Summary:

- We provide an update to our January rankings of the Magnificent 7 stocks, with a special focus on Amazon.

- After reviewing Amazon’s business, four big growth drivers, valuation and risks, we rank each “Mag-7” stock with special consideration for market conditions and the group’s maturation, dividends, AI and more.

- We conclude with our strong opinion on investing in Amazon (and each of the Magnificent 7 stocks) for the remainder of this year (and beyond).

Amazon: Ranking The Magnificent 7 (Blue Harbinger) Daria Nipot

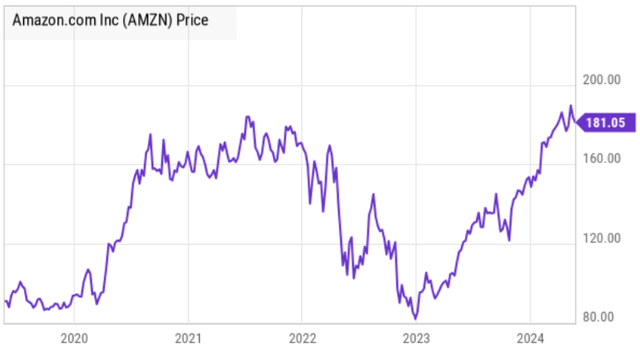

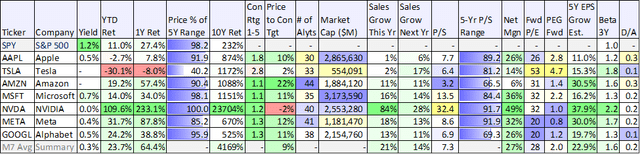

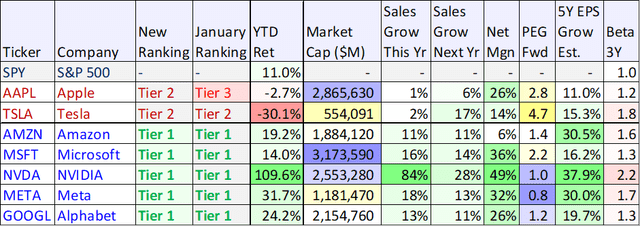

As you can see in the table below, “The Magnificent 7” mega-cap stocks have posted incredible 10-year returns. However, there have recently been some big changes in the market (e.g., interest rate expectations) and in these seven businesses in particular (e.g., maturation, dividends, AI and more). In this report, we provide an update to our January rankings of the Magnificent 7 stocks, with a special focus on Amazon.com, Inc. (NASDAQ:AMZN) (including its business, four big growth drivers, valuation, and risks). We conclude with our strong opinion on investing in Amazon (and each of the Magnificent 7) for the remainder of this year (and beyond).

Data as of 5/23/24 (StockRover)

(AAPL) (TSLA) (MSFT) (SPY) (NVDA) (META) (GOOG), (GOOGL)

The Magnificent 7

Before getting into the details on Amazon, you’ll notice in the table above “the magnificent 7” mega-cap stocks have posted more than 2x the returns of the S&P 500 (on average) so far this year (i.e., +23% vs +11%), and this comes on the heels of a tremendous 2023 (whereby the group averaged over a 100% gain).

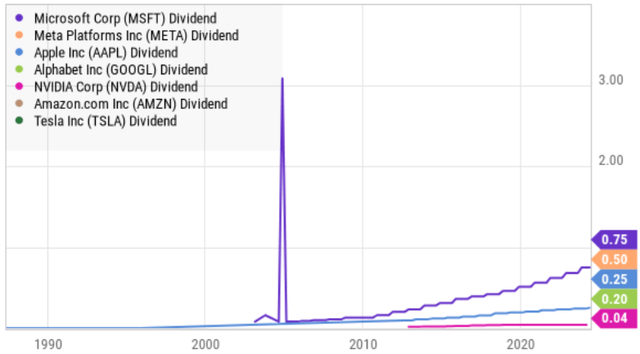

Also, worth noting, Amazon is now only one of two “Mag 7” stocks that does NOT pay a dividend (no dividend is typically an indication that the company believes it has plenty of growth opportunities ahead-more on this later). Amazon is also rated a stronger “buy” than the others (as per the Wall Street analysts), and Amazon has a sneaky high 5-year average EPS growth estimate (this is because it’s basically starting from a lower net margin than the others).

