Summary:

- Amazon’s Q1 results showed strong revenue growth across all metrics and business lines, showcasing the company’s fundamental strength.

- Amazon has the most ambitious R&D and CapEx plan for AI among all the technological hyperscalers, which puts it in the pole position of the AI race.

- Amazon’s valuation suggests a compelling investment opportunity with 20% upside potential.

FinkAvenue/iStock Editorial via Getty Images

Introduction

I had a ‘Strong Buy’ thesis on Amazon (NASDAQ:AMZN) stock in February. The stock appreciated by almost 6% since then, compared to a 3% increase in the S&P 500. In my earlier analysis, I emphasized several Amazon’s fundamental strengths, including leadership in cloud and unmatched market share in the U.S. e-commerce market, and promising endeavors in artificial intelligence (‘AI’). Today, I want to share my insights covering key developments around these strengths and update my valuation analysis. There are also some mitigating factors, but I think that growth prospects and the upside potential are worth taking these risks. Since I believe that Amazon continued improving its fundamentals over the last three months and the valuation is still compelling, I am inclined to reiterate ‘Strong Buy’ rating for AMZN.

Fundamental analysis

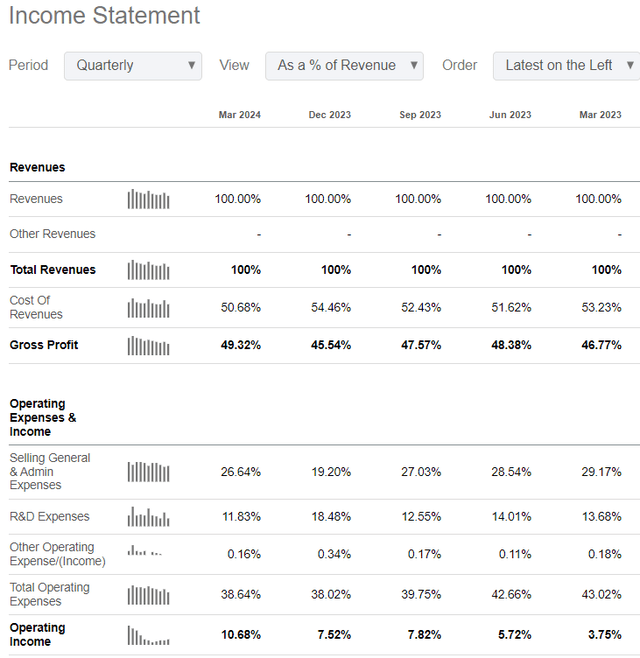

The most important development since my previous article is Q1 earnings release. Amazon delivered positive earnings surprise, which improved the market’s sentiment around the stock. Revenue rose by 12.5% YoY and the adjusted EPS more than tripled, from $0.31 to $0.98. The bottom line improvement was achieved due to strong operating leverage, with both gross and operating margins expanding YoY.

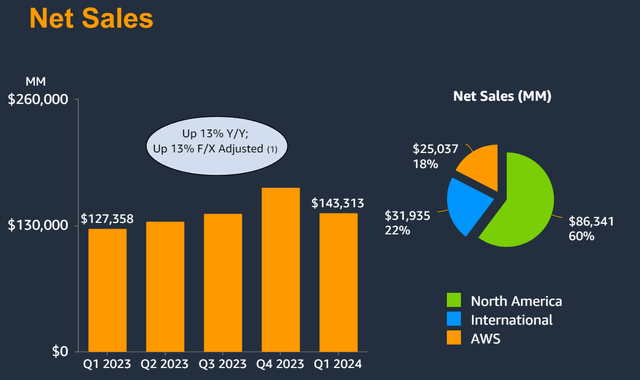

I want to highlight key top line developments because when revenue grows across various dimensions and business lines, it signals bullishness. This shows that the company does not rely solely on one or two key growth drivers, but instead leverages a well-rounded revenue mix. This increases resilience to potential external shocks. From segments’ perspective, AMZN’s revenue grew both in North America (up 12% YoY) and International (up 10% YoY). Amazon’s most important growth driver in recent years, the AWS, delivered a robust 17% YoY growth to $25 billion.

Revenue dynamic was strong across all key business lines. Amazon delivered growth both in Services (17% YoY) and Product (7% YoY). Revenue from digital advertising increased by 24% YoY to $11.8 billion. Physical stores sales, online sales, and Prime all delivered YoY revenue growth as well. As we see, revenue growth momentum is solid across all key streams.

