Summary:

- Amazon reports strong Q1’24 results, exceeding guidance and consensus expectations on both the top and bottom-line.

- AWS sees positive trends as companies have largely completed most of their cost optimization efforts and are now turning to newer initiatives.

- Amazon plans to increase capital expenditures in 2024 to support the growth of AWS and generative AI.

- Amazon’s Trainium 2, its latest generation chip for training AI models, will be available in larger quantities in the second half of 2024 and early 2025.

- Within the Retail segment, we are seeing Everyday Essentials creating more consistent and habitual purchases.

Anderson Coelho

Amazon (NASDAQ:AMZN) reported strong Q1’24 results, with the company’s profitability the main star as it exceeded the top end of its guidance and came in materially higher than consensus.

Trends for AWS are also positive, as management noted that they are seeing optimizations becoming a thing of the past, while customers are starting to look to deploy more workloads into the cloud and signing longer and larger deals.

The company is optimistic about the long-term opportunity for AWS in the cloud and generative AI space, and it intends to invest more in capital expenditures in this area compared to 2023.

I like that we are seeing margins improve significantly across the Retail segment, after the new regionalized fulfillment network has been implemented and the management team sees more opportunities to lower cost to serve further.

I have written extensively about Amazon on Seeking Alpha, which can be found here. I continue to be optimistic about the company and I think that Amazon is probably one of the most underrated megacap stocks right now, as I will explain below, with the strong topline growth accompanied by solid margin and profitability trajectory.

Q1’24 review

Amazon’s revenue of $143 billion is up 13% from the prior year, landing in-line with consensus and at the high end of its guidance.

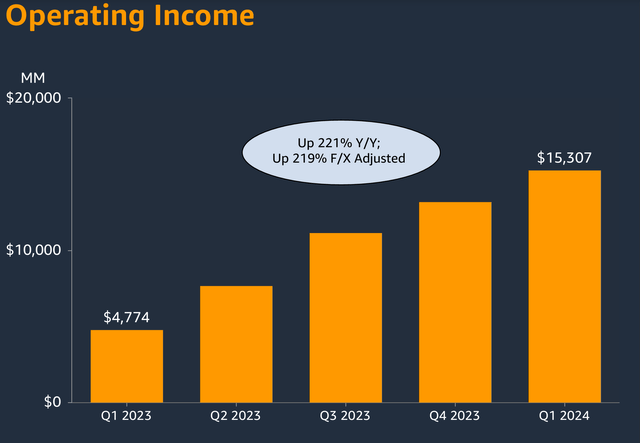

Operating income of $15.3 billion or 10.6% margin came in 37% above consensus and above the high end of guidance.

Operating income is up 219% on a constant currency basis, or up $10.5 billion from the prior year.

This was largely due to operating income for the North America Retail segment coming in at $5 billion or 5.8% margin, growing by more than $4 billion this quarter, and the AWS segment growing operating income by $4.3 billion from the prior quarter.

As a result, GAAP EPS came in at $0.98, exceeding consensus by 17%.

By segment:

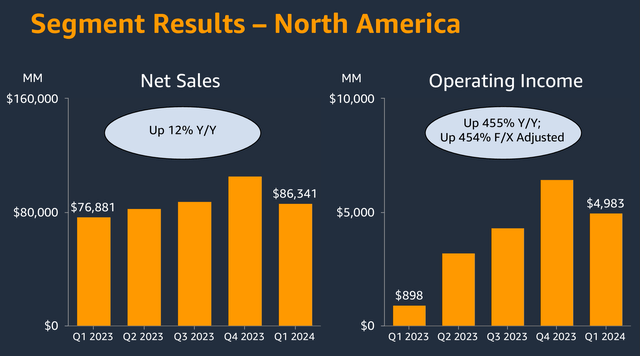

Within the retail segment, North America retail revenue came in at $86 billion, up 12% on a constant currency basis and 2% above consensus.

Operating income for the North America retail segment grew 454% on a constant currency basis to almost $5 billion. This represents a $4.1 billion increase in North America retail segment operating income from the prior year’s $898 million.

North America revenue and margins (Amazon)

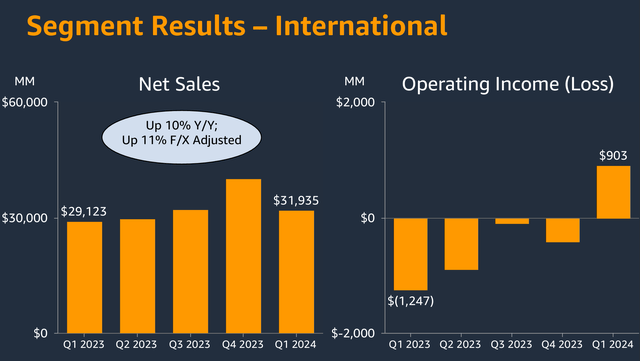

International revenue came in at $32 billion, up 11% on a constant currency basis and 4% below consensus.

