Summary:

- Amazon reported first quarter results, with earnings per share and free cash flow improving.

- The company decreased its capital expenditures and especially advertising is growing at a high pace.

- We could make the case for Amazon being fairly valued at best, but in my opinion, Amazon is still slightly overvalued.

hapabapa

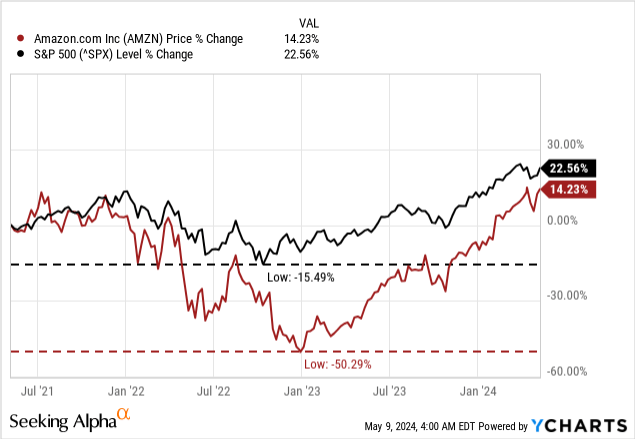

My last article about Amazon.com, Inc. (NASDAQ:AMZN) was published in December 2023 and not only was I wrong about Amazon in my last article – I was also too cautious in my previous articles. Amazon reached its previous all-time high again – a scenario I saw as rather unlikely in my previous articles.

When looking at the last 10 or 20 years it was always a major mistake to doubt Amazon and not to invest in the stock. And since my last article was published, Amazon increased another 22% and clearly outperformed the S&P 500, which increased only 10% in the same timeframe. During the last year and a half, Amazon clearly outperformed the S&P 500, but we must point out that Amazon declined much steeper than the S&P 500. While the index lost “only” about 25%, Amazon declined 56%.

And while it might have been a mistake in the last two decades not to invest in Amazon, it was probably not such a major mistake in the last few years, as Amazon performed only in line with the S&P 500 and depending on the timeframe it was either Amazon or the index that outperformed. But the question right now is not if a stock or index performed better in the past, the question is if we should invest in Amazon for the future.

Despite being wrong in the last few quarters (and underestimating the recovery of the stock) I am still arguing that investors should be rather cautious, and it is not the time to buy Amazon.

First Quarter Results

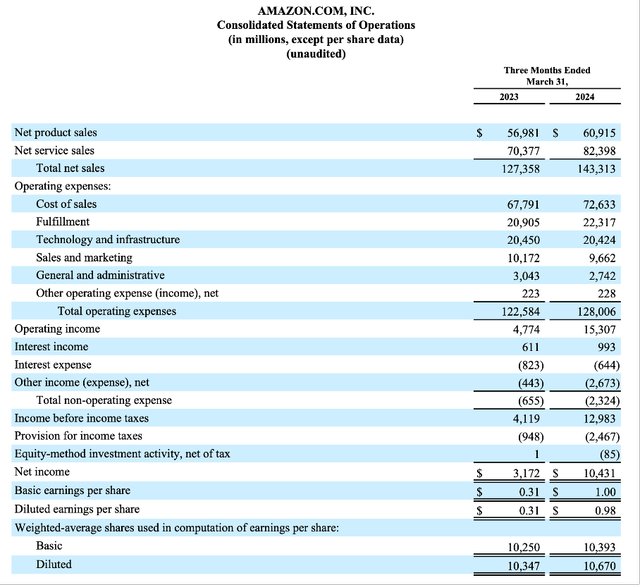

When looking at the first quarter results we actually have reasons to be rather bullish. Total net sales increased once again from $127,358 million in Q1/23 to $143,313 million in Q1/24 – resulting in 12.5% year-over-year growth. Sales were especially driven by net services sales, which increased 17.1% YoY to $82,398 million. Net product sales on the other hand increased only 6.9% YoY to $60,915 million.

