Summary:

- Amazon is set to report its Q4 2023 results and I expect various revenue records to be set.

- Despite a 26% gain since my last review, I retain my Buy rating on the stock.

- History says betting against this stock has been fool’s errand, despite constant overvaluation concerns.

- Stock is technically overbought but momentum names remain overbought far longer than textbooks allow.

tigerstrawberry

Amazon.com, Inc. (NASDAQ:AMZN) is set to report results for its Q4 that ended December 31st, 2023, after hours on Thursday, February 1st. Technology stocks are once again off to a great start as Nasdaq is up almost 3% YTD while Amazon is up nearly 5%. Will Amazon’s Q4 act as a catalyst to the surge or will it apply the brakes and bring these stocks back to reality?

Before we get into the Q4 preview, a quick recap of my most recent Amazon coverage. I had rated the stock a “Buy” ahead of the company’s Q3 earnings report. Since then, the stock has returned nearly 26% compared to the market’s 16% run. Does that make the stock less attractive heading into Q4? Let’s find out in our Q4 review without any further ado.

AMZN Q4 Preview (Seekingalpha.com)

Higher Expectations For Q4

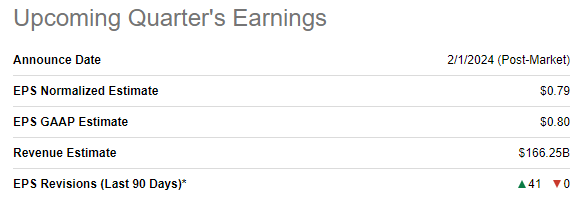

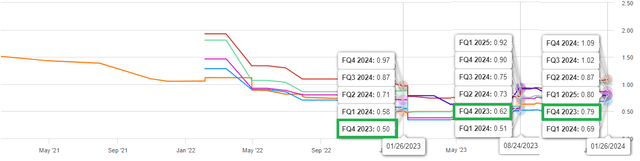

Analysts expect the company to report (an adjusted) EPS of 79 cents on the back of $166.25 billion in revenue. Investors may recall that Amazon recorded $2.7 billion (about 26.36 cents/share) in one-time charges in Q4 2022 related to severance payments, self-insurance liabilities etc. Adjusting for those charges, Amazon’s Q4 2022 EPS was roughly 29 cents. Should Amazon meet its Q4 2023 estimates, it would represent an impressive 11.42% YoY revenue growth and an-adjusted 172% EPS growth.

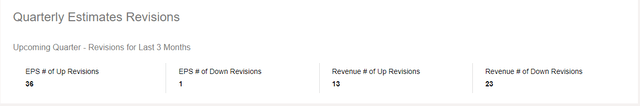

Another way to confirm increasing expectations is by looking at estimates revisions over the last 3 months. Heading into the Q4 report, an impressive 36/37 EPS revisions have been to the upside while just 13/36 revenue revisions have been to the upside. This is a bit of a reversal from the Q3 report where revenue revisions had more momentum than EPS revisions. It looks like I believe in the company’s revenue potential more than most analysts do as explained below.

AMZN Q4 EPS Revisions Count (Seekingalpha.com) AMZN Q4 EPS Trend (Seekingalpha.com)

Beat or Miss? I Say Beat On Both

Amazon has beaten both EPS and revenue estimates in every single quarter for FY 2023. I believe the streak will continue when the company reports its Q4, especially as the company touted record-breaking sales in November and holiday spending increased more than 3% YoY. I am far more confident about Amazon beating on Q4 revenue than on its EPS for two reasons:

(1) I expect record AWS and Advertising revenue as explained in the section below.

(2) Amazon’s tendency to surprise the market with new investments that affect EPS.

What To Watch? Usual Suspects Ads and AWS

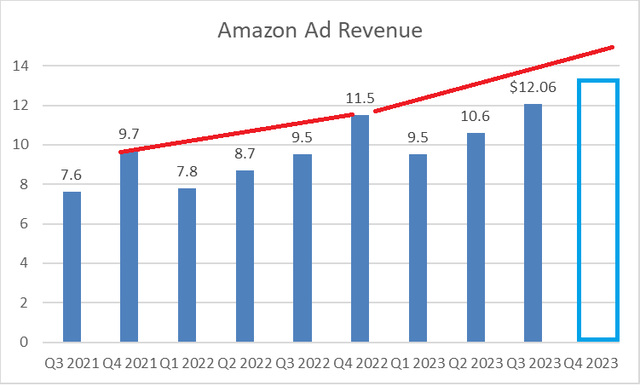

In my Q3 preview linked above, I had predicted that Amazon would report north of $11 billion in advertising revenue but would fall short of the average of $12.125 needed (at that point) in Q3 and Q4 to reach the projected $44.35 billion for FY 2023. Amazon did just that, although barely missing the average needed by reporting $12.06 billion. With Q4 being the holiday quarter, I am willing to bet this time that Amazon’s advertising revenue will cross $12.5 billion in Q4 2023, which would represent a 9% YoY growth and an all-time high in quarterly advertising revenue.

