Summary:

- Amazon had a year to forget in 2022, with shares tumbling 40% as the company struggled against inflation and a faltering economy.

- Amazon’s crown jewel, AWS, continued to shine, but growth and margins now look to be decelerating sharply.

- CEO Andy Jassy implied in his shareholder letter that investors should not expect growth or margins to rebound anytime soon for AWS.

- Yet I think the long-term story remains very attractive, with a potential near-term boost from margins recovering across the rest of Amazon’s business lines.

- 2023 looks set to be a very different year, and I expect this to become more clear when Amazon releases its Q1 results on Thursday.

Teamjackson

Investment Thesis

Before looking ahead to Amazon’s (NASDAQ:AMZN) Q1 results, I’ll quickly outline the AWS-centric thesis behind my investment: AWS is a fast-growing, highly profitable business with powerful moats. This should propel Amazon to new heights, and I think AWS would be a great standalone business in its own right. The additional bonus with Amazon is everything else; this is a company with innovation running through its veins, and there’s no telling which of their next avenues could create the next AWS for the business. Amazon also has plenty of potential to expand on its retail margins, which will provide an additional boost to the bottom line in the future.

There is a caveat to this original thesis: although AWS is starting to slow down due to the tough macroeconomic environment, I believe that Amazon’s beaten-down non-AWS divisions are going to start becoming tailwinds throughout 2023, as efficiency measures and easing inflation (especially in fulfilment) start to turn the margin decline around.

So, here’s what I’ll be looking out for when Amazon reports its Q1’23 earnings later this week.

Amazon’s Latest Expectations

Amazon is set to report its Q1’23 results on Thursday, April 27 after the market closes, and there are several key items that investors should keep their eyes on.

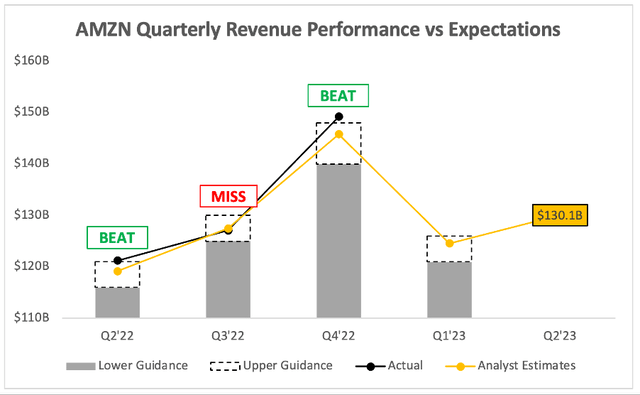

Starting with the headline numbers, where analysts are expecting Q1’23 revenue of $124.6B, representing YoY growth of 7.0%. This falls slightly towards the upper end of management’s $121-$126B guidance offered up in Q4.

Looking ahead to Q2’23, analysts currently expect Amazon to deliver revenue of $130.1B, which would represent YoY growth of 7.3%. Whilst it’s interesting to see that analysts are still expecting Amazon to deliver half decent growth in a period of economic uncertainty, I don’t think overall revenue growth will be the primary focus of Mr. Market when Amazon releases its results.

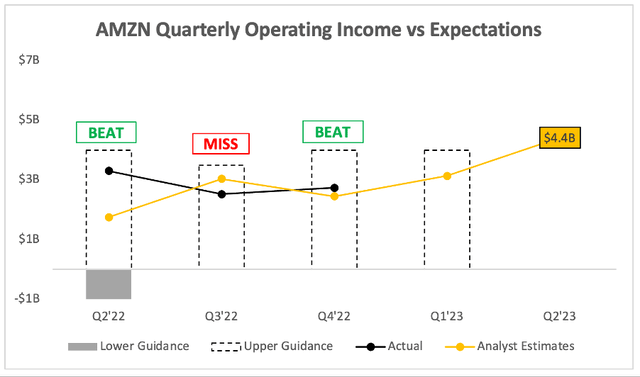

In my view, the two main things that will move shares immediately after earnings are EBIT margins and AWS’s growth (or lack of).