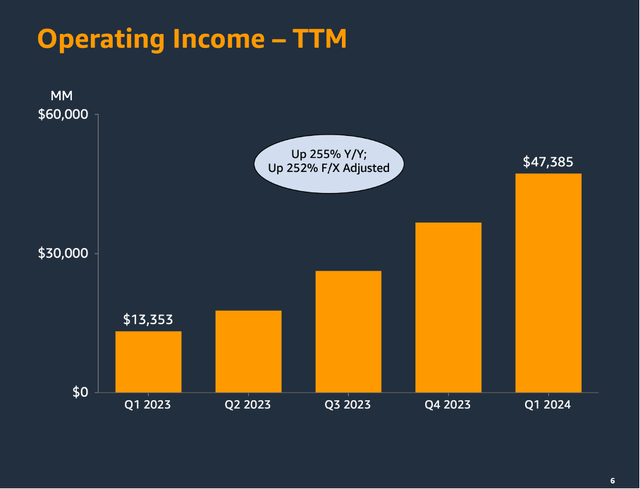

And while Amazon increased the top line with a solid pace, operating income increased from $4,774 million in the same quarter last year to $15,307 million this quarter – resulting in 221% growth. Diluted earnings per share also grew 216% from $0.31 in Q1/23 to $0.98 in Q1/24. And when looking at the following chart we see that Q1/24 is not an outlier but part of a positive trend.

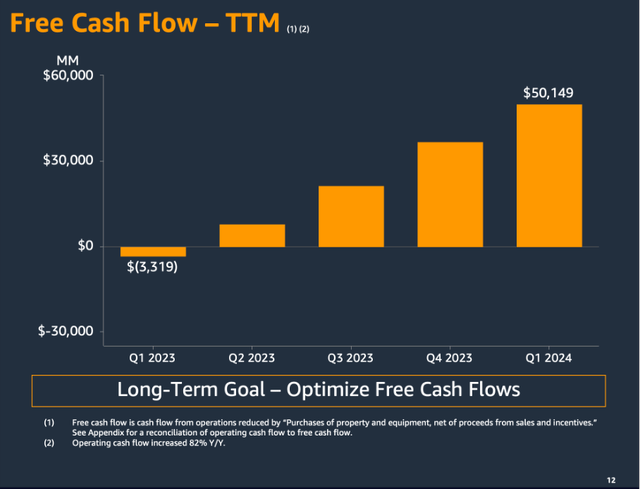

And when looking at free cash flow – and we can once again use the TTM numbers – it improved from a negative free cash flow of $3,319 million in Q1/23 to $50,149 million in Q1/24.

Continued Growth?

The decisive question right now is if Amazon can keep up the high growth rates and for how long it can keep up these growth rates. And we start by looking at Amazon’s core business – the e-commerce business.

North America Segment

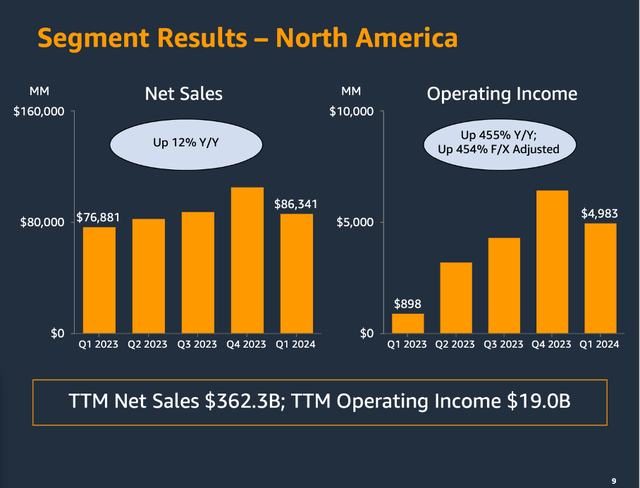

And although the North America segment results not only include revenue and operating income from e-commerce and wholesale (but also subscription and advertising revenue), it makes sense to look at these results.

When looking at Q1/24 results, we see sales growing stable but especially the focus on becoming more profitable is clearly visible. In the first quarter of fiscal 2024, net sales increased from $76,881 million in the previous quarter to $86,341 million – resulting in 12.3% YoY top line growth. And operating income more than quadrupled (455% YoY growth) from $898 million in Q1/23 to $4,983 million in Q1/24.

And the high growth rates for operating income underline once again that management is now focusing more on becoming more profitable and improve its operating income, its bottom line as well as its free cash flow. During the last earnings call, management made this clear once again:

And as a reminder, we spend most of the capital upfront. But as you’ve seen over the last several years, we make that up in operating margin and free cash flow down the road as demand steadies out. And we don’t spend the capital without very clear signals that we can monetize it this way.

