Summary:

- Looking at Q3 data, I believe Amazon remains a solid “Buy” due to its robust financials, market position, and growth potential.

- Q3 EBIT increased 56% YoY to $17.4 billion, which illustrates Amazon’s ability to make use of scale and operational efficiencies to drive profits.

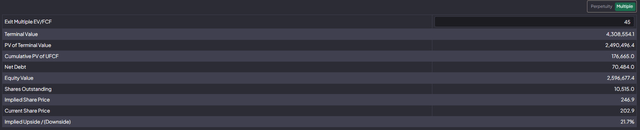

- With the new Q3 input data on hand, Amazon’s undervaluation has increased to 21.7% despite the positive momentum as of late.

- I think Amazon has significant potential to expand its current EBIT margins, which I consider relatively low, providing a strong base for future growth.

- I decided to maintain my “Buy” rating following the Q3 FY2024 report.

4kodiak/iStock Unreleased via Getty Images

Intro & Thesis

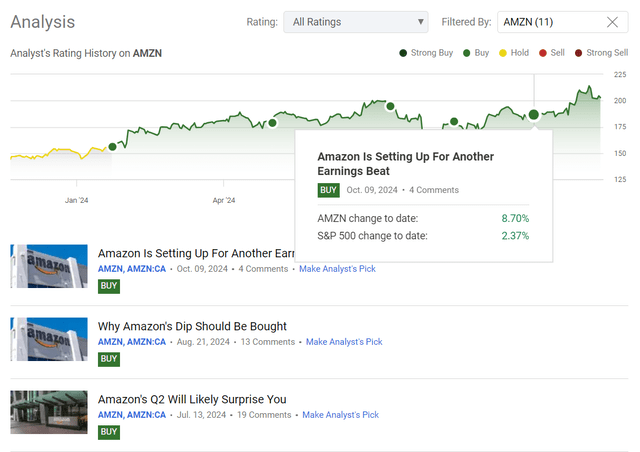

Since I first initiated my coverage of Amazon.com, Inc. (NASDAQ:AMZN) stock here on Seeking Alpha, my ratings have fluctuated between “Buy” and “Hold,” depending on market developments and my assessment of the company’s nearest prospects. In my last article, which came out in early October, I previewed the then-upcoming Q3 FY2024 report, stating that Amazon was setting up for another earnings beat at the time. I also said back then that AMZN’s management commentary would unlikely be negative, so the overall picture looked quite bullish for the stock to keep going higher. So far my call has been aging well compared to the broader market:

Seeking Alpha, my coverage of AMZN stock

In today’s article, I’d like to examine Amazon’s Q3 FY2024 figures more closely, as I haven’t covered them yet here on Seeking Alpha. What are the fundamental changes that should drive Amazon higher? Or maybe it’s time to sell?

Approaching those questions during my analysis, I’m again coming to the conclusion that AMZN is still a top-notch pick among FANGMAN stocks that investors would keep in their portfolios in the medium term. I believe the appreciation potential is still there, as the stock doesn’t look overvalued to me just yet – hence my “Buy” rating.

Why Do I Think So?

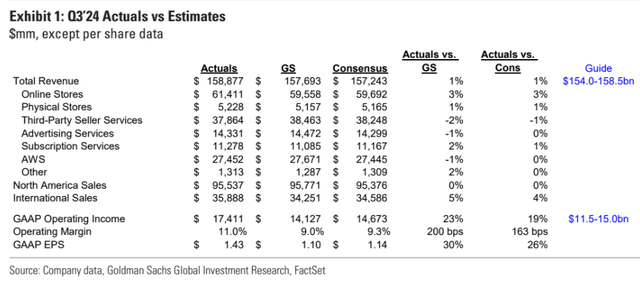

Amazon generated ~$158.9 billion in revenue during its Q3, which is 11% more than the prior year after adjusting for FX impacts. This solid top-line dynamic was driven by strong performance in both AMZN’s North American and international retail businesses, as well as in the AWS and advertising segments. One of the most significant contributors to Amazon’s growth was its retail business, which rose 9% in North America and 12% globally. This expansion was fueled by Amazon’s efforts to expand its product lines, lower prices, and speed up deliveries. The company’s Prime membership program remains a major contributor, with new offerings like unlimited grocery delivery and fuel savings adding further value to the offering.