If we move down the income statement to operating income, analysts are expecting Amazon to deliver EBIT of $3.14B, representing an EBIT margin of 2.5%, and a 14% YoY decline from Q1’22. This once again falls slightly above the midpoint of management’s $0-$4B guidance offered in the prior quarter.

Analysts continue to remain hopeful that operating income and margins will pick up throughout the year, and expect Amazon to deliver Q2’23 operating profits of $4.42B, representing a 3.4% EBIT margin and an impressive 33% YoY growth.

Clearly analysts are optimistic about Amazon’s future margin expansion, but this upcoming earnings report will be a balancing act between two things: how hard has AWS been hit, and how much of a recovery will the rest of Amazon see?

How The Tables Have Turned

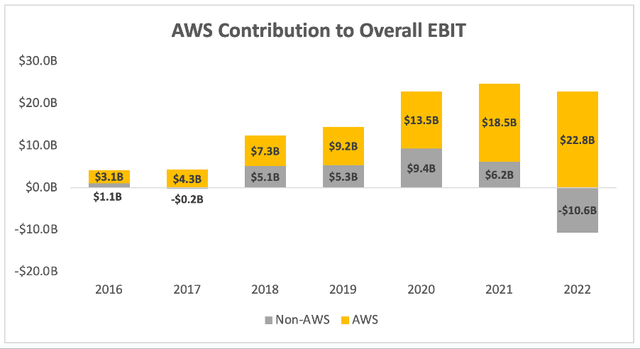

Amazon’s story over the past year or two has been all about how brilliant AWS has performed, delivering rapid growth and margin expansion that has helped to drive Amazon to new heights. This became even more apparent in 2022, as Amazon’s non-AWS business burned through cash and it was only the profits of AWS that kept Amazon in the green.

But in the words of leader, entrepreneur, and all-round superstar in the world of business Michael Scott:

Well, well, well… how the turntables

And how the turntables indeed, because the near-term trends have completely reversed: AWS is now facing a slowdown with fairly sharp margin contraction, and the worst may be over for Amazon’s non-AWS business.

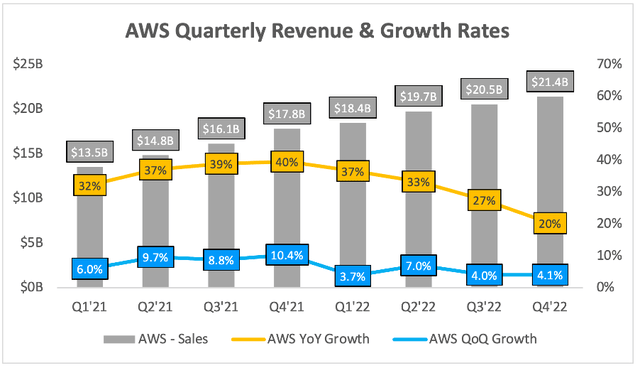

Starting with AWS, and it’s pretty clear from the below graph where the trend is heading in terms of growth.

Going from 40% YoY growth in Q4’21 to 20% YoY growth in Q4’22 doesn’t look great, and I would expect this slowdown to continue into Q1’23.

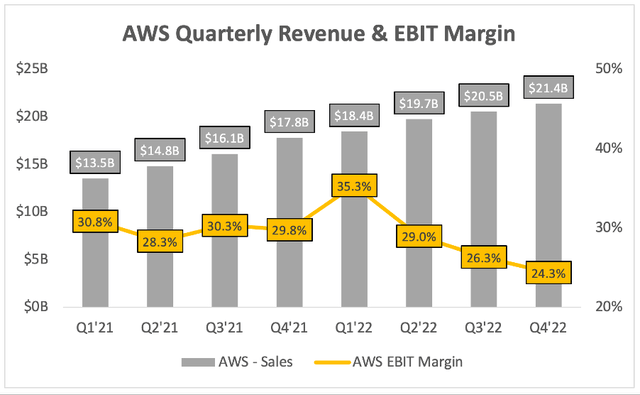

Perhaps even more concerning for Amazon shareholders is not the slowdown in AWS – this is to be expected as companies become more cautious about their spending – but the collapse of its margins.

