Summary:

- We continue to be bearish on Amazon and see more near-term downside ahead.

- We expect Amazon to be pressured on both its retail and cloud business fronts in 1H23 and expect growth to slow down in the near term.

- We expect the company to take more cost-cutting measures in 1H23 amid market uncertainty to better maneuver the post-pandemic environment.

- We’re bullish on Amazon in the longer term but recommend investors exit the stock at current levels and revisit toward the end of the year.

Anderson Coelho

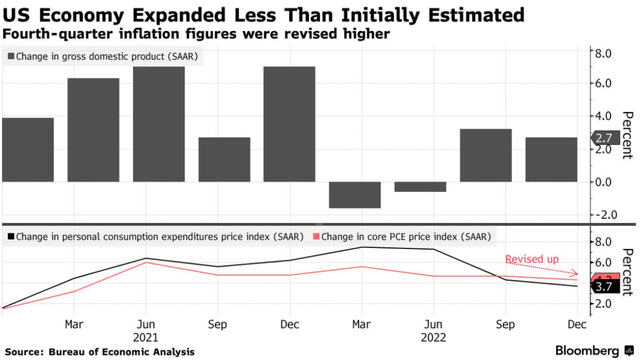

We remain sell-rated on Amazon (NASDAQ:AMZN). We expect the company to underperform the peer group in the near term as it continues to face pressure from the weak spending environment on both AWS and retail fronts. We see the stock dipping further in 1H23 before it provides a favorable entry point. The following graph outlines Amazon’s stock performance over the past year in comparison to the peer group and the S&P 500 index.

YCharts

We downgraded Amazon to a sell earlier this year based on our belief that the company would face a rough couple of months of reorganizing cost structures and maneuvering macroeconomic headwinds. We continue to expect the mega-cap tech stock to experience slower growth in FY2023 as macroeconomic headwinds persist and the company requires cost-cut measures to retain profitability.

Lagging growth

Amazon is down nearly 38% over the past year, and we expect the company to continue to drop as it experiences sale slowdowns. Amazon reported a 9% increase in revenue in 4Q22, topping expectations. Still, the company’s core retail business and AWS sales are showing signs of slower growth. The company’s market cap shrunk to about $929.7B from its original $1.7T at the start of 2022. Despite the company’s more attractive valuation compared to earlier quarters, we still don’t believe it’s time to buy. We expect Amazon to continue underperforming based on the following:

1. Cost problem:

We expect Amazon to be wrestling with a cost problem in 1H23 and see the company taking more cost-cutting measures beyond the layoff of 18,000 employees. Amazon surged during the pandemic and prepared for the post-pandemic environment to retain pandemic-led demand, which didn’t happen. Andy Jassy, Amazon CEO, admitted that the company over-hired and over-expanded its warehouse network to keep up with pandemic-era demand. In 1H23, we believe Amazon will focus more on cost-cutting measures, with the latest of the sort being the company’s attempt to shed warehouse space by subleasing a minimum of 10M square feet.

2. Macroeconomic headwinds

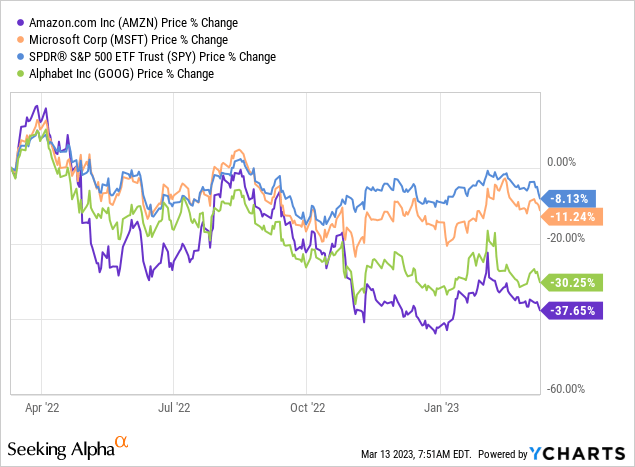

In our previous note, we discussed the impact of eroding customer spending power on Amazon’s sales. We continue to expect the company to be pressured by inflationary pressures and spiked interest rates in the near term. We believe consumers have less disposable income due to the weaker spending environment persisting through 1H23. The company’s e-commerce sales fell 0.3% for FY2022 and 2% to $64.53B Y/Y in 4Q22. The U.S. economic growth for the fourth quarter was weaker than expected; inflation-adjusted gross domestic product in the U.S. was up by a 2.7% annualized rate; the following graph showed the U.S. economy’s expansion in 2022. We expect to see a downward trend in consumer spending in 1H23 and believe this will pressure Amazon’s e-commerce sales in the near term.

