Summary:

- Amazon’s Q3 earnings exceeded expectations, with strong growth in international e-commerce and strict expense control.

- The company is trading at one of the lowest P/E ratios in 3 years, enhancing its attractiveness given its profitability.

- Significant investments in AI and infrastructure could drive future growth beyond market projections.

FinkAvenue

Investment Thesis

I recommend buying Amazon (NASDAQ:AMZN) stock after its Q3 earnings release. This article is an update to my introductory coverage article published on September 19, where I commented on the pragmatism of the global e-commerce leader to grow so quickly in new markets.

In Q3, the company showed strong growth in all segments, with an emphasis on international e-commerce and strict expense control. Amazon is investing heavily in AI and trading at one of the most attractive valuations in the last 3 years, the company could surprise the market.

Amazon Q3 Earnings Review

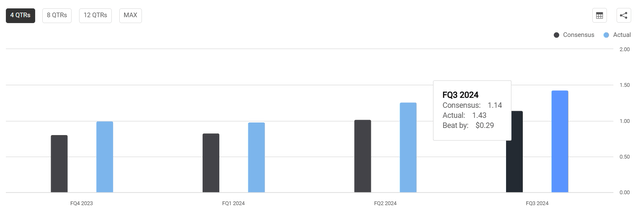

Amazon released its 3Q results on October 31st, and as we can see, the company exceeded market expectations in earnings per share. From now on, I will provide a full description of the company’s results.

Earnings Surprise (Seeking Alpha)

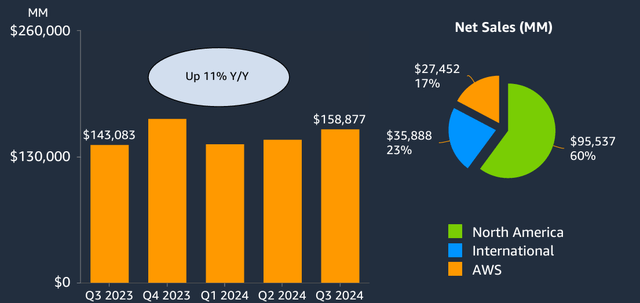

Revenues – International Sales Stand Out

Amazon reported a 6.8% QoQ and 11% YoY growth in net revenue to $158.87 billion. This quarter, international sales stood out, growing 12% YoY to $35.9 billion, while North American sales grew 9% YoY to $95.5 billion. Finally, AWS reported 19% YoY growth to $27.5 billion.

Digging deeper, while AWS revenue grew more than the same period last year, it grew less than the cloud businesses of Alphabet (GOOG) (GOOGL) (+35% YoY at Google Cloud) and Microsoft (MSFT) (33% YoY at Azure). This demands some attention in the next results.

However, the outlook for the business is very positive, as statistics point to a compound annual growth rate (CAGR) of 19.5% until 2028. Additionally, this potential could be even greater as strong investments are made in AI to enhance cloud businesses by big techs.

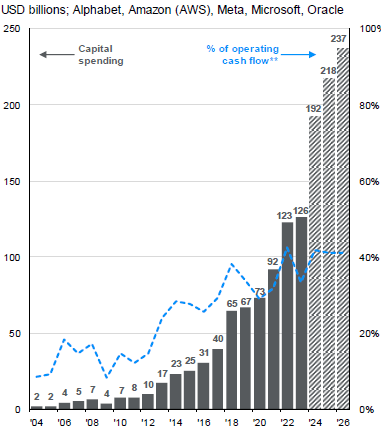

Capex from the major AI hyperscalers (Bloomberg, Federal Reserv, JP)

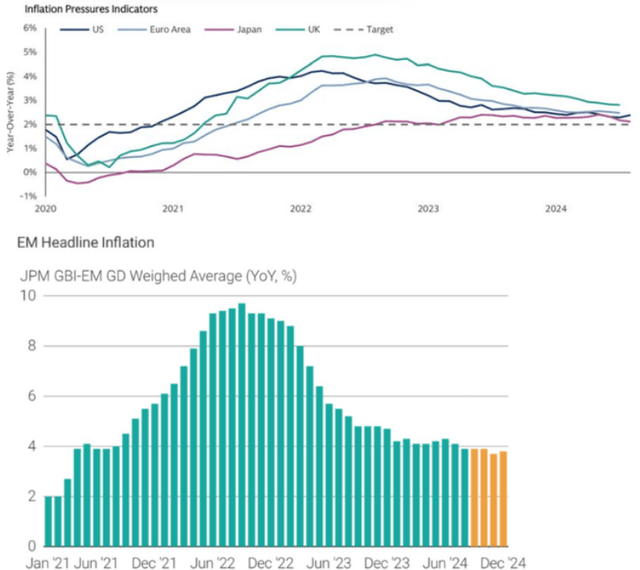

As for the retail business, it is interesting to note that Amazon has global operations. In this sense, there is a welcome confluence for its business, as we have inflation on a downward trajectory in developed countries (except Japan) and in many emerging countries.

