Summary:

- Amazon is considering offering low-cost or free mobile phone service to Prime members, which could attract more subscribers but may impact the company’s margins.

- The company’s core retail business currently has a negative operating margin, and its fluctuating FCF raises concerns about the potential partnership’s synergy.

- Despite a 44% YTD rally, investors should remain neutral on Amazon stock and monitor the profitability of its core business and the translation of Prime member benefits to earnings and FCF.

400tmax/iStock Unreleased via Getty Images

What Happens

When I saw the Bloomberg news headline in that morning, as an Amazon Prime member, I was excited because I finally got a chance to use my mobile service for free. However, this made me question the synergy it could bring to Amazon’s (NASDAQ:AMZN) shareholders. The company has been recently holding discussions with many wireless carriers regarding the possibility of offering low-cost (like $10 per month) or even completely free nationwide mobile phone service to Prime members. First of all, I believe this move is expected to intensify price competition and pose a significant threat to the top-three carriers, including T-Mobile (TMUS), AT&T (T), and Verizon (VZ). Unsurprisingly, their stocks retreated when the news came out. However, DISH Network Corp. (DISH) finished the day with a 16% rally. Based on this price action, it was obvious that DISH would be the biggest beneficiary from such a potential partnership, particularly given its ongoing struggle to maintain its market share.

Therefore, if AMZN ends up working with DISH, I think it won’t generate much synergy for AMZN, as DISH still lags behind its peers in terms of 5G network coverage, network connections, and customer base. It’s possible that this low-cost subsidy would potentially offset most of the long-term value generated from the increasing demand for Prime membership and its ecosystem. Moreover, considering the deteriorating trend in the AMZN’s margins over the past few years, the deal can further delay the margins recovery in the near term, as it may involve some upfront spendings. Furthermore, the company currently has negative FCF on the trailing twelve months basis. Given a concern about the potential demand slowdown associated with a looming recession, I remain neutral on the company as the stock has rallied 44% YTD.

CNBC

Margin Contraction

Company Model

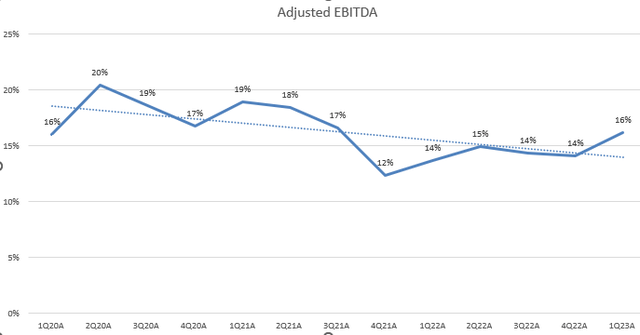

Over the past three years, AMZN’s adjusted EBITDA margin has been under pressure due to the significant increase in operating expenses caused by high inflation and labor shortages. While the company achieved a 16% margin in 1Q FY2023, rebounding from 14% YoY in 1Q FY2022, it hasn’t achieved overall margin expansion. This is evident from the charts, which indicate a deterioration in its operating efficiency, although the operating margin on AWS has shown improvement in recent years. This implies that the overall margins contraction can largely be attributed to its core retail business.

Company Model

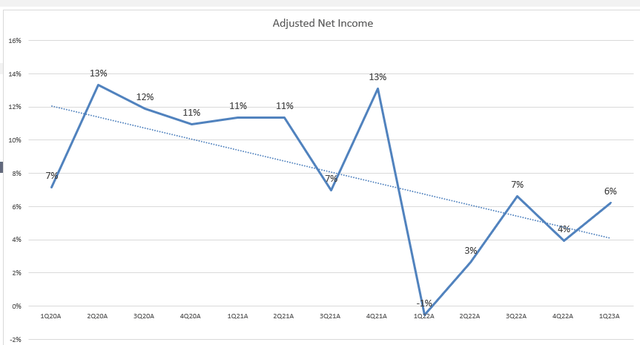

In addition, regarding the company’s profitability, we can see a significant downward trend of the company’s adjusted net income margin. Although adjusted EPS increased to $0.77 in 1Q FY2023 from $-1.17 in 1Q FY2022, it was still 36% below $1.2 in 1Q FY2021. As a result, the stock is currently trading at 75x of P/E FY2022. However, if we consider the forward-looking estimates of $3.83 adjusted EPS for FY2023, the P/E ratio would be 32.4x, which suggests a significant growth in the company’s bottom line, assuming that it’s achievable.

