Summary:

- Amazon is still undervalued despite its 50% year-to-date rally and is considered one of the best bargains in the stock market.

- The company’s strong growth potential, talented leadership, and long-term growth runway make it an attractive investment.

- Amazon’s position in eCommerce and cloud computing, as well as its strong operating cash flow, are driving its share price and expected future growth.

HJBC

I just performed my annual fair value update, transitioning from a 2023 to a 2024 fundamental focus, and every year when I do this there are big surprises.

This update allows me to start planning ahead for the new year, re-ranking my watch list, and prioritizing which positions I want to build up over the coming year.

Looking at the results, the biggest surprise that I saw this year wasn’t a high priority stock for me…

It’s not the type of company that I’ve been buying a lot of recently…

It doesn’t even pay a dividend and it’s been on a massive run throughout 2023, leading me to believe that my time and energy was better spent elsewhere, examining other, likely more attractive stocks.

But my assumption was wrong.

Even after its 50% year-to-date rally (which beats the pants off of the broader market’s 16% gains), Amazon.com (NASDAQ:AMZN) appears to be one of the very best bargains in the entire stock market.

To many that might sound crazy.

Amazon is this high flying tech stock with a crazy high price-to-earnings ratio, right?

Well, yes.

But that doesn’t mean that the stock isn’t cheap.

Actually, looking at my updated numbers for 2024 I believe that this company still has room to run higher.

A lot of room.

My fair value for AMZN shares right now is $213.00.

This implies upside potential of approximately 63% from here.

In this article, I’ll explain why.

Secular Tailwinds Makes AMZN a SWAN Stock

2022 was a tough year for Amazon shareholders.

When rapidly rising interest rates took the momentum away from the tech-trade, AMZN shares fell from the $170 range down to its current 52-week lows of $81.43.

The company’s bottom-line plummeted under new CEO Andy Jassy (falling from $3.24/share in 2021 to -$0.30/share in 2022).

And the aggressively negative sentiment against big-tech stocks from regulators and politicians across the world continues to ramp up.

None of this was good. But honestly, it doesn’t bother me.

I’ve been sleeping well at night with a large AMZN position for years because of the company’s strong growth potential.

This has never been a short-term trade for me and I continue to like the company’s long-term growth runway.

Call it naive, but throughout last year I always assumed that Amazon would recover (thankfully, 2023 has proven me right).

I’ve bought the stock several times into its recent weakness – most recently in January of this year at $84.84.

Right now my position is overweight and I haven’t considered adding shares in recent months because I’ve been building out my passive income stream.

But, after my recent deep dive into the company, AMZN is once again near the top of my shopping list.

This bullishness isn’t based upon blind faith. Amazon has accumulated an immense amount of human capital (talented leadership) over the years and that’s exactly what I look for when making long-term investments.

Excellence like Amazon has produced doesn’t happen by accident.

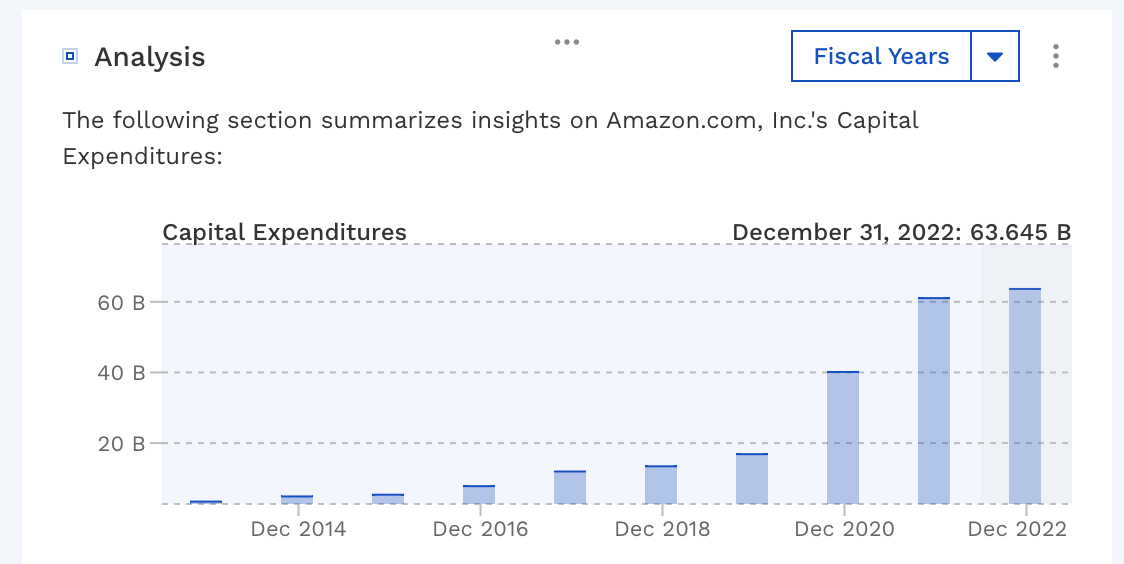

With that being said, I trust management when it comes to heavy spending that they’ve done in recent years. I believe that these investments will bolster long-term growth. There aren’t many companies who get this sort of benefit of the doubt when it comes to a non-profit oriented focus. But without a doubt, Amazon is one of them.

