Summary:

- Many are rushing to upgrade Amazon stock after spectacular Q2 results.

- One critical cash flow metric turned positive, several segments improved, and a massive future opportunity is coming to AWS.

- But is the stock still a buy after 60% YTD gains?

sankai

Are ratings upgrades too late?

A few months can be an eternity in the stock market, especially today when business conditions move extremely quickly.

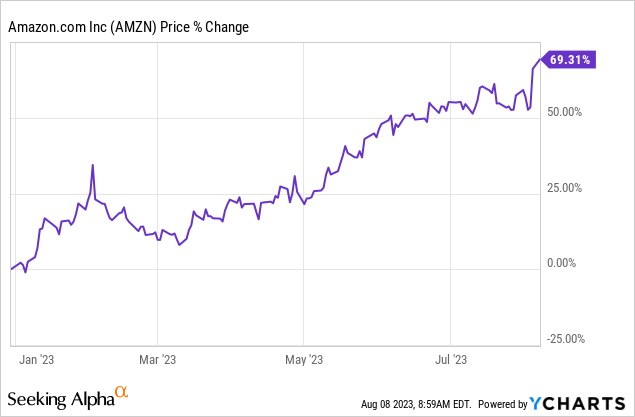

Many analysts and investors were leaving Amazon (NASDAQ:AMZN) out in the cold at the opening of 2023. Some even predicted a share price in the $60 per share range when the stock traded sub-$100. Those days appear gone after the company blew away fears in Q2.

Unfortunately, those who gave in to the narrative or just now upgraded the stock after Q2 have missed massive gains, as shown below.

Those who invested or added to holdings while the stock was down have been richly rewarded. This clearly illustrates the importance of looking past the News Du Jour and focusing on what is to come – easier said than done. It also speaks to the practice of dollar-cost averaging.

But with Amazon, there were clear signs that the company would battle through the headwinds. Let’s take a really quick look back and then focus on what’s to come.

Here are some of the problems Amazon encountered since 2021.

- Clogged ports and logistical snags eating costs

- High FOREX charges

- Labor bonuses and raises associated with COVID-19

- Rising CapEx to keep up with AWS demand

- Inflation

- Need I go on?

The perfect storm was more like a fast-moving monsoon, as most of these issues were fleeting.

A Clear sign of momentum

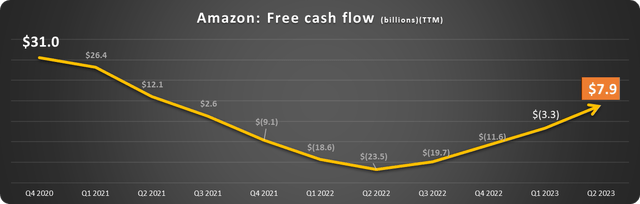

One chart I created and have been adding to and presenting as evidence of positive momentum for several quarters depicts the recovery. Below is the quarterly free cash flow generated over the trailing twelve months.

Data source: Amazon. Chart by author.

As I predicted last quarter, Amazon burst above the water line in Q2.

Finally, sales came in extremely strong, with 11% growth to $134 billion. The North American segment posted operating profits of $3.2 billion, and the International segment held its expected losses at less than $1 billion—terrific increases year over year (YOY) and quarter on quarter. I’ll get to AWS below.

An ace-in-the-hole

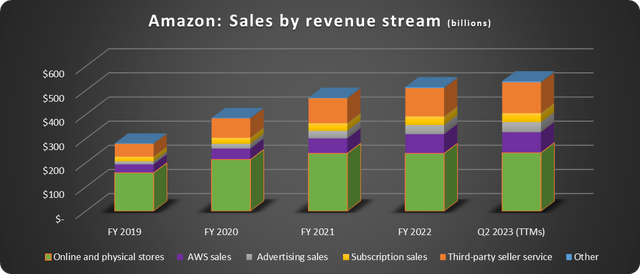

Amazon’s ability to weather economic challenges is its vast sticky ecosystem. When one segment is down, the others lead the way.

As depicted below, Amazon’s revenue is increasingly diversified and increasingly service-based. Both are great for growth and profitability.

Data source: Amazon. Chart by author.

Prime is the glue. Citigroup (C) estimates that subscribers spend 2.5 times more than others and that 80% of American households are subscribers. When times are tough, people spend more on staples and less on luxuries, which is great for Amazon.

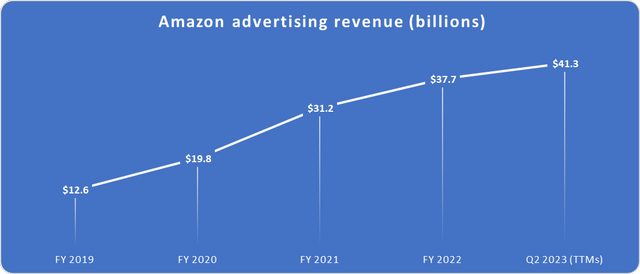

This also drives cost-conscious advertisers to Amazon’s digital advertising platform. Consumers on Amazon, or searching for products, are actively in a buying mode. Why else would I have been searching for a hose nozzle the other day? This makes Amazon’s pay-per-click and product placement ads one of the best choices for advertisers with limited budgets. Amazon’s advertising is extremely strong, as depicted below.

