Summary:

- Continued slowdown in AWS growth made the headlines when it came to Amazon’s Q1 earnings last week. However, there was much more to the recent earnings print.

- The company’s cost rationalization efforts began to kick in, forming only the beginning of a prolonged period of margin expansion.

- In light of this, and possibly bottoming AWS growth rates I believe it’s time to buy the rumors of a brighter future after the post-earnings sell-off.

martinova4

Opening thoughts on AWS

After positive surprises from its major peers, the bar for Amazon.com, Inc. (NASDAQ:AMZN) Q1 earnings was set quite high on the 27th of April. The company managed to exceed these expectations both on the top and bottom lines, with operating income reaching $4.8 billion, 20% higher than the high end of management’s guidance range. However, as most of us already know, management hinted on further growth slowdown in the Amazon Web Services (“AWS”) unit on the Q1 earnings call that followed, sending shares lower after the initial euphoria.

I believe the market and many analysts overreacted to this news as both Microsoft Corporation (MSFT) and Alphabet Inc. (GOOG) management shared similar information on their respective earnings calls two days before. Ruth Porat, Alphabet CFO said the following:

“That being said, in Q1, we continued to see slower growth of consumption as customers optimized GCP costs reflecting the macro backdrop, which remains uncertain.”

In the case of Microsoft, management projected that Azure’s constant currency growth should slow from 31% yoy in Q3 FY23 to 27% in Q4 FY23.

Based on this, I believe it wasn’t so surprising that Amazon management called out another 5%-point yoy growth slowdown in AWS after 16% yoy growth in the Q1 quarter. The trend at each of the three large cloud providers is still the same, which is continued slowdown in cloud momentum. However, as the global cloud services market is expected to reach $2.5 trillion by 2031 growing at a CAGR of 16.6% effectively quintupling from 2021 levels, I believe that the growth prospects of this segment remain still strong.

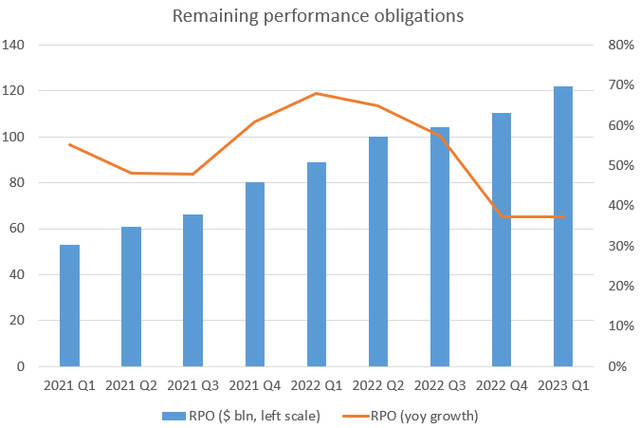

Furthermore, if we look at remaining performance obligations (RPO) at Amazon, which based on the company’s 10-Q filing are primarily related to AWS, we could see a significant increase in the Q1 quarter:

Created by author based on company fundamentals

RPO grew $11.6 billion, the second largest increase after 2021 Q4 in company history. This equaled a yoy growth rate of 37%, showing no further deceleration from 2022 Q4 levels. I believe this shows the real strength of Amazon’s cloud service and is a good sign that after recent conservative consumption patterns recede there could be a long runway for topline growth reacceleration.

Looking at the competitive positioning in the space, it’s worth noting that AWS seems to lose some market share to Azure in recent quarters, which is worth monitoring during 2023. Whether this could be the result of increased flexibility AWS provides with its cloud contracts or increased adoption of Azure among customers remains to be seen.

I believe it would be a big mistake to stay away from Amazon’s shares based only on this reason, just as the Retail business begins to regain its profitability. This, coupled with a strong AWS business makes the shares valuation quite attractive at current levels in my opinion. Let me explain this in numbers and a few charts in the upcoming paragraphs.

