Summary:

- Amazon.com, Inc. stock has shown volatility post-Q1, but a reversal is already being seen ahead of Q2 earnings on August 1.

- Profitability trends related to opex dynamics impact stock performance, with a focus on balancing SG&A and R&D.

- Despite concerns, I’m confident of my Buy recommendation due to this masterful balancing act between expenditure and profitability.

Daria Nipot

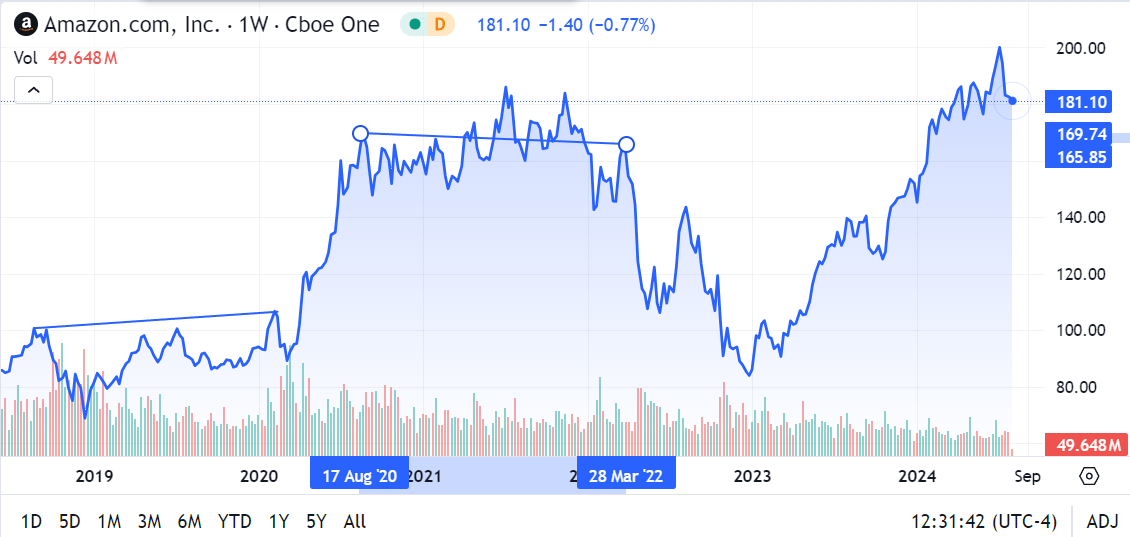

Amazon.com, Inc.’s (NASDAQ:AMZN) Q1 performance was received positively by the market, but ever since then, the stock has shown quite a bit of volatility. At one point, it repeatedly bounced off the $200 resistance level, but the resistance wouldn’t break, and since then, the stock has exhibited a clear downtrend that’s showing a reversal ahead of Q2 earnings on August 1. However, I hope to argue that investors don’t need to worry about the stock going up or down in shorter time-intervals. There are much bigger things at play.

In my initiating coverage on Amazon, I plan to detail how the dynamics in capex and opex (primarily opex) affect its bottom-line profitability, and what investors should expect for Q2 and beyond. Clear patterns emerge as we assess these numbers over the past several years. Hopefully, investors can sleep better at night knowing that the apparent irregularities and volatility in the stock price are actually highly correlated to some of these key metrics. My recommendation is a clear Buy before earnings, and I’ll reason out why I don’t really care which way the stock moves after the August 1 earnings release.

