Summary:

- Amazon beat 1Q-23 profit estimates handily.

- Amazon surprised the market by reporting slowing AWS growth. AI opportunity could lead to a rebound of sales growth quickly.

- Amazon’s low P/S valuation improves the value proposition.

4kodiak/iStock Unreleased via Getty Images

Despite exceeding profit expectations by a wide margin in the first quarter, Amazon.com (NASDAQ:AMZN) failed to break out to the upside as the company’s earnings release, particularly regarding AWS, raised new concerns for investors. AWS’s sales trajectory slowed QoQ, raising concerns among investors about the possibility of a broader deterioration of the company’s fundamentals.

As a result, Amazon’s stock price fell and fell below the 200-day moving average once more, contrary to my expectations. This is bad news from a technical standpoint, and Amazon may face further downside correction.

Having said that, I believe Amazon provides investors with an attractive valuation, and I see the potential for a rebound in AI-driven AWS growth.

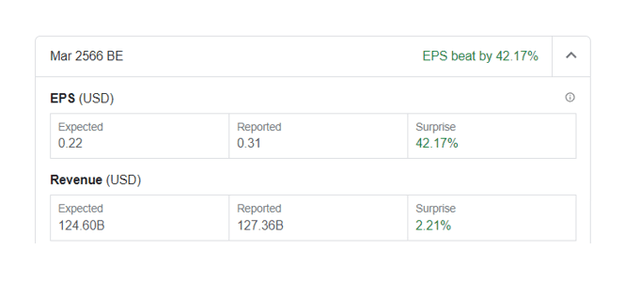

Amazon Delivered Double-Beat

Amazon delivered a double-beat in terms of first-quarter sales and profits. Amazon also provided a significant EPS beat, reporting $0.31 per share in profits versus $0.22 per share expected. Amazon’s sales beat was not as significant, but it was a strong earnings release in a difficult market.

AWS Performance Came As A Shock To Investors

Amazon surprised the market by revealing slowing growth at its cloud unit, AWS, which was most likely the single most important reason why investors did not react more positively to Amazon’s Q1-23 earnings report.

AWS provides cloud computing functionality to Amazon’s mostly corporate customers, and the company’s sales growth slowed in the first quarter as the enterprise sector continued to adjust spending in an uncertain market.

Enterprise customers are actively reducing expenses to improve profitability, and AWS is reporting slower growth as a result. Other cloud companies, including Google and Microsoft, saw similar declines in sales growth in the first quarter, but it should be noted that Amazon continues to outperform its peers in terms of sales growth.

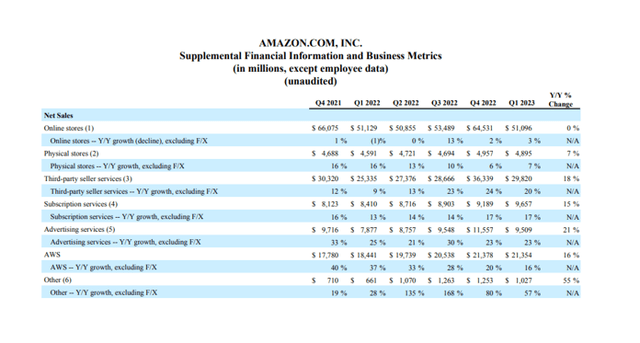

AWS grew sales by only 16% YoY (excluding currency changes), the slowest rate in years and a far cry from the 37% growth rate seen in the first quarter of last year. Not only is the company dealing with slowing spending in the cloud computing market, but most of Amazon’s individual businesses are also slowing.

Almost all Amazon businesses experienced slowing growth in 1Q-23, with the exception of online and physical stores, which both experienced a 1% increase in QoQ growth rates.

Supplemental Financial Information (Amazon.com)

Having said that, I believe it is premature to dismiss AWS as a problem. AWS has a long runway ahead of it and is the undisputed leader in the cloud computing industry, with an estimated 33% market share. I believe AWS has a tremendous opportunity to capitalize on the inevitable adoption of artificial intelligence.