Operating income for the International segment pivoted to the positive territory, bringing in $903 million in operating income for the quarter, an increase of about $2.2 billion from the prior year.

International segment (Amazon)

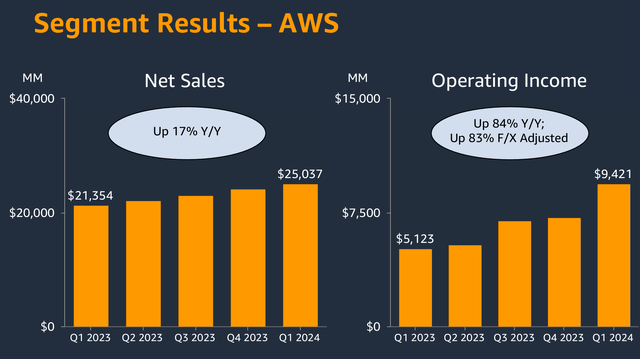

Within AWS, AWS saw demand accelerate and margins expand.

AWS revenues rose 17% to $25 billion in the quarter, 2% above consensus.

AWS operating margins came in at 37.6%, higher than consensus of 32.5%. On an absolute basis, operating income grew 83% on a constant currency basis from the prior year to $9.4 billion, up $4.3 billion from the prior year.

AWS revenue and margin (Amazon)

Guidance

For Q2’24, revenue guidance came in between $144 billion and $149 billion, 2.5% below consensus at the midpoint and assumes 60 basis points of unfavorable impact from foreign exchange headwinds.

Operating income guidance for Q2’24 came in between $10 billion and $14 billion, in-line with expectations.

In 2023, Amazon spent $48 billion on capital expenditures.

With the strong demand AWS is seeing from generative AI and non-generative AI workloads, along with customers signing longer and larger deals with AWS, Amazon continues to see a very urgent need to invest in this huge opportunity for AWS going forward in both the cloud space and the AI space.

As a result, Amazon will be increasing its capital expenditures meaningfully in 2024 compared to 2023. This increase is largely driven by higher infrastructure capital expenditures to support the growth of AWS.

I think at least 60% of that capital expenditure spend of Amazon is likely to go to AWS, which translates to the accelerating AWS and generative AI demand.

In my opinion, Amazon has become a very competent organization at managing profitability and growth.

With the progress, it has made on operating income and free cash flows over the past 18 months or so, Amazon is now at the stage where it can focus on both profitability and invest in growth at the same time.

Another important point to note is that with the strong free cash flow and operating income generation coming in, while the priority is to invest in long-term growth opportunities, Amazon now has the ability and intention to pay down its debt that was accumulated during its time of negative free cash flows.

As such, with free cash flows ramping on the upside, Amazon has the ability to pay down at least $25 billion of its long-term debt this year.

For reference, it currently has $57 billion in long-term debt, so this means that we will see debt come down significantly over the course of the year.

AWS accelerating

AWS has now seen that companies have largely completed most of their cost optimization efforts and are now turning to newer initiatives.

This is of course positive as AWS saw growth decelerate as a result of a focus on cost optimizations, especially in 2022, and with companies once again picking up their efforts to move from on-premises infrastructure to the cloud, this bodes well for AWS.

On top of that, AWS is also seeing strong interest to leverage generative AI in their businesses.

I think it is important to note that AWS now has already accumulated a multi-billion-dollar revenue run rate on the AI front already.

I think this just speaks to the advantage that AWS has in being the front-runner and largest cloud service provider.

Within generative AI, Amazon looks to position itself across the three layers of the generative AI stack.

At the bottom of the generative AI stack where models are being built, Amazon offers Nvidia compute (NVDA) for developers and companies to build their models.

On top of that, Amazon has its own custom silicon, where demand has been growing given the favorable price performance benefits relative to available alternatives.

Amazon’s Trainium 2, its latest generation chip for training AI models, will be available in larger quantities in the second half of 2024 and early 2025.

Lastly, within the bottom layer, Amazon has SageMaker, which is Amazon’s very own managed end-to-end service for developers to prepare their data for AI, and training models faster.

According to Amazon, with SageMaker, Perplexity AI is now able to train its models 40% faster, while NatWest reduced its time to value for AI using SageMaker from as long as 18 months to under seven months.

