Summary:

- Why I was wrong to have a sell rating on this stock. And what’s next?

- Amazon’s retail operations have positively surprised with improving profit margins.

- Amazon’s revenue growth rates are set to accelerate, showing its ability to control operations and deliver mid-teen growth rates.

- AWS revenue growth rates have significantly slowed down and it is losing market share to competitors.

Sundry Photography

Rapid Recap

As we headed into the earnings print I had a sell rating on Amazon (NASDAQ:AMZN) as I had a thesis that AWS had started to see a significant slowdown in revenue growth rates.

Furthermore, I didn’t buy into the idea that just because AWS was massive, this necessarily equated to Amazon’s AI technology being a leading technology. And that was what the market had expected.

However, what I had not counted on was that Amazon’s retail operations would positively surprise so significantly on the upside.

As a professional investor, I am both experienced and humble enough to acknowledge when something isn’t performing the way I thought it would, and am more than willing to change my mind when the facts change.

Consequently, I now move to the sidelines and am neutral on Amazon.

Amazon’s Near-Term Prospects

In the first instance, I’ll discuss some negative aspects as it pertains to AWS and then I’ll turn to discuss positive aspects of Amazon’s retail operations.

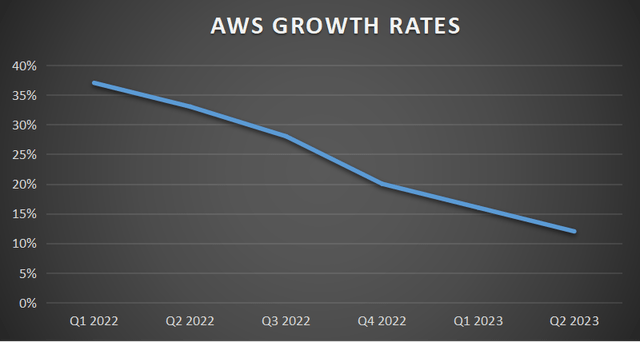

AWS saw its revenue growth rates slow down to 12% y/y. Looking back to the same period a year ago, AWS was delivering 33% y/y growth rates.

In fact, look below and you’ll see an undeniable trend.

Even if AWS described on the earnings call how it was seeing signs of stabilization in AWS’s growth rates, there’s no doubt that AWS is losing market share to both Microsoft (MSFT) Azure which was up 26% y/y in the same quarter and Google Cloud Platform (GOOG)(GOOGL) which was up 28% y/y (disclosure, I’m long GOOG).

Furthermore, AWS’ profit margins have compressed by approximately 480 basis points y/y, reaching 24.2%.

In summary, not only is AWS decelerating rapidly but its profit margins too aren’t as attractive as they once were.

We’ll next turn to discuss the positive aspects of this set of earnings results, and I’ll ask that consider this quote from the earnings call,

Since North America segment operating margins bottomed out in Q1 of 2022, we have seen 5 consecutive quarters of improvement, with second quarter operating margin of 3.9%. This is an improvement of 620 basis points over these past 5 quarters. One of the largest drivers of this operating income improvement in the stores business has been reducing our cost to serve, with shipping costs and fulfillment costs continuing to grow at a slower pace than our unit growth.

The message coming from Amazon for both its North America business and International business are rapidly expanding their profit margins.

Even though the International business remains unprofitable, Amazon is able to remind investors that it took Amazon nearly a decade to reach profitability in North America and its entry into many countries is much more recent than this.

All in all, this allows Amazon to say, we know how to excel with a positive customer experience while being disciplined towards profitability, as we’ve done this strategy before. And we will do it again. Just the same.

With that in mind, let’s turn to discuss Amazon’s financials.

Amazon’s Growth Rates Are Accelerating Again

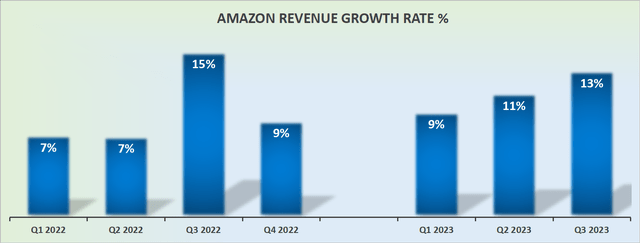

Looking ahead, Amazon’s revenue growth rates are set to accelerate. This is noteworthy, because all of a sudden, Amazon is no longer a company with single-digit growth, but one that is able to deliver mid-teen growth rates. Why is this so important?

Because it shows that despite having to operate with nearly $150 billion in revenues every 90 days, Amazon can still be able to tweak and control its operations and eke out extra revenue growth rates.

What’s more, investors will have no doubt observed that Q3 of last year was the toughest quarter to compare against. And if Amazon’s guidance for Q3 is already looking this strong, this bodes well for Q4 to also positively impress investors.

AMZN Stock Valuation — Never Cheap

A lot of investors believe that Amazon does not trade on any valuation. But this is false. Amazon does trade on a valuation. It’s simply that the stock has never been cheap.

That being said, if Amazon can convince investors that it’s getting back to growth mode, the multiples that investors can be willing to pay for a reaccelerating tech company, particularly one as successful and well-known as Amazon can range quite significantly.

Ultimately, Amazon is seen as a safe haven for many investors with upside optionality that Amazon can find new revenue streams.

With all this in mind, even having to pay around 80x next year’s EPS isn’t that expensive, particularly if Amazon is able to reassure investors that it has tight controls over its cost structure.

The Bottom Line

As a professional investor, my initial sell rating on Amazon was based on the belief that AWS would experience a significant slowdown in revenue growth rates.

However, I was taken by surprise when Amazon’s retail operations exceeded expectations with strong growth.

Considering the changed circumstances, I now adopt a neutral stance on the stock.

On the negative side, AWS revenue growth rates have decelerated to 12%, losing market share to competitors. Profit margins have also compressed.

On a positive note, Amazon’s North America and International businesses are expanding their profit margins, and the company’s revenue growth rates are set to reaccelerate, indicating its ability to control operations and achieve mid-teen growth rates.

Despite not being traditionally cheap, the stock’s valuation may be justified given Amazon’s reputation as a safe haven with potential for new revenue streams and investor reassurance regarding cost controls.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.