Inflation in developed and emerging markets (Lazard, GS, Factset)

As we know, controlled inflation is a great growth driver for retail businesses, as consumers have better credit conditions and feel more confident about consumption, which corroborates a positive outlook for the company.

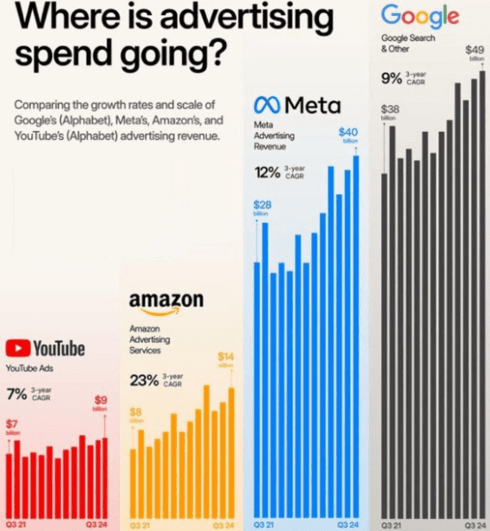

Finally, the company’s advertising revenues showed strong growth of 23%, and while they are still only a fraction of Alphabet’s revenues, they could be positive surprises in the future.

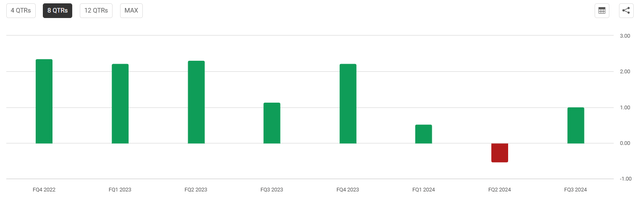

Ads Revenue (Qntr)

Margins

Operating expenses grew just 0.9% q/q and 6.4% y/y to $60.5 billion, reflecting the company’s excellent expense control. The company has been undergoing major team restructuring during the year.

Amazon Layoffs (Seeking Alpha)

Thus, the company presented strong EBIT in all operations, while operating profit reached $17.4 billion, above the guidance range of $11.5 billion to $15 billion. Data that once again corroborates a positive view of the company.

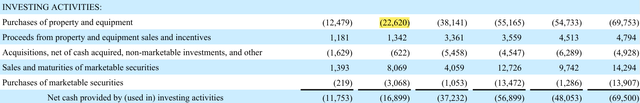

Capex

With a sharp increase in capital expenditures to $22.6 billion, Amazon continues to invest in data centers and next-generation GPUs with an eye on artificial intelligence.

The company’s CEO indicated that Amazon will invest about $75 billion in 2024, and an even larger amount in 2025, citing an opportunity that doesn’t come around every day.

While much of the spending is on infrastructure support, several AI products have been launched in its e-tail and cloud businesses. The company will also announce a new version of Alexa that will be powered by generative AI.

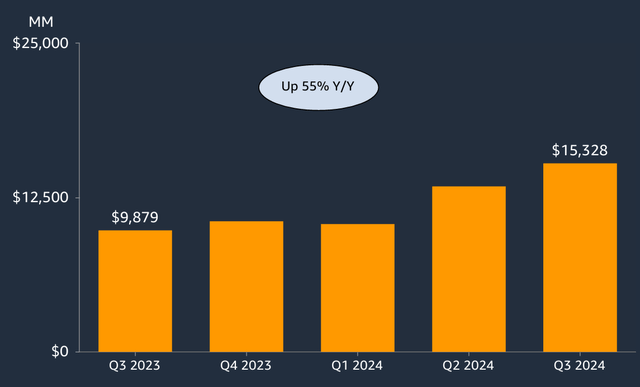

Net Income

Once again, the company proves the excellence of its executives, and, after a beautiful expansion of revenues with expense control, net income soared 55% y/y to $15.3 billion.

Overall, I see Amazon as very well positioned to report even better results in the coming quarters as investments in AI continue to yield returns and the company is highly disciplined in controlling expenses.

In this sense, for 4Q24, the company projects net revenue between $181.5 billion and $188.5 billion, representing growth of 7 to 11%. As for operating income, the company projects $16 billion to $20 billion, well above the $13.2 billion of the previous year. But is the valuation attractive?

Valuation

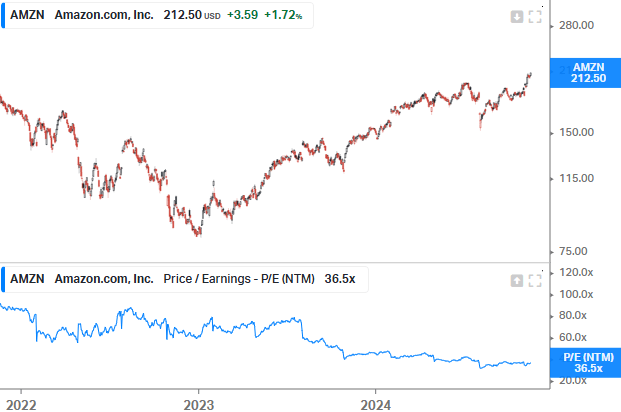

Amazon is a profitable company with a unique business model in the world, so it seems sensible to me to do a historical analysis of its P/E. Therefore, let’s look at its P/E over the last 3 years.

