Summary:

- Amazon has dipped about 49% over the past year, and we recommend investors should exit the stock.

- We believe Amazon is going through a rough couple of months of reorganizing cost structures to maneuver the macroeconomic environment and revive profitability.

- We expect Amazon’s layoffs are part of the larger wave of job cuts in the tech sector rather than any fundamental issue with Amazon’s business.

- Amazon has had a rough year due to macroeconomic headwinds as the company derives the bulk of its revenue from North America, accounting for 61% of net sales.

- We recommend investors sell the stock at current levels as we expect more downside ahead before the company can grow meaningfully.

Anderson Coelho/E+ via Getty Images

We’re moving Amazon (NASDAQ:AMZN) to a sell. Our bearish sentiment is based on our belief that Amazon is focused on rearranging its workforce and managing macroeconomic headwinds. Hence, we don’t expect the company to outperform in the near term.

We believe Amazon’s 3Q22 earnings report highlighted trouble with net income dropping 57% Y/Y. Since the company reported its earnings for the third quarter of 2022, the stock slumped about 25%, and we expect more downside ahead. Nevertheless, we’re bullish on Amazon in the long run, specifically with its AWS retaining the leadership position in the cloud infrastructure market. However, we believe the company will have a rough few months as it rearranges its workforce and maneuvers the macroeconomic environment.

Rearranging workforces and maneuvering macroeconomic headwinds

Amazon stock was cut in half in 2022, and we believe the stock will still face a few rough months of cost cuts and macroeconomic challenges before it recovers. Similar to e-commerce companies, Amazon’s stock increased exponentially during the pandemic and experienced the withdrawal of growth catalysts last year as the pandemic environment lifted and inflationary pressures rose. Our bearish sentiment is based on our belief that Amazon will be dealing with two issues in 1H23:

1. Cost cuts & reorganizing workforces

During the pandemic, we believe Amazon over-expanded as management anticipated growth that has yet to materialize. In November, the company announced its first major job cut of around 10,000 jobs since going public. At the start of 2023, we saw this number rise to potentially over 18,000 job cuts, communicated by a public staff note from Amazon CEO Andy Jassy. We believe Amazon will be pressured in the near term as it reorganizes its workforce and looks into cost cuts. We expect the pending need for cost cuts is the result of the company’s overexpansion during the pandemic; Bloomberg reported that Amazon’s global workforce surged around 75% during the pandemic to keep up with the demand created by the work-from-home environment. We believe Amazon is now dealing with cost cuts as it faces weaker-than-expected demand.

2. Macroeconomic headwinds

Macroeconomic headwinds is a phrase that was thrown around a lot during 2022- and for a good reason. While Amazon remains a TechStockPros favorite from the FANG stocks, it is not immune to inflationary pressures and rising interest rates. We expect Amazon to continue to feel pressure from eroding customer spending power in the first half of 2023.

While multiple analyses of Amazon on Seeking Alpha preach that the stock is a buy after the major pullback in 2022, we still don’t believe Amazon is out of the woods as inflationary pressures and spiked interest rates persist. In 3Q22, Amazon reported net sales growth of 15%. However, we believe the company’s bottom line is significantly weaker than in earlier periods.

We believe inflationary pressures don’t only harm Amazon’s customer spending behavior but also spill into the company’s operating costs. Inflationary pressure raised Amazon’s operating costs on all fronts. We believe inflationary pressures are reflected in Amazon’s operating income and cash flow declines. Amazon’s operating margin dropped to 2% in 3Q22 compared to 4.4% in 3Q21.

We believe the first half of 2023 will be crucial for Amazon to restructure costs and workforce to maneuver the macroeconomic environment. We’re bullish on Amazon in the longer term. Amazon remains the largest online retailer in the U.S. e-commerce market, with a 37.8% market share as of June 2022. Amazon’s AWS is also still the market leader in the cloud infrastructure market as of 3Q22, exceeding the combined market share of competitors Microsoft’s (MSFT) Azure and Alphabet’s (GOOG) (GOOGL) Google Cloud. Our bearish sentiment is not because we believe Amazon has bad fundamentals; instead, we expect the company is working through the grunt of adjusting cost structures to revive profitability.