The Problem with Profitability

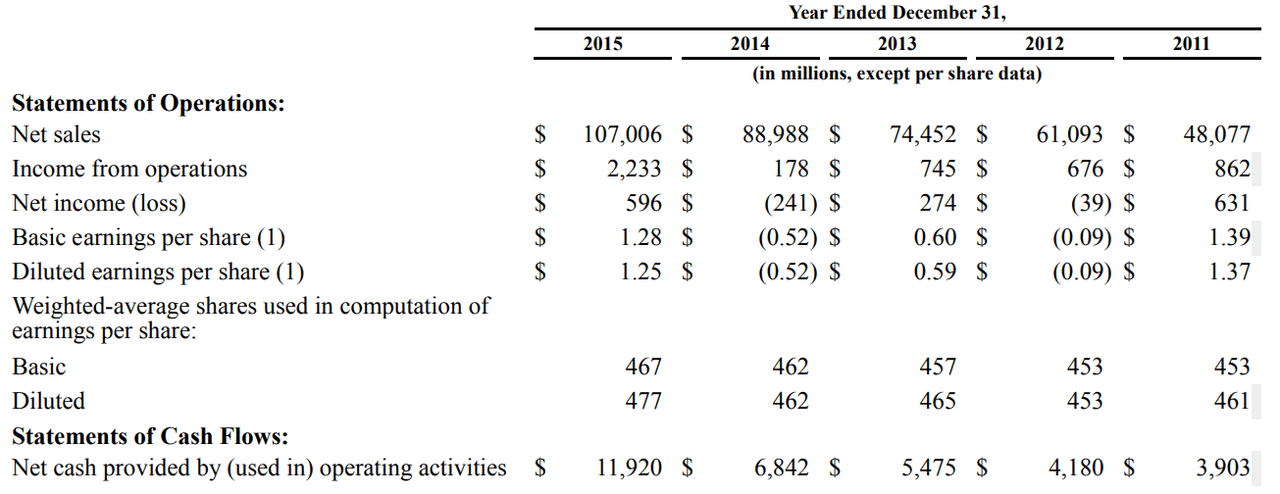

For years, Amazon was happy to keep its profitability at the lowest level possible without going too much into the red. The main reason was that it needed all its cash flows to grow its retail business and expand it around the world. Before 2006, when AWS was first launched, retail sales were quickly approaching the $10 billion mark. The company was growing its top line at a rapid rate, going from $5.3 billion in FY 2003 to $6.9 billion in FY 2004 to $8.5 billion in FY 2005.

During those years, its profitability at the net income level was kept at a minimum — a little under $600 million on an annual basis for FY 2004. I believe it was intentional because cash flows were the focus. It allowed the company to keep its liquidity position strong as well as keep reinvesting in its operations. In FY 2005, Amazon had $2 billion in C&CE and short-term investments, and it was investing large amounts in marketable securities as well as in capex. That trend kept its cash position at a steady level, which is what the business needed at the time.

Fast-forward 10 years to FY 2015, and interestingly, by then, AWS was approaching the $10 billion a year revenue mark, while the company broke the $100 billion a year revenue barrier. Jeff Bezos opened his note to shareholders with these words:

This year, Amazon became the fastest company ever to reach $100 billion in annual sales. Also this year, Amazon Web Services is reaching $10 billion in annual sales … doing so at a pace even faster than Amazon achieved that milestone.

Every Amazon investor knows the phenomenal growth story since then, but what about profitability? By then, AWS was already reporting topline figures as well as operating performance. That year, AWS reported $1.9 billion in operating income from $7.9 billion in revenues, while the North America and International segments reported a combined operating income of $2.7 billion from combined revenues of $99 billion. It was amply clear that this is where their profitability was going to come from for the foreseeable future.

More importantly, for investors, it was the year that marked the beginning of consistent bottom-line profitability. AWS had arrived, and it was going to push the company’s stock to even greater levels from a position of strength.

In many ways, it was a turning point for the company and its investors. There was already a lot of momentum building up as the company headed into FY 2015, but the annual report that year strongly validated the rampant optimism around the stock, and the rest, as they say, is history.

SA

Today, we stand on the cusp of a new generational shift in technology — artificial intelligence. Amazon is as ready now to capture growth in AI as it was to capture early growth in cloud computing in the first half of the previous decade.

That being said, coming back to the question of profitability, I posit that the growth of its profitability is closely tied to how its stock performs, and I’ll bring up two important points to validate this.

The 2022 Pullback

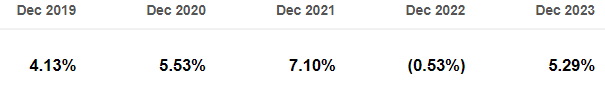

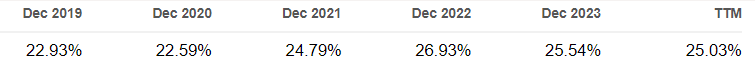

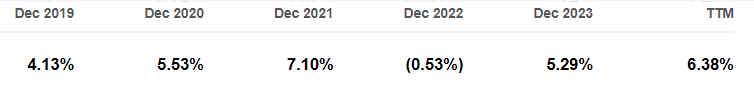

Not to sound crass or insensitive, but Amazon was one of the obvious beneficiaries of the pandemic. However, when life started returning to normalcy in the two years since it began, Amazon was hard hit on the profitability front. To drive home that point, this was what happened to net profitability.

