Summary:

- Amazon had a year to forget in 2022, with shares tumbling 40% as the company struggled against inflation and a faltering economy.

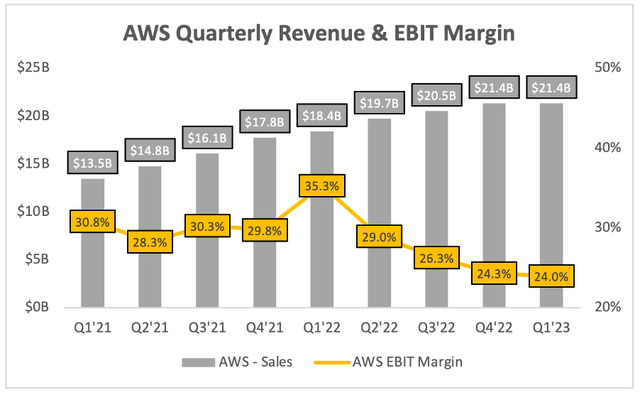

- Amazon’s crown jewel, AWS, continued to shine, but growth and margins now look to be decelerating sharply.

- CEO Andy Jassy implied in his shareholder letter that investors should not expect growth or margins to rebound anytime soon for AWS.

- Yet, I think the long-term story remains very attractive, with a potential near-term boost from margins recovering across the rest of Amazon’s business lines.

- 2023 looks set to be a very different year, and I expect this to become more clear when Amazon releases its Q2 results on Thursday.

Kirk Fisher/iStock Editorial via Getty Images

Investment Thesis

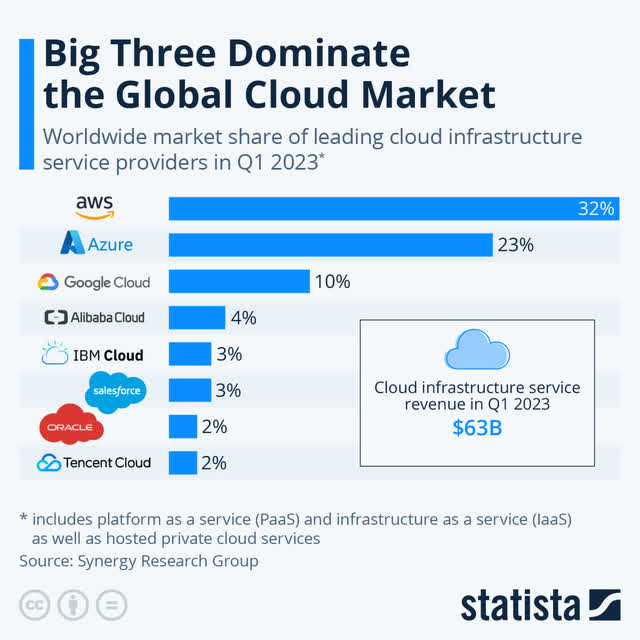

Before looking ahead to Amazon’s (NASDAQ:AMZN) Q2 results, I’ll quickly outline the AWS-centric thesis behind my investment: AWS is a fast-growing, highly profitable business with powerful moats, and should continue propelling Amazon to new heights. I think AWS would be a great standalone business in its own right, but the additional bonus with Amazon is that investors get everything else as well; this is a company with innovation running through its veins, and there’s no telling which future avenue could create the next AWS for the business. Amazon also has plenty of potential to expand on its margins outside of AWS, which will provide an additional boost to profitability in the future.

There is a caveat to my original thesis: although AWS has been slowing down due to broader uncertainties in the macroeconomic environment, I believe that Amazon’s beaten-down non-AWS divisions are going to start becoming tailwinds throughout 2023, as efficiency measures and easing inflation (especially in fulfilment) start to turn the margin decline around.

With that in mind, here’s what investors should be keeping an eye on when Amazon reports its Q2 2023 results.