We’ll provide more detail on each of the Mag 7 stocks (including rankings) later in this report, but first, let’s dive deeper into Amazon.

Amazon

Many people think of Amazon as the website where you search for whatever you want, click “buy,” and then it shows up at your home or office some days later. And while that part of its business (online stores and third-party seller services) generates the majority of its revenues (62%), most of the profits come from its cloud-data hosting service (Amazon Web Services, AWS), which makes up only 17% of the revenues.

Statista

For a little more perspective, Amazon’s total operating income in the first quarter of 2024 was $15.3 billion, but $9.4 billion of that came from AWS. Said differently, 61.4% of the company’s operating income comes from 17% of the revenues (i.e., AWS).

Amazon’s 4 Big Growth Drivers

So with that high-level backdrop in mind, let’s get into the four big factors that we see driving growth for Amazon for the remainder of this year and beyond.

1. Amazon Web Service (“AWS”), Despite Competition

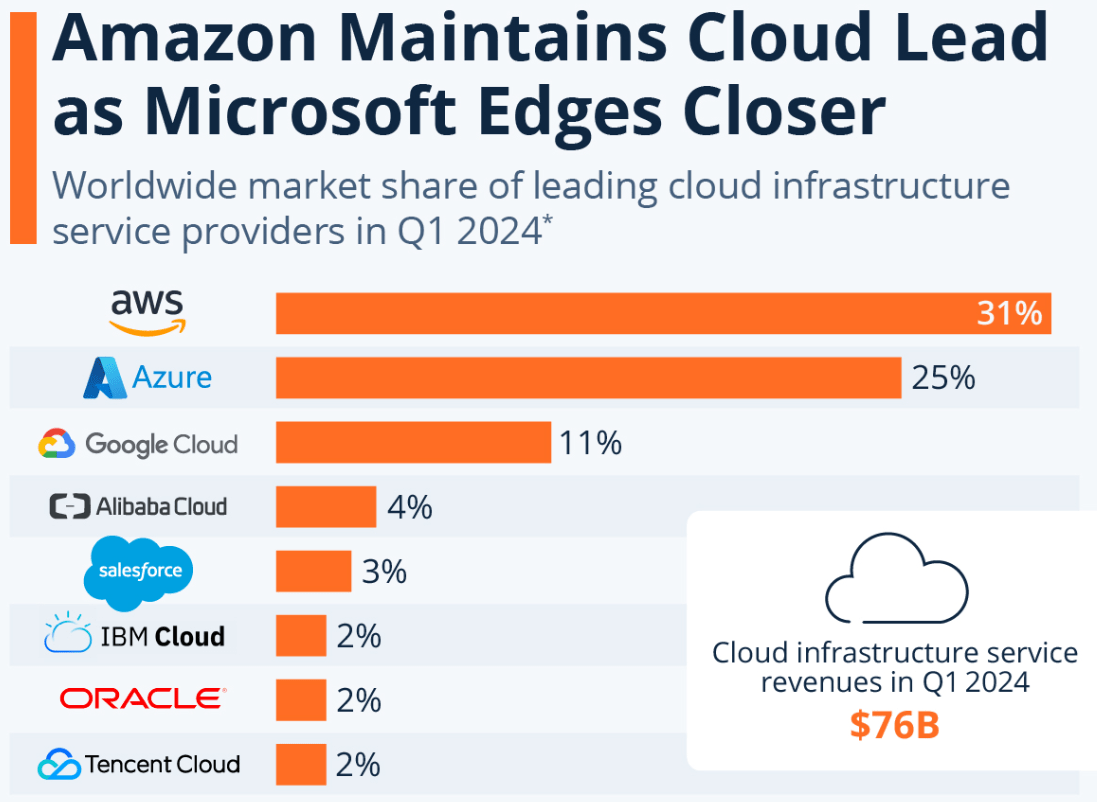

Amazon Web Service is the leader in the cloud market because Amazon had the foresight to recognize the massive secular opportunities ahead of the traditional big boys, like Microsoft, Google and the others (and because Amazon had an infrastructure head start via its online marketplace). For perspective, you can see the recent worldwide cloud market share (for the big players) in the following graphic.