Amazon Capex (FinBox)

And I’ve seen its management team flip on the profit-oriented switch when necessary. I suspect they could do it again – at the drop of a hat – if they really needed to.

Frankly, I’ve seen people who bet against this company get burned again and again over the years.

That’s not a trap that I’m willing to fall into.

So, instead of trying to time the market, Amazon is a simple buy and hold stock for me.

Why?

Because this company still stands to benefit from some of the strongest secular growth trends playing out in the world today.

Amazon shares have soared (Amazon is up nearly 770% during the last decade) because of their prime position when it came to taking advantage of the shift from physical retail to eCommerce and the rise of cloud computing.

At this point both of these trends seem like old news, but the fact is, there’s still plenty of gas left in the tank.

Forbes estimates that only 20.8% of retail sales will occur online this year. They also project 10.8% eCommerce sales growth during 2023, overall.

This low double digit growth rate is in-line with Amazon’s most recent North American (11%) and international (10%) segment results.

Looking out over the long-term, I expect to see digital sales continue to take share from traditional retail and eventually, I suspect that the majority of sales will be made digitally.

In short, eCommerce companies are still taking share from traditional retail and while this is a relatively low margin business, size and scale should allow this company to increase profits moving forward.

Admittedly, as someone who prioritizes competitive moats and high margins, Amazon’s retail business isn’t all that attractive to me.

But frankly, for years I’ve sort of felt like investors are getting that business for free anyway because of how wonderful (and likely undervalued) the cloud (Amazon web services) segment is.

Unlike its retail segment, Amazon’s cloud business generates strong margins.

Last quarter AWS’s cloud margins were 24.2%.

I’ll admit, those margins are falling.

A year ago, AWS’s operating margin was 29.0%.

Not only are margins falling, but AWS sales growth is slowing as well.

Last quarter AWS generated $22.1 billion, up 12% on a year-over-year basis.

Well, a year ago AWS’s y/y sales growth was 33%.

Granted, some of this has to do with short-term enterprise cloud spend fluctuations. But some of it has to do with fierce competition in the cloud space.

That’s a hurdle that AMZN will have to clear as it continues to compete for market share, but when I think about where the world is headed (the rise of artificial intelligence, automation, and the onset of a new industrial revolution) there will be more than enough demand for cloud storage to go around.

All of the biggest tech trends in the world right now are built upon big-data. That has to be stored, mined, and analyzed somewhere. And AWS is surely going to benefit.

Secular tailwinds aside, as any business matures, slowing trends like these make sense.

But, at the end of the day, I’m not going to complain too much about a business with a nearly $100b run rate with double digit growth and 24% margins.

And, as you’ll see in a moment, the metric that has best predicted Amazon’s share price movement over the years is soaring higher.

I believe this is the catalyst for Amazon’s strong year-to-date share price rally…and looking at the numbers, I don’t think this rally is going to end anytime soon.

Follow the Numbers: Operating Cash Flow

As the old saying goes, a picture is worth 1,000 words.

