Summary:

- Amazon is not perceived as a high-growth company anymore, but it has massive opportunities to invest in profitable ventures.

- These growth opportunities are highlighted by the CEO in his recent letter to shareholders.

- I expect that Amazon Marketplace will perform better, AWS earnings will improve, and the company will benefit from its AI investments.

- The stock price is not reflecting the company’s growth potential. Therefore, I assign a “Buy” rating to the stock.

alexsl

Introduction

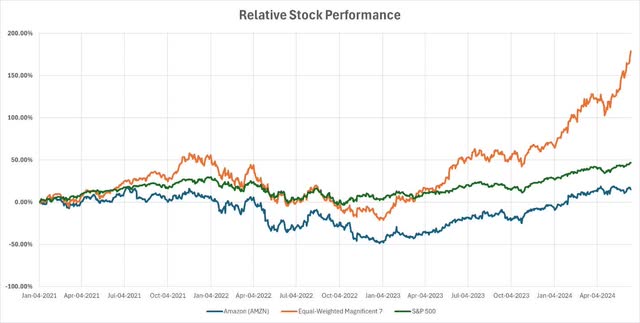

I have been following Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA) for a long time. Although the stock price has surged, the company has not participated in the AI-mania like other technology stocks have. However, I believe Amazon has growth opportunities that are at least as interesting as those of the other Magnificent 7.

While the core business is often viewed as the Amazon Marketplace, Amazon has been investing in other high-growth and high-profitability areas. I believe the company is seeing and will continue to see benefits from these investments.

However, it appears the market is not convinced that these opportunities will materialize, leading to a valuation pressured by unjustified concerns. Combined with the observation of current valuation multiples, I think the stock is undervalued.

I believe this is a great buying opportunity, and am assigning a “Buy” rating to Amazon.

Business Description

Even though the Magnificent 7 might not require a detailed review of their businesses, Amazon has arguably changed the most among these companies in the last decade. That’s why I want to make sure we understand the business fully. It is not only an online marketplace anymore.

The company defines itself as “the world’s most customer-centric company”. It aims to achieve this through its services in the Amazon marketplace, electronic devices, Amazon Web Services [AWS], and other offerings. Electronic devices include Kindle, Alexa, Echo, Fire Tablet, Ring, Blink, and more.

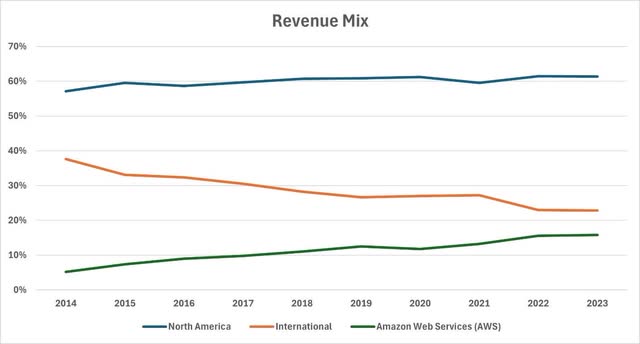

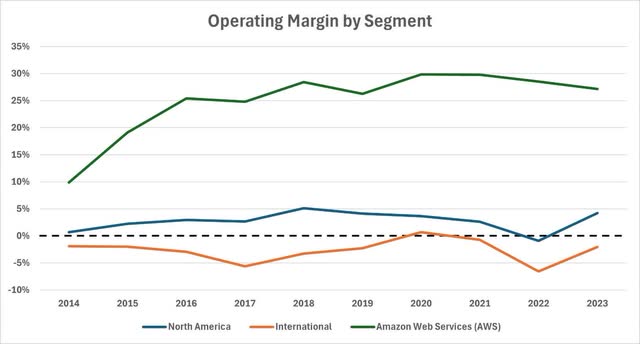

The business has three operating segments: North America, International, and AWS. All non-AWS activities (online stores, physical stores, third-party seller services, advertising services, subscription services, etc.) are categorized into the two geographical segments.

