Summary:

- Amazon.com, Inc.’s Q3 financial results beat expectations, with growth remaining resilient and profitability exceeding forecasts.

- There is a clear bottoming or even uptrend visible across multiple metrics that indicate that there are better times ahead for the company, and it is visibly improving operations.

- Amazon’s retail segment is showing robust growth and improving profitability, driven in part by its advertising operations.

- Amazon Web Services saw stabilizing growth in Q3, and while facing competition, it remains a significant contributor to the company’s overall performance.

- While I turn slightly more cautious about 2024, I upgrade my FY25 profitability projections and maintain my buy rating for Amazon.com, Inc. stock.

Teamjackson

Investment thesis

I maintain my buy rating on Amazon.com, Inc. (NASDAQ:AMZN) following its Q3 financial results, which beat the consensus and my own prior estimates, as growth remained resilient and profitability came in above expectations, allowing for my financial estimates to be revised upward.

Amazon shares jumped 8% on the day following the Q3 earnings release as the company beat the consensus on both the top and bottom lines. Getting straight to the point, I believe the Amazon Q3 results indeed presented investors with many positive indicators, as we can clearly see all metrics holding up well in a very challenging operating environment plagued by high interest rates, sticky inflation, and depressed consumer spending.

There is a clear bottoming or even uptrend visible across multiple metrics, which I will highlight throughout the article, that indicate that there are better times ahead for the company, while in the meantime, it is visibly improving its operations. Furthermore, criticism it received in the last few years regarding its disappointing retail profitability and dependence on the Amazon Web Services, or AWS, cloud segment can be thrown in the bin, as the Amazon ex-AWS bull case is slowly taking form.

With Amazon blowing past my expectations and profitability metrics improving faster than I anticipated, my conclusion from back in August still stands and I have turned even more bullish on the shares, reflected in my long-term financial projections, especially as the share price is still down by 6.5% since.

Before we dive into the Q3 results, I want to briefly lay out my bullish thesis for Amazon, starting with the remarkable resurgence of Amazon’s retail segment. Amazon continues to be a global leader in the e-commerce industry, holding a significant market share and exhibiting a robust growth outlook. As digitalization continues to proliferate, the e-commerce sector is projected to grow at a CAGR of 15% through 2030, and Amazon is well-positioned to capitalize on this ongoing trend.

Moreover, Amazon’s advertising and subscription services have emerged as noteworthy growth drivers. These services offer higher margins and contribute to a more dependable revenue stream. Amazon’s ability to leverage its extensive user base for advertising and subscription growth is a key strength that further bolsters its investment appeal.

Furthermore, while previously viewed as a drag on the company’s performance, the retail sector has now become profitable. With the operational environment normalizing, the retail segment is experiencing accelerated growth, driven by e-commerce, advertising, and subscriptions, painting a rosy long-term outlook with a clear potential for significant cash flows.

Meanwhile, despite facing challenges, Amazon Web Services remains a substantial contributor to growth and profitability. While it may lose market share to competitors, such as Microsoft (MSFT), AWS remains the industry leader and holds considerable potential for long-term growth, particularly as it shifts its focus toward customer retention and AI integration.

On that bullish note, let’s look closer at the company’s Q3 results.

Amazon shows resilience and rapidly improving margins

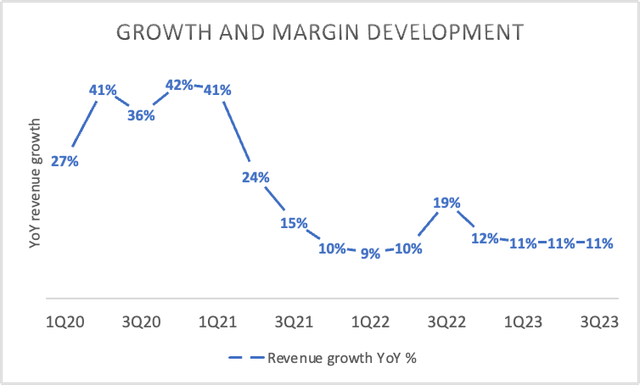

Amazon reported Q3 earnings on October 26 and blew past the Wall Street consensus, topping revenue by $1.54 billion and EPS by $0.34. The company reported a total revenue of $143.1 billion, up 11% YoY. This growth rate was steady with the previous two quarters as Amazon reported double-digit growth despite the significant number of headwinds the business faces across its segments, making it an impressive feat.