P/E (Capital IQ)

Over the past 3 years, Amazon has traded at highs of 90x earnings and lows of 30x earnings, averaging 60x earnings. The company is currently trading at 36x earnings, one of the lowest levels in the past 3 years, while it continues to become increasingly profitable. But why does this happen?

Basically, the company has had difficulty exceeding market expectations in terms of revenue, meaning growth has been lower than expected. Additionally, interest rates in 2022 were lower than they are today, which contributes to a compression of multiples.

Revenue Surprise (Seeking Alpha)

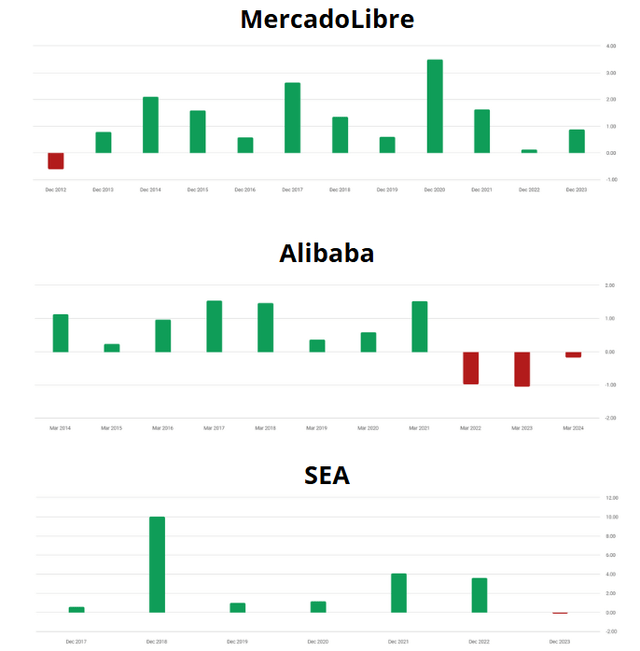

However, it is interesting to note that its main retail competitors in the world, such as MercadoLibre (NYSE:MELI), Alibaba (NYSE:BABA) and Sea (NYSE:SE) also went through a multiple compression, both due to the rise in interest rates and the difficulty in maintaining an excellent result consistently.

Revenue Surprise (Seeking Alpha)

Given that this is a sectoral phenomenon, and that Amazon has become increasingly profitable, I see the compression of the P/E multiple as a great opportunity, which corroborates my buy recommendation.

Potential Threats To The Bullish Thesis

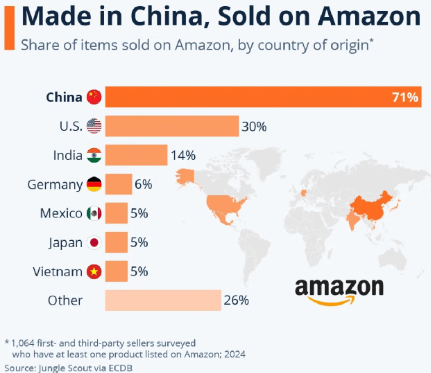

One of the biggest risks to the thesis is Trump’s new policies upon assuming the US presidency. Many Chinese items are resold on the company’s platform, and an aggressive increase in tariffs could reduce the company’s profitability.

Chinese products sold on Amazon (Statista)

Another risk concerns the return on AI investments. A recent survey showed that only 26% of organizations have successfully implemented AI experiments. Where will Amazon be given its massive investment in AI?

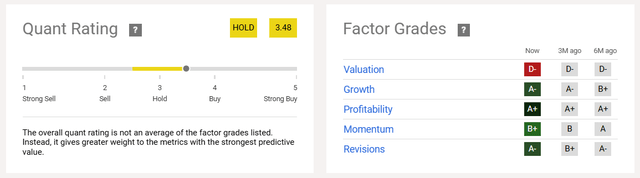

Last but not least, the buy thesis is not a consensus. Seeking Alpha’s quant tools recommend that investors hold on to their shares. The thesis is complex, and investors should exercise caution.

Quant Rating and Factor Grades (Seeking Alpha)

The Bottom Line

Amazon reported strong 3Q24 results, highlighted by international e-commerce performance and strong expense control. The low point was AWS’s growth below its peers, Azure and Google Cloud.

Amazon is trading at one of the most attractive valuations in the last three years, and massive investments in artificial intelligence could contribute to growth beyond what the market is projecting.

Based on this, I recommend buying Amazon shares. In my view, in such an expensive market, investors should stick to the attractive valuation given the quality of the company. In my view, the risk/return ratio is attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.