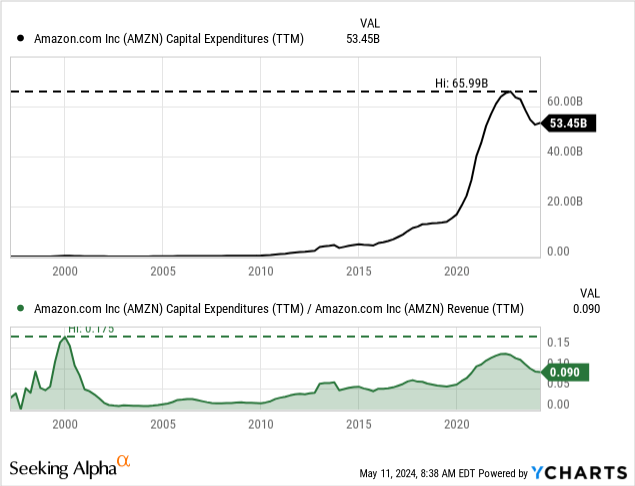

And it also becomes obvious that Amazon’s phase of high spendings and high capital expenditures is over (at least for now). A few quarters ago, Amazon’s capital expenditures peaked at $66 billion annually and are now down to $53.5 billion. This is leading to Amazon “only” spending 9% of revenue as capital expenditures (still a huge amount).

International

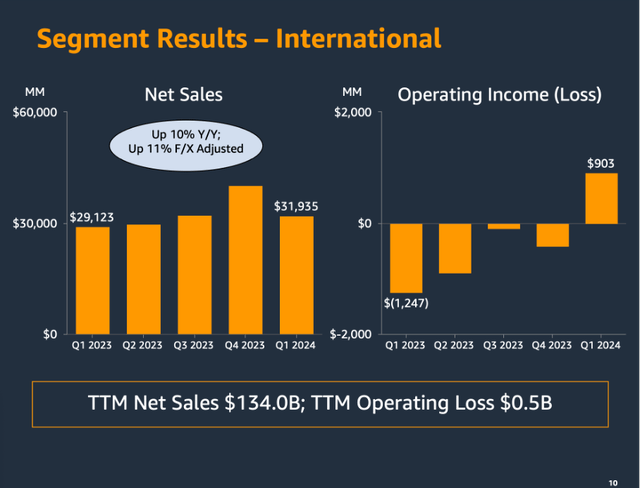

Compared to the North America segment, the International segment has always been lagging a little bit and the segment was often not profitable. But in Q1/24, the International segment generated $31,935 million in revenue and compared to $29,123 million in the same quarter last year it grew 9.7% year-over-year. And instead of an operating loss of $1,247 million in the same quarter last year, the company reported an operating income of $903 million this quarter.

Similar to the North America segment, we can assume that Amazon will lower its capital expenditures (in relation to the generated revenue) and become more profitable in the years to come.

AWS

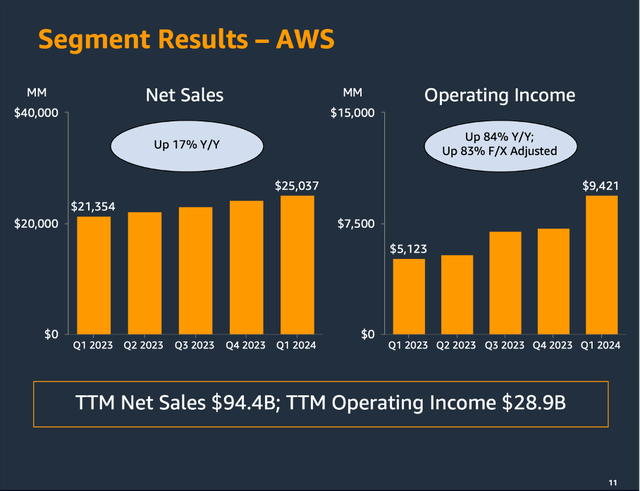

One of the segments growing with a stable pace, being highly profitable and increasing operating income is AWS. When looking at first quarter results, net sales increased from $21,354 million in Q1/23 to $25,037 million in Q1/24 – resulting in 17.2% YoY top line growth. And operating income almost doubled – growing 83.9% YoY – from $5,123 million in Q1/23 to $9,421 million in Q1/24. This resulted in the segment’s operating margin increasing from 24.3% in the same quarter last year to 37.6% this quarter.

And especially in case of its cloud business, Amazon is focusing on generative AI and management is continuing to add capabilities at all three layers of the Gen AI stack (bottom layer for developers, middle layer for customers using existing LLM as easiest way to scale GenAI applications, top layer being the applications layer).

