Summary:

- Amazon’s share price has taken a beating and dented many investors’ returns in the past year.

- Skepticism about the company in the post-Jeff Bezos era is real and fueled by recent Amazon logistical capital expenditures.

- Doubts are increased by federal monetary policy that cuts Amazon Web Services and consumer retail spend.

- Amazon has many powerful and synergistic drivers, including retail, AWS and Amazon Prime – plus advertising.

- Amazon’s future remains very bright. I rate the stock a strong buy.

Daria Nipot

Introduction

Amazon (AMZN) is an amazing company, unique in the quality and vision of its leadership and fully capable of weathering the storms of 2022. It’s basically a diversified conglomerate with an enormous presence, brand cache and multiple future drivers that play off one another.

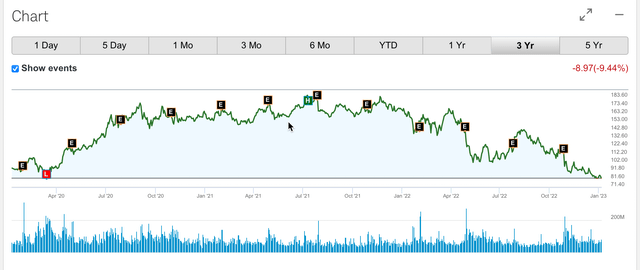

Still, significant company logistics expansion and US Federal Reserve monetary tightening contributed to Amazon’s financials and share price suffering. This Schwab chart illustrates share price movement of the past three years – a sobering sight:

Schwab

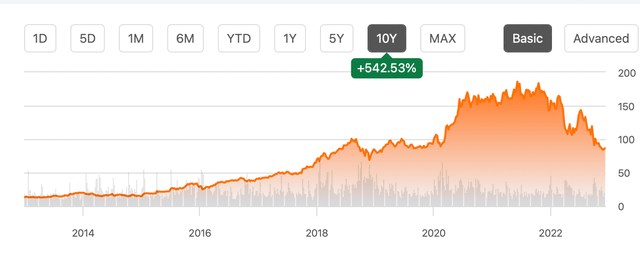

However, there’s also this Seeking Alpha 10-year chart to consider:

Seeking Alpha

The longer view shows where the rise and fall, mountain range pattern of the past three years begins. It also displays a steady up-trend from 2013 until late 2021 and a 10 year return of 542%.

Price charts are only records of what has been. I’m confident that the positive pattern will return soon enough.

Intelligent Growth and Resource Utilization Toward Market Dominance

Jeff Bezos, founder and long-time CEO of Amazon before handing the corporate reins to Andy Jassy in 2021, operated on basic principles. Bezos applied a determined customer focus founded on hard work and systematic leveraging of assets and resources. It was and is a no-frills, problem-solving approach emphasizing employee efficiency. The goal – and result – was achieving market dominance in multiple product spaces.

The story began with transformation of an online bookstore into the world’s great e-retailer and wealth for key Amazon employees and shareholders. That leap became model and catalyst for maximizing the Internet’s commercial potential and driving deep changes in habits of masses of consumers.

The customer was the focus. That customer wanted large and varied selection, ease of transaction, reliability and low prices. Amazon learned to streamline browsing and purchasing process and drive low prices and broad sources of supply like third-party merchants. Internal processes and resources such an evolving computer infrastructure led to the development of Amazon Web Services (AWS) – now Amazon’s heart and a stable source of massive revenue from corporate and individual clients.

Amazon has created horizontal expansion within the Amazon Store and productized its own IT infrastructure via AWS. It has broken out of the Internet retailing paradigm through the purchase of Whole Foods. And it has expanded its subscription-based Amazon Prime membership service to fold in Whole Food Prime shoppers. The value of Prime membership is enhanced even more by Prime Video streaming.

Amazon has also leveraged its massive online presence by creating an advertising model to drive revenues well into the future.

Genius can appear in simple guises and be cultivated organically. Jeff Bezos knew this then. Amazon still practices it today.

