Summary:

- Amazon.com, Inc. reported better-than-expected Q1 2023 earnings yesterday.

- However, AWS’s momentum is slowing and should be expected to weigh on the company’s overall growth and valuation factor.

- The risk profile remains unattractive as the company’s fastest-growing business is seeing a reset of expectations.

Noah Berger

Ahead of Amazon.com, Inc. (NASDAQ:AMZN)’s earnings release for the first-quarter, I identified slowing AWS top line growth as a key risk for the internet retailer heading into earnings, next to an unprofitable e-Commerce business — in Get Ready For A Weak Q1 Report. And although Amazon squeezed out a solid revenue beat for the first-quarter, the earnings release was not as great as the market thought it was. Amazon’s share price initially soared, but they gave up gains in extended trading. The big problem is that growth in Amazon Web Services is slowing and Amazon will have to push for more efficiency gains in order to drive earnings growth going forward. With the shares having few catalysts in the short term, if any, I believe Amazon’s shares are ripe for a correction and should be avoided!

Amazon Web Services is staring down a serious growth slowdown

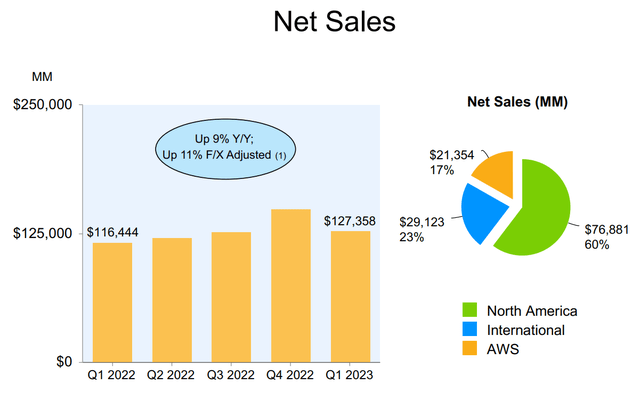

Amazon reported 9% year over growth in revenues for the first-quarter which exceeded the company’s top end of its Q1’23 guidance range. Amazon projected that it could generate 4-8% growth in revenues in the first-quarter and total revenues of $127.4B also beat estimates for the first-quarter, so overall the internet retailer did well. In currency-adjusted terms, Amazon generated net revenue growth, year over year, of 11% with revenues growing in both Amazon Web Services and e-Commerce.

However, AWS revenues slightly dropped quarter over quarter. Amazon’s e-Commerce sales typically dip after the holiday season, but this has not been true for Amazon Web Services which account for roughly 17% of total revenues. Total e-Commerce revenues accounted for 83% of the company’s net revenue mix in the first-quarter and the e-Commerce business is likely to stay the dominant revenue source for Amazon for years to come.

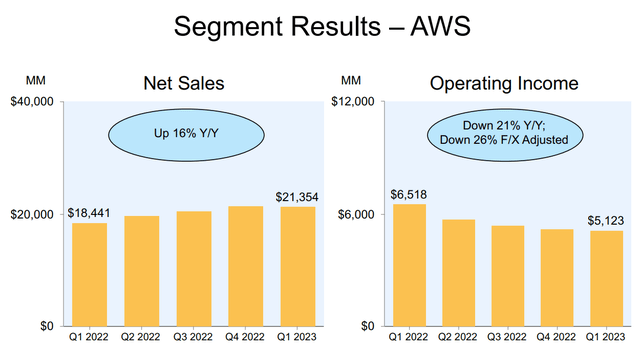

While overall revenue growth was solid and beat guidance, Amazon’s earnings release revealed a weak spot… which is the company’s fastest-growing segment, the Cloud business. Amazon Web Services generated $21.35B in net revenues in Q1 ’23, showing a year-over-year growth rate of only 16% compared to 37% year-over-year growth in the year-earlier period. Amazon Web Services’ growth rate also decelerated from over 20% in the fourth-quarter as corporations look to control costs in a high-inflation world and, according to Amazon, are “optimizing” their IT expenses. This growth slowdown is likely, in my opinion, to result in a reassessment of Amazon’s perception as a growth stock, and it translates to significant valuation risks as well.

