Summary:

- We remain buy-rated on Amazon.

- We think Amazon is improving its competitive position against Microsoft and Google in the race to leverage A.I. with the recent announcement of a $4B investment in Anthropic.

- We expect the investment to also stretch visibility for AWS as Anthropic will use AWS as its primary cloud provider and give AWS customers early access to unique features.

- Additionally, we’re seeing Prime Video move closer to profitability with the introduction of ad-tier subscriptions in 2024, following the footsteps of Netflix and Disney.

- We see an increasingly favorable risk-reward profile for AMZN stock into 2024.

peepo

We maintain our buy rating on Amazon (AMZN). We’re more constructive on the stock now that management is taking visible steps to improve its competitive advantage against Microsoft (MSFT) and Alphabet (GOOGL) in the race to leverage A.I. – Amazon recently announced a strategic investment of up to $4B in A.I. start-up, Anthropic. We think Amazon is expanding its footprint in A.I. development and attempting to position itself as an all-in-one A.I. stop. Management also announced new software and hardware with gen A.I. for Alexa at its annual devices bonanza; the new Alexa is supposedly more human-like and is able to interact naturally without promotion. Earlier in the A.I. boom, both Amazon and Alphabet were recognizably behind Microsoft, and we’re now seeing Amazon edge ahead and see the stock outperforming the peer group in 2024.

Our buy rating is primarily driven by our belief that management’s cost-control and operation efficiencies, including its regionalization strategy, will fuel resilience, and ad revenue will rebound in 2024. We now add an additional layer to this thesis that involves A.I. as a growth driver in the mid-to-long run; we still don’t expect the investment to be a material positive for Amazon in the near term, but we do think it’ll do two things: provide a competitive edge in a rapidly expanding market, and stretch AWS visibility in multiple fronts. We’re seeing Amazon’s risk-reward profile become increasingly favorable into next year.

What’s up with Anthropic?

Amazon will invest up to $4B in Anthropic, an A.I. start-up founded by OpenAI veterans. The deal is more than an investment; Anthropic will also use AWS as its primary cloud provider and offer AWS customers early access to unique A.I.-related features. Anthropic successfully raised +$1B on its pitch to make a chatbot similar to ChatGPT and is not putting all its eggs in one basket with Amazon; the company also has $400M invested from Alphabet. We see the partnership greatly expanding AWS’ visibility in the cloud computing market. Additionally, the investment also bears significance for Amazon’s in-house chip-making plans, including Trainium and Inferentia, both designed for machine learning. We now see a clearer path to revenue reacceleration as the company catches up to Alphabet and Microsoft.

We think investors should consider Amazon as a cloud computing rather than consumer discretionary play. Consumer spending is more volatile at the back end of the year due to fears over another interest rate hike and a looming recession. With this in mind, we do expect the retail side of the business to grow materially for the next two quarters due to holiday season demand. Reports from Bloomberg confirm that the company is already hiring a quarter million people for seasonal holiday demand, while Target (TGT) has also hired about 100,000; we think these are strong indicators of stronger-than-expected consumer spending in spite of macro uncertainty. We remain cautious about a true recovery in consumer discretionary spending but see an upside in the near term due to the holidays.

Joining ad-tier wagon

Netflix (NFLX) and Disney (DIS) introduced an ad tier subscription late last year in attempts to stir the streaming business towards profitability – a profitability that has yet to materialize. We’re constructive on Prime Video introducing an ad tier in 2024; users would have to pay an additional $2.99 a month for an ad-free subscription. While ad revenue has been muted this year for the most part, not only on the streaming front but also on the retail one, we expect to see ad spending rebound more meaningfully in 1H24.

