Summary:

- Amazon.com, Inc.’s Q2 2023 shows a YoY jump in revenue by nearly 11% and a beat of consensus by about 2%.

- The company’s Q3 guidance of $138 billion to $143 billion exceeds consensus and demonstrates strong revenue growth.

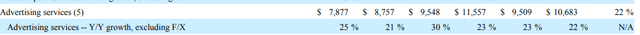

- Advertising services revenue shows continuous improvement, with a 22% YoY increase, indicating potential as a growth driver.

- Amazon stock remains a long-term growth story with focus on revenue.

4kodiak/iStock Unreleased via Getty Images

Amazon.com, Inc. (NASDAQ:AMZN) has just reported its Q2 2023 earnings result, as Seeking Alpha has covered here. EPS of 65 cents is not comparable on YoY basis nor to consensus due to the company booking some gains related to its Rivian Automotive, Inc (RIVN) investment. Revenue of $134.3 billion beat consensus by about 2% while showing a YoY jump by nearly 11%. As an immediate reaction, the stock is up nearly 8% after-hours, although this can turn on a dime.

I recently previewed this earnings report and rated the stock a “Buy,” noting that the company’s revenue guidance will set the tone for the stock. I had also reviewed Amazon’s Q1 report while again rating the stock a “Buy.” Since the April review, the stock is up nearly 4 times the market’s 8% increase, including the after-hours run. With that background out of the way, let us evaluate the Good, Bad, and Ugly from Amazon’s Q2 results and Q3 guidance.

Good

- I wrote in my preview that Amazon still remains a revenue story and to pay attention to Q2’s actual revenue and Q3’s revenue guidance. Amazon hit it out of the park on both counts, with Q2 revenue showing an 11% jump and Q3 guidance of $138 billion to $143 billion, easily upping the consensus of $138.29 billion.

- As a direct effect of the company reining in on its expenses, Amazon’s Free Cash Flow (“FCF”) in Q2 2023 improved to almost $8 billon compared to -$23.5 billion in Q2 2022. Headcount is now down 4% YoY.

- Advertising, which I’ve highlighted as the next growth driver in many of my past articles, was up 22% YoY. But, more importantly, resumed its upward trajectory on a quarterly basis. Advertising services revenue showed continuous QoQ improvement until the first blip in Q1 2023. Whether Q2’s upsurge is a new trend remains to be seen, but it is encouraging that Q2 did not follow Q1 down. I am also glad that my prediction that advertising will cross $10 billion in sales came true.

- It appears like retail has finally stopped bleeding profusely to avoid wasting all the gains from AWS and Advertising. In my view, retail is just their medium to sell their ecosystem, and this is acceptable to me.

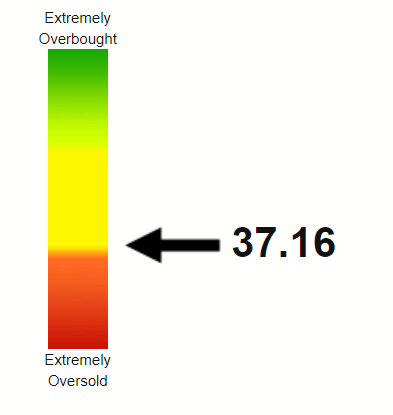

- Heading into earnings, Amazon stock was almost into the oversold territory with a Relative Strength Index (“RSI”) of 37. Revenue beat and guidance should help the stock garner more analyst support in the upcoming days, and I fully expect the stock’s almost-oversold conditions to be in the stock’s favor as it has plenty of room upwards technically. The after-hours move has also helped the stock clear all of the commonly used moving averages.

AMZN RSI (Stockrsi.com)

Bad and Ugly

My preliminary readings of the numbers and the market’s reaction appear mostly positive. Hence, I am combining the bad and ugly sections into one.

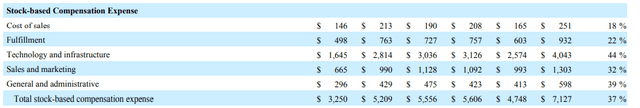

- Despite the announcement that the company was reining in on its stock- based compensation (“SBC”), this number went up 37% in Q2 2023. As noted in the articled linked above, Amazon is the only member of the mega-cap techs to have increased its outstanding shares count. While a 5% increase in 5 years may not sound like much, it is something investors need to keep an eye on.