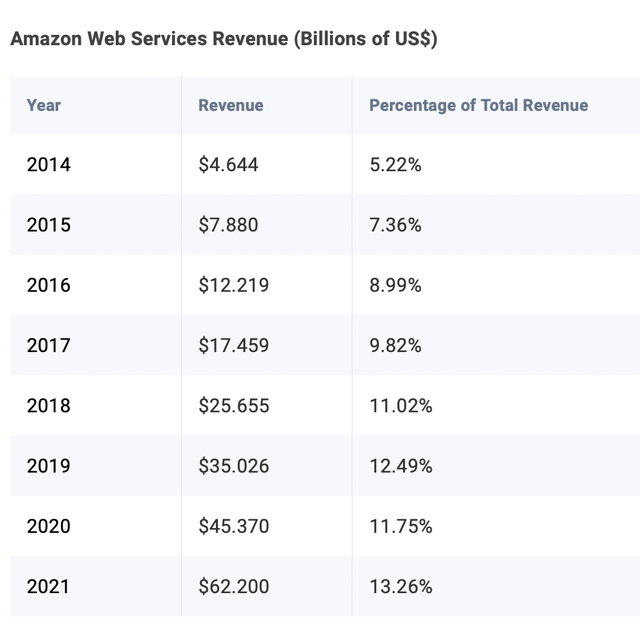

The Rise of AWS: Turning Infrastructure Into Product

AWS began as the structure and practice of Amazon IT in supporting the burgeoning e-tailing business. It was opportunistic to turn computing infrastructure into a cloud service for mostly Enterprise customers running their own operations and software development programs.

Here’s a definition of AWS:

“Amazon Web Services, Inc. (AWS) is a subsidiary of Amazon that provides on-demand cloud computing platforms and APIs to individuals, companies, and governments, on a metered, pay-as-you-go basis…clients will use this in combination with autoscaling (a process that allows a client to use more compute in times of high application usage, and then scale down to reduce costs when there is less traffic). These cloud computing web services provide various services related to networking, compute, storage, middleware, IOT and other processing capacity, as well as software tools via AWS server farms. This frees clients from managing, scaling, and patching hardware and operating systems….”

“AWS services are delivered to customers via a network of AWS server farms located throughout the world. Fees are based on a combination of usage…hardware, operating system, software, or networking features chosen by the subscriber required availability, redundancy, security, and service options. Subscribers can pay for a single virtual AWS computer, a dedicated physical computer, or clusters of either… AWS operates from many global geographical regions including seven in North America.”

From Amazon itself on benefits of using AWS:

“AWS is designed to allow application providers, ISVs, and vendors to quickly and securely host your applications... you can use the AWS Management Console or well-documented web services APIs to access AWS’s application hosting platform… you receive a virtual environment that lets you load the software and services your application requires. This eases the migration process for existing applications while preserving options for building new solutions.”

AWS also offers billing is on a flexible basis. The customer is charged dynamically, according to a range of specific use measurements that relate to:

- Compute.

- Storage.

- Database.

- Networking & Content Delivery.

- Analytics.

- Machine Learning.

- Security, Identity, & Compliance.

The recent announcement of a Department of Defense contract demonstrates AWS’ relevance in critical applications including national security, as well as the lucrative associated revenues. The article is from December 8, 2022:

״The Department of Defense (DoD) recently publicly announced the awarding of multiple contracts totaling up to $9 billion for a cloud-computing initiative known as the Joint Warfighting Cloud Capability. They contacted Amazon (ticker: AMZN), Microsoft (MSFT), Alphabet (GOOG) (GOOGL), and Oracle (ORCL), which are the four most significant cloud-computing corporations in the United States… According to the research by Piper Sandler analyst Thomas Champion, AWS commands a market share greater than fifty percent, which is three times that of Salesforce (CRM).״

״In addition, Amazon reported in a statement with the Securities and Exchange Commission that AWS has a total of $104.3 billion in future income from contracts with companies as of September 30. These revenues have yet to be realized.״

Investing Times

AWS: Gateway to Amazon-The-Technology Company?

This piece by Daniel Shvartsman addressed the evolution or transformation of Amazon from a retail company to a technology-focused company. A few points emphasize this shift:

- Amazon owns a wide range of products: Amazon Game Studio, Amazon Drive, a cloud storage application, and Amazon Web Services (AWS), a comprehensive cloud platform, used by many technology representatives worldwide.

- Amazon owns over 40 subsidiaries and brands, the most well-known of which are Whole Foods, audio-book seller Audible, book review site GoodReads, and live-streaming platform Twitch.