North America Retail: Another Cash Cow Emerging

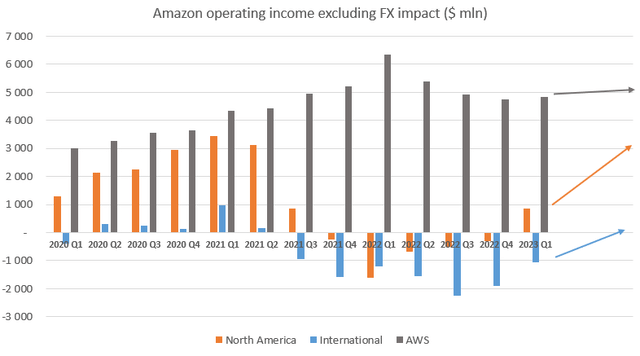

After several quarters of operating losses, the North America segment of Amazon reached an operating income of $900 million in Q1, which was close to 20% of AWS’s operating income. This has equaled an operating margin of 1.2%, which is still far from the 5-6% in pre-pandemic times. In one of my previous articles on the company (Amazon: My “Margin-Call“) I provided many details on why I believe, that reaching pre-pandemic margins in the North America segment could be a realistic scenario in the upcoming quarters. Those trends like growing into spare capacities, increasing availability of labor, decreasing raw material and transportation costs, cautious Capex and hiring (just to name a few) still prevail. In light of this, I believe that in a few quarters the profit generation ability of the North America segment could catch up to that of AWS, even if this seems a large step from current levels:

Created by author based on company fundamentals

Another encouraging sign for the North America business was the following comment from Andy Jassy on the Q1 earnings call:

“And we have found a lot more opportunities than we even thought were there before. So, I’m pretty optimistic that we have a chance not just to recover to where we were pre-pandemic in terms of operating margin, but I think there’s additional upside with some of the opportunities we’ve identified.”

The CEO was talking on cost rationalization initiatives in the North America segment, summarizing their findings from the past 6-9 months after taking a deep dive in the current cost structure. Even if it could seem a bit too optimistic at this point to talk about 6%+ operating margin in the North America segment, I am sure there is a good reason Andy called this out. An operating margin of 6.7% in the Q1 quarter would have resulted in the same operating income for the North America business than for AWS (~$5.1 billion). So, if Andy is right, Amazon could stand soon on two strong pillars again instead of one.

Besides the stronger than expected operating income figure for Q1, the guidance for Q2 also gave reason for optimism. Management expects operating income of $2-$5.5 billion following several quarters, where the lower end of the guide has been 0.

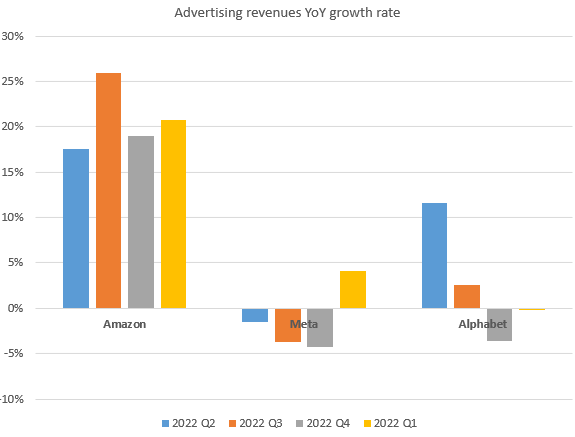

On the top of cost rationalization efforts continued strong top line growth in advertising aids margins in the North America segment as well. Despite lackluster growth at the competition, Amazon ad sales are still holding up well with 21% yoy in the Q1 quarter:

Created by author based on company fundamentals

As advertising sales make up an increasing share of North America segment revenues (~20% yoy growth rate vs 11-14%) and provide much higher margins than general retail margins they provide a natural support to the bottom line.

I believe, the Q1 earnings release provided some long-awaited proof that North America margins should make a strong comeback this year. In light of AWS growth headwinds, I think this information has been underappreciated, but it should support the share price in the aftermath.

Finally, just as the North America segment regains its foothold, so should things improve in the International segment as well. However, as this segment is still characterized by increased investments in previously untapped markets it should take a few more years until it could significantly add value to Amazon’s bottom line.

