Summary:

- AMZN’s retail segment faces growth and profit uncertainties.

- However, its recently announced partnership with Oracle highlights AWS’ leading position and AI opportunities.

- Its AWS segment features a far higher margin than retail (~35% vs. ~4.5% in my estimate).

- AWS acceleration and AI opportunities, as accentuated by the ORCL-AWS partnership, thus can both drive rapid EPS growth, and also expand margins considerably.

krblokhin

AMZN stock: previous thesis and new developments

I last wrote on Amazon stock (NASDAQ:AMZN) a bit more than a month ago, shortly after the release of its Q2 earnings report (“ER”). As you can see from the screenshot below, that article was titled “Amazon Q2: Be Greedy When Others Are Fearful”. As the title already gave away, the article was a review of its ER and argued for a buy rating amid the selloff following its ER. Quote:

The market’s fear over a potential AI bubble certainly has good reasons. However, the fear is overblown in the case of Amazon.com, Inc. judging by its Q2 results. In Q2, Amazon continued to show the superiority of its e-commerce, well-balanced revenue sources, and differentiating services/products. The recent selloff has offered a wide margin of safety to buy Amazon shares.

Seeking Alpha

Since that writing, besides the stock price changes (more than 14%), there have been a few new developments surrounding the company. The most important one in my view was the strategic partnership AMZN and Oracle (ORCL) jointly announced a few days ago. More specifically,

Oracle and Amazon Web Services, Inc. (AWS) announced on September 9, 2024, the launch of Oracle Database@AWS, a new offering that allows customers to access Oracle Autonomous Database on dedicated infrastructure and Oracle Exadata Database Service within AWS. Oracle Database@AWS will provide customers with a unified experience between Oracle Cloud Infrastructure (OCI) and AWS, offering simplified database administration, billing, and unified customer support. In addition, customers will have the ability to seamlessly connect enterprise data in their Oracle Database to applications running on Amazon Elastic Compute Cloud (Amazon EC2), AWS Analytics services, or AWS’s advanced artificial intelligence (AI) and machine learning (ML) services, including Amazon Bedrock.

In the remainder of this article, I will argue that this partnership highlights the leadership position of AWS in the burgeoning cloud space, a position that allows AMZN to not only grow its EPS at a rapid pace but more importantly also to expand its profit margins considerably.

AMZN stock: EPS growth outlook

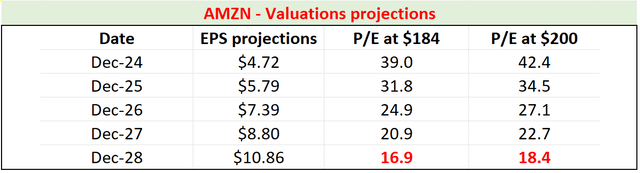

First, let’s look at EPS growth potential. As you can see from the following consensus estimates, the market expects its EPS to rapidly grow from $4.72 in FY 2024 to $10.86 in 5 years. Such growth translates into an annual growth rate of over 18% CAGR.

Thanks to its AWS (together with other catalysts, as to be detailed later), I consider such a projection highly plausible. In recent quarters, ASW segment revenue has been growing at similar rates. AWS has maintained its market-leading share, thanks to custom silicon solutions, highly sought developer services (led by Sagemaker), AI and machine learning capabilities, large partnerships, and trusted security. The above partnership with ORCL just added another testament – a very sizable one – to these strategic strengths.

Also note that under this growth scenario, the implied P/E ratio would be only about 16.9x in five years at the current stock prices ($184 as of this writing). Even at its 52-week peak price of around $200, the implied P/E is still only about 18.4x. Finally, I don’t recommend investors rely solely on accounting P/E ratios for the evaluation of high-growth companies. These companies invest heavily in growth CAPEX, and thus their true owner’s earnings are far higher than the accounting EPS.

Next, I will argue that such EPS growth and P/E multiples understate the attractiveness of stock, as they do not reflect the improvement in the QUALITY of its earnings.

Source: author based on Seeking Alpha data.

AMZN stock: margin expansion potential

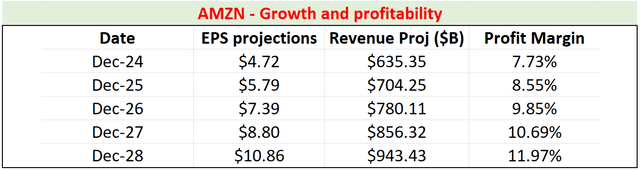

The next chart shows the consensus estimates for its topline growth. As seen, the market expects the revenues to grow from $635 billion in FY 2024 to $943 billion in FY 2028, translating into an annual growth rate of 8.2% CAGR in the next five years. This is significantly below the above-projected growth rate for its EPS. The discrepancy means that the margin is likely to expand substantially. Indeed, under the assumption of a fixed number of outstanding shares (taken to be 10.2 billion shares), I estimated the profit margin implied by the consensus EPS and revenue forecasts. As seen in the last column, its profit margin is projected to expand from 7.73% to almost 12% in the next five years.

Source: author based on Seeking Alpha data.

Similar to my view on the EPS growth curve, I consider the margin expansion to be also plausible. To better contextualize things, the following chart shows its quarterly profit margin over the long term. As seen, the company has become profitable (in accounting terms) around 2015~2016. Since then, its profit margin has been on an overall expanding trend, except for the brief disruption by the pandemic. Currently, the profit margin is about 9.11% as of the latest quarterly, almost fully recovered to the pre-pandemic level.

Dissecting the data a bit closer, the margin for its AWS segment is far above the company-wide level. My estimate for its AWS margin is above 35% for FY 2024 (and about 4.5% for its retail segment, more on this later). Given the AWS acceleration and AI opportunity as highlighted by the ORCL partnership, I certainly expect an increasing role of AWS in its future profit mix and consequently a higher aggregated margin for the whole company.

Seeking Alpha

Other risks and final thoughts

In terms of downside risks, the retail business continues to face growth and profitability uncertainties in my view. In contrast to the rapid growth of the AWS business, I see more demand issues (i.e. slower consumer spending) that might overshadow the retail segment. Although, the company has invested heavily to improve its retail operations’ efficiency and profitability in recent years. These efforts have boosted profitability markedly, and its retail operating margins climbed to around 5.0% in recent quarters. Going forward, I expect the company to keep investing in the retail side to expand its services (such as same-day delivery) and improve operations, especially overseas. I am optimistic that these investments to bear fruit in the long term, but they may create drags on near-term profitability.

All told, my verdict is that the positives far outweigh the negatives under the current conditions. The top positive on my list is the potential for AWS acceleration and AI opportunities, as accentuated by the recently announced ORCL-AWS partnership. I expect these catalysts to not only drive rapid earnings growth but also improve margins considerably in the next few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.