- In 2012, Amazon acquired Kiva Systems, a robotic company, for $775 million. Over 200,000mobile robots now work in the Amazon warehouse network, carrying product shelves to workers and reading barcodes on the ground for directions.

I would add to this Amazon’s semi-automated delivery fleet and its investments in electric vehicle startups. Future possibilities for the ground and airborne logistics arm are certainly compelling.

The Amazon Prime Driver

Size and scale make Amazon and its store the dominant leader in e-commerce. The secular strength of e-commerce continues. I believe that COVID and its perceptive side effects exaggerated the belief that online purchasing was a phase of sorts and destined to wither. Once the pandemic passed, the yearning of people to get out, mingle and shop would dent e-tailer’s momentum.

COVID and its aftermath, though, are transitory events that don’t impact the secular shift to online purchasing – especially not for a leader like Amazon.

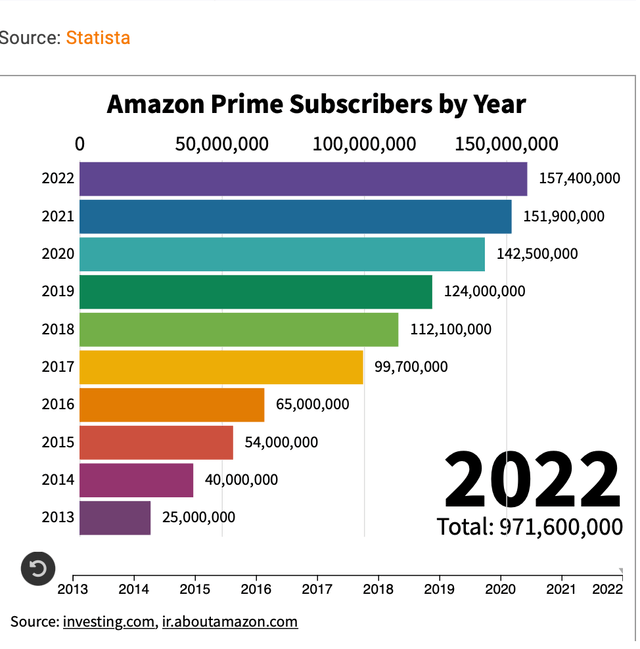

How does Amazon Prime play into the retail picture? Prime connects Amazon’s e-commerce efforts and provides a steady stream of recurring revenue with large margins. Much of that stems from Prime customers that buy more frequently than non-Prime customers, thanks to one-day shopping, Prime video and additional services.

Here’s a graphical look at Prime Membership growth:

Statista

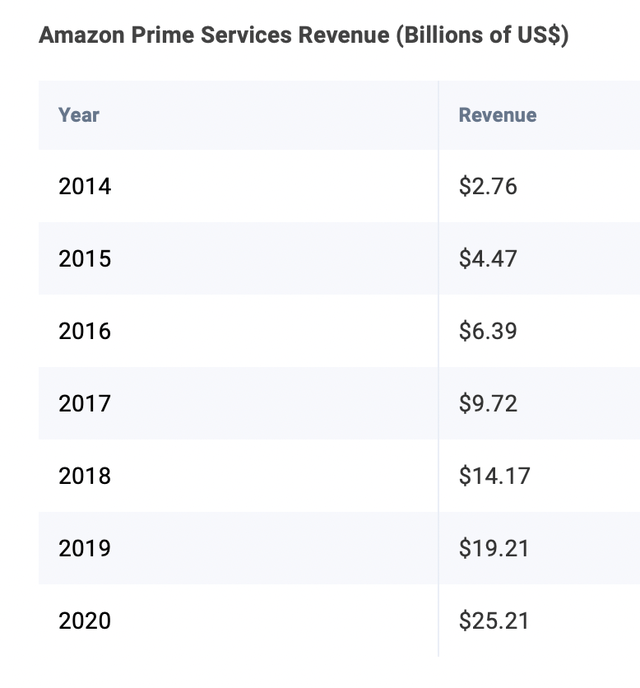

Some relevant statistics on the impact of Amazon Prime on the company:

- Over 200 million people globally have an Amazon Prime subscription.

- There are over 157.4 million Amazon Prime subscribers in the United States.

- Amazon Prime is available in 22 countries.

- Amazon Prime video, the second-largest streaming service in the world, has over 205 million subscribers.

- Around 25.21 billion US dollars is generated yearly from membership services.