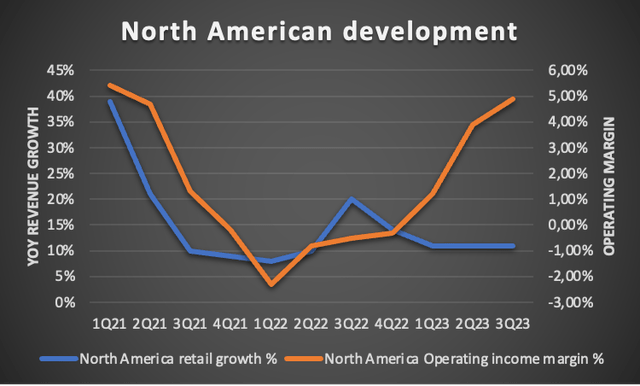

This YoY growth was driven by double-digit growth across all its operating segments, but let’s start by looking at the retail segments, which delivered another strong quarter, despite consumers being very price conscious. In North America, Amazon reported revenue of $87.9 billion, up 11% YoY and again steady compared to the previous two quarters in terms of growth after a significant growth slowdown coming out of the pandemic.

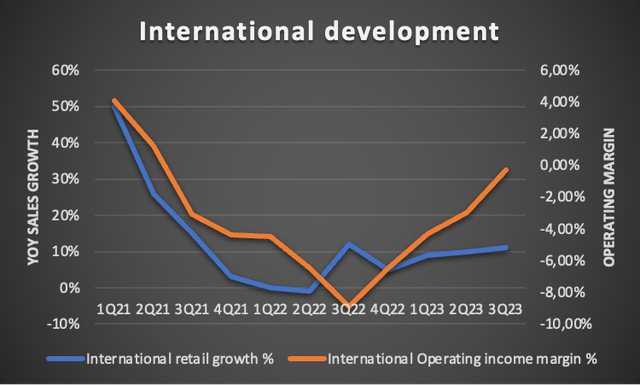

Meanwhile, the international retail segment reported revenue of $32.1 billion, also up 11% YoY and 16% including a favorable FX impact. Growth has been accelerating for this segment, driven by the expansion of international operations. Yet, while these growth rates for both segments are solid, I am even more impressed by Amazon’s profitability improvements.

Both retail segments saw operating margins bottom in 2022 and have since shown an impressive rebound, with the North American segment reporting its sixth consecutive quarter of margin expansion, increasing the operating margin by 700 basis points. This resulted in an operating income of $4.3 billion coming from the North American segment, representing an operating margin of 4.9%. This is up another 100 basis points from last quarter.

Not so long ago, Amazon was heavily criticized for its lack of profitability in retail operations with plenty of analysts claiming Amazon would struggle to report steady margins due to the nature of the operations. However, as Amazon started scaling back investments in recent years, it is now showing that it is capable of driving solid profits in its retail segments, even in the current challenging operating environment with subdued growth.

Yes, the international segment continues to report a loss, but this is rapidly improving, as visible in the graph above, approaching a breakeven point. In Q3, the international operating loss shrunk to just $95 million or a negative margin of just 0.3%, which is a 270-basis points improvement sequentially and 860 basis points YoY. This improvement was fueled by improved productivity and inflationary pressures easing.

That Amazon has been able to improve margins significantly in such a short period is due to several factors. First, management has been scaling back investment, as highlighted by TTM Capex falling 17% YoY. Amazon has focused entirely on expanding its operations and building a reliable delivery network for many years. Now that the business is maturing and performing strongly, management is comfortable scaling back these investments, and this is visible in the margins.

Furthermore, the move from a single national fulfillment network in the U.S. to 8 distinct regions is bearing fruit in terms of cost efficiencies as it results in shorter distances and fewer touches to get items to customers, or in other words, it is a way more efficient model.