One example for the middle layer is Amazon Bedrock, which already has tens of thousands of customers including some major businesses like Adidas, Pfizer (PFE), or Toyota (TM). Amazon Bedrock is offering models like Meta’s (META) Llama 3 model or Anthropic’s Claude 3 models. And tools in this middle layer are targeting companies who prefer not to build models from scratch but want to use an existing large language model that can be customized with their own data.

And overall, management is remaining very bullish on AWS. The CEO stated during the last earnings call:

We remain very bullish on AWS. We’re at $100 billion-plus annualized revenue run rate, yet 85% or more of the global IT spend remains on-premises. And this is before you even calculate gen AI, most of which will be created over the next 10 to 20 years from scratch and on the cloud. There is a very large opportunity in front of us.

Advertising and Subscriptions

When talking about the two segments – North America and International – we mostly think about e-commerce. But within these segments, Amazon is also reporting revenue from advertising and subscriptions, which are two ways for Amazon to continue growing.

Especially in advertising, Amazon is still lagging behind its major peers Alphabet (GOOG) (GOOGL) and Meta Platforms but can narrow the gap from quarter to quarter. In the first quarter of fiscal 2024, Amazon generated $11,824 million from advertising services and compared to the same quarter last year this is a 24% year-over-year increase (when excluding F/X effects).

And when looking at revenue from Amazon, Alphabet and Meta in the last three years we can see that all three companies are able to grow advertising revenue with a high pace, but Amazon is clearly outperforming and gaining market share. Nevertheless, Meta Platforms and especially Alphabet still have a much higher market share.

During the last earnings call, management also commented on the advertising results:

Advertising performance remained strong with ad sales up 24% year-over-year, excluding the impact of foreign exchange. The strength in advertising was primarily driven by sponsored products, supported by continued improvements in relevancy and measurement capabilities for advertisers. We still see significant opportunity ahead in our sponsored products, as well as areas where we’re just getting started like Prime Video ads.

Prime Video ads offers brands value as we can better link the impact of streaming TV advertising to business outcomes like product sales or subscription sign-ups, whether the brands sell on Amazon or not. It’s very early for streaming TV ads but we’re encouraged by the early response.“

Another way for Amazon to grow aside from advertising is subscriptions. In Q1/24, subscription services generated $10,722 million in revenue and compared to the same quarter last year this was an increase of 11% year-over-year. In the last few quarters, growth rates for subscription services were slowing down, but we have to see what the next quarters will bring – especially as Prime Video is now showing more and more advertising but also offering to remove ads by purchasing another subscription.

Intrinsic Value Calculation

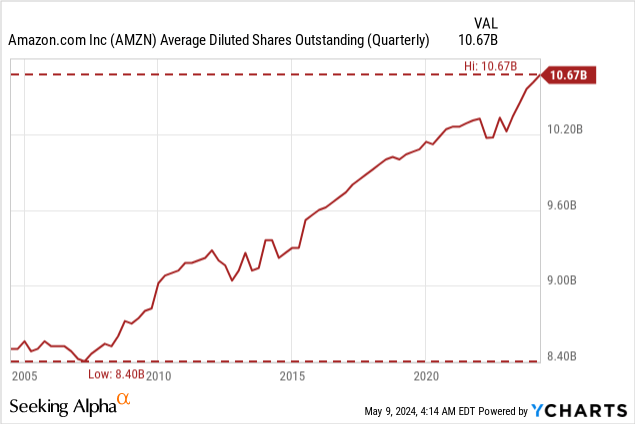

Finally, we are calculating an intrinsic value for Amazon by using a discount cash flow calculation. As basis for our calculation, we are using the last reported number of diluted outstanding shares (10,670 million) and a 10% discount rate. When taking the free cash flow of the last four quarters ($50,149 million) as basis for our calculation, Amazon must grow 13% annually for the next ten years followed by 6% growth till perpetuity in order to be fairly valued.

When asking if these assumptions are realistic, we must look a little closer. I mentioned in the past that Amazon is constantly increasing the number of outstanding shares. And although Amazon doesn’t dilute aggressively (compared to companies like Tesla (TSLA) or Palantir (PLTR)) we still should not ignore this.

Even if Amazon is diluting its shares about 1% or 2% annually, this negative effect must be offset by higher margins or higher top line growth. But I assume that Amazon will start using share buybacks at some point and offset the ongoing dilution, although management didn’t give any hints so far it might consider share buybacks as a tool it would use.