AWS cannot offset macroeconomic headwinds

Our last note on Amazon in mid-September was buy-rated, with AWS at the core of our bullish sentiment. While we believe AWS will be a major growth driver for Amazon in the long run, we don’t believe the segment can offset the domestic and international slack in the e-commerce space. AWS grew by 27% Y/Y in 3Q22, which is significantly higher than Amazon’s e-commerce segment but still decelerating from the 39% growth rate of a year earlier.

We expect to see businesses and companies opt for cheaper alternatives or delay their cloud migrations due to macroeconomic pressures. We believe cloud migration may not be the priority of AWS customers due to the 40-year high inflation rate and spiked interest rates. Amazon’s CFO, Brian Olsavsky, attributed the slowdown of AWS growth compared to a year earlier to an “uptick in AWS customers focused on controlling costs.” Due to macroeconomic challenges, we believe AWS customers are practicing what management coined as “cost optimizations” in their 3Q22 earnings call. We don’t believe macroeconomic challenges will last forever. We expect AWS to be well-positioned to grow once macroeconomic headwinds ease, but we don’t see this happening in the near term.

Valuation

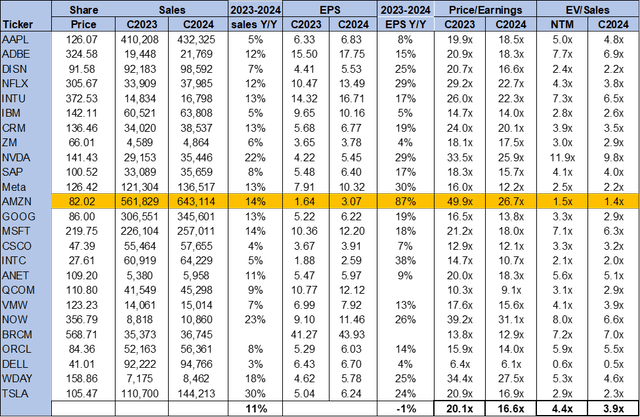

We believe Amazon is overvalued for the near-term pressing risks trading at 26.7x C2024 EPS $3.07 on a P/E basis compared to the peer group average of 16.6x. The stock is trading at 1.4x EV/C2024 Sales versus the peer group average of 3.9x. We believe the stock still needs to factor in the near-term risks facing Amazon and recommend investors exit the stock at current levels.

The following table outlines Amazon’s valuation compared to the peer group.

Word on Wall Street

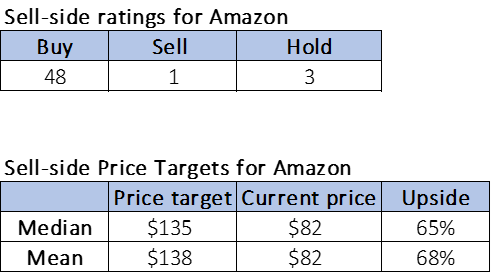

Wall Street is buy-rated on Amazon. Of the 52 analysts covering the stock, 48 are buy-rated, three are hold-rated, and the remaining are sell-rated. We attribute Wall Street’s bullish sentiment on the stock to Amazon’s leading position across e-commerce and cloud computing markets. The stock is trading at $82. The median sell-side ratings are $135, while the mean is $138, with a potential 65-68%.

The following table outlines Amazon’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We believe Amazon’s future looks bright, but we believe buying the stock during the current bear market for tech would be similar to trying to catch a falling knife, tricky and risky. We like Amazon’s long-term position in e-commerce and cloud computing markets, but we believe the company will be pressured in the near term. We believe 2022 taught us something valuable about Amazon: the company is vulnerable to the cyclicality of the macroeconomic environment. With no clear roadmap for inflationary pressures easing or how the Fed will handle interest rates in 2023, we believe the stock is too volatile to invest in at the moment. We recommend investors sell the stock at current levels and revisit it toward the end of 1H23.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.