Summary:

- I think Amazon will generate negative alpha over the S&P 500 in the quarters ahead.

- Consumer sentiment remains weak.

- There is no rebound yet in AWS growth.

- There are early signs of problems in AWS profitability.

- I see limited re-rating risk.

Kenishirotie/iStock via Getty Images

Thesis

I struggle to find a fundamentally bullish case for Amazon (NASDAQ:AMZN) due to 4 key reasons:

- Consumer sentiment remains weak

- There is no rebound yet in AWS growth

- There are early signs of problems in AWS profitability

- I see limited re-rating risk

I believe Amazon is likely to generate negative alpha over the S&P 500 (SPY) (SPX) over the next few quarters. However, I withhold from issuing a ‘sell’ rating on the stock as I recognize that it may still go up along with the market.

Hence, from an absolute return perspective, I adopt a ‘neutral/hold’ stance on Amazon. However, from an alpha vs the market benchmark perspective, I think it is prudent to exit active Amazon exposure and redeploy the proceed into the S&P 500 or other alpha-generating ideas.

Honing in on what matters

Modelling Amazon took me a while. It was not as complex as British American Tobacco (BTI) (OTCPK:BTAFF), but it is still quite multi-faceted in terms of business segments. However, summarizing the business pieces in the following way clearly shows which pieces matter the most:

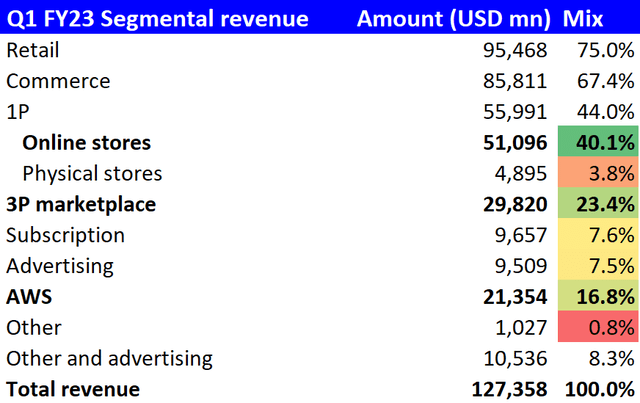

Q1 FY23 Segmental Revenue Split (Company Filings, Author’s Analysis)

The numbers clearly show us that 80% of the revenue mix is composed of 3 key businesses; 1P online stores, 3P marketplace and Amazon Web Services (AWS). Although it has the smaller mix compared to the traditional commerce business, I believe the under-penetration of the cloud makes AWS the most important growth driver for the company in the medium to long term.

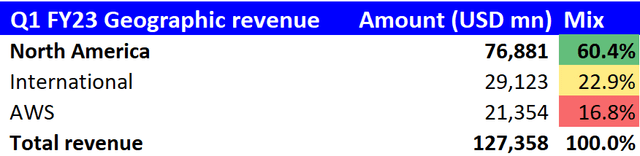

The bulk (60.4%) of the commerce (non-AWS) revenues come from North America, making that geography’s consumer behavior a key driver of business performance:

Q1 FY23 Geographic Revenue Split (Company Filings, Author’s Analysis)

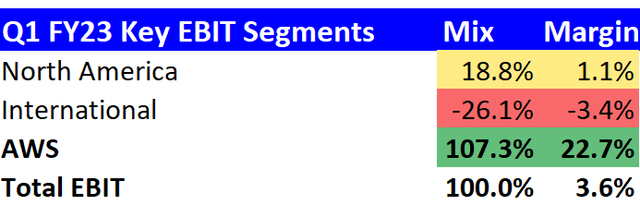

From a profitability perspective, AWS is by far the most important piece; without it, Amazon would be operationally unprofitable:

Q1 FY23 EBIT Split (Company Filings, Author’s Analysis)

Identifying these key drivers of Amazon operational performance helps focus on the key elements of the thesis:

Consumer sentiment remains weak

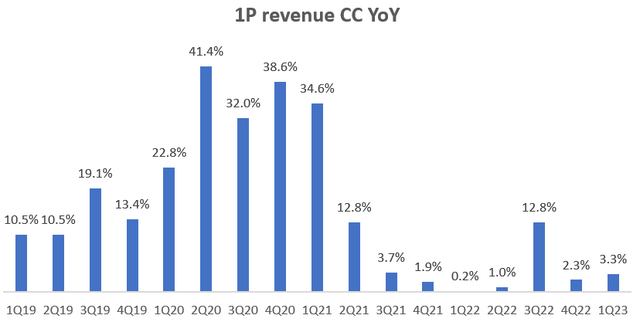

As seen in the section above, the e-commerce business drives 63.5% of Amazon’s sales. The 1P e-commerce segment has been seeing a tepid growth trend in recent quarters as YoY growth rates have fallen off a cliff to below pre-pandemic levels:

1P revenue Constant Currency (CC) YoY (Company Filings, Author’s Analysis)

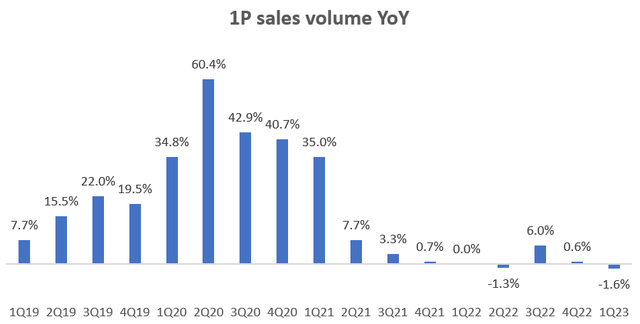

This weakness is driven mostly by stagnant growth in sales volumes:

1P sales volume YoY (Company Filings, Author’s Analysis)

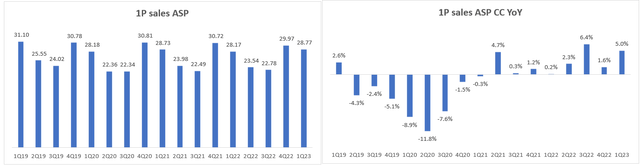

Average selling prices (ASP) is seeing a little bit of seasonal rebound:

1P Sales Average Selling Price (ASP) (Company Filings, Author’s Analysis)

However, I deduce that this is mostly due to inflationary effects rather than premiumization since management noted customers’ “focus on value” in the Q1 FY23 earnings call.

The 3P marketplace piece shows similar trends of being below pre-pandemic in terms of overall revenue growth, volume and pricing as well. But it is not as bad as the 1P e-commerce business. Regardless, I anticipate further volume and pricing pressures on both 1P and 3P as consumer sentiment remains weak:

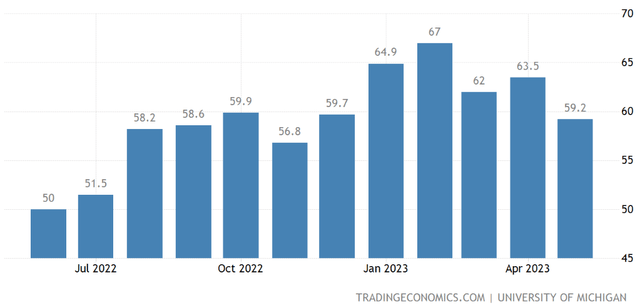

University of Michigan Consumer Sentiment Index (Trading Economics, University of Michigan)

May 2023’s University of Michigan Consumer Sentiment Index saw a sharp 6.8% decline from 63.5 to 59.2, indicating a worsening outlook ahead. Note that these levels are well-below the longer term average of around 80.

Management’s commentary was also cautious for the outlook ahead:

the uncertain economic environment and ongoing inflationary pressures continue to be a factor, and we believe it’s continuing to drive cautious spending across consumers.