Statista

(BABA) (CRM) (IBM) (ORCL) (OTCPK:TCEHY)

However, Microsoft and Google have been gaining on Amazon in this space. For example, according to estimates from Synergy Research Group:

Amazon’s market share in the worldwide cloud infrastructure market amounted to 31 percent in the first quarter of 2024, down from 32 percent a year earlier. Meanwhile, Amazon’s main rival Microsoft slowly edges closer, growing the market share of its Azure platform to an all-time high of 25 percent in Q1 2024. Combined with Google at 11 percent market share, the “Big Three” now account for two-thirds of the ever-growing cloud market, with the rest of the competition stuck in the low single digits.

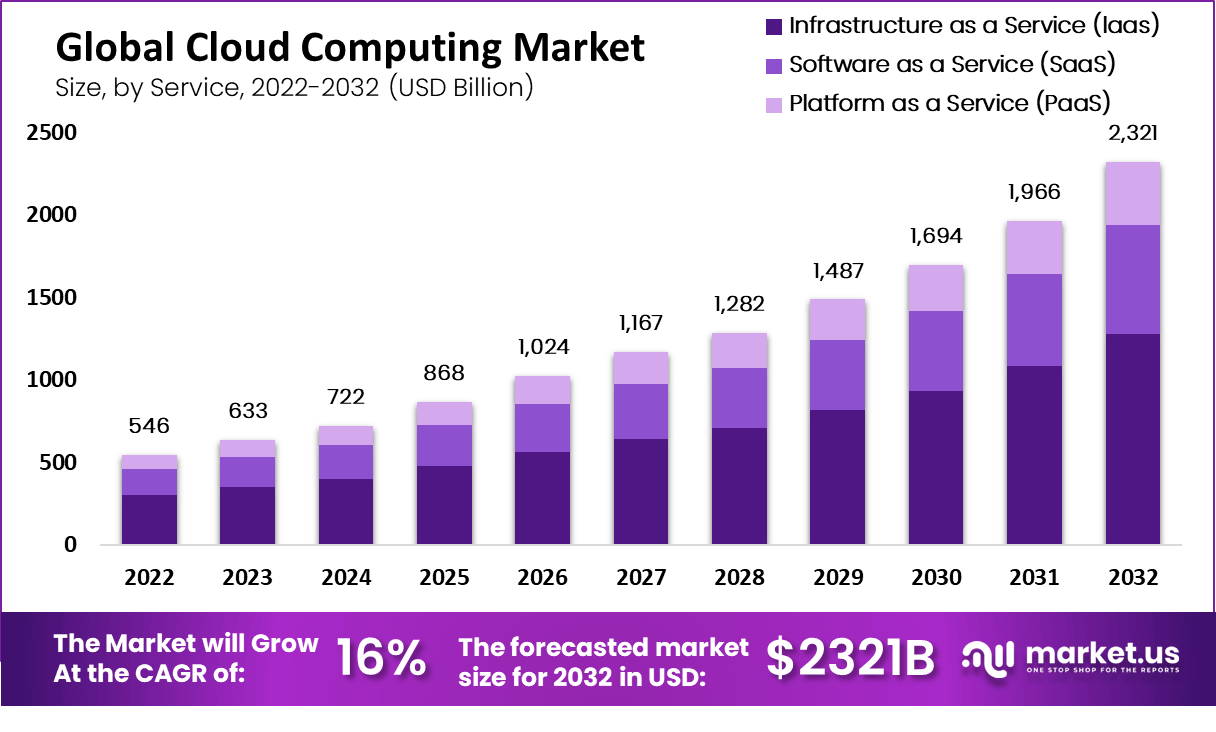

Cloud competition is absolutely a concern for Amazon, but it is important to keep it in perspective. Specifically, Amazon is still the worldwide cloud leader, it is very profitable in this space, and it is still growing rapidly. Moreover, the cloud opportunity (and the digitization of everything) remains perhaps the biggest technology secular trend in the world, expected to continue growing rapidly for many years, and recently being accelerated by Artificial Intelligence (more on Amazon AI later).

market.us

Said differently, “the cloud” continues to present massive growth opportunities for Amazon (for many years to come).

