Summary:

- Amazon.com, Inc. shares rallied after a strong Q2 report, beating on both the top and bottom lines.

- AWS growth came in at 12%, not slowing down as much as the Street was expecting.

- Amazon Q3 revenue growth is forecast to be quite strong as compared to expectations.

jetcityimage

One of the year’s biggest winners so far has been Amazon.com, Inc. (NASDAQ:AMZN). The retail and Internet giant has seen its shares rally nearly 50% to get back over a $1 trillion market cap, helping to lead the overall market higher. On Thursday, we received second quarter results from the company. Not only did the company come in with strong revenues for its June period, but gave a better than expected forecast for the September quarter, sending shares nicely higher in the after-hours session.

In the past few months, expectations for Amazon have risen a bit. The company announced a revenue beat for the first quarter of 2023, while Q2 guidance was mostly in-line. Despite management giving some downbeat guidance for Amazon Web Services (“AWS”), analysts had raised their revenue estimate average by about $1 billion since then. As a reminder, net sales were expected to be between $127 billion and $133 billion, and the Street was at $131.34 billion going into Thursday’s report.

As it turned out, Amazon did even better than the top end of its own guidance. Q2 revenues came in at $134.4 billion. All three segments reported double-digit percentage growth over the prior year period. Even better was the profit picture, where total operating profit more than doubled. This was led by the North American segment, where operating income was $3.2 billion, compared with an operating loss of $0.6 billion in second quarter of 2022. As a result, Amazon came in with earnings per share of $0.65, which nearly doubled what the street was looking for.

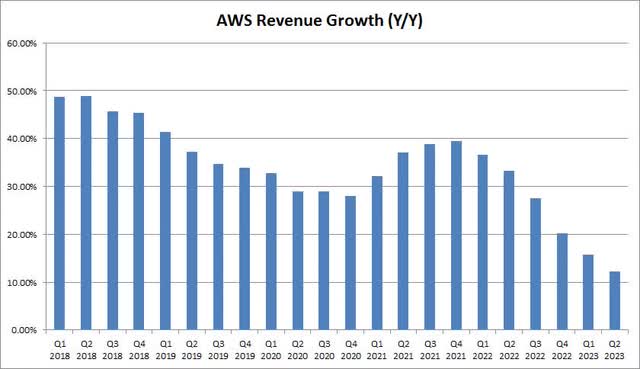

Perhaps the most important item investors were watching for was the AWS growth rate. As the chart below shows, revenue growth has decelerated quite a bit in recent quarters. Part of this is due to the law of large numbers, as the company continues to work off higher base numbers, with AWS generating about $85 billion in revenue over the past twelve months. As it turned out, AWS came in with more than 12% revenue growth. While that percentage is still down sequentially, it was a couple of points better than the Street expected. The operating margin here did fall year-over-year as we’ve seen in recent periods, but it was up a tiny bit sequentially.

AWS Revenue Growth (Company Earnings Reports)

One of the biggest items I was eager to see was Amazon’s guidance. In the U.S., student loan repayments will start again in October, with interest resuming in September. This could have a material impact on consumer spending, and while Q4 will be the first true test, I was curious to see if retail sales will be impacted a little in Q3 as well.

Well, Amazon certainly put that worry to rest for now. Net sales are expected to be between $138.0 billion and $143.0 billion, with almost all of this range being above the roughly $138.3 billion the street was looking for. Also, currencies are now expected to be a tailwind, reversing what we’ve seen recently.

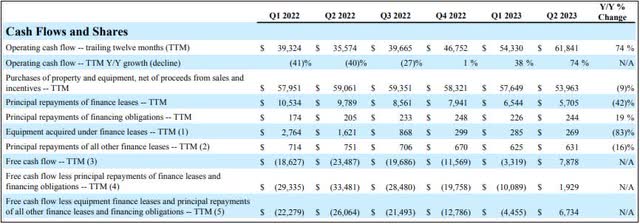

One of the other key items I’ve been discussing in recent quarters for Amazon was its cash flow picture. The company has been spending heavily not only to grow out its AWS infrastructure, but also its fulfillment and delivery business post-COVID thanks to the shift to more online shopping. This resulted in free cash flow going quite negative, resulting in Amazon taking on a bit of debt. Things have been improving over the past year, however, and as the graphic below shows, that trend definitely continued in Q2. Amazon’s free cash flow (“FCF”) in the trailing twelve months is now positive again, which will calm any fears that capital expenditures were out of control.

Amazon Cash Flow Data (Q2 Earnings Report)

Amazon has always been one of the darlings of Wall Street, with 49 of 54 analysts having some form of buy recommendation on the stock going into earnings. The average price target on the Street was $147 and change, implying more than 14% of upside going into the report. The 6% rally Thursday afternoon will initially eat into that upside, but I expect we’ll see a number of target hikes after this report.

As for my current opinion, I would rate Amazon shares a hold. The Q2 report here was certainly strong, but I still worry about the U.S. economy in Q4 and early into 2024. Also, shares have rallied significantly this year, and so it’s hard to recommend buying with the stock up another $8 after this report. I would be a buyer if we see any near-term weakness, and would look for support at the 50-day moving average (that line is currently $127.53 but rising by the day).

In the end, Amazon announced another strong set of results on Thursday. The company handily beat Street revenue estimates and its own guidance, with AWS growth also coming in ahead of expectations. North American operating margins were very solid, helping to lead to a large bottom line beat, and Q3 revenue guidance was ahead of analyst estimates. Amazon stock is rallying on the news, but I’d be hesitant to buy now unless we see a pullback, as there are some potential headwinds coming later this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.