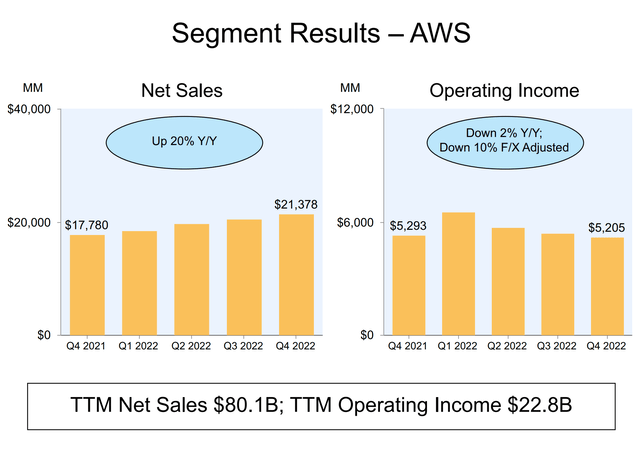

We also believe the weaker spending environment is spilling into Amazon’s cloud business, AWS. The company retains its dominant position in the cloud market, with a 34% market share, alongside Microsoft’s (MSFT) Azure and Alphabet’s (GOOG) Google Cloud. Still, we expect softer demand in the cloud market due to macroeconomic headwinds. AWS is Amazon’s fastest-growing segment; still, it missed expectations this quarter, with sales increasing 20% Y/Y to $21.4B compared to 27.5% in 3Q22. We expect AWS to be a great long-term growth driver for Amazon but don’t expect growth to see growth slow down meaningfully in the near term. AWS segment experienced a 2% Y/Y decline in operating income in 4Q22- we believe this indicates Amazon is experiencing higher operating costs that could not be offset by increased demand. We don’t expect cloud growth to stop altogether; instead, we see cloud growth slowing down in 1H23. We believe AWS revenue is at risk of enterprises tightening IT budgets amid market uncertainty. Canalys expects the global cloud infrastructure services spending to increase by 23% during 2023, compared to 29% in 2022. We see more downside ahead and recommend investors exit the stock at current levels.

The following graph outlines Amazon’s AWS segment results in 4Q22.

Amazon 4Q22 earnings presentation

We believe much of Amazon’s pullback is tied to the rough macro environment. Hence, we expect the company to reaccelerate growth as the economy reopens and consumer spending picks up. But we don’t see this happening in the near term. Instead, we expect the situation to worsen in 1H23 before the company can meaningfully recover.

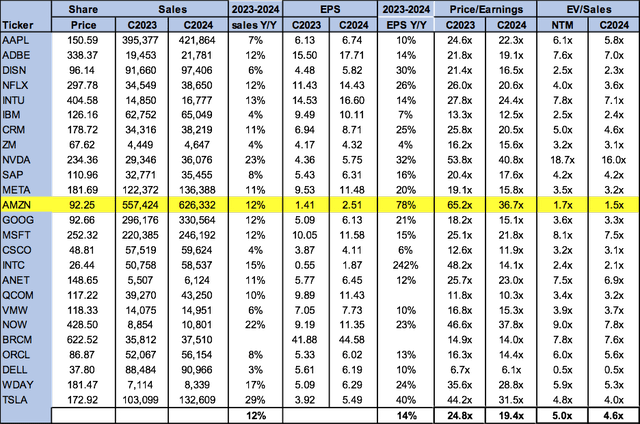

Valuation

Amazon is trading well above the peer group average at 36.7x C2024 EPS $2.51 on a P/E basis compared to the peer group average of 19.4x. The stock is trading at 1.5x EV/C2024 Sales versus the peer group average of 4.6x. We expect the stock to dip closer to its 52-week-low of $81.43 and recommend investors exit it before the downslide materializes more meaningfully.

The following table outlines Amazon’s valuation.

Word on Wall Street

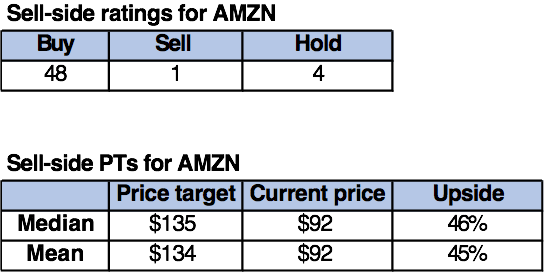

Wall Street is overwhelmingly bullish on the stock. Of the 53 analysts covering the stock, 48 are buy-rated, four are hold-rated, and the remaining are sell-rated. We attribute Wall Street’s bullish sentiment to Amazon’s expanding AWS business and its position in the e-commerce market, holding a nearly 38% market share. We’re bullish on Amazon in the longer run, but we believe things will get worse before they get better, and we recommend investors exit the stock.

The stock is currently priced at $92 per share. The median sell-side price target is $135, while the mean is $134, with a potential 45-46% upside.

The following tables outline Amazon’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We remain sell-rated on Amazon. We see the stock dipping further in the near term due to the harsh macroeconomic environment of 2022 spilling into this year. We expect Amazon to see slower sales growth in its retail and cloud businesses in the near term. We’re bullish on Amazon’s long-term performance, especially as it expands its AWS business, but believe the company is vulnerable to cyclicality and macro headwinds in 1H23. We previously wrote on Amazon recommending investors sell and revisit the stock toward the end of 1H23; we now revise this outlook and believe investors may have to wait until the end of 2H23 to see more attractive entry points. We see more downside ahead and recommend investors exit the stock and wait for the downside to be discounted.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.