Valuation

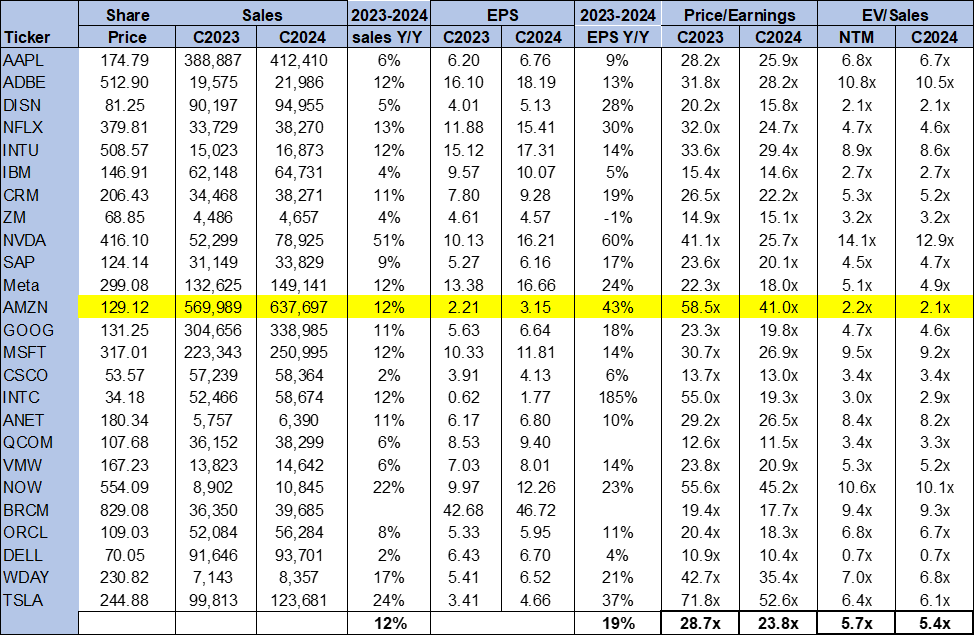

The stock is fairly valued, in our opinion. On a P/E basis, the stock is trading at 41.0x C2024 EPS $3.15 compared to the peer group average of 23.8x. The stock is trading at 2.1x EV/C2024 Sales versus the peer group average of 5.4x. We think the stock is relatively cheap considering the growth rate prospects in 2024 and recommend investors explore favorable entry points at current levels. We think Amazon is among the large-cap stocks that will work in the near term in spite of macro uncertainty.

The following chart outlines Amazon’s valuation against the peer group.

TSP

Word on Wall Street

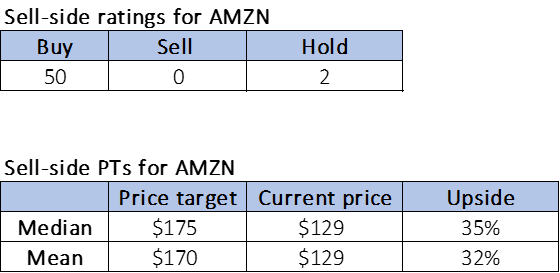

Wall Street is overwhelmingly bullish on Amazon. Of the 52 analysts covering the stock, 50 are buy-rated, and the remaining are hold-rated. Wall Street shares our bullish sentiment on the stock. The stock is currently priced at $129 per share. The median sell-side price target is $175, while the mean is $170, with a potential upside of 32-35%.

The following charts outline Amazon’s sell-side ratings and price targets.

TSP

What to do with the stock

We maintain our buy rating on Amazon. We’re seeing Amazon’s competitive position in the A.I. race improve exponentially after the company announced the investment in Anthropic and simultaneously introduced a new Alexa with unique A.I.-driven features. While we continue to see softer cloud spend in the second half of the year, we expect AWS to be relatively resilient. The stock is up 53% YTD, outperforming the S&P 500 but not the peer group; outperformance moderated over the past month alongside the broader tech industry. We recommend investors explore attractive entry points into the stock on pullbacks as we think Amazon is now better positioned to outperform the peer group into 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2-week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2-week free trial, so we hope to see you in our group soon.