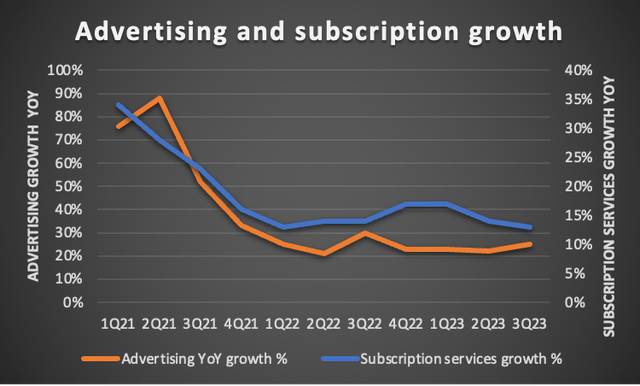

Also contributing to the improving margins is Amazon’s rapid growth in its advertising business and subscriptions. Advertising operations generally carry relatively high margins, as is made very clear by the likes of Alphabet/Google (GOOGL) and Meta Platforms (META), which are true cash-flow machines. The same can be said about subscriptions, as they generally require little operational costs. Therefore, as Amazon’s advertising and subscription revenues grow, this positively affects its margin profile.

Last quarter, subscription revenues increased by 13% YoY while growth in advertising accelerated to 25%. This resulted in advertising revenue of $12 billion, bringing the annual run rate to $48 billion. While this is just 50% of that of AWS, Advertising is growing at twice the pace, making it a significant contributor to not only margins but overall top-line growth as well.

As the advertising revenue is recovering from a cyclical slowdown, I expect growth to accelerate further over the next couple of quarters and to get closer to a 30% growth rate again, as I expect Amazon to benefit from the mid-teens growth CAGR projected for the digital advertising industry and to continue taking market share from the likes of Meta and Google. In my previous article, I explained what makes Amazon such a strong competitor in this industry:

Amazon has shown its ability to grow advertising revenue at a rapid clip, also through a down cycle in the advertising industry. The secret to this success is the massive number of eyeballs that are attracted to the Amazon platform and apps every single day and the fact that these people come to Amazon with clear intent. They literally type what they want in the search bar, making it easy for Amazon to precisely target the advertisements, which leads to better results for advertisers, which is why they likely prefer Amazon as an advertising platform over alternatives like Meta’s social media apps.

Regarding advertising, it is also worth mentioning that Amazon plans to show a limited number of advertisements on its Prime Video streaming platform. While this will not be as much as we see from other streaming services, it could boost advertising growth from Q2 of next year.

Overall, there is enough reason to remain bullish on the company’s retail and advertising operations, as well as further margin improvements. During the earnings call, management stated that it continues to see plenty of room for further margin improvements, and as I laid out in my previous article, this should result in significant cash flows over the next couple of years. To end this segment, this is what I previously wrote regarding the company’s potential cash flows, and as margins are improving faster than expected, there could definitely be more upside:

Even when assuming a very conservative growth rate of 11% over the next 2.5 years for the retail segment and the operating margin improving to 5%, which should be absolutely no problem for Amazon when looking at the massive improvement over the last year or so and headwinds in the International segment easing, this would result in a very significant $29.7 billion in operating income in FY25 generated by the North American and International segment alone.

AWS growth stabilizes in Q3

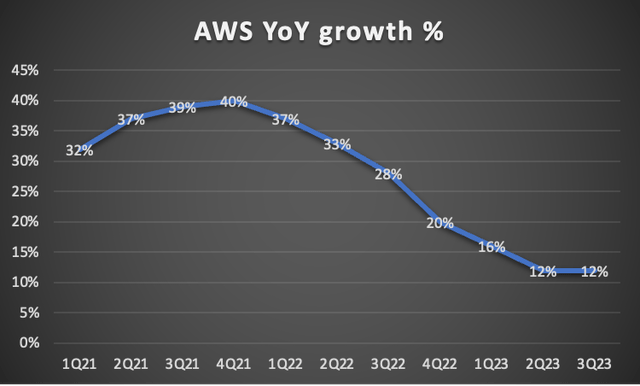

Amazon reported Q3 AWS revenue of $23.1 billion, up 12% YoY, slightly missing the consensus but sitting roughly in line with my expectations. The growth rate had been declining rapidly from a peak in 4Q21 at 40% to just 12% in Q2. This was primarily the result of customers moving more slowly in an uncertain economy to complete deals and focusing on cloud optimization instead of expansion.

