Summary:

- The rally in Amazon’s shares seems to be only getting started.

- The company is making strides in the generative AI space and its advertising business is growing rapidly too.

- Amazon stock makes for a great buy for investors with a multi-year time horizon.

HJBC

Amazon’s (NASDAQ:AMZN) shares have rallied nearly 60% since its January lows and investors are now wondering if the stock is due for a correction. This explosive rally is in the midst of recessionary times so the bearish line of thought is warranted. But the ground reality is a little different. The company is turning out to be a major player in the advertising space, its e-commerce operations are due to rebound and its positioning to gain from the booming generative AI. These developments, in my opinion, will drive Amazon’s growth in the quarters ahead and are likely to also catapult its shares to new highs. Let’s take a closer look to gain a better understanding of it all.

Strong Comparables

When we talk about Amazon’s prospects, investors are generally extremely divided. While bulls argue that the company’s trend of disrupting new fields will take it to new heights, bears point out that Amazon’s two largest revenue streams – online stores and AWS — have been slowing down which will inevitably drag the company’s overall financials lower.

With inflationary and recessionary pressures weighing down on personal disposable incomes, consumers across the globe are not shopping as frequently as they used to until last year. Similarly, enterprises worldwide are also cutting back on discretionary spending in a bid to be financially frugal in these tumultuous macroeconomic conditions. These dynamics are weighing down on AWS and online store results and fueling bearish speculation on Amazon overall.

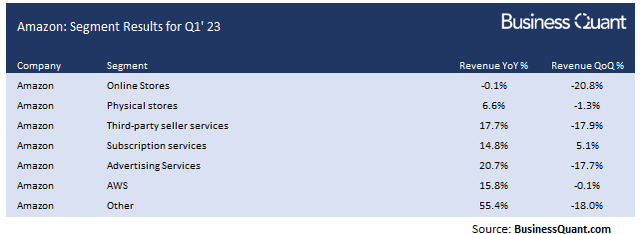

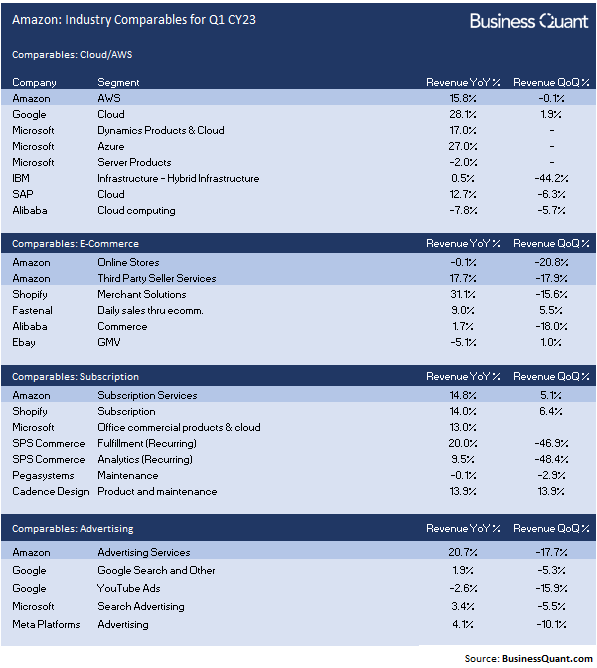

Now let’s shift attention to the table below. Note how other prominent e-commerce and cloud comparables also posted a steep decline in their sequential revenue during Q1. This goes to show that Amazon’s slowdown isn’t necessarily due to market share losses or company-specific issues. Rather, the slowdown seems to be industry-wide and likely cyclical. This suggests that once the Fed starts to cut rates, the liquidity crunch will ease which will encourage enterprises and consumers alike to resume their spending on Amazon’s platforms. So, in essence, Amazon’s online stores and AWS segments are experiencing some short-term pain, and seem set to rebound next year.

BusinessQuant.com

But having said that, also pay close attention to Amazon’s Subscription Services and Advertising Services segments. These have handily outperformed their comparables in Q1, especially the latter segment, during recessionary times. For the record, Amazon’s Subscription Services segment includes offerings with a recurring revenue model like Prime Video and Audible amongst others. The company’s continued growth in this segment keeps building a sticky and recurring revenue base for the company as a whole.