Data source: Amazon. Chart by author.

Amazon doesn’t tell us whether this revenue stream is profitable on its own, it gets lumped in with the North American segment, but for my money, it is definitely a profit and cash flow driver.

But what about Amazon Web Services (AWS) whose growth slowed further to just 12%?

AWS and the AI effect

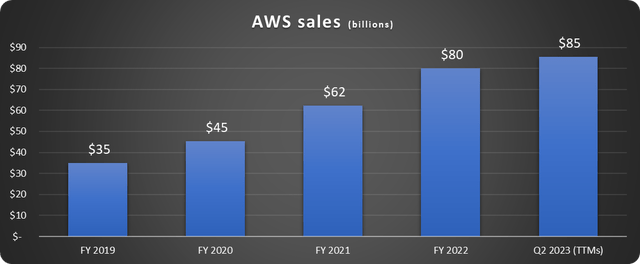

The easy button to push right now is to lament the slowing growth of AWS. But again, this is backward-looking. First, the comparables are tough after the massive gains in prior years, as shown below.

Data source: Amazon. Chart by the author.

The segment has grown 2.5x since 2019. Some (I’m guilty!) saw the growth rates continuing higher for longer, but the economy intervened. Still, even growing by 12% will see sales of $100 billion and operating profits near $25 billion in 2025.

Still, I expect that growth will continue or accelerate once budgets renew due to the effects of artificial intelligence (AI) and Machine Learning (ML).

AWS isn’t rolling over; it’s just taking a breather.

Budgets for data usage have shrunk this year because of the challenging economy (and when budgets were made, many thought the economy would be much worse this year). This hurts AWS because its billing is primarily usage-based. Amazon is actively working with clients to reduce usage and lower their bills this year. This is how you grow strong long-term relationships, which is the correct move.

But what about next year or the year after?

Here’s the long and short of it: AWS is critical infrastructure for the modern world, with 1/3 of the total platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS) market. Cloud data needs will continue to grow, AI or no AI.

But AI and ML will significantly increase demand. Here’s why.

Companies need to spend money and time determining whether AI/ML is either a threat to their business, transformative to their business, can it help their business, or does it have little effect.

This harkens back to the late 1990s and early 2000s when the Internet was transforming businesses. No one can afford to get “Amazoned” (Borders and Barnes and Noble) or “Netflixed” (Blockbuster). Companies need to invest in finding out what this is all about. Budgets will reflect this in the coming years, and AWS will benefit.

AI/ML applications require substantially more data than others because the program requires data to “learn” and make better decisions. The more data, the better performance, as a general rule.

Amazon also has other tools coming online, like Amazon Bedrock, that customers can use to automate processes and build their applications using existing base platforms. Things like conversational virtual customer service agents and data analysis. Given the cost and time savings, you can bet that more and more companies will look to adopt these solutions ASAP.

AWS is a clear upside winner in the long haul, despite a slow year in 2023.

Is Amazon stock a buy now?

Amazon stock has made significant gains this year; however, it still trades at about the same level as it did one year ago and 25% off its all-time high. Still, there are economic risks in the short term to be aware of. Business budgets could stay constrained next year as we wait for a recession that may or may not come. This could hurt AWS and advertising sales. Investors need to buy incrementally over time. Nowhere is this better illustrated than the opportunity in early 2023.

It’s not appropriate to value Amazon on price-to-earnings (P/E) now (and maybe it never is). Amazon’s profits are returning but are still depressed. Also, Amazon invests heavily in research and development and other growth initiatives.

Amazon trades based on sales and growth. This makes some investors uncomfortable, but it has been and will continue to be the case.

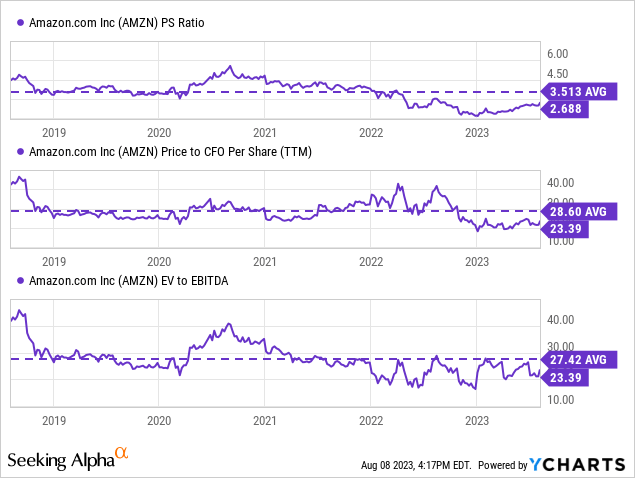

The price-to-sales (P/S) ratio is still well below its historical average, as shown below.

Several other ratios, like EV-to-EBITDA and Price-to-Cash From Operations per share, show a similar pattern. The stock is recovering but not yet there.

Amazon stock isn’t the screaming buy it was a few months ago, but it is still undervalued historically, has a tremendous future, and will likely outpace the market over the long haul. It remains a mainstay in a growth portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors' goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.

The author is short the following options: AMZN JAN 2024 $150 CALL.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.