SA

Accompanying that was this unsightly price movement that resulted in a sharp pullback.

SA

Investor sentiment is clearly palpable — they expected pandemic-time profitability to continue and become stronger, but the opposite happened, and the stock came back down to earth. By the time FY 2022 earnings were released, the stock had already given up all of its pandemic-time gains.

My point is, that’s how hung up AMZN investors are on profitability right now. And that’s the main challenge for management to navigate.

Opex Curtailed by the Need to be Profitable

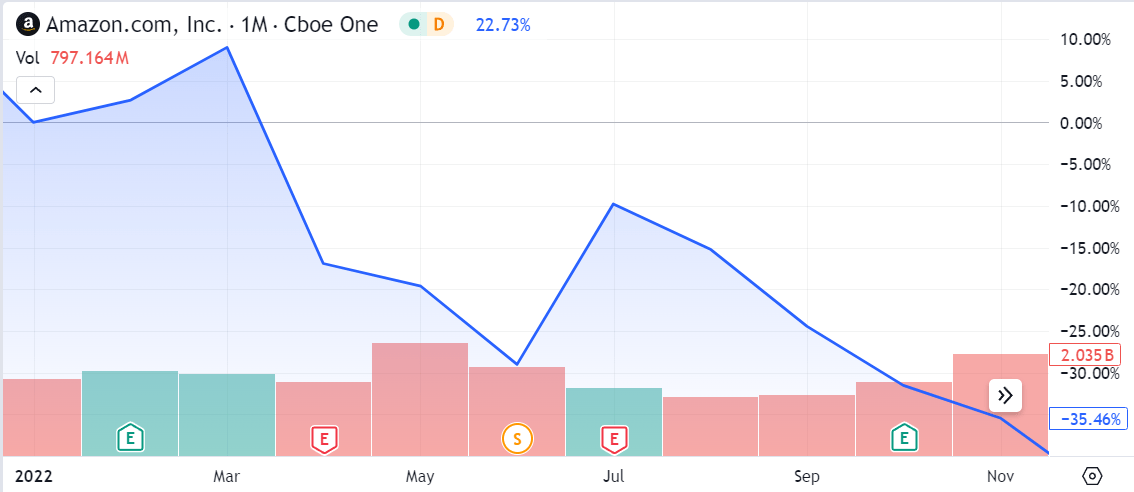

The second point of validation for my hypothesis is that the company has had to balance its opex line items just to ensure it remains profitable at the bottom line. Look at what happened during FY2022 when R&D spend went up.

SA

That 230 or so basis-point increase between FY 2021 and FY 2022 caused net income to go negative, and we already saw what happened to the stock because of that. Therefore, because R&D spending is so crucial to the company’s future, the company was forced to find efficiencies in its other opex line items, such as SG&A.

SA

SG&A was proportionately reduced to allow net profitability to keep growing, and the result can be seen at the bottom line as well as the stock’s performance.

SA

SA

What Are the Implications of This for Investors in AMZN?

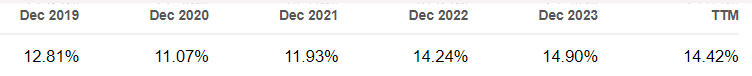

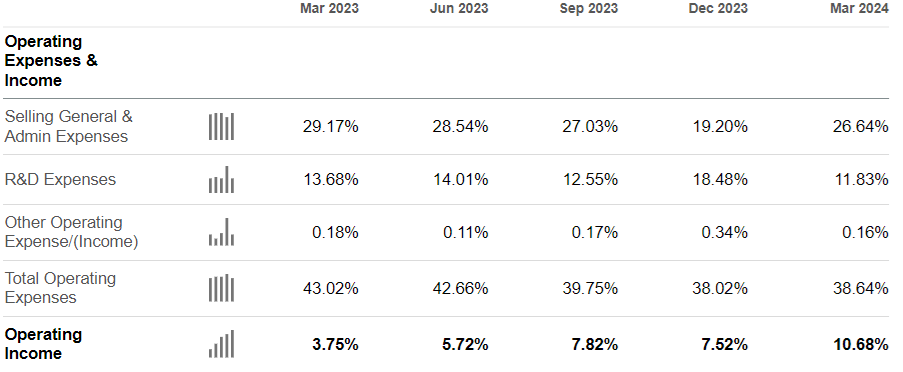

To answer this question, let’s zoom in on the last five reported quarters and see if that hypothesis passes the test.