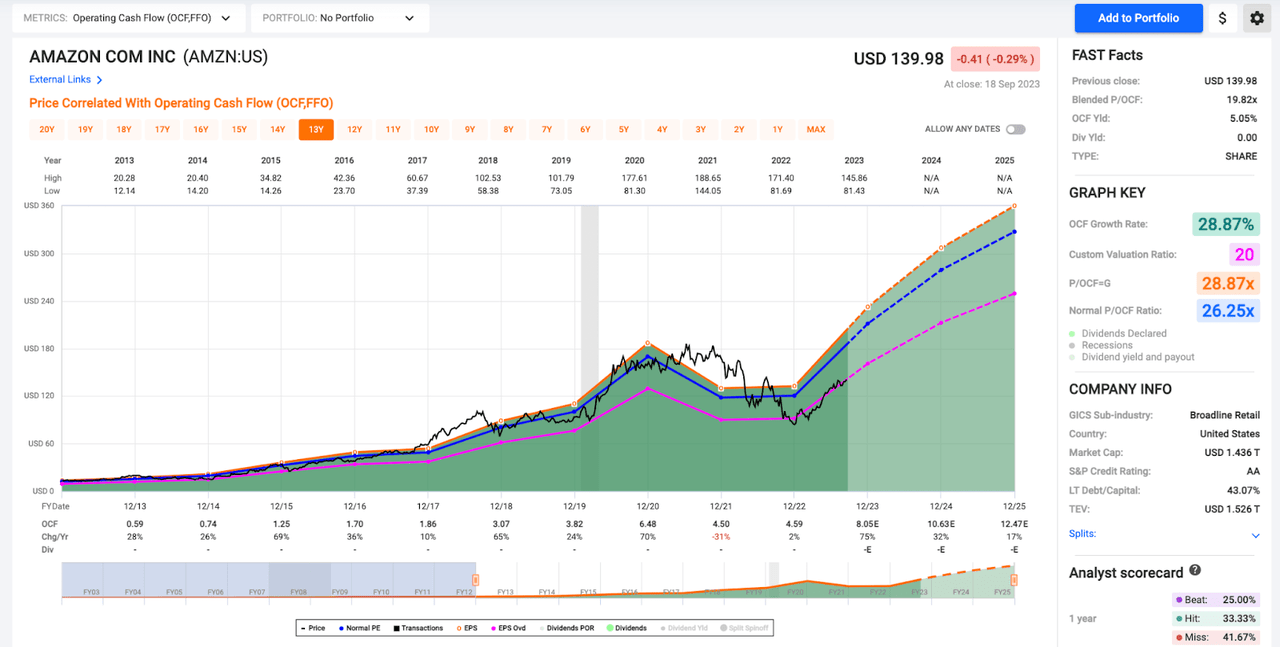

One glance at this chart should convince you that operating cash flows drive AMZN shares.

FAST Graphs

I look at countless stock charts each week and honestly, there are few that follow a trend so closely.

On this chart you’ll see the 10-year average P/OCF average (26.25x) that AMZN tracked closely from 2012-2020 with the blue line.

During 2018 and 2020 AMZN broke out above this trend-line.

After the 2018 rally AMZN’s P/OCF multiple quickly reverted to the mean and tracked it closely for 2 years.

In the aftermath of the COVID-19 pandemic we saw another rally up above that historical average; however, when the stock eventually cooled off it broke down below that 26x threshold and fell to the long-term support range in the 20x area.

I marked this 20x threshold with the pink line on the chart above and you’ll notice that this 20x level has served as support for the stock during dips throughout the last decade.

I love seeing strong support like this. It gives me confidence to buy dips, signaling relatively limited (at least, in a historical sense) downside risk.

AMZN shares have been riding this 20x support level higher throughout 2023.

During its last quarterly report, AMZN noted that its OCF was up by 74%, to $61.8 billion, during the trailing 12 months.

This strong growth trend is expected to remain in place during the coming quarters, leading me to believe that AMZN shares are going to rise even higher.

As seen in the chart above (which sources data from FactSet Research), the consensus analyst estimate for AMZN’s OCF growth rate in 2023 is 75%.

That isn’t a sustainable long-term growth level; however, consensus estimates are calling for AMZN’s operating cash flows to grow by another 32% in 2024 and 17% in 2025.

It looks like all of those 2021/2022 investments are paying off.

And shareholders are set to benefit.

Conclusion

If AMZN continues to track the 20x support level over the next 5 quarters then we’re looking at my $213/share price target and total returns of ~63%.

I was happy to stick with the relatively conservative support threshold here, instead of predicting mean reversion back up to that longer-term 26.25x level because of AMZN’s slowing growth rates.

Moving forward it’s possible that a 20x OCF multiple here is fair.

And even if that’s the case, the upside potential is considerable due to ongoing growth rates (who wouldn’t be thrilled with 55% gains?).

But, in the event that my conservative outlook is wrong and AMZN’s OCF multiple expands…well, then we’re looking at triple digit upside.

If AMZN meets consensus estimates for OCF of $10.63 in 2024 and sees its cash flow multiple rise back up to the 26x long-term then we’re talking about a 15-month price target of $279.00.

I’m not necessarily banking on that in the near-term, but fundamentally speaking, it wouldn’t be unreasonable.

Amazon has followed that trend for a decade and I certainly wouldn’t be surprised to see it get back on track (just like it did after the 2018 sell-off) in the near-term.

Either way, I believe that a $200+ share price is not only possible, but likely by the end of next year.

To me, looking at the numbers, that’s a relatively conservative target.

With that being said, don’t be surprised if you see me adding to my Amazon position in the coming days, weeks, and months.

It’s rare to find such strong upside potential (50-100%) combined with the peace of mind that comes with such solid downside support.

This is why I consider AMZN to be one of the most appealing opportunities in the stock market today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADC, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BMY, BN, BR, BTI, BX, CARR, CCI, CMCSA, CME, CMI, CNI, CPT, CRM, CSCO, CSL, DE, DEO, DHR, DIS, DLR, ECL, ENB, ESS, FRT, SPAXX, GOOGL, HD, HON, HRL, HSY, ICE, ITW, JNJ, KO, LHX, LMT, LOW, MA, MAA, MCD, MCO, MDT, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PFE, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, RY, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, WM, WPC, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.