However, according to Amazon management, the optimization rate now seems to be slowing down as they are seeing the pace and volume of closed deals pick up in recent months. This has resulted in a stabilization of growth for AWS at 12%.

Furthermore, as Amazon is seeing the operating environment and customer demand grow meaningfully every month, I expect a more robust performance in Q4, with AWS growth potentially accelerating toward the 12-14% range.

While 12% might not sound so impressive, this still gives AWS an annual revenue run-rate of $92 billion, making it the largest global cloud provider and a significant part of the Amazon business. It also means that, despite headwinds, it still added $3 billion in revenue YoY.

This is partly driven by the company introducing new AI functionalities like Bedrock, which has seen a very positive reaction from customers. Amazon is seeing fast growth in the usage of its AI functionalities and said the following regarding this during the earnings call:

Bedrock is the easiest way to build and scale enterprise-ready generative AI applications and a real game changer for developers and companies trying to get value out of this new technology.

The number of companies building generative AI apps in AWS is substantial and growing very quickly, including Adidas, Booking.com, Bridgewater, Clariant, GoDaddy, LexisNexis, Merck, Royal Philips and United Airlines, to name a few. We are also seeing success with generative AI start-ups like Perplexity.ai who chose to go all in with AWS.

Management believes these AI investments will give it a strong base to grow. While this is true, I also view AI as a headwind for AWS, mainly because it is on the back foot against the primary competitor, Microsoft, regarding AI functionalities and development. Furthermore, while 12% cloud growth was able to satisfy investors, this was still far below the growth rates reported by Google (22%) and Microsoft (29%) in their respective latest quarters.

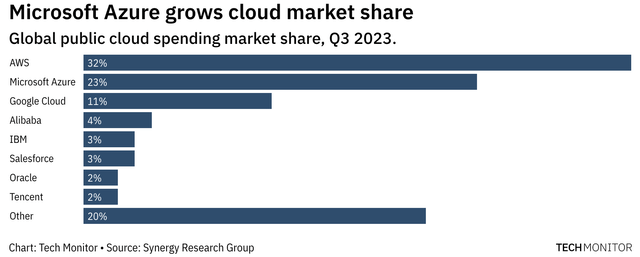

Amazon has been trailing its competitors for several quarters now in terms of growth rates, which has resulted in the company losing a couple of percentages in market share in the last 12 months. As of this quarter, Amazon remained the market leader with a market share of 32% (35% one year ago). However, according to data from Synergy Research Group, Microsoft is quickly closing in with a market share of 23% (21% one year ago).

With Microsoft having the edge over the competition with its head start in AI through the partnership and partial ownership of OpenAI, Amazon is facing tough competition, and going by recent growth rates and platform reviews, I believe it is safe to assume that Microsoft will close in further over the next 12-24 months, taking market share from Amazon.

Nevertheless, with the cloud industry expected to show impressive growth and Amazon remains the market leader for now, it is poised for strong growth, although I am not expecting AWS to return to reporting growth that sits consistently above 20%. Still, with growth in the mid-to-high-teens through the end of the decade, the segment will remain a growth driver and strong performer for Amazon.

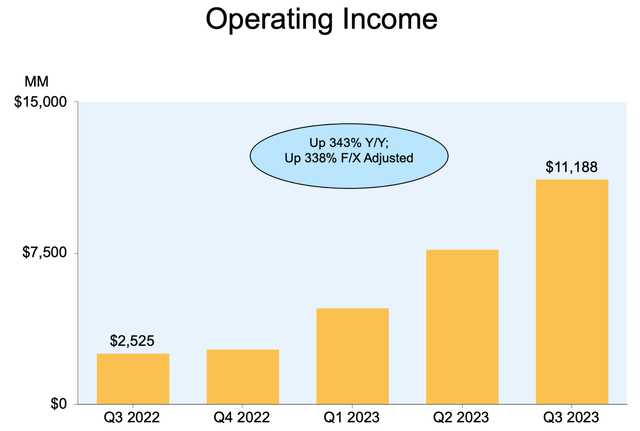

Looking at the Q3 bottom-line performance, AWS’ operating margin expanded by 400 basis points YoY to 30.3% as investments declined and growth stabilized. Sequentially, this was up 600 basis points. Margins should recover further over the next few quarters as growth accelerates and expenses remain relatively flat. This will support operating cash flow growth.