2. Ads Have Arrived for Prime Video

In late January of this year, Amazon began advertising on Prime Video (a huge and previously untapped revenue opportunity). Amazon Prime is a subscription service that gives users access to additional services (including faster delivery, streaming music and videos and more).

According to this article, customers can pay an additional $2.99 per month to avoid ads (a prime membership costs $14.99 per month or only $139 if you pay annually). And according to Amazon:

“We aim to have meaningfully fewer ads than linear TV and other streaming TV providers. No action is required from you, and there is no change to the current price of your Prime membership.”

Considering the large size of Amazon Prime (over 200 million customers worldwide), ads have the potential to meaningfully move the revenue needle for the company. And according to CEO, Andy Jassy, during the Q1 conference call:

We still see significant opportunity ahead in our sponsored products, as well as areas where we’re just getting started like Prime Video ads.

Prime Video ads offers brands value as we can better link the impact of streaming TV advertising to business outcomes like product sales or subscription sign-ups, whether the brands sell on Amazon or not. It’s very early for streaming TV ads but we’re encouraged by the early response.

3. Artificial Intelligence CapEx is a Good Sign

With technological advances in artificial intelligence, it has become a major theme (and growth driver) across businesses in every sector. And Amazon is also looking to capitalize on AI opportunities. According to Amazon’s latest Q1 earnings call:

The number of companies building generative AI apps in AWS is substantial and growing very quickly, including Adidas, Booking.com, Bridgewater, Clariant, GoDaddy, LexisNexis, Merck, Royal Philips and United Airlines, to name a few. We are also seeing success with generative AI start-ups like Perplexity.ai who chose to go all in with AWS, including running future models in Trainium and Inferentia. And the AWS team has a lot of new capabilities to share with its customers at its upcoming AWS re:Invent conference.

Given the profound impact AI is expected to have on the economy, it’s important that Amazon stays at least on pace with the curve so as not to be left behind (as many slower movers inevitably will be). The company says it also uses AI beyond AWS, including helping customers better discover products that meet their needs, forecasting inventory levels and improving delivery, to name a few. As an example, Andy Jassy explained on the latest quarterly call:

“We’ve recently launched a new generative AI tool that enables sellers to simply provide a URL to their own website, and we automatically create high-quality product detail pages on Amazon. Already, over 100,000 of our selling partners have used one or more of our GenAI tools.”

And very importantly, Amazon’s capex spending in this area is encouraging:

“We expect the combination of AWS’ reaccelerating growth and high demand for gen AI to meaningfully increase year-over-year capital expenditures in 2024, which given the way the AWS business model works is a positive sign of future growth. The more demand AWS has, the more we have to procure new data centers, power, and hardware.”

And for a little more color, according to CFO Brian Olsavsky:

“As I mentioned, we’re seeing strong AWS demand in both generative AI and our non-generative AI workloads, with customers signing up for longer deals, and making bigger commitments. Still relatively early days in generative AI and more broadly, the cloud space, and we see a sizable opportunity for growth.”

And with regard to capital expenditures (as a good sign for growth), Olsavsky explained:

“in Q1, we had $14 billion of CapEx. We expect that to be the low quarter for the year. As Andy said earlier, we are seeing strong demand signals from our customers and longer deals and larger commitments, many with generative AI components. So those signals are giving us confidence in our expansion of capital in this area.”

Capex spending (on AI) is a good sign for Amazon’s continuing future growth.