Last quarter, Amazon invested heavily in the fulfillment network, including regionalizing its outbound logistics and building more same-day fulfillment centers – these initiatives have helped increase both delivery speeds and costs, which led to a 25% increase in inventory placement efficiency. Amazon’s past investments in robotics and automation have also improved the speed and security of Amazon’s fulfillment services by minimizing the processing time and improving the safety of customers.

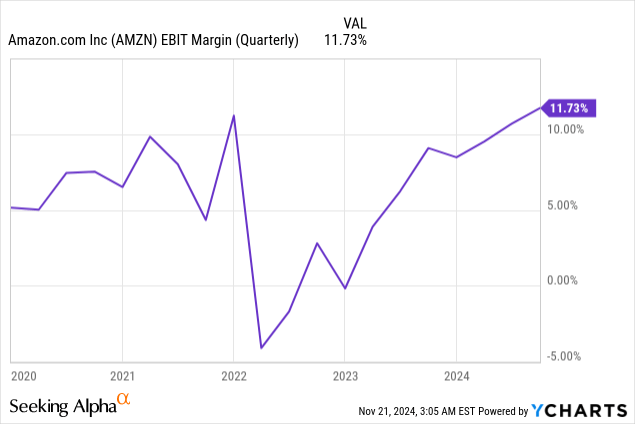

Operating income increased 56% YoY to $17.4 billion, which illustrates Amazon’s ability to make use of scale and operational efficiencies to drive profits. In fact, the EBIT margin we saw in Q3 was a record-breaking one – even higher than at the end of 2022:

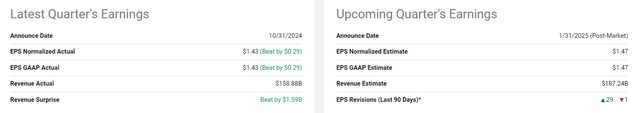

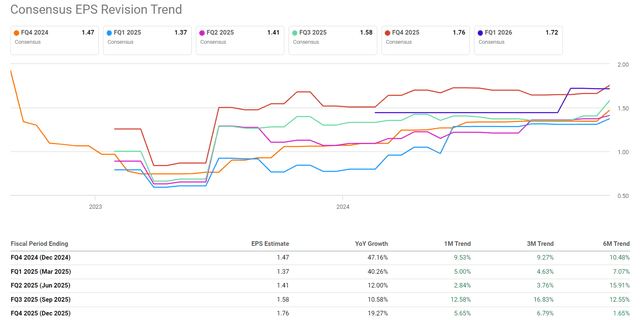

As a result, my prediction regarding a potential Q3 beating came true – the positive surprise magnitude was actually way bigger than I expected, triggering massive Q4 EPS/sales revisions to the upside:

It is crucial to say that AWS’s growth accelerated – growing 19.1% YoY to reach a $110 billion annualized run rate – as customers have been adopting the cloud and demand for AI has grown. The segment’s operating income jumped 50% YoY to $10.4 billion, with an operating margin of 38.1%. Compare that to Google Cloud’s (GOOG) (GOOGL) EBIT margin of 17% and you’ll figure out who’s still the ultimate leader of the cloud market right now:

Statista [updated November 1, 2024]![Statista [updated November 1, 2024]](https://static.seekingalpha.com/uploads/2024/11/21/49513514-17321769600385451.png)

AWS’s stance – including the firm’s association with Nvidia (NVDA) and its AI infrastructure investments – should make it ideally positioned to tap into the market demand for generative AI, in my view.

Amazon’s advertising business, too, did exceptionally well during Q3 with revenue of ~$14.3 billion, an 18.8% rise year-over-year. Because AMZN can provide targeted ads for its entire ecosystem, a diverse set of brands have come to utilize the company’s services, driving its growth. As Goldman Sachs analysts noted in their post-earnings report (proprietary source, November 2024), AMZN’s advertising segment continued to outperform the industry’s growth rates and expanded into new areas such as long-form video and ad tech. International profitability improved, particularly in mature markets such as the UK, Germany, and Japan, benefiting from cost efficiencies and higher advertising contributions.