Topline growth and valuation

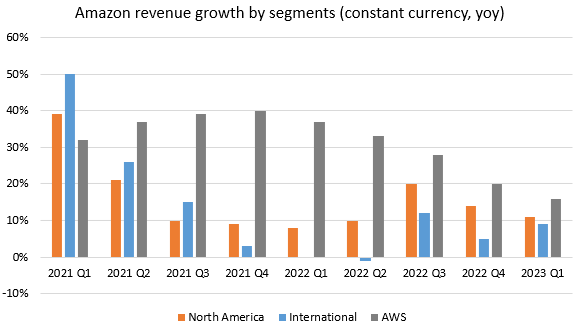

Before jumping to valuation, it’s worth to highlight current and expected revenue growth trends for each of the three segments as these will serve as inputs to the valuation framework. Looking at North America and International segments, where the majority of revenues still consist of online retail sales, I believe a long-term growth rate of ~10% should be realistic as most research estimates a ~10% CAGR for the retail e-commerce market globally. Currently, both segments had a similar YOY revenue growth rate amid a global economic backdrop in the Q1 quarter, which confirms that this assumption should be a realistic one:

Created by author based on company fundamentals

AWS revenues grew 16% YOY in the Q1 quarter but slowed further in April to 11% YOY based on management’s comments on the Q1 earnings call. As Q2 was an exceptionally strong quarter last year this 11% growth rate could possibly slow further over the course of the quarter. As easier comps follow in Q3, and especially in Q4 I believe top line growth should recover to 15-20% levels that is expected from the cloud services market in general.

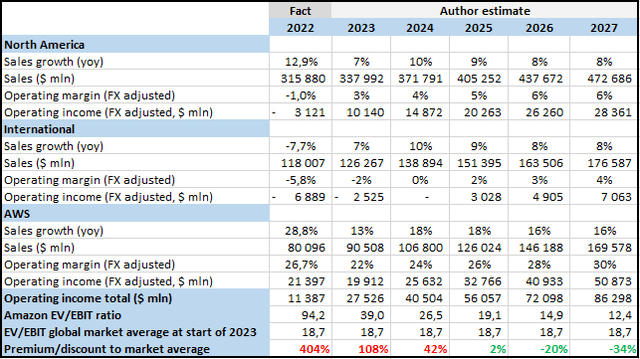

Based on the assumptions above and the previous discussion on operating margins, I have put together the following valuation framework:

Created by author based on company fundamentals and own estimates

In case of top line growth, I stayed on the conservative side for all three segments assuming a soft continuation to 2023, a moderate positive turnaround for 2024 and stabilization for the upcoming years. In the case of margins, I have assumed that the turnaround should continue in the North America and International segments, while AWS margins stay at current levels this year followed by a gradual increase in the upcoming years. I believe, this is a conservative assumption as well, especially in the case of AWS, where a return to ~30% operating margin levels seen during 2020 and 2021 could possibly occur much sooner.

Comparing Amazon’s current EV/EBIT ratio to the general market based on 2023 estimates shows that shares are overvalued to a great extent (108%). However, if we look only a few years into the future and incorporate the significant improvement of the bottom line and stabilizing sales in the valuation framework the shares look more reasonably priced. Already, with the 2025 operating income estimate, shares would trade at the market average, while looking one year further this translates into a 20% discount.

Considering that I have used rather conservative estimates for my valuation framework I believe shares are priced attractively. As Amazon is present in businesses, which shape the future of our economy with above-average long-term growth prospects, I think shares should deserve a premium valuation compared to the market in general. At current ~$100 share price levels this premium could diminish within a few years, which is not realistic in my opinion. Whether business conditions should deteriorate materially, or the share price should increase significantly to resolve this dilemma. I believe there is a great chance for the second option, which makes shares a good investment at current levels.

Conclusion

It’s finally happening! Amazon.com, Inc.’s margins began to improve significantly in the Q1 quarter. Unfortunately, this has been overshadowed by a continued slowdown in the AWS unit, which left investors with a bad taste. I believe people should look through this short-term noise and focus on the strong Amazon.com, Inc. long-term growth prospects, which visibly began to materialize this quarter. At current valuation levels, Amazon.com, Inc. shares provide a compelling investment opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.