– CEO Andrew Jassy in Q1 FY23 earnings call, author’s bolded highlight

There is no rebound yet in AWS growth

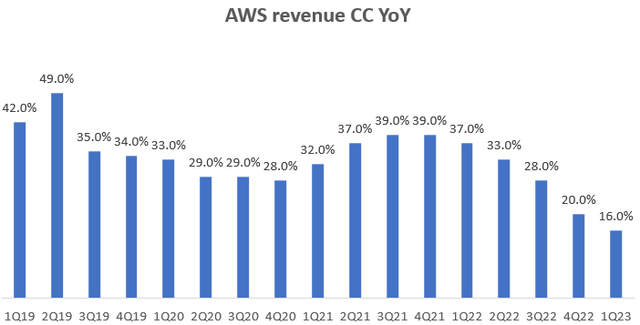

AWS growth continues to decelerate sharply to 16.0% YoY in constant currency terms as enterprises focus on reprioritizing spends:

AWS Revenue Constant Currency (CC) YoY (Company Filings, Author’s Analysis)

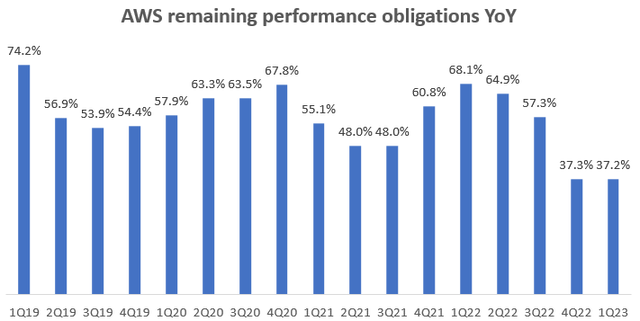

AWS’ remaining performance obligations (RPO) indicate the backlog of AWS-related spends, making it a leading indicator of AWS revenues. This metric has also seen a sharp growth deceleration over the past 2 quarters:

AWS Remaining Performance Obligations YoY (Company Filings, Author’s Analysis)

Management emphasized that they are working with customers to help them optimize (meaning cut now and potentially postpone for later) cloud spends in these times. Over the medium to longer term, when I look at this comment by CEO Andrew Jassy, I get the sense Amazon’s AWS may be losing out in technology leadership when it comes to cloud and generative AI opportunities:

these large language models and generative AI capabilities, they’ve been around for a while, but frankly, the models were not that compelling before about 6, 9 months ago.

– CEO Andrew Jassy in Q1 FY23 earnings call, author’s bolded highlight

I am surprised to hear such commentary which is a stark contrast to that of Microsoft (MSFT) and Google (GOOG). I notice that other Seeking Alpha authors have alluded to the same idea about Amazon potentially being a laggard in the AI driven opportunities.

There are early signs of problems in AWS profitability

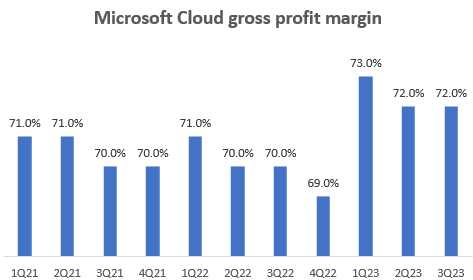

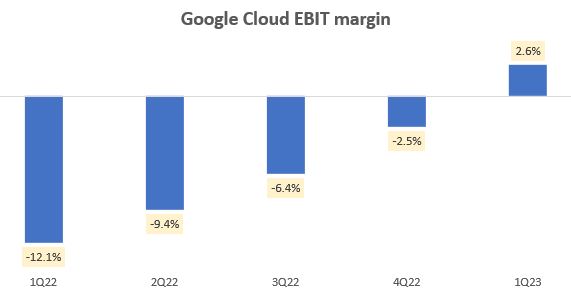

Microsoft Cloud Gross Margin (Company Filings, Author’s Analysis) Google Cloud EBIT Margin (Company Filings, Author’s Analysis)

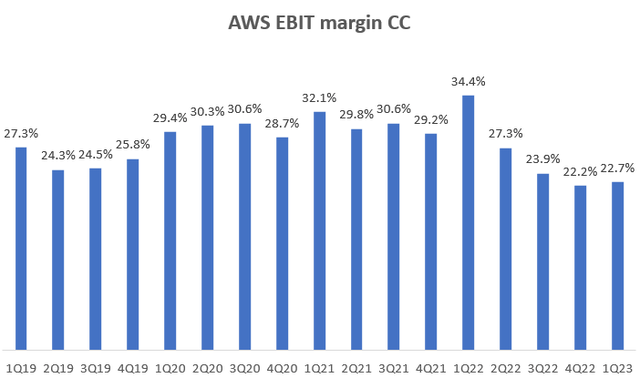

As both Microsoft and Google see meaningful sequential improvement trends in their cloud profitability margins, Amazon’s AWS has seen margin declines:

