Summary:

- Amazon’s shares are trading close to all-time highs due to successful business performance and improving macroeconomic environment.

- Strong Q1 results and positive economic indicators suggest Amazon may continue to perform well in Q2 and beyond.

- Despite growth opportunities, Amazon faces risks from geopolitical tensions and potential overvaluation, leading to a non-existent margin of safety for investors.

VisionsofAmerica/Joe Sohm/DigitalVision via Getty Images

Amazon’s (NASDAQ:AMZN) shares have greatly appreciated since the start of the year and are currently trading around their all-time highs thanks to the successful performance of the company’s business that was fueled by the improving macroeconomic environment. Thanks to the resilience of the American economy, Amazon now has a decent chance of releasing another successful earnings report on August 1 and boosting investors’ confidence at the same time. However, while in the short term there are reasons to be optimistic about Amazon, the company faces several rising challenges that could undermine its growth story in the long run.

America Strikes Again

Back in March, I wrote an article titled Amazon: America Strikes Back in which I acknowledged my bad call of giving the company a rating of SELL in late 2023, which played out poorly. Last year, I underestimated the strength of the American economy, which has started to improve and approach a soft landing, which positively affected Amazon’s performance in recent quarters. This has been described in greater detail in my March article about Amazon.

Since that time, the American economy continued to improve as disinflation picked up pace. On top of that, Amazon’s shares have appreciated by a single-digit rate in recent months, and I made it a rule of thumb to never underestimate how resilient the U.S. economy can be.

As a result of all of this, there’s a case to be made that as long as the disinflationary trend continues, the confidence of the American consumer will be increasing and positively affecting the performance of Amazon’s business, which is greatly exposed to how well the U.S. economy is performing.

The latest Q1 earnings results that were released a couple of months ago showed that Amazon has started a year on a high note as its revenues increased by an impressive 12.5% Y/Y to $143.3 billion and exceeded expectations by $750 million. Such a performance was achieved in large thanks to the improvement of the American economy, as Amazon’s North American sales during the quarter were up 12% Y/Y to $83.6 billion.

At the same time, Amazon will likely be able to report similar impressive results for the second quarter of the year. The latest data from the U.S. Census Bureau shows that from April to June the retail sales in the United States increased by 2.5% Y/Y, which indicates that Amazon’s Q2 sales in North America should also be up Y/Y given the company’s exposure to the American economy. In addition to that, online retail sales have also been increasing Y/Y in recent months, while the inflation has been easing and the headline inflation rate in June was up only 3% Y/Y against the expectations of 3.1%.

All of this indicates that the United States was able to avoid a major recession, and a soft landing appears to be on the cards right now. This is undoubtedly a major positive development for Amazon, since the rising retail spending and the decrease of borrowing costs as a result of a potential interest rate cut in September might boost consumer confidence even more and help the company achieve its fiscal targets in North America.

What’s more, is that the improving global macro environment could also boost Amazon’s worldwide sales in the following quarters. In Q1, the company’s international segment generated $31.9 billion in sales, up 10% Y/Y. Given that the global economy is expected to grow at a modest pace in 2024 and beyond, while the ECB has become one of the first major central banks to cut interest rates in the current environment, it makes sense to assume that Amazon’s international sales in the following quarters should also not disappoint investors. Add to all of this the fact that the overall eCommerce market is expected to grow at a CAGR of nearly 10% by the end of the decade and reach over $4 trillion, and it becomes obvious that Amazon has a decent number of catalysts to retain its momentum for a while.

What’s more, is that the expected growth of the cloud and online advertising markets should also boost Amazon’s sales in the foreseeable future, given the company’s exposure to both of those markets. Therefore, Amazon’s business has more than enough catalysts, which should help it retain its momentum from Q1 into Q2 and beyond.

Margin of Safety Is Non-Existent

Despite all of the growth opportunities described above, Amazon is likely to be more exposed to geopolitical risks in the foreseeable future, which could undermine its growth catalysts in the long run.