4. Free Cash Flow for Innovation Investments

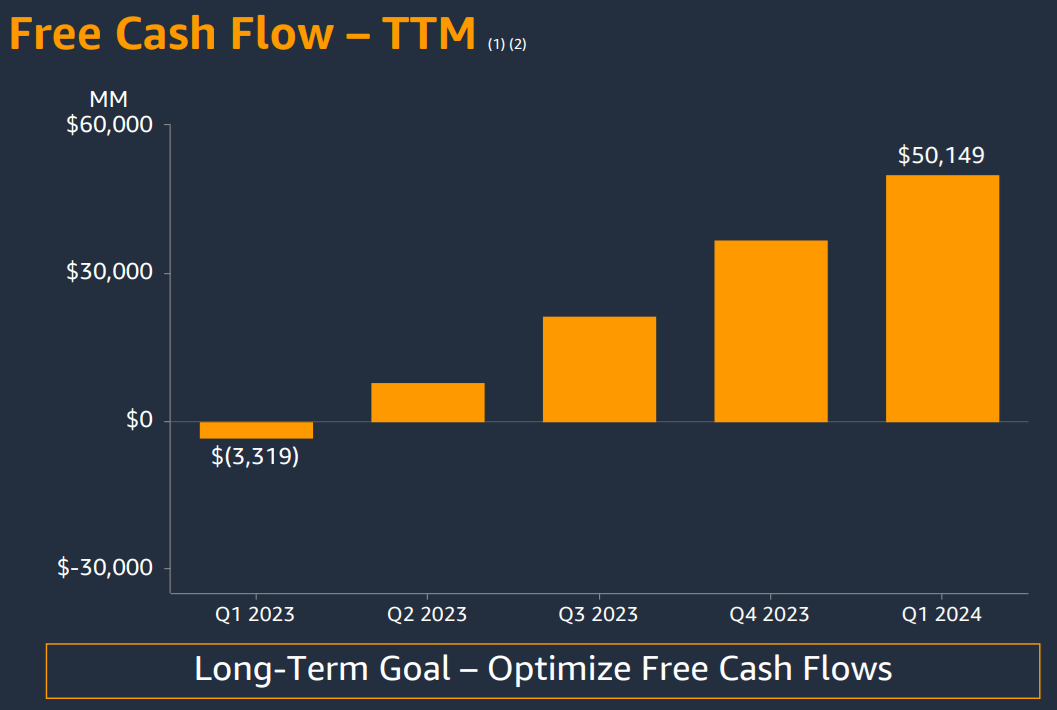

Since it first started trading publicly, Amazon has not focused on short-term profitability. However, it is a good sign for the company to be focusing its efforts more on the long-term goal of optimizing free cash flows. More specifically, Free Cash Flow has been on the rise (a good thing) as you can see in the following chart.

Amazon Investor Presentation

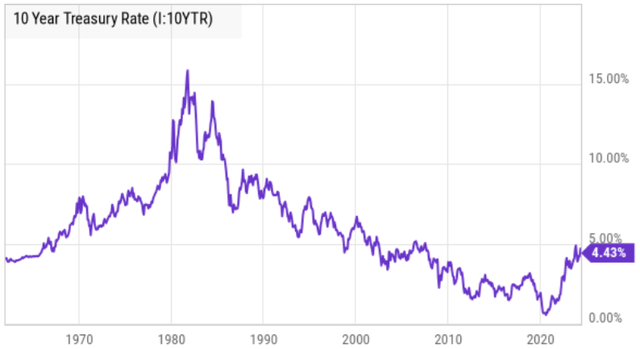

And growing free cash flow is particularly important in the current market environment (i.e., as interest rates have risen) because it is an indication of a healthy company that can continue to fund its own growth in any market environment.

Amazon’s Valuation

As you can see in our earlier comparison table, Amazon is currently the highest-rated stock (of the Mag 7) by Wall Street analysts, and it has the most price upside versus analyst targets. Also, Amazon has an attractive 11% expected revenue growth rate for this fiscal year and next.