- In 2021, Amazon Prime Day sales amounted to $11.19 billion.

- On average, Prime subscribers spend $1,400 per year.

From Statista, we have these Prime revenue statistics:

Statista

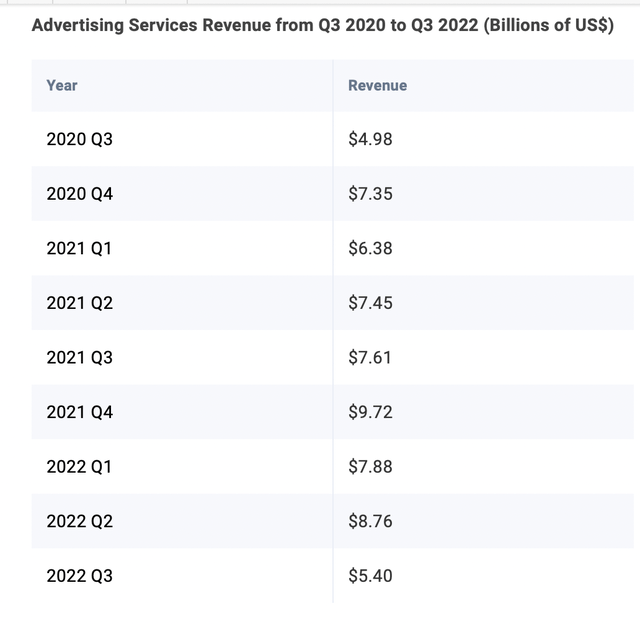

Advertising

Amazon’s advertising business continues to scale. Advertising on Amazon is a desirable choice for large company marketers looking to access a vast audience. The advertisers have many proprietary data points about those consumers that add to their spend confidence.

Both high-margin advertising and AWS are growing faster than the corporate average, and are set to boost profitability over the coming years.

More advertising stats:

Statista

We can definitely see a downturn in advertising revenue as inflation and fed tightening hit. Still, a huge number of consumers visits Amazon’s site daily. The company’s future potential income from advertisers hungry to reach the sources of this traffic is enormous.

Amazon: A Financial Review

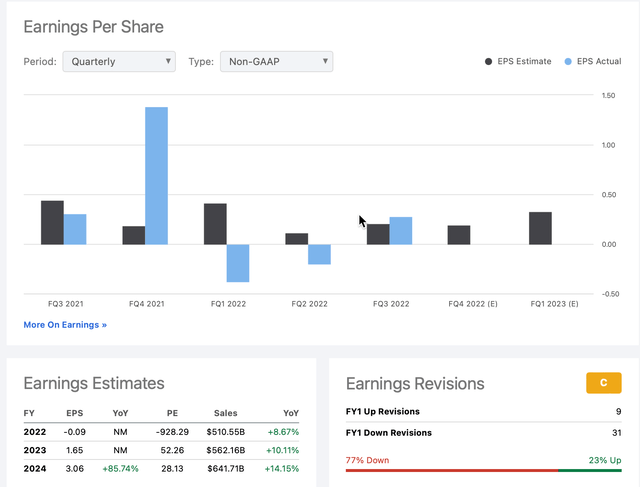

Amazon reported its third quarter earnings after the bell on Thursday, Oct. 27, posting weaker-than-expected earnings and giving a disappointing fourth quarter sales forecast. The company reported earnings of $0.28 per share, $0.06 better than the analyst estimate of $0.22, with revenue for the quarter coming in at $127.1 billion versus the consensus estimate of $127.76 billion.

AWS growth did slow, implying a deceleration of the rate of increase in cloud optimizations. The struggle in the face of AWS customers’ budget restrictions in anticipation of possible recession is real. Amazon is still clearly the leader in Cloud deployments and growth rates should recover once customers regain confidence in the future.

This chart of earnings per share also captures the recent trends:

Seeking Alpha

Since the very positive quarterly EPS report from Q4 2021, there has been a sharp drop into Q1 2022. Q2 saw some recovery, and Q3 reported EPS at .28 per share. Expectations for Q4 on EPS are tepid.

