Summary:

- Amazon’s fourth-quarter earnings beat expectations, leading to a fourth consecutive profit beat.

- The company’s robust forecast for first-quarter sales and operating income triggered an 8% stock rally.

- AMZN’s eCommerce segment saw significant growth in sales and operating income, leading to a favorable risk/reward relationship.

4kodiak/iStock Unreleased via Getty Images

Quarterly earnings for the fourth quarter of Amazon.com, Inc. (NASDAQ:AMZN) were released on February 1, 2024, and the eCommerce company once again produced much better-than-expected results, leading to a fourth consecutive profit beat.

Amazon continues to profit from growing eCommerce transactions, record-breaking sales events, and lower inflation which have already emerged as key investment themes for the company in 3Q-23. Amazon’s robust forecast for 1Q-24 sales and operating income explosion triggered an 8% stock rally on Friday.

I think that Amazon is selling for a very compelling earnings multiple given the pace of anticipated sales and profit growth. Consequently, my stock classification of Amazon is a Strong Buy.

My Rating History

Amazon profits from robust spending on its eCommerce platform and is seeing big jumps in operating income as a consequence. With inflation growth slowing and big gains in operating income growth, Amazon might be set for a record-breaking year.

Amazon’s rebound in eCommerce, in terms of operating income, and robust economic tailwinds in the U.S. equate to a favorable risk/reward relationship.

Amazon Is On Fire, Big Gains In Operating Income

Amazon presented very robust earnings for its fourth quarter and as 4Q-23 includes spending boosts related to the Christmas shopping season, Amazon was able to beat profits comfortably.

The eCommerce company earned $1.00 per share in profits vs. $0.80 per share expected by the Street. Amazon also beat the Street’s profit estimate every single quarter in 2023.

The eCommerce giant did have an amazingly successful fourth quarter in terms of both sales and operating income growth. Amazon’s sales jumped 14% to $170 billion and its operating income exploded skyward as its eCommerce segment crushed it. Amazon benefited from record-breaking Black Friday and Cyber Monday sales, triggering a big rebound in eCommerce.

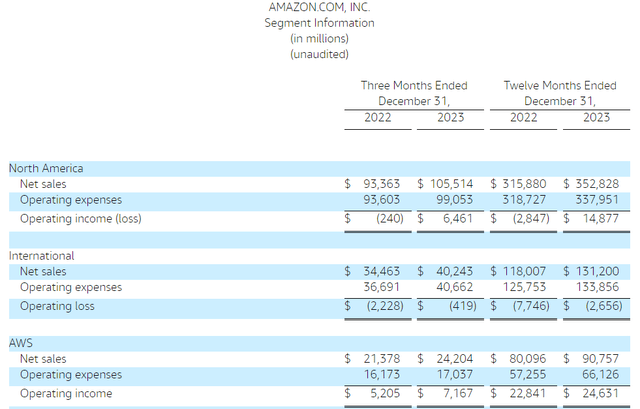

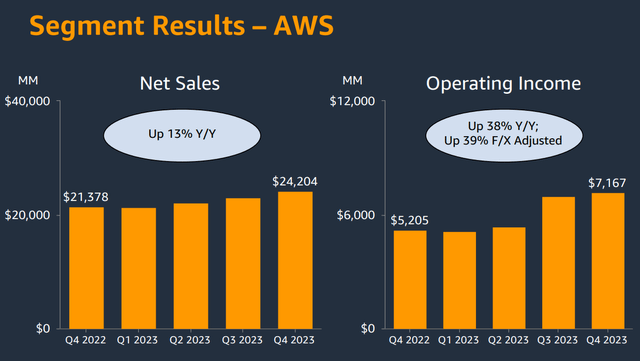

Amazon’s fourth quarter produced double-digit sales growth in all parts of the business: eCommerce, both in America and abroad, and in AWS, Amazon’s cloud segment. International eCommerce put up the best numbers with sales of $40.2 billion and 17% YoY growth. North America and AWS both managed to grow segment sales by 13% YoY in 4Q-23 and had sales of $105.5 billion and $24.2 billion respectively.

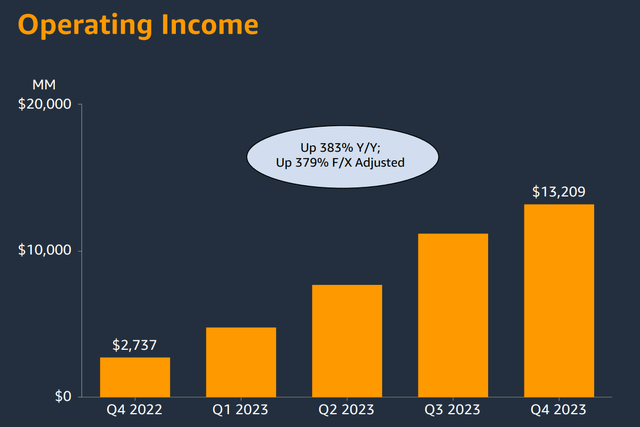

Whereas the market has been more focused in 2023 on the company’s sales growth, I think the real story is that Amazon is riding a big upswing in its operating income. On a YoY basis, Amazon’s operating income skyrocketed 383% to $13.2 billion. At no point in Amazon’s history was the company more profitable than now from an operating income point of view.