On the other hand, the growth in the advertising space is downright impressive. Google (GOOGL), Meta Platforms (META) and Microsoft (MSFT) have struggled to grow their advertising revenue, at least on a year over year basis, during Q1. Yet, Amazon posted a yet another quarter of robust advertising revenue growth. This suggests that direct-to-consumer marketeers are starting to prefer Amazon over other platforms as, perhaps, it offers a better return on their advertising dollars. If Amazon is starting to displace Google, then its advertising business might register explosive growth for several years to come.

The point that I’m trying to make here is that Amazon is showing green shoots of growth, while its e-commerce and AWS businesses ready up to rebound next year. But having said that, let’s move forward to Amazon’s next growth frontier – the Generative AI.

Generative AI Moves

The phrase “Generative AI” has become synonymous with OpenAI, ChatGPT, Microsoft and Google of late. After all, these are the companies and brands that have rolled out the initial batch of large language models (or LLMs) for the masses. But Amazon isn’t too far behind on this front and it’s readying to get a slice of this generative AI market. For the uninitiated, generative AI is estimated to become a $1.3 trillion industry by 2032.

The e-commerce giant has made a number of announcements of late which is a clear indication that it’s betting big on generative AI. To put things in perspective, the company’s cloud unit, AWS, is investing $100 million to set up an AI Innovation Center that will allow it to create and sell AI offerings. This might very well be in the form of AI-as-a-Service offering for B2B use cases.

The company will also benefit from renting out GPU units through its AWS platform. Enterprises looking to build and host their LLMs can simply rent the hardware from AWS and get their infrastructure up and running, within minutes. That’s Amazon’s second avenue of growth in the AI space.

Besides, the company has already launched Amazon CodeWhisperer, which is an AI tool for writing code in 15 programming languages. The company also launched Amazon Bedrock which is a Foundation Model API service. Essentially, Amazon is banking on a number of avenues to profit off of from the market’s raging interest in LLMs and Foundational Models.

Wrapping It Up

Sure, Amazon’s online stores and AWS segments posted lackluster results during Q1 but that seems to be a cyclical anomaly and look like short-term pain. The company, overall, has a number of growth catalysts at play as detailed above and it seems to be readying up for a yet another spurt of rapid, sustainable, growth in the quarters to come.

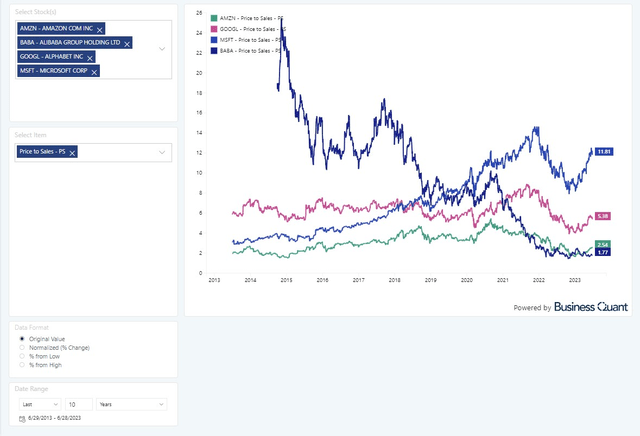

As far as the stock is concerned, it’s trading at nearly 2.5-times the company’s trailing twelve-month sales. This is quite low on a standalone basis as well as relative to its peers. The chart above highlights how Amazon’s P/S multiple used to hover above 5x merely a few months ago, indicating that it’s currently trading at a steep discount on a historic basis.

This undervaluation suggests that the stock is already pricing in the sales slowdown but is not factoring in a turnaround of its core e-commerce and AWS businesses, rapid growth in its advertising segment and key opportunities in the generative AI space. Therefore, I’m reiterating my bullish stance on the company. Growth-seeking investors with a multi-year time horizon may want to accumulate Amazon’s shares on potential price corrections. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.