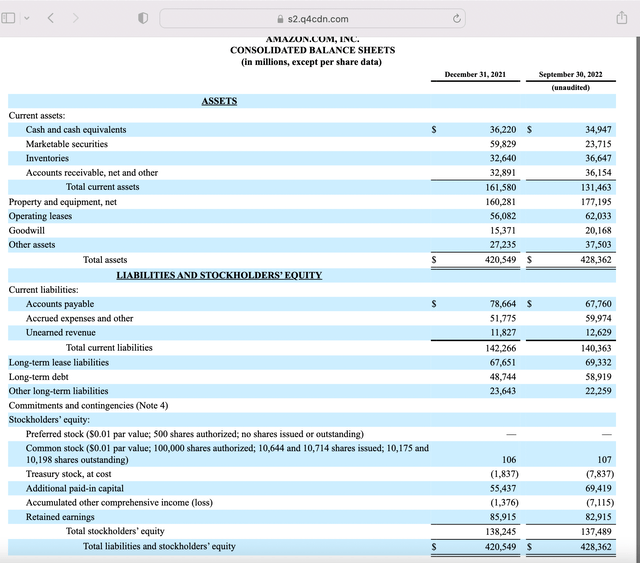

The Amazon official 2022 Q3 10-Q filing with the Securities and Exchange Commission provides an in-depth looks at those results. The consolidated balance sheet:

Amazon 10-Q Filing

Assets and liabilities show some interesting facts about Amazon. End of Q3 comparisons are with numbers at the end of 2021.

Assets:

- Cash has declined slightly, down a bit less than 3%.

- Marketable securities owned has dropped sharply, $23.7 billion from nearly 60 billion at the end of 2021.

- Total current assets have declined in value from roughly $161.6 billion to 131.5.

- Goodwill is up about 25%, and

- Total assets are roughly the same – just an $8 billion increase from end of year 2021.

Liabilities and Stockholders’ Equity

- Accounts payable figure has declined from $78.7 billion to 67.8 for Q3 2022.

- Accrued expenses are up by about 15%.

- Total current liabilities are nearly the same – 140.4 billion as compared to $142.3 at end of 2021.

- Long-term debt up approximately 20.2% to $58.9 billion.

- Stockholders’ equity is essentially unmoved, having dropped less 0.6%.

Total liabilities and shareholder equity are up approximately 2% from end of year 2021.

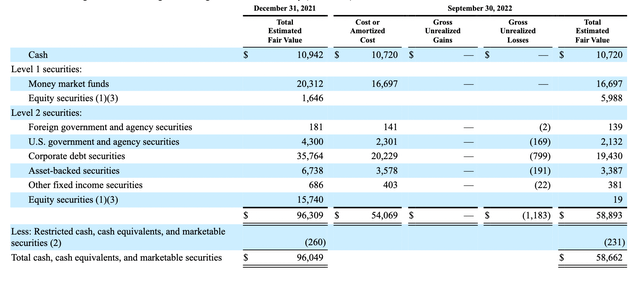

Supplemental Cash Flow Information (Financial Instruments)

SEC 10-Q Amazon filing

Financial instruments include both cash and securities.

As regards overall cash, there’s a slight decline from end 2021 to $10.7 billion from 10.94. Money market fund deposits are down just under 20% while equity securities have almost quadrupled, to about $6 billion.

Government securities have dropped by just over 50%. This decrease was mostly expressed in the amount of US securities owned.

Corporate debt securities held have nearly halved, as have asset-backed securities. Overall decline in securities held stands at just about 40%, $59 billion against $96 at the end of 2021.

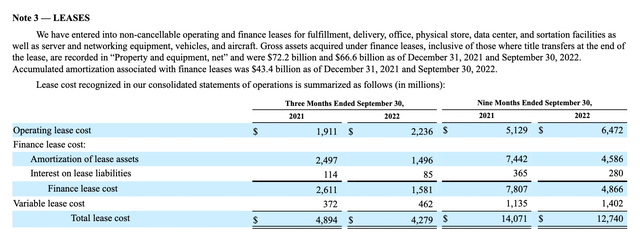

Leases

This category includes non-cancellable operating and finance leases for fulfillment, delivery, office, physical store, data center, and sort facilities as well as server and networking equipment, vehicles, and aircraft. Leases that terminate at the end of a specific period are calculate in Property & Equipment, under Assets in the Consolidated balance sheet previously displayed.

Amazon SEC Filing

Note that the comparisons shown include a three-month-basis comparison as well as nine months. I focus on the latter.

Lease costs have jumped from $1.9 billion to $6.47 billion at the end of the third quarter, 2022.