Amazon’s Q2 Earnings: Analysts’ Expectations

Amazon is set to report its Q2 2023 results on Thursday, August 3, after the market closes, and there are plenty of things for investors to look out for.

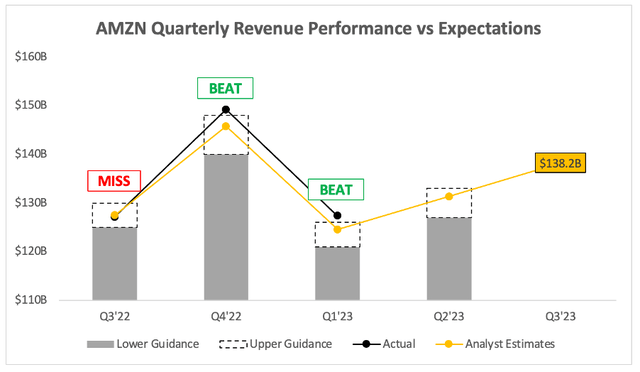

Starting with the headline numbers, analysts are expecting Q2’23 revenue of $131.3B, representing YoY growth of 8.3%. This is just above the midpoint of management’s $127-$133B revenue guidance that was offered up in Q1, but as the chart below shows, Amazon has exceeded the top end of its revenue guidance for the past two quarters – so don’t be surprised if it happens again.

But we all know that the market is forward-looking, so you can expect most investors to be focusing heavily on the guidance that management offers up for Q3’23. As it stands, analysts are expecting Amazon to deliver revenue of $138.2B in Q3, representing YoY growth of 8.8%.

Whilst it’s interesting to see that analysts are still expecting Amazon to deliver decent growth in a period of economic uncertainty, I don’t think overall revenue growth will be the primary focus of Mr. Market when Amazon releases its results.

In my view, the two main things that will move shares immediately after earnings are EBIT margins and AWS’s growth (or lack of).

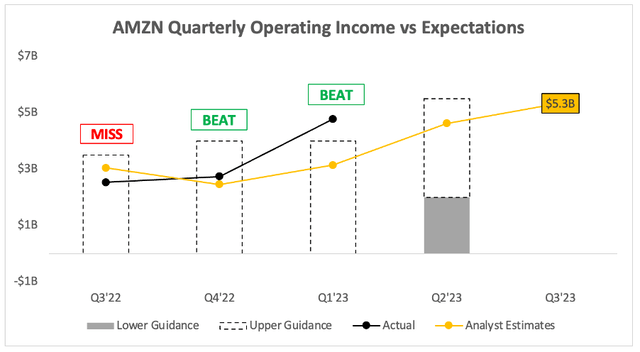

Let’s move down the income statement to operating income, and analysts are expecting Amazon to deliver EBIT of $4.61B, representing an EBIT margin of 3.5%, and an impressive 39% YoY increase from Q2’22. Once again, this EBIT falls towards the top end of management’s $2.0-$5.5B guidance offered up last quarter.

Finally, looking ahead to Q3’23, analysts are expecting Amazon to deliver an operating income of $5.33B, representing an EBIT margin of 3.9% and quite staggering YoY growth of 111%. Clearly, we are seeing a huge turnaround in profitability for Amazon, and shareholders should be excited to see just how much these EBIT margins can improve over the next couple of years.

But what’s going to be driving these increasing profits? Here are three key items that investors should be watching when Amazon reports on Thursday.

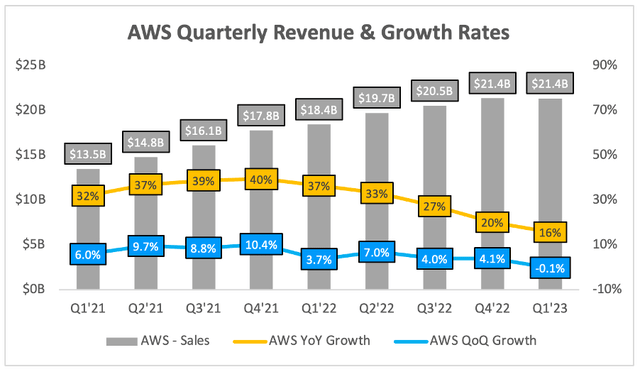

1. AWS Is Approaching Single-Digit Growth Rates

The crown jewel of Amazon has lost its sparkle over the past year. We saw plenty of technology businesses see tremendous success and demand in 2020 and 2021, which in turn gave AWS a huge boost as it provided the cloud infrastructure and services for these high-flying businesses.

