Summary:

- Buying sentiments in Amazon stock have turned constructive, with buyers increasingly confident of its recovery.

- I assessed that AI investors could rotate to AMZN subsequently, as the cloud computing leader demonstrates its strengths in generative AI against its peers.

- The company is reportedly working with AMD on its new AI chips, suggesting that it’s looking to gain a competitive edge against its cloud rivals.

- With AMZN’s valuation still far below its 10Y average, the next stage of its recovery could be explosive.

FinkAvenue

Amazon (NASDAQ:AMZN) investors have much to cheer about recently, as momentum investors returned to bolster its upward recovery, as AMZN re-tested and decisively breached its February highs. I assessed it as a pivotal development, as market sentiments have shifted decisively in favor of AMZN.

While hyperscaler rival Microsoft (MSFT) has gone on close to re-testing its November 2021 highs urged on by AI investors, AMZN remains well below its August 2022 highs. As such, I assessed that the market had afforded much more optimism over Microsoft’s partnership with Generative AI leader OpenAI. While Amazon remains well-primed to benefit from the AI interest as the global cloud computing leader, investors are likely concerned whether the other segments of Amazon’s sprawling business would play ball.

Moreover, a recent Insider report highlighted that Amazon could be looking to redevelop its product features to incorporate more AI features, including “a major overhaul of its search bar with ChatGPT-like features.” As such, Amazon could be viewed by some investors as behind the curve as it seeks to respond to the threat of Microsoft.

Moreover, Bernstein’s recent open letter to CEO Andy Jassy and his team highlighted why Amazon’s diverse business segments could impact the company’s focus on its core competencies. The analysts reminded management to concentrate on ideas that “only Amazon can do.” As such, it questioned the company’s big bets in healthcare and satellite services through Project Kuiper. In addition, some of the company’s international e-commerce bets were also called into question, coupled with its uninspiring push into the physical grocery retail format.

With that in mind, investors have the right to question whether Amazon still has what it takes to return the company to growth mode. Why? Because AMZN is still priced for growth.

Seeking Alpha Quant “D-” valuation grade indicates that Amazon is priced at a premium against its consumer discretionary sector peers. However, some AMZN Bulls could argue that a sum-of-the-parts or SOTP valuation could be more appropriate, given Amazon’s diverse segments. Based on Trefis’ SOTP valuation framework, AMZN’s $132 fair value estimate is predicated on the strength of Amazon Web Services or AWS (53.6%), further supported by its North American segment (37.7%).

Therefore, I believe it’s fundamental that Amazon demonstrates that AWS can recover from its growth normalization to lead the company’s next phase of growth as it leverages the generative AI wave.

As the leading hyperscaler, I believe Amazon is very well-positioned to benefit from further adoption of cloud computing as companies look to benefit from the AI wave.

The company has created the Bedrock service within AWS to offer it as an AI service to rival Azure OpenAI services. As such, the company is not behind the curve, even as OpenAI, Microsoft, and perhaps Google (GOOGL) (GOOG) are taking most of the plaudits for their AI capabilities. As the cloud computing leader, AWS has significant scale and resources to compete head-on with Azure and Google.

Furthermore, Amazon is also reportedly working with AMD (AMD) on its newly-launched MI300 AI chips and potentially its flagship customer. Since Amazon is not working with Nvidia (NVDA) on its DGX cloud as opposed to Oracle (ORCL) and Microsoft, Jassy & team are likely looking to differentiate their offerings.

Moreover, I believe AMD is also keen to take share from Nvidia in the AI chips market. As such, it could provide significant leverage to Amazon in pricing negotiations, given AWS’s scale. Hence, AMD is likely keen to sign up AWS as its flagship customer, demonstrating to other customers that it has the backing of the leading cloud computing service, a likely win-win scenario for both companies.

Notwithstanding, investors shouldn’t take their eyes off Oracle, as it reported robust cloud computing performance recently. The company is moving rapidly, introducing enterprise AI services across its stack. It also announced a partnership with “Cohere, a Canadian company competing with OpenAI and Anthropic.” As such, Oracle can also integrate Cohere’s LLMs for its customers to develop their AI applications expeditiously. With ORCL bursting through a new all-time high recently, investors’ optimism is palpable.

With AMZN trading at a forward EBITDA multiple of 15.3x, it’s still well below its 10Y average of 21.5x. Hence, I believe it’s pretty clear that investors are still concerned about the more cyclical part of its business. Investors are likely still pricing in the risks of a broader macroeconomic slowdown, even though the Fed’s revised dot plot indicates an upgrade to its 2023 economic outlook. As such, I believe AMZN’s continued recovery suggests that investors are pricing in a more robust economic recovery, further lifting Amazon’s more cyclical businesses moving ahead.

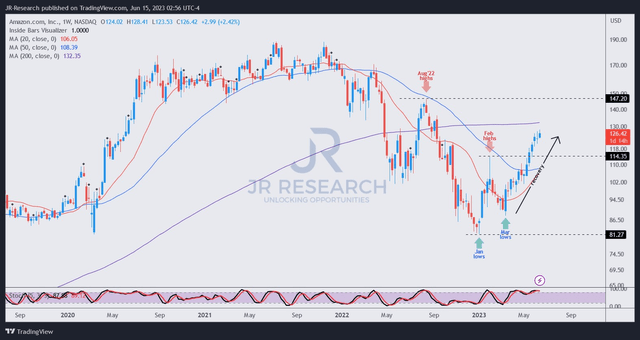

AMZN price chart (weekly) (TradingView)

As seen above, AMZN’s price action has breached a critical resistance zone that saw intense selling pressure in February. However, buyers defended the lows stoutly in March, forming a higher low, and AMZN has not looked back since.

Usually, I would have suggested that investors be wary about chasing further upside on AMZN from here. While I will still anticipate a pullback, I don’t expect AMZN to fall back toward its March lows.

That said, I expect AMZN to consolidate above its 50-week moving average or MA (blue line), corroborating that AMZN is still in the early stages of forming a new medium-term uptrend.

With AMZN still far from its all-time highs and a relatively attractive valuation compared to its 10Y average, I expect AI investors to subsequently rotate to the cloud computing leader.

As such, I’m ready to revise my rating on AMZN as it emerges from the ashes of its battering, prepared for the next wave up.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, NVDA, AMD, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!