Finance lease costs changes for nine-months periods ending September 2021 and September 2022 are:

- Amortization*, down from $7.44 billion at end of Q3 2021 to 4,586 end of Q3, 2022.

- Interest on lease liabilities – a decline from $365 million to $280 million.

*Amortization means “the action or process of gradually writing off the initial cost of an asset.” It may also be defined as “the action or process of reducing or paying off a debt with regular payments.”

We also can see from the chart that variable lease costs have dropped from just over $14 billion for the nine months ending on September 30 2021 to $12.74 billion for the same period ending 30 September 2022.

Gross lease liabilities for the operating leases increased by approximately 13%, reaching 75.5 billion dollars at close of Q3, while finance lease liabilities declined considerably, dropping from $25.86 billion to $18.83 billion over the nine months since Dec. 2021. Total gross lease liabilities were up just over 2%, combining both types – operating and finance.

Debt

Amazon’s debt or debt burden has increased since end 2021. The rise is significant, from $48.75 billion (approximate) to $58.9 billion.

Amazon has a considerable debt load by any measurement or vantage point. The size and scale of the company make that burden manageable.

Risks

Any company carries risks for those considering an investment, a hold or adding to a current holding. Amazon is no exception. Here are several risks to consider:

- AWS falters, either because a deep recession strikes and/or because Microsoft, Google and additional Cloud competitors cut into Amazon’s web services lead. As a key component of the company’s revenue and growth, this would certainly affect the bottom line.

- Outcome: Unlikely. AWS will continue to drive massive growth, both because of client satisfaction and dependence on the product and because recessions end. After corporate belt-tightening now in progress, customers will again expand their compute infrastructure. (I have seen how deeply implanted AWS is in corporate enterprises in my own time in high tech.)

- Retail takes a hit. Amazon’s retail footprint remains an enormous piece of the whole, so consumer reluctance about discretionary purchases or the rise of competition might ding Amazon.

- Outcome: Unlikely. As with AWS, Amazon’s size and scale and quality of service are unmatched in the space. Amazon Prime is a monster, a glue between on-line and off-line retail, and a subscription “hook” that at least partially resembles Costco’s revenue-through-renewal strategy. Recession-fear-related reductions in consumer discretionary spending will be temporary. A return to pattern favors Amazon over competitors.

- Post-Bezos leadership drops a level. Without the singular dedication and focus of the practical, strategic vision of Jeff Bezos, any successor will fall short and produce lesser results.

- Outcome: Possible, But a Manageable Risk. The leadership team around Jeff Bezos helped drive success for years. Andy Jassy is one of the inner circle with a proven track record. He may appear as a lesser CEO, based on a very brief time period marred by COVID impacts, inflation/interest rates and macroeconomic realities such as the Ukraine war and recession anxiety. I think Jassy will do just fine.

Summary

Amazon is a tricky stock in a present snapshot view. However, investing demands that we consider the company and not the stock. A dip in share price can be a wonderful buying opportunity.

There are facets of recent financial performance that give people reasonable pause when considering an investment in Amazon. The logistics infrastructure build-out that closely paralleled the COVID pandemic is why. What about the compelling EPS decline from Q4 2021 and the somewhat anemic results since? Again, these relate in part to Capex and to belt-tightening in anticipation of recession.

Add on the end of the Jeff Bezos era, and concerns mount. CEO Bezos was a superstar of the major leagues of American and international capitalism. It’s natural to suppose that his retirement might lead to Amazon hitting some roadblocks.

I believe that these concerns are simultaneously legitimate and overblown. The secular growth of Amazon’s product elements – from retail to category-crossing Prime to AWS to advertising – is real. The logistical infrastructure expansion looks very much like a singular “surge” event not to be repeated on a similar scale. The post-Bezos transition will be eased by the tremendous foundation set down and the skills and talents of his successors.

William Miller, a famously successful investor, recently offered his take on Amazon:

“I think it’s one of the easiest names in the market,” Miller said. “A year ago Amazon was double this price. If it takes three years for Amazon to get back to where it was a year ago, you make 25% a year. I think that will easily beat the market.”

“We think AWS alone right now is worth almost the whole price of Amazon,” Miller added. “So you get the advertising business, the logistics business, which is a relatively new business, retail, all for free.”

I agree wholeheartedly.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.