Unfortunately, in 2022 and 2023 the demand fizzled, the economy looked shaky, and all of these investments in cloud computing disappeared, leaving AWS facing a sharp slowdown.

Now 16% YoY growth in Q1’23 wasn’t bad, but the worrying trend for investors was that AWS saw a sequential decline from Q4’22 to Q1’23, indicating that the YoY growth rates are likely to keep falling this quarter. In fact, CFO Brian Olsavsky gave some less-than-promising early indications on AWS’s growth rates for this quarter in the Q1 earnings call:

April revenue growth rates about 500 basis points lower than what we saw in Q1.

If the trend continues throughout the whole of Q2 that would take growth rates down to 11% YoY, but it doesn’t stop there. The Zacks Consensus estimate for AWS net sales stands at $21.5B, which would in fact represent just 9% YoY growth in Q2 – ouch!

In truth, I’m just hoping to see improving QoQ growth, because that will be the first indication that growth is slowly but surely returning to AWS.

2. Expect Profitability To Improve Rapidly

The positive news for Amazon is that most things should be getting better, rather than worse, over the next 12 months – especially if we see sequential growth improving in AWS this quarter.

The other potential catalyst for AWS is its margins, as these have plummeted over the past year.

Amazon CEO and AWS master Andy Jassy told investors in a shareholder letter earlier this year that Amazon had no intention to try and extract as much money from its AWS customers as possible during these tough times, and instead, they will work with customers to ensure a successful long-term partnership.

The knock-on effect is that AWS growth rates and margins are going to feel some pain during 2023, but as a shareholder with a long-term view, I believe this approach will lead to a lot more future success for AWS – so, once AWS customers stop feeling as much pressure (which I think may be just around the corner, or already happening), I can see revenue growth and EBIT margin expansion being a huge catalyst for AWS’s results and Amazon’s share price.

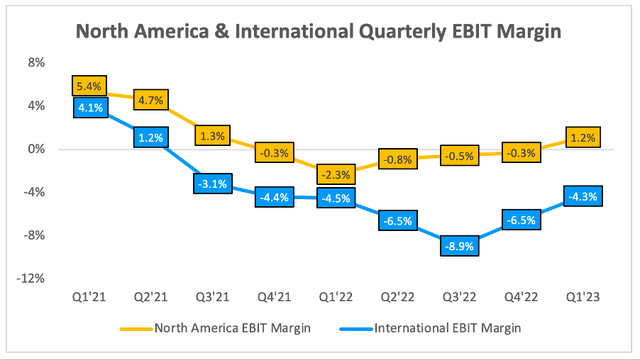

Another catalyst that should boost margins, and a turnaround that is already underway, is the improvement in Amazon’s non-AWS business. As the chart below shows, the EBIT margins for North America appeared to have bottomed in Q1’22, and the EBIT margins for Amazon’s International segment appeared to have bottomed in Q3’22.

These margins have been recovering ever since, and North America actually delivered positive EBIT last quarter for the first time since Q3’21. I think these margins are only going to keep improving throughout 2023 and into 2024, as the headwinds that Amazon faced last year (high inflation, high energy costs, a strong US dollar, over-expansion during the stay-at-home e-commerce bubble) start to dissipate, and Amazon’s cost-cutting measures start to pay off.

In short, I don’t see any more pain in terms of operating income for Amazon shareholders, and I believe the company is very much on the road to recovery: firstly with the non-AWS segments already seeing this turnaround, and then I would expect to see signs of a turnaround in AWS as we approach the end of 2023 (or sooner if I’m lucky!).