The North America segment has allowed the company to build its cash base and expand into other geographies and business areas. It generates more than 60% of total revenue and has historically been a profitable business with operating margins typically between 0% and 5%.

On the other hand, the international segment has historically not contributed to the company financially. While establishing its presence in different regions in the world, Amazon failed to turn this expansion into a profitable business. Additionally, this is a lower-growth segment compared to the other two, leading to a decline in revenue mix in the last decade. This segment now generates slightly more than 20% of total revenue.

The last and potentially most interesting segment is AWS. It offers a broad set of technology services, including machine learning, storage, database, computing, and analytics. This segment has grown significantly over the last decade. It generated around 5% of the company’s total revenue in 2014. Now, this number is close to 20%. Additionally, it is by far the most profitable segment out of the three. Operating margin has reached 30% in 2020, and has mostly been between 25% to 30%.

The revenue mix and operating margins by segment over the last decade are shown below:

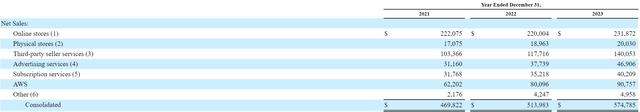

Additionally, Amazon provides a breakdown of its products and services included in the North America and International segments. Based on net sales, the biggest business remains the Amazon online marketplace, followed by AWS, with advertising and subscription services trailing.

With AWS generating a larger portion of total revenue and its operating margin increasing, Amazon has ensured a steady growth in earnings. With its growing asset base, the company’s adjusted return on assets remained stable slightly above 10%.

Stock Performance

After the surge in stock price right after the pandemic, Amazon stock has mostly been flat. It has massively underperformed its peers in the Magnificent 7 and the broader S&P 500 index.

I believe there are two main reasons for this. The first is Amazon’s little exposure to new technologies. We will discuss this further in the growth section, but essentially, Amazon was not perceived to be as exposed to high-growth technologies as its peers. Most of Amazon’s revenue still comes from the online Amazon marketplace.

Secondly, its exposure to end consumers made the investors concerned after the initial surge in spending right after the pandemic. Economists started talking about a potential recession more. An economic slowdown would mean reduced consumer spending, and therefore fewer product sales on the Amazon marketplace. Although this has not materialized, concerns regarding this still exist, putting pressure on the stock price.

Big Growth Opportunities

I have a more optimistic perspective on Amazon’s growth opportunities compared to the broader market. While investors have not seen it that way, Amazon is a big tech company and is a part of the Magnificent 7. It has a lot of cash, and many growth opportunities to utilize it.

I’ll break down this section into smaller subsections.

Amazon Marketplace

Investors remained concerned about Amazon’s core business, selling products online. Although there have been no company-specific developments that would lead to a decline in Amazon’s competitive position in retail and third-party sales, the macroeconomic outlook wasn’t attractive.

Inflation was the main concern. As the US experienced the highest inflation since the 80s, analysts expected a decline in consumer purchasing power and therefore, consumer spending. The Fed has taken substantial measures including hiking the interest rates aggressively to battle inflation, and it seems to be coming down. In May 2024, inflation in the US was at 3.3%.

Concerns regarding consumer spending have not materialized. If I had to show one reason, I would point to unemployment metrics. Despite high rates, unemployment remained low. People still have paying jobs, keeping the consumers strong.

Additionally, now that inflation has been high for a while and seems to be in a declining trend, consumers are adjusting. They are getting used to the current prices, making their spending habits return to normal.

To conclude, with the sustained dominance of the Amazon Marketplace in e-commerce, I expect the company to benefit from upcoming macroeconomic developments.

Artificial Intelligence

Contrary to popular belief, Amazon is investing heavily in AI. CEO Andy Jassy discussed this extensively in his recent letter to shareholders. While the attention has been on ChatGPT and other Generative AI applications since 2022, Amazon enables others to work on AI, just like it enables other companies through AWS.