Amazon’s eCommerce trajectory suffered greatly in 2022 as pandemic tailwinds wore off and inflation started to weigh on the U.S. consumer. In 2023, however, Amazon has overseen a major rebound in operating income, particularly in eCommerce.

The North American segment produced $14.8 billion in operating income in 2023 compared to a loss of $2.8 billion in 2022. AWS is by far the most profitable business segment for Amazon right now as it produced $36.9 billion in operating income in 2023.

North America Operating Income (Amazon)

AWS Is Growing Robustly, Favorable Margin Trend

Sales of Amazon’s AWS segment were up 13% YoY and reached $24.2 billion while the company is making solid gains in this segment also. AWS’ operating income margin in 4Q-23 was 30% which was pretty much unchanged compared to 3Q-23.

In the last twelve months, AWS’ operating income margin amounted to 27%, so the margin trend in the last two quarters is promising. Amazon is making progress here and expanded its reach into Western Canada and multiple customers expanded their relationships with AWS including Salesforce, Amgen, Accor, and Mitsubishi UFJ Financial Group. Another company, pharmaceutical brand Merck, said that it will migrate a portion of its IT infrastructure over to AWS.

Segment Results – AWS (Amazon)

Amazon’s Forecast For First Quarter Sales

Amazon anticipates seeing between $138.0 billion and $143.5 billion in sales in the first quarter which reflects a YoY growth of 8-13%. Amazon’s optimistic forecast for 1Q-24 caused the stock price to pop 8% on Friday.

Why Amazon Is A Steal

Amazon produced 12% sales growth YoY in 2023 and 14% in 4Q-23. The outlook for 1Q-24 is positive and indicates that the company can sustain its growth momentum.

The market presently models 11% sales growth for this year and next year, and I think there is a chance that Amazon can surpass these estimates if inflation continues on its downward trajectory and the economy keeps growing.

The most recent economic reports showed that U.S. employers added 353K jobs in January. People have money right now and they are spending it, which will support Amazon’s eCommerce sales.

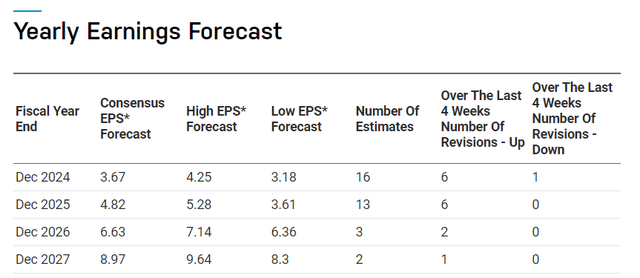

As far as profit estimates go, Amazon is in a solid spot, too. For next year, the market anticipates $4.82 per share in profits. Thus, Amazon is presently selling for a leading earnings multiple of 35x. This multiple may be considered expensive for a regular eCommerce company, but Amazon is putting up impressive sales and operating income growth numbers and its AWS segment is throwing off a boatload of cash also.

As long as Amazon’s total sales and operating income are growing, I am comfortable growing my Amazon position through additional stock buys as well.

Yearly Earnings Forecast (Amazon)

Why The Investment Thesis Might Be Off

Amazon is edging from one sales record to the next as more people utilize Amazon’s eCommerce platform. The U.S. consumer seems to be in increasingly good shape and employers are adding a bunch of jobs. Thus, at the end of the day, Amazon is a big bet on consumer spending, so any kind of weakness developing on this front could have a negative impact on the company’s sales trajectory.

My Conclusion

Amazon had a very profitable and successful fourth quarter which was aided by the Christmas shopping season as well as sales events like Black Friday and Cyber Monday. I think that the robust sales forecast for 1Q-24 and the operating income explosion to the upside, driven by eCommerce, not AWS, justifies my assertion that Amazon’s business is on absolute fire right now.

The eCommerce company grew its sales in the double digits in all segments in 4Q-23 and Amazon enjoyed a 383% YoY leap in operating income. The economy is presently outperforming expectations and consumers are willing to spend, so I don’t see Amazon’s sales momentum running into a roadblock any time soon.

Taking into account that Amazon is still growing quite fast given its size and that the company’s valuation is backed by very strong operating income momentum, I see no reason not to rate Amazon Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.