AWS EBIT Margin in Constant Currency (CC) terms (Company Filings, Author’s Analysis)

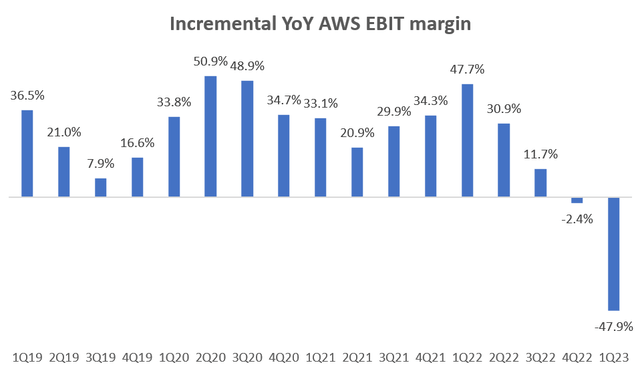

Operating leverage in AWS has gone for a toss particularly in Q1 FY23. This is visible when we look at the sharp -48% drop in incremental AWS margins:

Incremental AWS EBIT margins (Company Filings, Author’s Analysis)

There was a $270 million AWS-related severance cost in Q1 FY23. However, even after normalizing for this one-time cost, the broader point rings true; in Q1 FY23, normalized AWS constant currency EBIT margins are 25.3% and normalized incremental YoY AWS EBIT margins are -38.6%.

This makes me wonder whether Amazon is bending over backwards too much to please its AWS customers on pricing. In an increasingly competitive cloud services environment, there is elevated risk of whether Amazon would be able to make back the profitability concessions.

I see limited re-rating risk

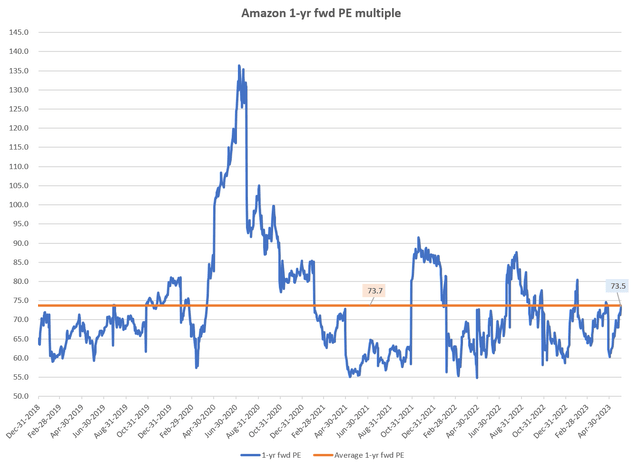

Amazon 1-yr fwd PE (Capital IQ, Author’s Analysis)

At 73.5x, Amazon is currently trading very close to its 5-year 1-yr forward PE of 73.7x. I believe the weaker consumer outlook and unexciting performance of the AWS segment limit the chances of a meaningful bullish re-rating.

Conclusion

On the e-commerce side, I think May’s weaker consumer sentiment figures confirm management’s outlook for more cautious growth ahead. Hence, I anticipate continued bleak trends in pricing and volumes.

On the AWS side, Amazon is suffering from an industry-wide cloud spending slowdown. However, I think the more idiosyncratic risks are in AWS being a laggard in the AI-driven opportunities compared to Microsoft’s Azure and Google’s Cloud Platform (GCP). Additionally, I believe there is a risk of Amazon conceding on AWS pricing too much as enterprises look to cut down their spends. In an ever-more competitive cloud services market, I am skeptical about enterprises’ longer term stickiness, loyalty and price inelasticity.

Given these headwinds, I also see limited risks of a bullish re-rating on Amazon. I believe the stock is likely to underperform the S&P 500 over the next few quarters. However, I rate the company a ‘neutral/hold’ as I recognize that it may be buoyed up by the overall market, which seems to be turning bullish. Personally, I have 0 active Amazon exposure. I have positions in the Vanguard S&P 500 ETF (VOO) as I think that will outperform.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.