However, the metric that stands out the most about Amazon is its expected earnings per share (“EPS”) growth rate for the next five years. Specifically, Amazon currently has the lowest net profit margin of the group, but this is by design (the company has always focused on spending for innovation and growth, not quarterly profits). But with free cash flow on the rise, and the company’s high economies of scale and operating leverage, Amazon likely has more room for EPS growth than other Mag 7 stocks (with the exception of possibly Nvidia and maybe Meta).

In a nutshell, Amazon has operating leverage to drive earnings dramatically higher in the years ahead, and this bodes well for shareholders and the stock price.

Amazon’s Risks

Amazon (and most of the Mag 7) are financially strong businesses that can be profitable in virtually any market environment. However, that doesn’t mean they don’t face risks.

Volatility: For example, Amazon shares fell dramatically in 2022 (before rebounding in 2023 and so far, in 2024), however price volatility remains a risk factor in the near term.

Prime Ad Risk: Another risk is that new Amazon Prime ads could backfire (causing the company to lose customers to streaming competitors). Additionally, Amazon needs to continue delivering streaming content that keeps users on the platform.

Cloud Competition is also a risk. For example, Microsoft and Google Cloud are both chipping away at Amazon’s lead in the space. The good news is that the cloud is so large that there is room for multiple winners. Nonetheless, competition is a risk.

Increasing Capital Expenditures also pose a risk. Even though Amazon views capex as a good sign (i.e., they see high demand and growth opportunities), if commensurate revenue and operating income don’t materialize, the company could end up destroying value by overspending on capex.

So with that information on Amazon, let’s get into the rankings of the “Magnificent 7” stocks.

Ranking the Magnificent 7: Big Changes

In the following table, you can see our new rankings for Mag 7 versus our January rankings (as well as the year-to-date performance for each name). We have broken the group into three tiers (tier 1 is the most attractive).

Data as of 5/23/24 (StockRover)

And before getting into the specific details on why each name received the ranking it did, let’s first consider two big changes for the entire “Magnificent 7” group:

1. The Group is Maturing

For starters, the “Magnificent 7” has been magnificent for a long time (for example, see the impressive 10-year total returns in our earlier table), and it is increasingly challenging to maintain such high growth rates considering the market caps of these companies are now enormous (i.e., it can be a lot easier to rapidly grow a $10 billion company than a trillion-dollar-plus company).

Also, most of the “Magnificent 7” stocks now pay a small dividend (typically a sign that growth opportunities may be slowing). We’re not saying growth is over for these companies (it’s not!), but the growth rate has slowed (for most) and this impacts our final conclusions on investing in them (later in this report).

Most of the Magnificent 7 dividend yields are not particularly impressive (you can view recent examples of our top big-dividend ideas here (ARCC) and here (PTY)), but if Microsoft and Apple are any indications (they have strong “yield on cost metrics” thanks to steady long-term dividend growth), we could be at the very beginning of several of the most epic dividend growth stories to unfold in the decades ahead for Meta and Google (and even Nvidia just announced a dividend hike too).

2. The Market Is More Challenging

Interest rates have been coming down basically for the entire existence of these companies, and that created a tailwind for economic growth. However, rates have now risen to their highest level in 15 years and this will create a bit of a headwind for economic growth (because it’s now more expensive to borrow money to fund growth, courtesy of the Fed’s efforts to combat high inflation).

The good news is these companies are so profitable that they can continue to fund themselves (via free cash flow) and this gives them a huge advantage over other less-cash-rich companies (that will struggle mightily in the changed macroeconomic interest rate environment). The “somewhat” bad news is the customers of these companies will be negatively impacted by higher rates and this will make growth a bit more challenging for the Magnificent 7.

Tier 2 Stocks:

Starting with our “tier 2” rankings…

Apple: Apple is a truly incredible business. The sheer number of iPhones (and the vast data advantages this gives the company) makes Apple a highly attractive wide-moat business that generates tons of cash for dividends and share repurchases. And despite efforts into AI, we view Apple as the least disruptive and the least innovative of the Magnificent 7. If you are looking for a steady healthy business, Apple is great, but it’s not a “tier 1” stock in our book. After a slow start (for the shares) in 2024, we’re rating Apple as tier 2 (up from tier 3 in our previous report at the start of the year) based on valuation and the relatively steady nature of the business.