Company Model

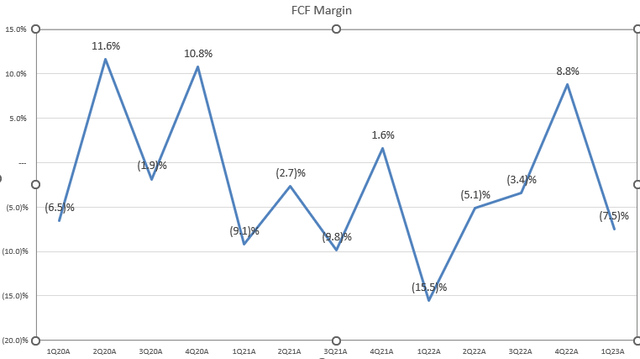

Furthermore, we can see the company had an inconsistent FCF generation over the past quarters, failing to achieve a sustained FCF breakeven based on trailing twelve months basis. As mentioned earlier, the decision to subsidize a low-cost or free mobile phone service for Prime subscribers would add pressure on the company’s margins in the near term, leading to an unstable outlook on its FCF profile. While the company heavily relies on AWS to boost its growth outlook, this poses a potential challenge to the company’s ability to achieve margin expansion and positive FCF, which may add pressure to the stock’s upside momentum and valuation.

Focus on Retail Margin

Based on 1Q FY2023, the company’s retail revenue accounted for 83% of total revenue. It’s a bad sign to see the retail operating margin was -0.3%, indicating that Amazon’s core retail business is currently unprofitable. Some investors may argue that its cloud business, AWS, maintains a strong growth and high profit potential. However, it only contributed 16.7% of the total revenue in 1Q FY2024. Therefore, it’s important for investors to pay more attention on the profitability of Amazon’s core retail business rather than solely focusing on the performance of AWS.

During the 1Q FY2024 earnings call, the management expressed a high level of confidence in their ability to improve retail margin above the pre-pandemic operating income margins of 2.5%, setting up a multi-year runway for higher operating income and FCF growth at AMZN’s retail segment. When an analyst asked a question about the roadmap of achieving pre-COVID operating margins, the CFO says:

“if you look at our operating margin in North America, for example North America segment, it was 1.2% this quarter, pre-pandemic that number was in the 4% to 6% range broadly.”

Therefore, by considering the idea of offering low-cost or free mobile phone service to Prime members, AMZN aims to attract more Prime members and potentially increase demand for its Prime ecosystem services. I admit that this deal may accelerate the top-line growth in the retail segment, but I need to see how the company will effectively manage and offset the additional expenses in order to improve the profit margin in the long-term. Although AMZN can avoid additional capex of building its own mobile network by working with other wireless carriers, it’s likely that the potential high-cost Prime mobile service will add some pressure on the company’s margins, at least in the near term.

Conclusion

In sum, the idea of Amazon offering low-cost or free mobile phone service to Prime members presents both opportunities and challenges. While it has the potential to attract more Prime subscribers and drive top-line growth in the retail segment, there are concerns regarding the impact on the company’s margins and profitability. Despite the confidence expressed by management in improving retail margins, the current lack of profitability in the core retail business raises questions about the synergy of this partnership. Additionally, the fluctuating FCF and the heavy reliance on AWS for getting attentions from investors further contribute to the uncertainties. It’s important for investors to check out the profitability of AMZN’s core business and monitor how the benefits for Prime members will translate to its earnings and FCF in the long run. Therefore, given 44% YTD rally, I remain neutral to the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.