I can’t help but feel like AWS’s margins in Q1’23 will be nowhere near the 35.3% from a year ago, and may well head into the low 20 percents.

On the plus side, CEO Andy Jassy addressed these headwinds in his shareholder letter, and said exactly what Amazon was going to do about AWS and the current macroeconomic difficulties:

AWS has an $85B annualized revenue run rate, is still early in its adoption curve, but at a juncture where it’s critical to stay focused on what matters most to customers over the long-haul.

Despite growing 29% year-over-year (“YoY”) in 2022 on a $62B revenue base, AWS faces short-term headwinds right now as companies are being more cautious in spending given the challenging, current macroeconomic conditions.

While some companies might obsess over how they could extract as much money from customers as possible in these tight times, it’s neither what customers want nor best for customers in the long term, so we’re taking a different tack.

In short, Jassy is saying that Amazon will be working with customers to try and help them in these tough times, and that is going to hurt short-term growth rates and margins for AWS.

As a shareholder with a long-term view, I think this is the best approach that will lead to future success, but it may also cause some pain to Amazon’s shareholders in the near term.

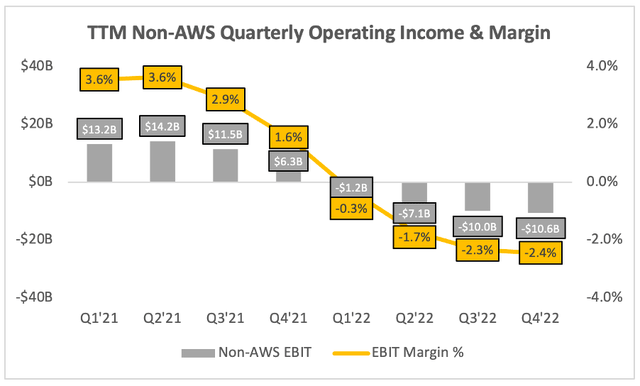

On the other side of the coin, we have the rest of Amazon’s business. As the graph below shows, margins here have absolutely collapsed over the last couple of years, and a few percentage points on hundreds of billions of dollars in revenue is a lot of profit lost.

However, I think this chart also gives shareholders a reason to be optimistic. I’ve taken the trailing-twelve-month view on these revenues and margins, and it certainly feels as though the negative margins have ‘bottomed’ and we may soon see positive margins once again.

Let’s not forget that some of the headwinds that Amazon has faced in the past year, such as:

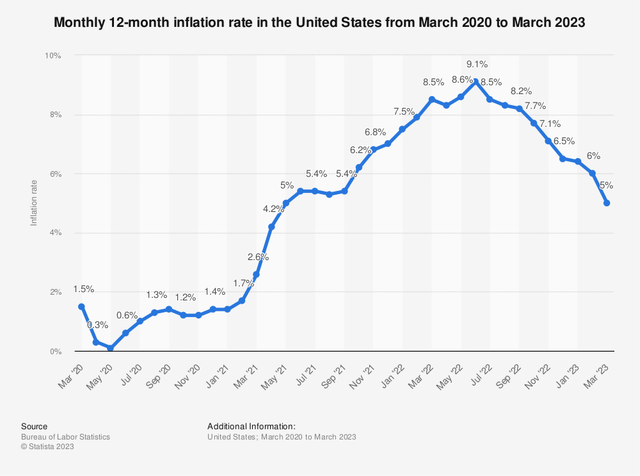

- High inflation and energy costs across its supply chain

- A strong US dollar

- Over expansion during the stay-at-home e-commerce bubble

These are trending in the opposite direction now: inflation is falling sharply, the dollar is not as strong, and Jassy has taken control of this excess spending – all of which should become tailwinds for Amazon in 2023.