Stock Comp (ir.aboutamazon.com)

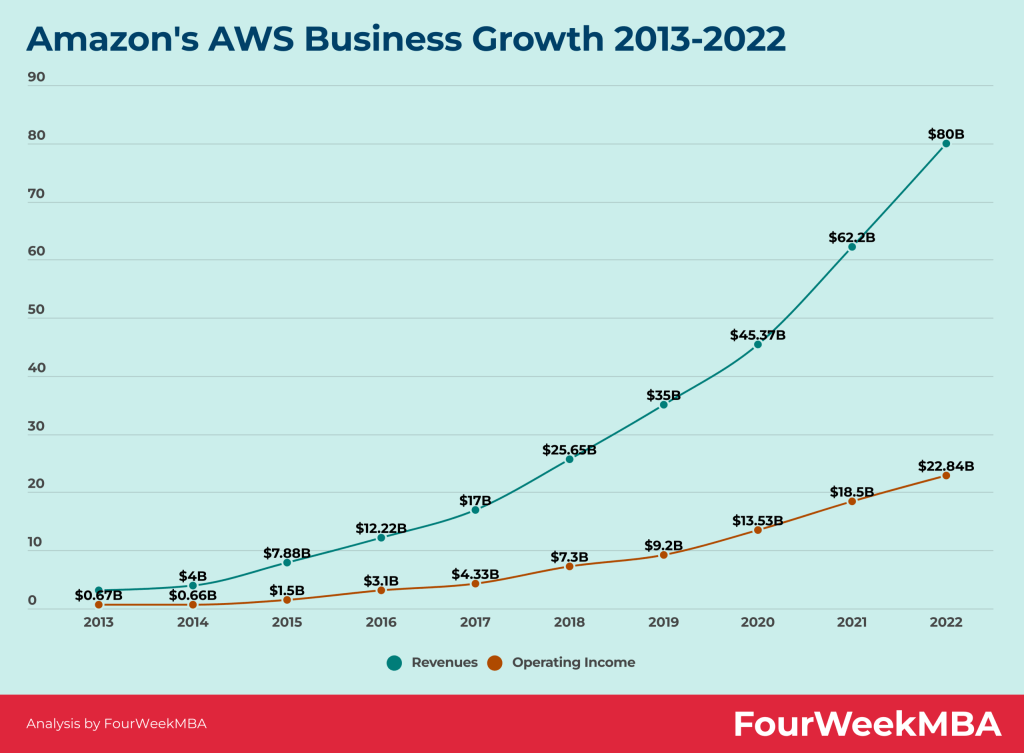

- AWS’s revenue and operating income appeared to be on a perennial, mid-double-digit growth trajectory until recently. However, Q2 saw AWS’ sales increase by “just” 12% while operating income fell by more than 5%. It is in this context that advertising services becomes even more important. While $22 billion is strong, it fell well short of the $25 billion I predicted, as the company aims to cross $100 billion in 2023 AWS revenue.

AWS Growth (fourweekmba.com)

- The stock was already up 50% YTD heading into earnings and the run appears set to continue. I am not complaining as a long, but it shouldn’t surprise anyone to see the stock pullback from the highs given the market’s shaky behavior the last few days.

Conclusion

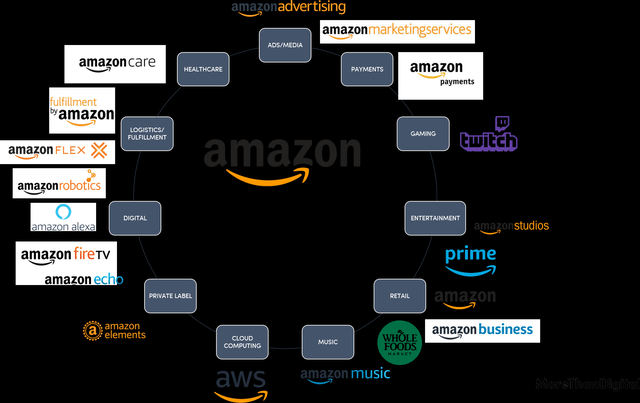

Overall, Q2 results are much better than Q1, and that shows in the stock’s performance, at least as shown in the after-hours price movement. However, Amazon has never been a single quarter or single year story for me. Amazon’s ecosystem is enough reason for me to continue believing in the company long-term. The ability to leverage multiple products and services across the entire organization is not something any company can build overnight. In fact, even Amazon has taken nearly 30 years to be the company that it is today.

I am sticking with my “Buy” rating for anyone with a long-term (at least 2 years) horizon.

Amazon Ecosystem (morethandigital.info)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.