Tesla: We’re putting Tesla at tier 2 just because the uncertainty is so high (and because CEO Elon Musk appears to be staking the company’s near-term success on full self-driving vehicles). To be clear, we’d never count out Elon Musk altogether as he has surprised the market to the upside over and over again throughout history. And his hands are currently full with a variety of initiatives ranging from Twitter (now “X”) to Neuralink and SpaceX. And even though the shares have been the worst performing of the Mag 7 stocks this year (some see this as a contrarian opportunity) the shares are not particularly inexpensive relative to their growth rate.

Tier 1 Stocks:

Switching to our top-tier stocks…

Nvidia: In case you’ve been living under a rock, there is currently a massive revolutionary artificial intelligence megatrend going on, and Nvidia is leading the way with its industry-leading GPU chips (that are used in the data centers processing the massive amounts of new and growing AI data). Chip stocks are notoriously cyclical (and Nvidia has a higher beta than other stocks on our list), but if you can handle high short-term and mid-term volatility in the years ahead, NVIDIA shares are eventually still going much higher in our view. Nvidia has higher margins, higher revenue growth and higher expected earnings growth than the other Magnificent 7 stocks, and it still trades at a very low (attractive) 1.0 PEG ratio.

Alphabet: Powerful growth, powerful margins and strong ratings from Wall Street analysts make Alphabet hard to ignore (especially considering it has a lower beta and likely much lower volatility than Nvidia). The company’s vast ecosystem across Google and YouTube (not to mention it’s the 3rd biggest cloud services company) basically gives Google an impenetrable moat to fend off competition (and to keep growing). Trading at only a 1.2x PEG ratio, and with strong earnings growth expected, Alphabet is an extremely attractive stock to own now and over the long term.

Microsoft: Simply put, Microsoft is an amazing business. Thanks to Microsoft Windows, Microsoft Office and Microsoft Azure (cloud), the company has extremely high margins (wide moat) and it continues to spend heavily on innovation and growth opportunities (a good thing). And despite recent price gains, Microsoft still trades at a reasonable 2.2x forward PEG multiple and 32x forward PE ratio. One of only two publicly-traded stocks with an “AAA” credit rating (not even the US government is rated this high), Microsoft will likely be trading much higher in the years and decades ahead.

Meta Platforms: Despite an unfriendly share structure (founder/CEO Mark Zuckerberg controls the voting rights), Meta Platforms (parent of Facebook, Instagram, and WhatsApp) continues to print money. It has extremely high net margins (32%), high growth and a low (attractive) 0.8x PEG ratio. The market didn’t like the very high capex spending in the most recent quarter, but Meta is focused on growth (particularly spending on data centers) and this is a good thing. Also, a good thing, WhatsApp is now over $1B annual revenue run rate (from click-through ads and paid messaging) and it has continuing huge growth potential. Meta shares can be volatile, but the ongoing long-term growth potential makes this an attractive tier-1 investment opportunity.

Conclusion:

The “Magnificent 7” stocks are such a large and important part of the global economy (some even more than others) that it would be a mistake to avoid them altogether. In many ways, these stocks are the leading “blue chips” in the market today, and they will likely continue to be in the years and decades ahead.

We especially like all the tier 1 names in this report, and Amazon, in particular, stands out for its impressive combination of growth, “sneaky” operating leverage (the net margin has so much more room for improvement than the others) and valuation (it’s the top-rated Mag 7 stock by Wall Street analysts right now).

We’re currently long-shares of Amazon in our Disciplined Growth Portfolio, and have no intention of selling anytime soon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

–

If you are looking for big-dividend opportunities, consider Big Dividends PLUS, where you’ll get access to our new report: Top 10 Big-Yields: BDCs, CEFs, REITs and our 27-position High Income NOW portfolio (aggregate yield: 9.0%).