Free cash flow

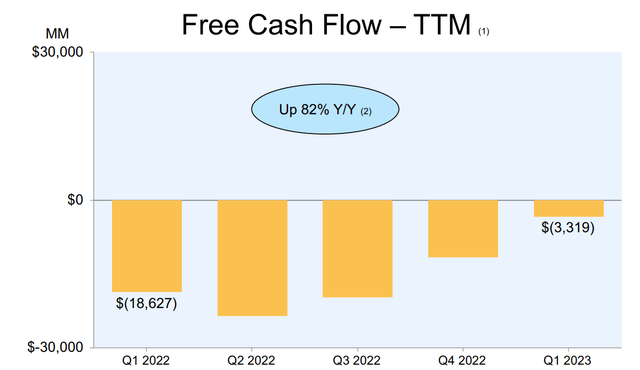

Amazon generated free cash flow (“FCF”) of $(3.3)B, showing an 82% year-over-year improvement, but free cash flows remained negative nonetheless… which is a concern for shareholders as Amazon continues to invest heavily in artificial intelligence, AWS, Prime and its hardware portfolio including Amazon-built TVs. Combined with the growth slowdown in Amazon Web Services and an unprofitable e-Commerce business, I believe Amazon faces serious near term challenges, in addition to negative free cash flows.

Guidance for Q2 ’23

Amazon forecasts 5-10% year over year top line growth in Q2 ’23, which implies a revenue range of $127-133B and operating income of $2.0-5.5B. In the year-earlier period, Amazon generated operating income of $3.3B. Amazon’s operating income growth in recent years has been chiefly driven by the expansion of Amazon Web Services so I would expect weaker operating income growth going forward as well.

Overall, Amazon’s guidance was not great, especially as far as demand weakness in Amazon Web Services was concerned. With AWS growth slowing, Amazon will have a harder time going forward to convince investors to buy the company’s shares.

Amazon’s valuation

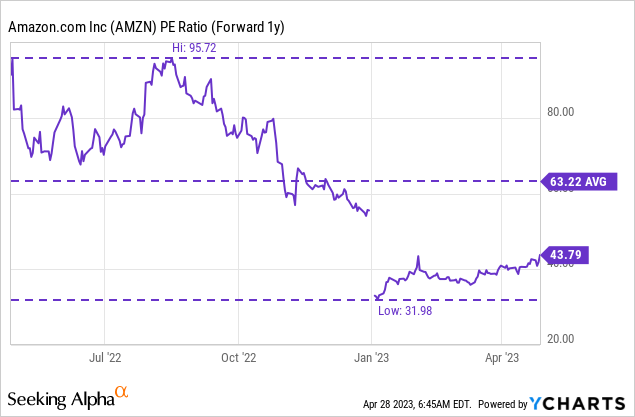

Amazon is still valued as a growth stock, although the company has seen a major reset of its growth potential after the COVID-19 pandemic. Now, investors also have to price in the possibility of a broader and longer slowdown for Amazon’s fastest-growing business, AWS, which could impact the willingness of investors to pay a higher earnings multiplier for Amazon’s shares.

Amazon’s growth is currently valued at a P/E ratio of 44X, which is not a small multiplier to pay considering that Amazon just dropped a bombshell on investors. The stock is also still priced well below its 1-year average P/E ratio, but I predict that the AWS bombshell is going to hurt Amazon’s perception as a growth stock. While it is true that investors can get an approximate 31% discount to the 1-year average P/E ratio, the risks fundamentally increased for Amazon investors last week.

Risks with Amazon

The biggest risk for Amazon is slowing top line growth for its fastest-growing business: Amazon Web Services. Although I warned of slowing growth before earnings, it could get worth for Amazon because AWS is the growth engine that contributes nearly all of the company’s operating income growth. If AWS growth slows further in the second-quarter and in the second half of FY 2023, then Amazon’s consolidated top line growth can also be expected to take a hit… which I believe is set to weigh on Amazon’s valuation factor.

Final thoughts

Amazon.com, Inc. delivered better than expected revenue growth for the first-quarter, but there are real issues to be concerned about: Amazon Web Services’ expected growth slowdown due to spending cutbacks in the corporate sector was a real bombshell and it could put investors off of the stock for some time. Amazon Web Services was the main reason why many investors bought into Amazon’s growth story in the first place, and with growth slowing, investors have few reasons to invest in Amazon. This is especially because the e-Commerce business remained unprofitable in Q1’23.

With Amazon.com, Inc. still being valued like a growth stock, at a P/E ratio of 44X, I believe investors are paying too high a multiplier factor. Amazon’s shares look ripe for a correction after the company dropped a bomb on investors last week!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.