The CEO highlights three different layers of generative AI (GenAI) that Amazon is investing in.

The bottom layer focuses on providing the computational power and software needed to build and train AI models. This also includes custom AI training chips. The middle layer is for customers who want to leverage existing foundation models and customize them with their own data. Customers can build and scale GenAI applications using Amazon Bedrock. The top layer involves building a variety of GenAI applications across Amazon’s consumer businesses. One example is Rufus, which is an AI-powered shopping assistant.

Amazon is not only using AI to improve its customer experience, but also provides the infrastructure for other businesses to build AI applications, either by training their own models or leveraging existing ones.

These initiatives position Amazon as a leader in AI technology and drive more business for AWS, which is a much more profitable segment than the Amazon Marketplace.

Other Growth Areas

Amazon is a huge business with many products and services. The company is focusing on innovation and expansion in many ways.

The company is investing in Prime Video for more exclusive content and launching satellites into space to commercialize its Project Kuiper, which aims to provide broadband connectivity.

Additionally, AWS remains a major growth area with innovations and more companies using this digital infrastructure for AI capabilities.

Moreover, the company’s advertising revenue is growing significantly. This is driven by the growth in existing channels to consumers, and the introduction of ads in Prime Video.

There are also many other potential growth areas, such as projects in affordable housing, investments in AI startups, and ventures into the Indian streaming market. However, these areas currently contribute less to the overall business.

The Most Recent Earnings Call and Guidance

Amazon released its first quarter results at the end of April 2024. Sales increased year-over-year by double digits in all segments. International business was profitable in terms of operating income, and the North America segment’s operating income increased from $0.9 billion to $5 billion. AWS was what made the headlines. Its operating income jumped from $5.1 billion to $9.4 billion. Operating cash flow increased 82%.

The CEO talked about how AWS’s AI capabilities are accelerating growth, which was apparent in the financials.

Management guidance shows another double-digit growth year for the business, excluding the impacts of foreign exchange rates.

Strong Cash Position

Amazon had $85 billion in total cash and short-term investments at the end of March, 2024. This is close to an all-time high for the company. I expect maintenance capex to be around $125 billion, with cash earnings exceeding this figure before accounting for obligations, including capex. This means that the company has plenty of cash to spend on growth.

Additionally, I would not be surprised if Amazon announced share repurchases or dividends. Investors might interpret this as a signal of limited growth opportunities, but I do not think so. It is not easy to invest this amount of cash profitably. I think there might come a time when Amazon returns more direct value to shareholders soon. This would affect the stock price positively.

Why These Opportunities Are Not Priced In

I believe the future is bright for Amazon, but the market seems to disagree despite the recent surge in the stock price.

Below is the historical adjusted price-to-earnings multiple of the Amazon stock. It appears that the market sentiment dipped in 2022 and is now improving. However, the market is still concerned about an economic slowdown impacting the core business and Amazon being left out of AI. Despite massive near-term growth opportunities, P/E has not moved past historical levels. I believe it has the potential to reach all-time highs.

One might argue that assets matter the most for Amazon as they need a lot of warehouses, other facilities, and inventory to run their core business, and therefore P/B makes more sense to look at. You can find the historical adjusted price-to-book multiple below.

This shows a very similar pattern. It dipped in 2022 and recovered a little in 2023. I believe with these high-growth high-profitability opportunities, Amazon has a strong chance to improve its return on assets and grow fast at the same time. Based on these expectations, this multiple should surpass its historical average.

Conclusion

I believe Amazon is severely misjudged, and despite the recent increase in the stock price, it is still far away from its fair price.

There are huge growth opportunities including but not limited to artificial intelligence capabilities and growth of the core business in North America and internationally. Amazon has a strong balance sheet to invest in high-growth areas, and at the same time return value to shareholders through dividends and share repurchases.

I believe the current valuation does not reflect these opportunities. Therefore, I assign a “Buy” rating to Amazon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.