When accounting for an ongoing dilution, I believe Amazon must grow net income about 15% annually and when looking at the reported metrics of the last ten years, the company was able to achieve these growth rates. Revenue in the last ten years increased with a CAGR of 22.68%, operating income increased with a CAGR of 47.72% and earnings per share increased even 58.22% annually (despite dilution).

But of course, taking these growth rates might be just a little too optimistic. And especially operating income and EPS growth rates might be a bit misleading as Amazon was hardly focusing on the bottom line or operating income and reinvested every dollar it made back into the business. Focusing on profitability was not an issue back then and once Amazon focused on the bottom line as well it led to high growth rates in the first few years.

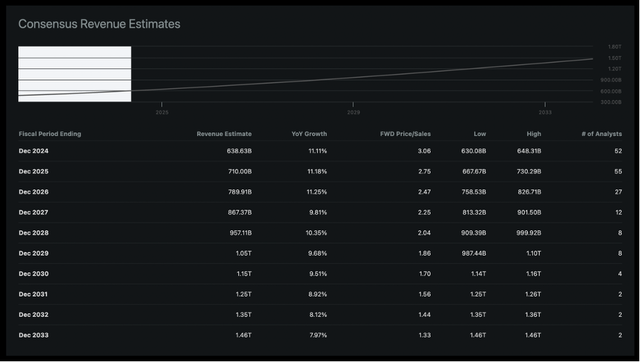

Revenue Estimates for Amazon (Seeking Alpha)

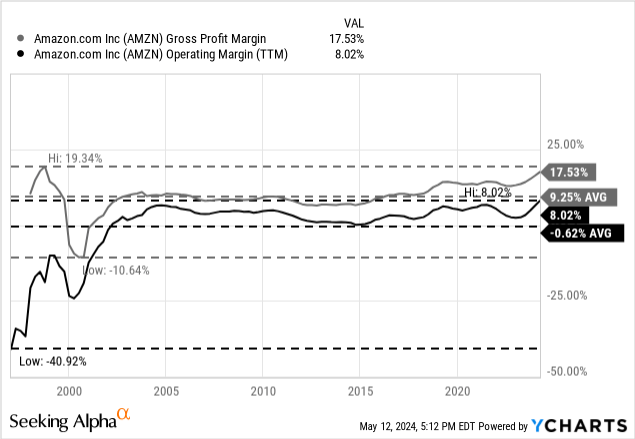

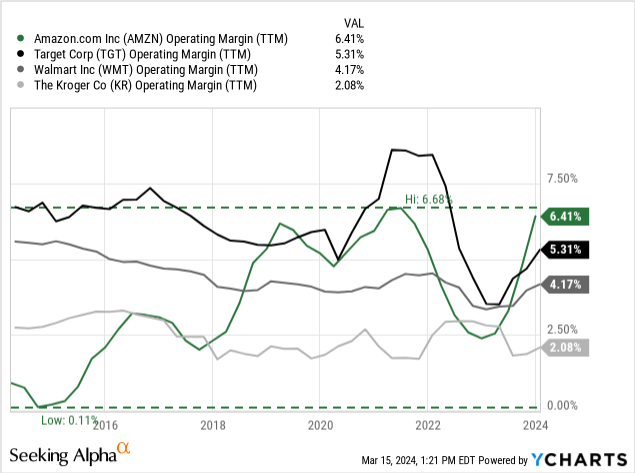

And when looking at the next few years, analysts are not so optimistic anymore. Revenue in the next ten years is expected to grow with a CAGR of 9.77%. We can also expect Amazon to continue increasing its margins, but to achieve 15% bottom line growth (to offset a potential dilution), Amazon must improve its operating margin to slightly above 13% in ten years from now (assuming tax rates and interest income as well as interest expenses will stay more or less the same).

At least when comparing Amazon to other retailers in the United States an operating margin of 13% almost seems impossible. But the operating margin is already rather driven by AWS than the retail business and with Amazon focusing on subscriptions as well as advertisement higher margins certainly are possible (but this won’t be sure-fire success for Amazon). Overall, I see Amazon fairly valued at best and it is certainly not a stock I would buy or a stock I would call a bargain.

Conclusion

I certainly could be wrong again at this point and my caution about Amazon might not be justified. After all, the company improved its bottom line and free cash flow in an impressive way, and we are still dealing with a great business that has a wide economic moat around its business (built on several sources of moat – including switching costs and cost advantages).

And Amazon also grew more and more into its valuation, but 43 times free cash flow is still rather expensive and certainly not a bargain. And considering that the stock reached its previous all-time highs I would be cautious at this point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.