advertising market conditions, based on the growing revenues of $12.77B (+8% QoQ/+19.5% YoY).

While the company has yet to break down the segment’s bottom-lines, it is no secret that advertising is typically a high margin endeavor, with Prime Video driving high engagement and the management already hinting at “strong growth on an increasing larger revenue base this quarter.”

This is despite the supposedly tighter ad inventory during the ongoing US election campaigns, with it demonstrating the immense attractiveness of its platform to advertisers.

Thirdly, while AMZN’s North American segment remains the top-line growth driver, with net sales of $90.03B (+4.2% QoQ/+9% YoY) and the cost optimization efforts already flowing into its richer operating margins of 5.6% (-0.1 points QoQ/+1.8 YoY), it is apparent that the same efforts have been observed in its International segment.

The latter has been reporting two consecutive quarters of positive operating incomes at margins of 1.8% in H1’24 (+5.4 points YoY), well reversing the cash burn trend observed since the last reported TTM profitability in FQ3’21.

Lastly, AMZN’s balance sheet has improved drastically to a net cash position of $34.2B (+24.6% QoQ from $27.44B/+3,831% YoY from $0.87B), well reversing the issues faced during the hyper-pandemic period, thanks to the increasingly rich Free Cash Flow generation of $53B over the last twelve months (+570.8% sequentially).

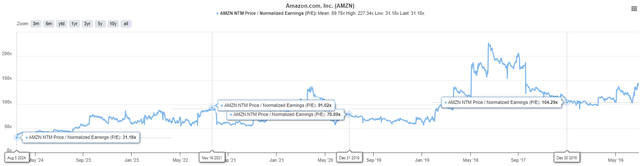

AMZN Valuations

TradingView

Therefore, while past performance may not be indicative of future performance, it is undeniable that AMZN looks extremely cheap at current FWD P/E valuations of 31.18x, compared to the 1Y mean of 38.52x, the 5Y mean of 68.90x, and 10Y mean of 93.01x.

This is especially when comparing its valuations and bottom-line growth projections at a CAGR of +10.8%/+36.8% through FY2026 to its hyperscaler peers, such as Alphabet at 20.99x/+19.7% and Microsoft at 29.98x/+15%, respectively.

As a result of its improving top/bottom-line performance across its online/physical sales, growing advertising opportunities, and market leading AWS metrics, we believe that the consensus estimates do not appear to be overly ambitious as well, with it offering interested investors with the chance of the great upside potential.

So, Is AMZN Stock A Buy, Sell, or Hold?

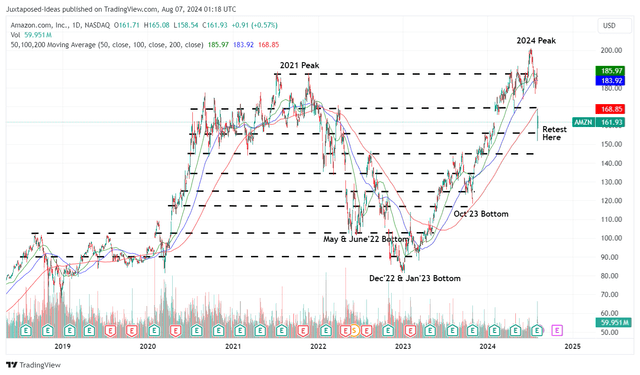

AMZN 5Y Stock Price

TradingView

For now, the recent pullback has caused AMZN to trade well below its 50/100/200 day moving averages, while returning most of its 2024 gains.

Based on its LTM adj EPS of $4.18 ending FQ2’24 (including RIVN write-downs) and the 1Y P/E mean of 38.52x, it is apparent that the stock is trading near to our updated fair value estimates of $161.00 (down -7% from previous estimates, since the previous calculation method omitted the write-down impacts on FQ1’24 results – erroneous, in hindsight).

Based on the consensus raised FY2026 adj EPS estimates from $7.32 to $7.43 (+1.5%), it is apparent that there remains an excellent upside potential of +77% to our updated long-term price target from $281 to $286 (+1.7%), thanks to the deep pullback.

As a result of the extremely attractive risk/reward ratio at these discounted levels, we believe that AMZN remains a compelling Buy for investors looking to buy the dip – resulting in our reiterated Buy rating, with a few caveats to be discussed below.

Risk Warning

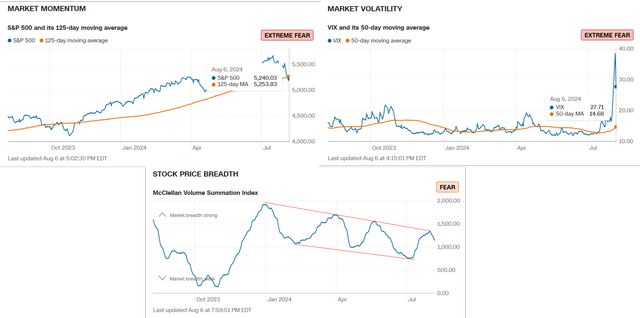

Market Momentum

CNN

While AMZN bulls have continued to defend the $150s/$160s support levels during the market-wide correction, indicators suggest that the pullback may not be over yet, attributed to numerous events:

- The developing Yen Carry Trade, with unwinding likely to continue for a little longer as the Bank of Japan hikes rates, with it potentially triggering moderate volatility in the near-term.

- The SPY is still inverted against the 125-day moving average, with VIX at heightened levels. Assuming that it remains well-supported at current levels through the Q2’24 earning season, we may see this bottom hold, with sentiments likely to normalize.

- Even so, the McClellan Volume Summation Index is already trending downwards, with the ongoing SPY inversion potentially widening nearer to October 2023 levels prior to the eventual recovery after the Fed (supposedly) pivots in the upcoming September 2024 FOMC meeting.

- For now, most analysts have already priced in a 50 basis point rate cut, barring which we may see further volatility.

Therefore, while AMZN’s financial metrics remain excellent, we believe that the market wide pessimism may continue to impact the stock’s near-term performance, prior to the start of the next recovery cycle.

Interested investors may consider observing the stock’s movement for a little longer, before adding according to their portfolio allocation and risk appetite.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.