Encouragingly, Amazon is also seeing a growing number of model builders standardizing on SageMaker.

In the second layer of the generative AI stack where generative AI applications are made from existing large language models (“LLMs”), Amazon Bedrock has the largest selection of LLMs available.

Amazon shared that Bedrock already has tens of thousands of customers like Adidas, Pfizer and Toyota, amongst many others.

Amazon also shared that Bedrock has launched a series of new features and added new models, including Anthropic’s Claude 3 models, Meta’s Llama 3 models, Mistral’s models, Cohere’s newest models, and brand-new Amazon Titan models.

Finally, at the top of the stack, where generative AI applications are built, Amazon announced the general availability of Amazon Q.

Amazon Q is a generative AI-powered assistant that helps with software development.

It will help developers become so much more productive, but testing code, debug conflicts in codes and transform code from one form to another. Developers using Q came now save months when moving from older versions of Java to newer and more secure ones.

There are many features within Q like Apps and Agents that you have to learn more about.

But we are seeing many companies use Q, like Datadog, National Australia Bank and Tata Consultancy Services, amongst others.

AWS remains well positioned in the long run as despite being a more than $100 billion revenue run rate with AWS, more than 85% of global IT spend remains on-premises.

On top of that, we will see generative AI add to the AWS opportunity, with the next decade likely to be a huge opportunity for AWS to capture within the space.

This is likely the reason for the need to spend more capital expenditures on this front so that Amazon continues to be a leading player not just within the cloud space, but also in the generative AI space.

However, over time, I expect to see that this capital expenditure reward Amazon in the form of operating incomes and free cash flow growth.

Retail

We are seeing Everyday Essentials creating more consistent and habitual purchases for the Retail segment.

This does help Amazon more towards more non-discretionary goods and at the same time increase the frequency of purchases.

Another positive within Retail is the faster delivery speeds. There was a 65% increase in Same Day or Next Day items delivered in the US in the fourth quarter, and 60% of prime member orders now arrive either the same or next day, up 50% from Q3’23.

The faster shipping speeds are helping to improve conversion rates, which helps to bring consistent growth in the future.

As a result of a focus on lowering the cost to serve, this has helped the Retail segment contribute meaningfully to the overall profitability of Amazon.

With the regionalization efforts reaping benefits over the last year and lowering the cost to serve, Amazon continues to find areas within its fulfillment network where it can improve costs further.

Within the International Retail segment, Europe appears to be weaker relative to the US. This has already been taken into account in the guidance, but the company continues to monitor consumer spending and macro trends closely.

Valuation

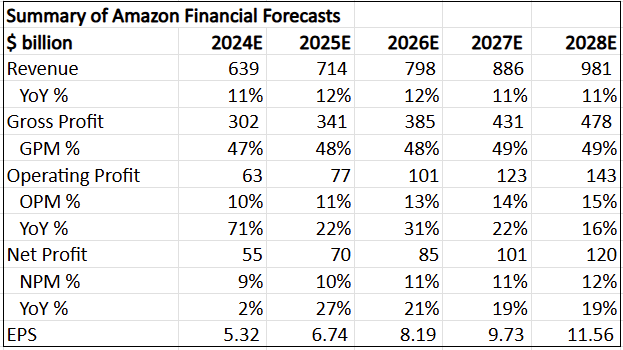

Amazon’s 5-year financial forecasts have been revised upwards due to the strong profitability beat in the quarter.

Summary of my forecast for Amazon’s financials (Author generated)

My intrinsic value for Amazon goes up to $199, as a result of the improved profitability and margin profile. This assumes a 30x terminal 2028 multiple and discount rate of 12%.

This means that I would enter Amazon at $160 or better, for a more attractive risk reward profile.

My 1-year and 3-year price targets also goes up $202 and $291 respectively. They both imply 30x 2025 and 2027 P/E respectively.

Conclusion

This was a solid set of results from Amazon, which the market probably did not expect given the strong beat in profitability.

AWS is seeing growth accelerating as most companies have completed their cost optimization efforts and are now turning to newer initiatives.

On top of that, AWS is also seeing strong interest to leverage generative AI in their businesses.

Retail margin improvement was also the star of the quarter, with more margin improvements expected in the future.

All in all, the opportunity for Amazon remains a huge one and with the company pivoting strongly to a profitable growth model, the company is now able to also invest in its future growth while generating significant cash flows.

Amazon is probably one of the most underrated megacap stocks right now, as I think the level of profitability and cash flow generation is being underestimated by the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 60% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!