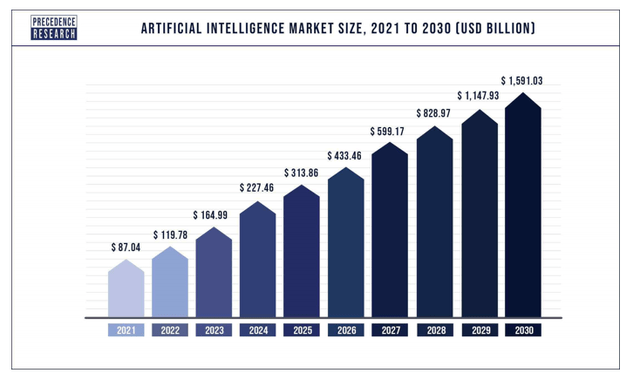

AI requires a lot of computing power, and AWS already provides machine learning services. As the enterprise sector looks for ways to scale AI, I believe AWS’s growth will accelerate. The AI market is about to explode with new innovations like ChatGPT and other AI tools that promise massive productivity gains. According to Precedence Research (chart below), the AI market will grow 13-fold between 2022 and 2030.

As more data is processed and stored, cloud computing platforms such as AWS will play a significant role in the AI market. AI is clearly the new frontier for AWS, which is why I believe investors looking to invest in Amazon should look a decade ahead rather than just the next quarter to realize AWS’s potential.

AI Market Size (Precedence Research)

Failed Upside Breakout

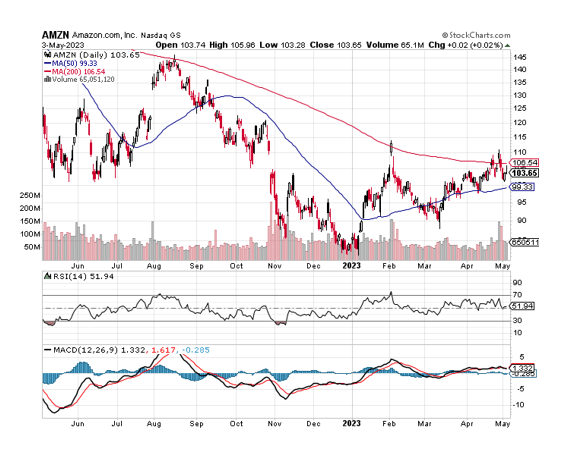

In my previous article on Amazon, I stated that I was bullish going into earnings because I expected the company to report strong results, thanks in part to AWS, which could have resulted in an upside breakout of the stock. This breakout did not occur because investors were irritated by Amazon’s slowing growth in its crown jewel unit, AWS.

As a result, Amazon’s stock price dropped and fell below the 200-day moving average line once more, indicating a negative chart signal and short-term upside resistance.

It may also indicate further short-term correction potential, despite the fact that AMZN is not yet oversold according to the Relative Strength Index.

Moving Averages (StockCharts.com)

Amazon’s Value Proposition

Amazon’s value proposition remains attractive to me, despite the fact that the company did not meet my expectations for AWS performance in the first quarter. Amazon’s total sales have increased at double-digit rates in recent years, with AWS accounting for the majority of this growth.

With growth slowing, investors must now expect downward pressure on Amazon’s sales estimates. The market currently forecasts $560.0 billion in sales for this fiscal year, reflecting a growth rate of only 9%.

Revenue Estimate (Yahoo Finance)

Despite slowing growth, I believe the company’s valuation is still very appealing, with a sales multiple of 2.0x. In the previous twelve months, the retailer saw a much higher valuation multiple.

PS Ratio (YCharts)

What I like best about investing in Amazon is that the company’s total sales are still growing in the high single digits, and it is growing much faster than Microsoft, Google, or Alibaba. All three companies’ growth rates have been significantly slowed in recent quarters, with Microsoft posting the fastest YoY growth rate of 7% in the most recent quarter.

Google, on the other hand, grew only 3% YoY in 1Q-23, weighed down by ongoing ad market challenges.

Alternatively, Amazon delivered 9% YoY growth in 1Q-23 and remained one of the fastest mega-cap companies in the tech sector. This indicates to me that, despite AWS’s challenges, Amazon is making the right decisions and playing the long game.

Why Amazon Could See A Lower/Higher Valuation

Amazon’s valuation could change depending on the performance of its AWS cloud computing unit. More customer migrations and widespread adoption of artificial intelligence by the enterprise sector could fuel AWS’s growth.

A recession, on the other hand, may be viewed as an excuse for the business sector to cut spending in the short term.

My Conclusion

As far as I am concerned, the slowing growth of AWS is not a major issue, despite the fact that it was the primary reason why Amazon failed to stage a breakout after reporting better-than-expected earnings and a 43% profit beat.

While AWS is clearly experiencing some transitory spending headwinds in the enterprise sector, investors should consider AWS’s long-term growth potential: Artificial intelligence could be a powerful theme for AWS moving forward, and widespread adoption of AI could lead to a resurgence of growth in the long run.

Amazon’s valuation based on sales is attractive and doesn’t do justice to the fact that Amazon owns the world’s largest cloud computing business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.