It looks like Amazon’s innovative use of generative AI for advertising, including AI-based creative tools, has further augmented its products, giving advertisers more efficient methods of reaching consumers. I don’t think this competitive advantage of Amazon should disappear any time soon.

The company has an attractive balance sheet, with cash and marketable securities at $88.1 billion as of the close of Q3 2024. Also, Amazon has reduced its overall debt to ~$54.9 billion – a testament to its emphasis on financial flexibility. The free cash flow for the quarter also increased dramatically, reaching $8.4 billion and marking the 6th consequent quarter of FCF profitability:

Seeking Alpha, AMZN’s CF statement

That robust cash flow generation allows Amazon to spend on growth projects, including expanding its fulfillment channel and improving its technology, so I think the profitable growth we’ve seen in the recent past is just the beginning despite higher CAPEX expectations.

By the way, since I’ve touched upon expectations, I should say a few words on the management’s updated guidance, which, I think, was more than solid this time.

Amazon’s management has issued a sales forecast of $181.5-188.5 billion (7-11% YoY, including negative FX impact) and an operating profit forecast of $16-20 billion (+36.4% YoY) for the 4th quarter of FY2024. This new guidance was a big positive surprise on the Street, as seen in the data GS provided:

Goldman Sachs, proprietary source

The company should reap the rewards of the holiday season as strong consumer demand and continued operational efficiencies support profitability. We can’t ignore Amazon’s ability to exceed market expectations, particularly in terms of operating leverage and profit growth, so the positive revisions that followed after this strong guidance seem to be fully justified.

So the primary question for investors following such a strong quarter is: What’s next? Can the stock continue to grow? Amazon is already a leader in numerous market niches, and its market cap of over $2 trillion might seem daunting. I disagree with this perspective and believe Amazon has significantly greater growth potential than many skeptics might anticipate.

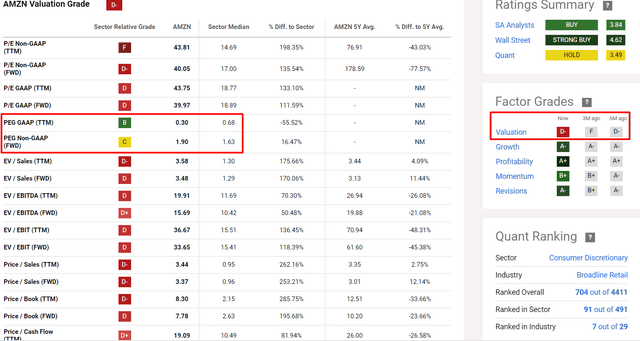

Yes, if we look at Seeking Alpha’s Quant Rating, the company’s valuation multiples are well above the sector’s medians – by a factor of two to three for certain ratios. However, over the last three months, AMZN’s Valuation grade has improved from an “F” rating to a “D-” rating. I believe this improvement is largely due to the improved PEG multiple, which is weighting P/E by the EPS growth. It currently stands at 0.3x based on the TTM basis – 55% lower than the sector’s norms right now:

Seeking Alpha, AMZN, notes added

Amazon’s PEG ratio is expected to rise to 1.9x next year. However, I believe the actual PEG multiple will be significantly lower next year because the market is currently pricing in only 20% EPS growth in 2025 against a P/E multiple of around 33x. I anticipate that the actual growth will be considerably higher as Amazon’s ecosystem continues to capture still-underserved niches while keeping its cost control strictly in place.

Valuation multiples are just one method to gauge whether a stock might be undervalued, whether compared to its historical norms, industry standards, or similar peers. However, Amazon is truly one of a kind – peers are very hard to find. At the same time, the recent history can be misleading, especially after the company’s business experienced sharp fluctuations, leading to inconsistencies in past financials and multiples. So I believe it’s time to update my fair value model using discounted cash flows to better assess how much Amazon may be truly undervalued or overvalued today.