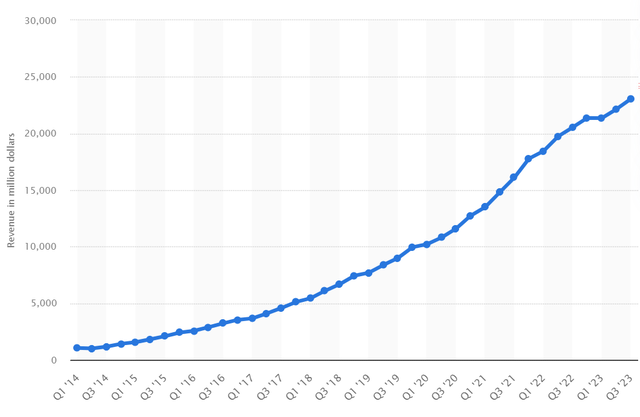

In my Q3 preview, I had predicted AWS revenue of $22.5 billion but the actual came in at $23.1 billion, a 12% YoY growth. While AWS is still growing, its pace has definitely dropped into low double-digits over the last few quarters. Using a 12% to 15% YoY growth rate for Q4 2023, I project AWS’ revenue to come in around $24.5 billion, another all-time quarterly record. However, that would place AWS’ FY 2023 revenue at $91 billion, far short of the rumored $100 billion target.

AMZN AWS Revenue (statista.com)

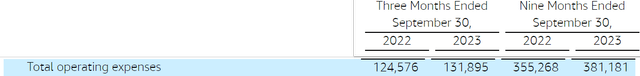

Although it was Meta Platforms, Inc. (META) that called 2023 its “year of efficiency”, Amazon did its own fair share of cost-reduction through layoffs and closing down warehouses. The latest layoffs (for Q4) took place in the Alexa division. Despite these cost-cutting efforts, Amazon’s operating expenses went up more than 7% YoY for the first nine months of the year and nearly 6% YoY in Q3. It will be interesting to see how Q4 and FY 2023 ended in this category. For the record, I expect expenses to go up YoY in Q4 2023 as well but for it to remain at about half of the revenue growth. That would mean a 5% to 6% jump in operating expenses to reach about $154 billion compared to $146 billion in Q4 2022.

Finally, as always, Amazon’s revenue guidance and tone towards Q1 and FY 2024 will be key items to be monitored. Currently, Q1 2024 revenue estimate is for $142 billion, representing almost 12% YoY growth.

Valuation Is Not As Attractive Heading Into Q4

- As always, Amazon’s stock remains pricey using traditional valuation metrics. A forward PE of 59 is partially offset by the fact that earnings are expected to grow by an average of 30%/yr for the next three years at least. However, that still represents a Price-Earnings/Growth [PEG] of 2 but I’d like to remind readers that quality rarely comes cheap.

- Despite the stock’s 26% run since my Q3 preview, the median price target of $185 is a good 16% away. The 52 analysts offering a 12-month price target have a range of $150 to $230. That the lowest price target is just 5% below the current market price should comfort investors about their margin of safety for buying here.

Technical Indicators – Overbought

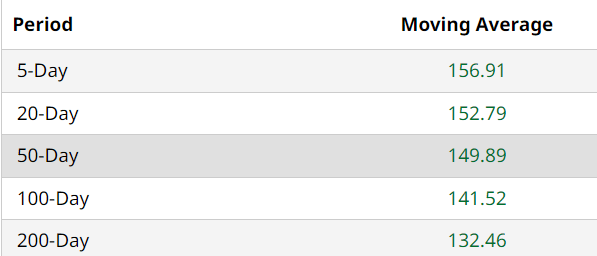

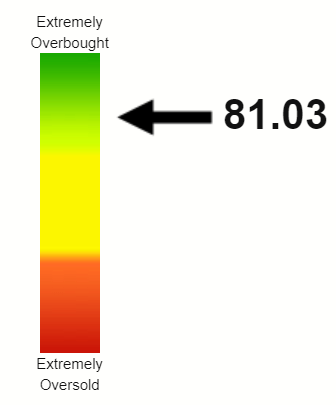

Amazon’s stock is much stronger technically heading into Q4 earnings compared to how it was during the Q3 preview. The stock is now trading higher than all the commonly used moving averages. In addition, a Relative Strength Index [RSI] of 81 suggests the stock is overbought and a hint of bad news in the Q4 report (or guidance) may push the stock lower given that 200-Day moving average is almost 17% below the current market price of ~$159.

However, momentum stocks like Amazon tend to stay overbought for much longer than the textbooks may call for.

AMZN Moving Avgs (barchart.com) AMZN RSI (stockrsi.com)

Conclusion

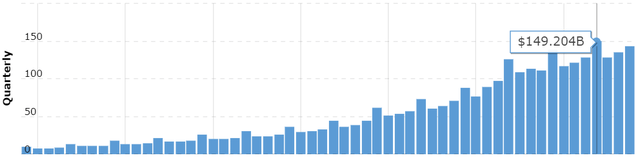

While I expect Amazon to record its highest-ever quarterly revenue (previous high $149.204 billion), backed by AWS and Advertising both reaching individual quarterly milestones, the stock’s 26% run since October is giving me pauses. However, we are talking about arguably the best cross-industry ecosystem, which is coming off adjusting for its recent excesses.

I retain my “Buy” rating on Amazon as in the short to medium term, I believe Amazon is about to reap rewards for taking hard decisions on less profitable divisions. For the long-term, it is all about Amazon’s carefully constructed and powerful ecosystem. Cloud was a $40 billion revenue segment in 2020 but is about to cross $90 billion for FY 2023 as explained above. Ads were worth $19 billion back then but is now expected to bring in at least $44 billion for FY 2023. A lot of naysayers (including me, at times) argued Amazon was too big to grow further back then. Here we are four years later and I am not going to argue against the company for the next four years.

What do you think of Amazon’s upcoming Q4 results? Please leave your comments below.

AMZN Qtrly Rev (Macrotrends.net)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.