3. Advertising Continues To Excel

The final item that I want to touch on is advertising, which is a higher growth, higher margin business line for Amazon that should keep seeing success in 2023 and beyond, especially as the digital advertising market has shown signs of recovery after a tough 12-18 months.

As CFO Brian Olsavsky called out in the Q1 earnings call:

We also saw strong engagement in our advertising services with revenue up 23% year-over-year, excluding the impact from changes in foreign exchange rates.

… It’s also worth noting that we’re still very early in our efforts to find a way to thoughtfully place ads in our broader video, live sports, audio and grocery properties. We have a lot of upside still in advertising.

Advertising remained Amazon’s fastest-growing reported revenue stream in Q1’23, and made up ~7.5% of the total revenue, so this could become yet another high-growth, high-margin business over the next couple of years that may reap rewards for shareholders.

Amazon Stock Valuation

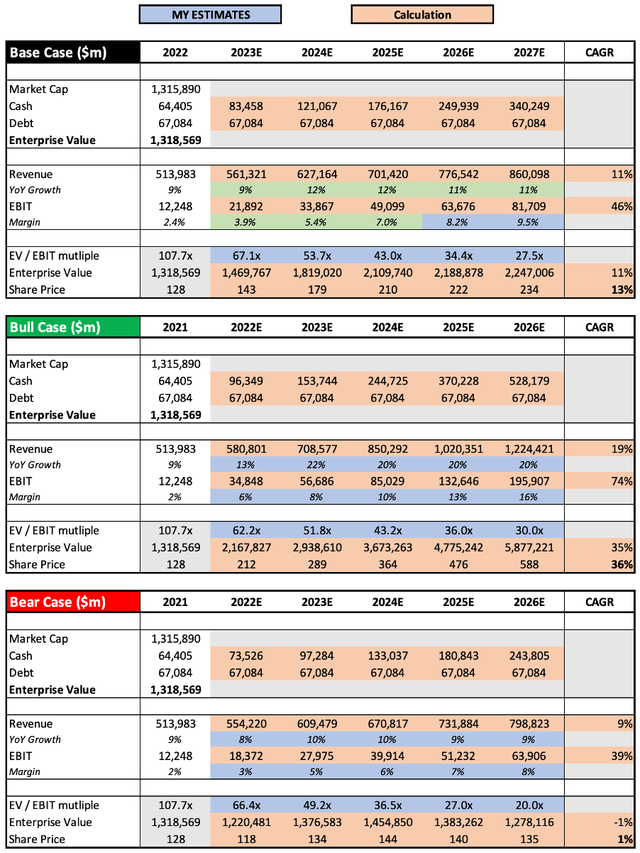

As with all innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Amazon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

Author’s Work/Seeking Alpha/TIKR

I haven’t changed the valuation model too much from my previous article, besides updating the figures for Amazon’s enterprise value and any new analysts’ estimates – in general, analysts are expecting a bit more growth this year and slightly better margins, which isn’t a surprise after Amazon saw a fairly substantial margin beat in Q1.

Putting all that together, I can see Amazon shares achieving a CAGR through to 2027 of 1%, 13%, and 36% in my respective bear, base, and bull case scenarios.

Bottom Line

I expect Amazon’s Q2 earnings to be the very definition of a ‘mixed’ report – I can see the market getting upset with AWS’s growth potentially hitting single digits, but I also expect Amazon to deliver higher profitability than expected, as the rest of the company stops being such a drag on margins.

2023 may well be a rollercoaster for Amazon’s shares, but I think Thursday’s report is likely to help investors see the light at the end of the tunnel, and it should hopefully give Mr. Market fewer reasons to panic about the long-term potential of this incredible business.

For these reasons, I will reiterate my previous ‘Buy’ rating on Amazon shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, DOCN, ETSY, SHOP, MELI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.