Amazon has seen its bottom line improve significantly over recent quarters, and Q3 was no different. Together with the strong performance in the retail segments, this brings total operating income to $11.2 billion, up 343% YoY and $2.7 billion above the high-end of guidance. This resulted in a net income of $9.9 billion, including a $1.2 billion pre-tax gain from the Rivian Automotive (RIVN) investment. Excluding this, the net income margin was 6%. The TTM free cash flow now stands at $20.2 billion, up from a negative $19.7 billion in the 12 months prior.

Outlook & AMZN stock valuation

Amazon management has guided Q4 revenue to be between $160 billion and $167 billion, up 9.6% at the midpoint, potentially indicating that growth is slowing somewhat.

Meanwhile, management guides for Q4 operating income to be within a range of $7 billion to $11 billion, up 233% at the midpoint. However, this does point to a sequential operating margin decline of 130 basis points to 5.5%.

This guidance from management sat somewhat below the Wall Street consensus, but shares jumped 8% on the next trading day nevertheless, and while the strong Q3 results gave plenty of reason for this, I also believe investors and analysts acknowledge that Amazon is being very conservative with its guidance, leaving a lot of room for upside. This is highlighted by the fact that Wall Street analysts continue to guide for close to $166 billion in revenue, only slightly down from their pre-earnings expectations and sitting at the higher end of management’s guidance.

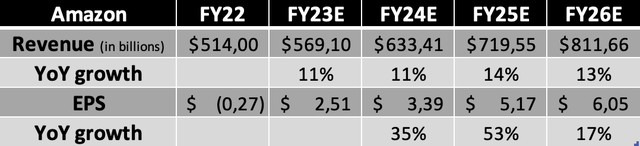

However, I chose to be somewhat more conservative and now expect revenue of $164.2 billion and EPS of $0.61, reflecting a challenging operating environment in retail but a slight uptick in AWS growth to the 12% to 14% range. Meanwhile, I have lowered my FY24 sales forecast as retail sales will come under some slight pressure as economic weakness persists, impacting consumer spending. AWS will partially offset this weakness by returning to mid-teens YoY growth on easier comparables and improved demand. Nevertheless, I have slightly increased my EPS projection as margin development exceeds expectations and management continues to look for cost efficiencies.

At the same time, my FY25 and FY26 revenue projections remain essentially unchanged. The strong margin development has allowed me to upgrade my FY25 operating margin from 8.7% to 9.2%, which I believe is still relatively conservative. This results in an FY25 operating margin of $66.2 billion and EPS of $5.17, up slightly from earlier projections.

Financial projections (By Author)

So, what does this mean for the valuation? Well, while my short-term estimates have come down slightly, I am more bullish on the company’s margin development, resulting in a higher EPS projection for FY25. Suppose Amazon were to hit these targets and continue to grow sales in the low-double-digits, which I deem highly likely considering the robust outlook for the e-commerce, advertising, and cloud computing industry, and EPS grows in the mid to high teens. In that case, I believe a P/E of 32x by FY25 is realistic and even somewhat conservative.

Based on these expectations, I calculate an FY25 price target of $165. From a current share price of around $128, this should position investors for very favorable annual returns exceeding 12%.

With shares poised to deliver double-digit annual returns to investors based on conservative estimates and multiples, I believe these continue to present excellent value following the Q3 results, even after the 8% price jump. Therefore, I maintain my Buy rating and remain bullish on Amazon’s long-term growth potential, driven by a strongly performing retail segment, rapidly improving margins, great potential in advertising, and a robust cloud segment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.