SA

Looking at the last five quarters, we can immediately see how management has astutely been doing a balancing act between SG&A and R&D. By the end of FY 2022, it was clear that R&D couldn’t afford to go any lower, or key growth investments would suffer. So what did management do? It started cutting costs on the SG&A side — and it did that aggressively because it had to increase its R&D just as aggressively. Why? Because the age of AI had arrived, and management was smart enough to start ratcheting up its R&D spend in time to capitalize on that boom. Did they do it too aggressively? That’s a possibility, but then again, they’d need to spend heavily on capex to ensure that AWS stays ahead of the AI game.

Here’s something to think about for some added perspective. We already know that nearly 70% of AI workloads are running on the cloud, which implies that aggressive R&D as well as capex spending will be necessary to sustainably maintain AWS’s lead in AI deployments. Earlier this month, Axios reported that Amazon had launched a “blitz of new AI products” to address the growing needs of its AI customers. According to AWS’s VP of AI products, Matt Wood:

We’ve done over 320 generative AI major feature launches into general availability this year, and that’s more than twice than all of the other large cloud providers combined.

So, that spending is not going to let up, but that could lead to profitability taking a temporary hit.

My Forward Look for Q2 2024 and Beyond

As we approach Q2 earnings on August 1, I’d like to make a few observations.

One, because SG&A ramped up aggressively again in Q1 2024 to 26.6% of quarterly revenues, R&D expenditure was limited to 11.83%. That’s the lowest (as a percentage of revenue) it’s been in the past five quarters.

As a result of that, I’m projecting a gradual decline in SG&A in Q2, which would have allowed the company to increase R&D as well as capital expenditure. We already got a hint of that at the Q1 earnings call, where CEO Jassy clearly outlined the company’s strategy (emphasis mine):

We expect the combination of AWS’ reaccelerating growth and high demand for gen AI to meaningfully increase year-over-year capital expenditures in 2024, which given the way the AWS business model works is a positive sign of the future growth.

The more demand AWS has, the more we have to procure new data centers, power and hardware. And as a reminder, we spend most of the capital upfront. But as you’ve seen over the last several years, we make that up in operating margin and free cash flow down the road as demand steadies out.

There’s our clue that spending on important line items such as capex and R&D is paramount, but it needs to be balanced with operating profitability, which organically translates to bottom-line growth. That’s my first observation.

Two, now that the company has found this ‘sweet spot’ in terms of balancing expenditure and profitability, there’s an advantage and a disadvantage. The advantage is that we’re likely to have more visibility on the profitability side of things, which is great for an investor because we’ve already seen that the stock’s prospects are closely correlated with profitability. The disadvantage, however, is that the company might not spend as much as it needs to stay at the top of the AI infrastructure game.

Although that’s not happened yet, that’s my biggest concern. And the reason I have that concern is that Amazon’s retail business is still a massive drag on the bottom line. Just look at FY 2023 figures — operating income for the combined North America and International segments was reported at $12.22 billion, and that’s from a revenue base of $484 billion. AWS reported $24.6 billion in operating profits from $91 billion in revenues.

The implication is that if Amazon wants to keep growing its bottom line the way investors clearly expect it to, it may need to sacrifice something on the expenditure side to keep showing growth in terms of YoY and QoQ net earnings. That’s a dilemma because there’s only so much room for cost-cutting, and while I don’t see SG&A dramatically reducing in Q2, I do see R&D ramping up again by at least 150 to 200 bps. That balancing act needs to be done prudently because more and more must trickle into the bottom line each quarter.

If that doesn’t happen, the stock could end up in another volatile but largely sideways pattern, which we’ve already seen happen twice in the past five years.

SA

Overall, I’m definitely bullish on AMZN, and my stance is a clear Buy and hold for the long term. However, to avoid the kind of frustration holding a volatile and seemingly unpredictable stock like AMZN can cause to an investor, it’s important to be prepared for this kind of growth cadence. That pattern is likely to keep on repeating — taking the stock higher with each new stage of the pattern. If you’re prepared for it, it will help you sleep better at night.

As such, my advice is to Buy AMZN before earnings. Even if that careful balance isn’t achieved this quarter or even this year, it will eventually happen, taking the stock up to its next “resting plateau” until strong bottom-line growth resumes again. And on and on it goes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.