Summary:

- Amazon is showing strength in its AWS and advertising segments, driven by broader bullish margin-expansion catalysts such as AI and robotics.

- Q3 is likely to be strong, with analysts expecting a YoY normalized EPS growth of 20.6%. However, this is a risky time to heavily add to positions.

- We may be on the cusp of a long-term recession, and this weakness is likely to intensify geopolitical hostility toward the West from Iran, Russia, and China.

- As a result of the current high-risk environment, against which I do not consider Amazon to be a hedge, my rating is a moderate Buy, with a caveat for diversification.

happyphoton/iStock via Getty Images

I last covered Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA) in July, and since then, the stock has increased by 1% in price. At the time, I mentioned overvaluation concerns, and the stock is still showing this vulnerability at the moment when including sentiment factors. However, Amazon is a buy-and-hold company with long-term stable growth ahead of it. Although there are risks of a protracted long-term recession, I don’t think this means Amazon is not worth holding. Instead, I would be careful about adding to a position at this time due to the high valuation relative to broader macroeconomic weakness in the West, which is Amazon’s core market. A recession is likely to compound geopolitical threats, so the medium-term macroeconomic environment should place Amazon’s growth investment thesis into the proper context.

Leading into Q3, there are several bullish catalysts that I expect will be strong for the company. However, it is important to recognize these wins could be temporary. That being said, I am looking forward to the company’s likely high level of AWS growth, as well as management’s mention of Amazon’s advertising business in the earnings call.

Growth Catalysts Leading Into Q3

Amazon’s Q3 earnings are expected this month, with the estimated announcement date being 10/25/24. Analysts are expecting a 20.6% normalized EPS growth for the quarter, which is a substantial increase from the 10.1% YoY growth achieved in Q2. Furthermore, such substantial earnings expansion is expected into Q4, where the consensus is 34.5% YoY growth. Therefore, on an earnings basis, this is definitely a time that warrants near-term bullishness. However, I would allocate with moderation, considering the valuation and recession risks, which I will analyze below.

As Amazon is so fundamental to the current trends in AI, it is vital to assess the results from this segment in Q3. At such a vulnerable time macroeconomically, the growth narrative and associated results related to Amazon’s AWS segment are critical both for shareholders and the broader sustenance of the Western capital markets. AWS’s custom AI chips and services like Amazon Bedrock and CodeWhisperer are gaining traction among major clients like adidas (OTCQX:ADDYY), Booking Holdings (BKNG), and Merck (MRK). In Q3 2023, AWS revenue grew by 12% YoY, and I expect this to be much stronger in Q3 2024 related to AI consolidation. In Q2 2024, AWS delivered a YoY revenue growth of 19%. As of Q2 2024, AWS now makes up 18% of Amazon’s total revenue. I expect this to expand further in the coming decades.

Amazon’s advertising segment is also of critical importance to the company’s future growth direction. As a key example of management’s operational strategy with this segment, the company has been expanding its advertising offerings on Prime Video by introducing commercials, with subscribers needing to pay an additional fee to avoid them. Tactics like this might put pressure on the customer experience, but they are also likely tolerable adjustments that are highly beneficial to the company’s growth. In Q2, this segment delivered a 20% YoY revenue growth; however, I expect this segment could be one of the areas that sees a significant slowdown in adoption if a long-term recession begins in the next few years. Having addressed that, Q3 is likely to show continued strength in advertising. I notice this is a key long-term strategic and tactical area through which the company can continue to expand. Notably, Amazon has been underperforming Meta (META) here, which reported a 22% growth in its advertising last quarter.

Valuation Analysis

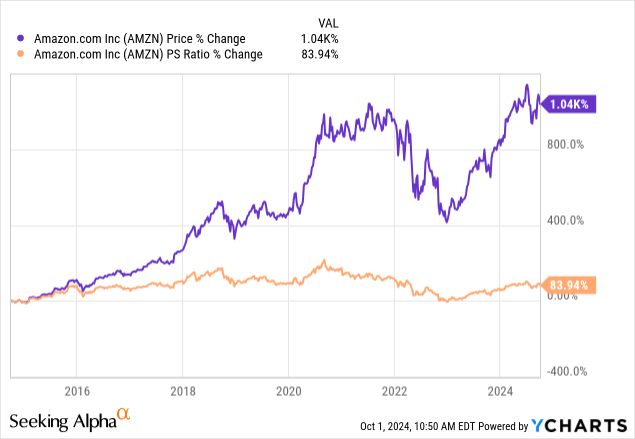

As Q3 is expected to be a strong quarter for Amazon, its elevated valuation reflects this. It is important to gauge that Amazon’s top-line growth rates have decelerated significantly as the company continues to develop from a high-growth entity to an established conglomerate. Therefore, the firm’s valuation is much more reflective of internal efficiency gains being developed by tactics such as those it is engaging in with Prime Video advertising. Furthermore, the company’s continued investment in and development of AI and robotics capabilities is likely to be highly margin-expansive over the long term. This was the core focus of my last long-term Buy thesis on Amazon. Therefore, a high valuation is warranted, but it still deserves caution due to higher potential volatility over the coming years due to macroeconomic risks.