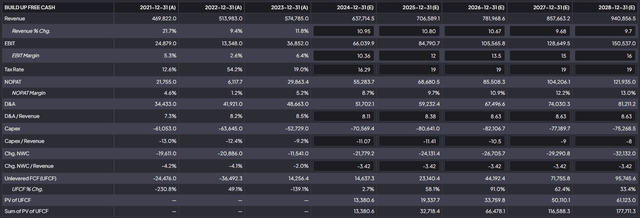

So, as I did in my previous article on Amazon, I’ll assume that the current consensus revenue growth expectations are accurate. However, I project that EBIT margins will exceed current consensus estimates – I believe that Amazon will achieve a 16% operating profit margin by FY2028 as its AWS business becomes an increasingly significant part of the consolidated structure. I’ll also assume a 19% corporate tax rate for the company, with CAPEX-to-revenue capped at 10-11% for the next 3 years, gradually declining to 8% by FY2028. Based on these assumptions, I have the following operating data:

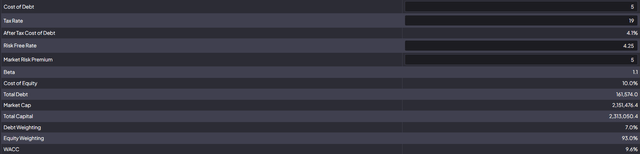

Assuming the same cost of debt (at 5%) and the same market risk premium (also 5%) as last time, I get a slightly higher WACC today (9.6% vs. 9.2%) because of the higher risk-free rate (4.25% vs. 3.86%). So the final model should become a bit more conservative:

Amazon’s 5-year median and 7-year median EV/FCF multiples are 43.5x and 47x, respectively. Given my assumption that the FCF margin has the potential to go even higher, I think it’s a fairly conservative assumption that the stock could trade at 45x EV/FCF by the end of 2028. This means that despite the increase in WACC, AMZN is still undervalued by the market today by 21.7%:

Before Amazon announced its Q3 2024 results and before the stock rose by more than 8% of my DCF model indicated an undervaluation of about 20.5% in early October. With the new input data on hand, the undervaluation has increased, which means that the stock has effectively become cheaper despite the price increase after the release of the results. For this reason, I believe Amazon deserves its “Buy” rating, even at its current price level of around $200/share.

Where Can I Be Wrong?

While I remain bullish on Amazon, there are points where my interpretation may be too optimistic.

First, my predictions for AWS and advertising growth don’t necessarily take into account Microsoft, Google, and Meta’s (META) fierce rivalry which may impact AMZN’s market share and margins. Plus, my projection of a 16% operating profit margin in FY2028 (in my DCF modeling) could get dented by regulation, increased cost, or changes in consumer habits that impact profitability and, as a result, Amazon’s valuation and stock price.

Second, if the capital expenditures and heavy investments Amazon is making in AI and its infrastructure do not pay off as expected, my expectations for the company’s FCF margin growth may not materialize. The stock price will be affected as a result.

Third, I might underestimate execution risks simply because I believe that Amazon can beat the competition on innovation and efficiencies. The company’s growth strategy, including investment in fulfillment and AI, requires perfection – any major mistakes, like delays in deploying technologies or operational inefficiencies, may undermine overall growth and profits.

The Bottom Line

Despite the above risks, I believe the company’s investment in AI and its capacity to leverage its massive data stores will play as important tailwinds to further fuel its market expansion and competitiveness. Over the past years, we saw that Amazon can seize on opportunities as the market continues to evolve and reinvent itself in order to deliver shareholder value.

I believe investors shouldn’t be deterred by Amazon’s current high valuation multiples, such as its P/E ratio and other metrics. Instead, they should focus on the company’s fair value. I think Amazon has significant potential to expand its current EBIT margins, which I consider relatively low, providing a strong base for future growth. If my forecasts, detailed in the DCF model above, are realized, the current price will seem a bargain even for medium-term investors.

This is why I’ve decided to maintain my “Buy” rating following the Q3 FY2024 report.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!