One of the biggest disadvantages of Amazon is its heavy reliance on the cross-border eCommerce trade. Some reports suggest that the number of Amazon sellers that are from China has doubled by the end of the last decade, while others indicate that Chinese sellers are currently the biggest third-party sellers on Amazon’s marketplace. The official data from China shows that last year there was a major increase in cross-border eCommerce import-export volumes, which might indicate that Chinese sellers retained their dominance over the global eCommerce market. At the same time, in late 2023 it was reported that Amazon has doubled down on its strategy of helping Chinese merchants sell goods abroad.

The biggest issue with this is that in the current environment where Sino-American relations are at historically low levels, any escalation of the ongoing trade war risks disrupting the cross-border trade even more and indirectly negatively affecting Amazon’s performance in the future. Earlier this year, the Biden administration has already greatly increased tariffs on Chinese EVs and other green tech. While this is unlikely to have a meaningful impact on Amazon, it nevertheless indicates that the trade war is far from being over.

If Donald Trump wins the Presidential election in November and later greatly increases tariffs on Chinese goods to over 60% and implements a basic tariff of 10% on goods from the rest of the world, then Amazon might experience a major disruption of its business model. The potential new tariffs not only have the chance of negatively affecting retail sales due to the rising costs of goods for the households but also prompting a portion of Chinese sellers that are active on Amazon’s marketplace to look for customers in other markets, which could also negatively affect Amazon’s business model. What’s more, is that the potential escalation of trade tensions could also result in a slowdown of the global economy, which would be a major negative development for Amazon given how exposed it is to sales in North America and abroad.

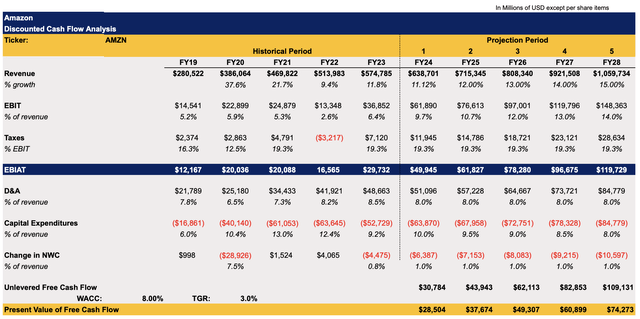

On top of that, despite the growth opportunities that Amazon has going for it, by trading at a forward P/E ratio of ~41x, the company could be considered overvalued especially since the sector median forward P/E ratio is significantly lower. To figure out whether there’s any margin of safety left at the current price, I created a DCF model that can be seen below. The revenue assumptions in my model for FY24 are mostly in-line with the street expectations, while in FY25 and beyond I assume a gradual increase in the growth rate due to the potential further improvement of the economy and the monetization of growth opportunities that were described earlier in this article.

The EBIT assumptions in the model also closely correlate with the overall street expectations. The CapEx assumptions are significantly higher than before, primarily due to the need of the company to expand its AWS infrastructure to meet the rising demand for generative AI tools and platforms. The assumptions for the rest of the metrics closely correlate with Amazon’s historical performance. The terminal growth rate in the model is 3%, while the weighted average cost of capital is 8%, which is close to the market’s average cost of capital rate.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

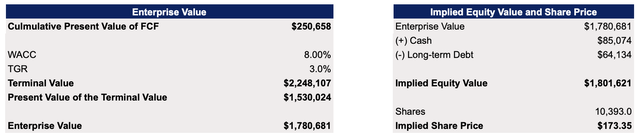

This model shows that Amazon’s fair value is $173.35 per share, which represents a discount of ~5% from the current market price.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Considering this, I believe that the margin of safety for buying Amazon at the current price is almost non-existent. That’s why I decided not to add any shares of the company to my portfolio, despite the relatively successful performance of the business in recent quarters.

The Bottom Line

The momentum is currently on Amazon’s side. Despite the overall market selloff in recent days, the company’s shares could regain their momentum closer to August 1 when Amazon reports its Q2 earnings results, which should be relatively successful given how well the American and global economy have performed during the second quarter.

However, given the nearly non-existent margin of safety at the current price and the rising long-term risks, I’ve decided to look for other opportunities so that my portfolio is not significantly exposed to the ongoing Sino-American trade war, which has the potential to be greatly escalated in the foreseeable future. While the American economy itself will likely adapt to the changing macroeconomic environment even during the worst-case scenario like it did countless times in the past, the same can’t be said about Amazon at this stage due to its exposure to cross-border trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.