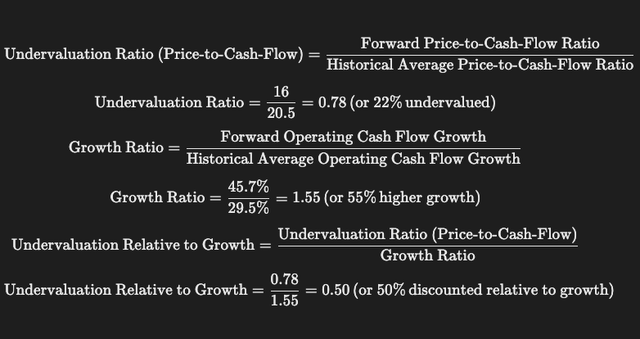

| Forward price-to-cash-flow ratio | 16 |

| Historical forward price-to-cash-flow ratio five-year average | 20.5 |

| Forward operating cash flow growth | 45.7% |

| Historical forward operating cash flow growth five-year average | 29.5% |

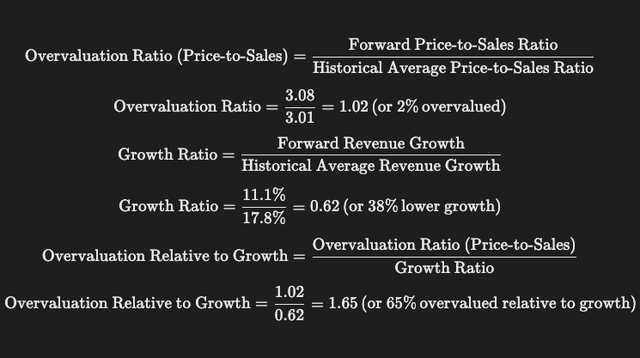

The above data shows that Amazon is somewhat undervalued based on an operating cash flow basis. However, its forward P/S ratio is currently 3, with a 2.4% increase from its five-year average. Taking that in conjunction with the fact that the company has a forward revenue growth rate of 11%, which is a 37.75% contraction from its five-year average, there is a juxtaposition for what is fair value for the company right now.

| Forward price-to-sales ratio | 3.08 |

| Historical forward price-to-sales ratio five-year average | 3.01 |

| Forward revenue growth | 11.1% |

| Historical forward revenue growth five-year average | 17.8% |

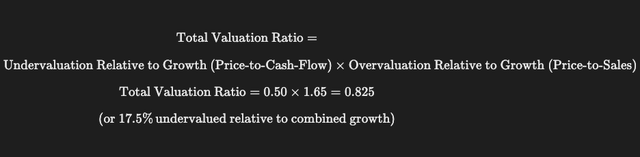

In essence, investors are left with the dilemma of how long Amazon can sustain such strong margin expansion. In my estimation, the long-term outlook is very favorable, primarily related to robotics and AI rather than short-term boosts from tactics like increased advertising. However, the slowdown in revenue is still a concern investors have to contend with, and it means that the stock is not as undervalued as it may seem from a pure cash flow generation perspective initially. That being said, based on these equations, the company still could be 17.5% undervalued based on my specific model.

If this model is correct (though it may not accurately account for shifting sentiment related to recession and geopolitical risks), the stock could be worth significantly more than the current consensus. The average consensus price target from 58 analysts suggests a 19.4% upside over the next 12 months. That being said because the company is expected to deliver much lower consensus YoY EPS growth of 22.5% in FY25 compared to 63% in FY24, sentiment factors could reduce the returns even given the long-term valuation of the stock. Given the impact of sentiment, I believe the company’s P/E ratio is likely to stay relatively constant for now, perhaps even showing a contraction. If so, I believe this would warrant a strong buying opportunity. For example, if the December 2025 normalized EPS estimate of $5.79 is achieved by the company, and it trades at the current P/E non-GAAP ratio of 44.6 in 12 months’ time, I would consider increasing my stake significantly, as long as the macroeconomy looks stable at the time.

Macroeconomic Risk Analysis

It’s important to understand that we are likely at the cusp of a long-term recession in the West. 2025 is likely to be a year of low interest rates in Western countries, but this stimulation in the macroeconomy is likely to have a further negative impact on inflation. The cost of living crisis is becoming somewhat unbearable for many Western countries. I consider these effects to have been largely exacerbated by the COVID-19 crisis. However, that crisis largely intensified and brought light to latent economic weakness in the West, particularly in the debt of the United States Federal Government.

These issues are manageable, but I believe they are also showing weakness in the West on the global stage. As such, the likelihood of intensifying global wars escalating during a long-term Western recession is high. This could further compound a negative environment for technology’s capital markets. Amazon is likely to be one of the companies that face a significant contraction in revenues and cash flows, along with its share price, if this negative environment manifests. While it is a common sentiment that elections often have little impact on the capital markets, I consider the 2024 election to be different. The candidate who is most competent at dealing with international threats, including a high level of diplomacy, as well as in strengthening America’s capital markets and tightening federal expenses, is undeniably the best candidate for the long-term future of the West at this time, based on my analysis. This fundamentally coincides with my long-term investment thesis of Amazon, and it is one of the reasons why, at this time, my rating for Amazon is a Buy, but certainly not a Strong Buy. Portfolios must be diversified internationally across asset classes and industries, including strategic hedges, to protect from Western macroeconomic and regional geopolitical risk. Potential negative impacts include supply chain disruptions, further inflation for essential goods, and lower consumer demand. Severe headwinds are avoidable, but risk mitigation in portfolios is still vital.

Conclusion

Ahead of Amazon’s Q3 results, I am cautiously optimistic about the stock. Despite the company likely continuing to lead the West in advanced tech and retail, we are at the cusp of a very fragile period in macroeconomics. Q3 is likely to be strong, but investors should not lose sight of the bigger picture and must understand that the current risk environment is high. Too much focus on short-term results, inciting heavy buying behavior, could result in significant long-term losses in a worst-case environment. My rating is a moderate Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.