Jassy focused on this cost optimisation in his shareholder letter about when it came to the rest of Amazon, being brutal when cutting off certain parts of the business that don’t look like worthwhile investments, whilst still chasing those opportunities that appear attractive:

Over the last several months, we took a deep look across the company, business by business, invention by invention, and asked ourselves whether we had conviction about each initiative’s long-term potential to drive enough revenue, operating income, free cash flow, and return on invested capital.

Amazon has also laid off tens of thousands of staff members over the last year or two, and has really slowed down on its capital expenditure, as the company was just one of many that got ahead of itself during the pandemic and e-commerce boom.

But I believe that the trajectory for this part of Amazon’s business will be upward for most of 2023, particularly when it comes to margins, and this should provide a big boost to Amazon’s bottom line.

AMZN Stock Valuation

As with all innovative, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Amazon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

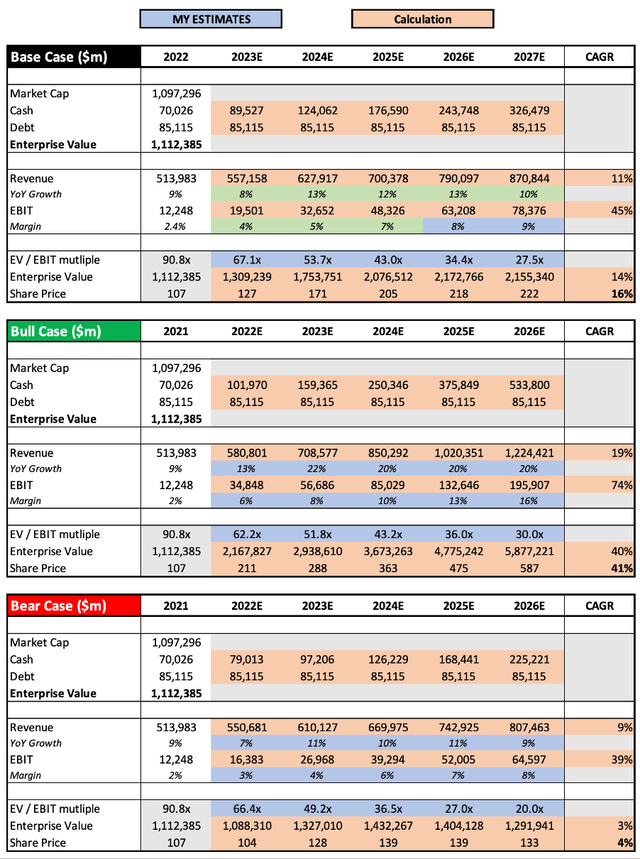

Author’s Work / Seeking Alpha / TIKR.com

I have made a slight change in recent months to my valuation approach, as I now include analysts’ estimates from Seeking Alpha and TIKR in my base-case scenario to ensure any biases I might have not been taking over – plus, with a company like Amazon, these analysts will likely have access to far more information and data than I could dream of.

Overall, my assumptions for the valuation model have not changed much from my previous article. I still expect Amazon to grow at a decent pace through to 2027, and believe there is plenty of opportunity for the company to keep expanding margins as AWS becomes a bigger contributor to overall revenues and the rest of Amazon starts to shake off its pandemic-induced hangover.

Putting all these together, I can see Amazon shares achieving a CAGR through to 2027 of 4%, 16%, and 41% in my respective bear, base, and bull case scenarios.

Bottom Line

In short, I’m not expecting a great Q1’23 report from Amazon. AWS margins will almost definitely be lower than Q4’22, and growth will again almost certainly be lower – the only question is how low will it go?

On the other hand, I do believe that the rest of Amazon could act as a catalyst for boosting margins, as the impact of Jassy’s cost-optimisation measures starts to kick in.

Perhaps most importantly, this is still an incredible business that is taking a long-term view: work with AWS customers, continue to invest in attractive opportunities, but trim the fat on projects that haven’t been paying off.

Whilst shares may be in for a rocky 2023, I still think this is an attractive price to be paying for a company that should continue to succeed for the rest of the decade, and I will reiterate my previous “Buy” rating on Amazon shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, DOCN, ETSY, SHOP, MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.