For forward-looking analysis, let me return to segments. Amazon’s commands a 37.8% global market share in e-commerce, which makes it a dominating power in the field. Being a pioneering e-commerce company gave the company a solid advantage, which was widened thanks to Amazon’s massive investments in innovation. I believe that Amazon’s position in the global e-commerce is intact because it has an unmatched ecosystem involving 310 million active users and 2 million active sellers. Therefore, Amazon’s e-commerce business is likely to enjoy positive secular shifts as the global market is expected to compound with a 15.8% CAGR by 2029.

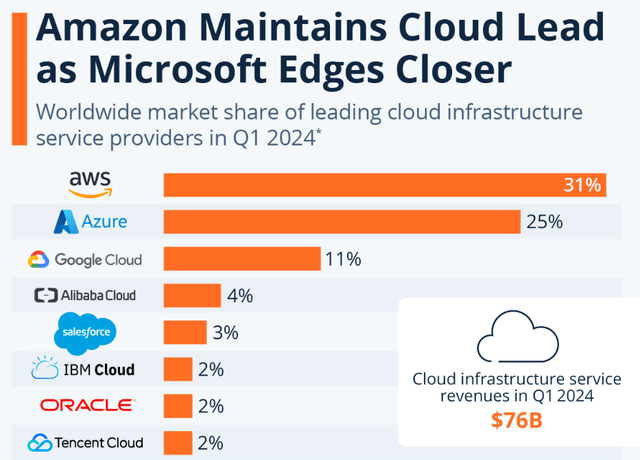

Moving on to the company’s star, the cloud business. AWS continues to hold the crown in the global cloud infrastructure market with a 31% market share. All key service providers in cloud are currently in the AI race, each of the players ramping up their investments in data centers. Amazon plans to invest up to $150 billion in its data center infrastructure over the next decade, and it is the most ambitious plan moneywise I have seen so far from tech hyper-scalers.

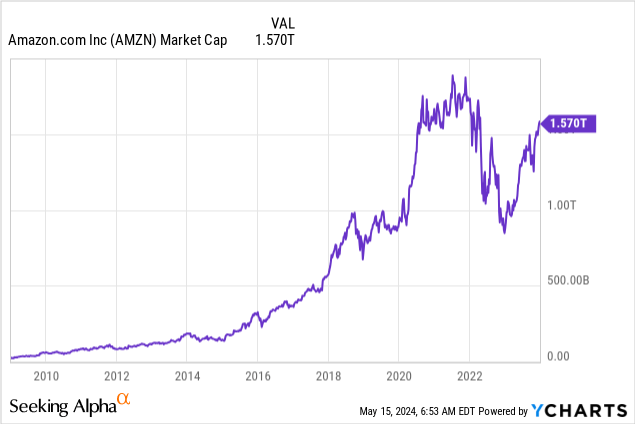

For any company, investments of such a scale are risky because there is always a possibility that the investment could not pay back. However, Amazon is well-known for high efficiency of its investments. Over the last 15 years, since 2009, Amazon invested in R&D around $400 billion. Amazon’s market cap increased from around $30 billion to $1.7 trillion over the same period. Thus, the company has a stellar record of converting R&D investments into value for shareholders.

That said, AWS’s growing investments in CapEx and R&D is likely to aid in supporting growth momentum for the company’s cloud business. Apart from investing in CapEx and internal R&D, the company also recently increased its investment in Anthropic by $2.75 billion. Anthropic is considered to be one of the closest competitors to the market leading OpenAI, and it recently launched its Claude chatbot in Europe, supporting various languages like French, Spanish, German, and other. As part of Amazon’s AI strategy, the company also launched a partnership with South Korean startup called Upstage to add its small language model called SOLAR MINI on AWS.

Amazon also released new features to Amazon Bedrock recently. New additions will help customers to streamline to develop advanced generative AI applications. Bedrock currently offers a wide selection of foundation models including AI21 Labs, Anthropic, Cohere, Meta, Mistral AI, and Stability AI. This variability ensures seamless deployment, scalability, and continuous optimization.

The company continues investing heavily in its major star, the AWS. Investments appear to be quite efficient as the company constantly adds new features and capabilities to its all cloud and AI offerings. Fresh information that AWS CEO Adam Selipsky is stepping away from his position soon does not look like a problem to me because he will be replaced by Matt Garman. According to Mr. Garman’s LinkedIn profile, he has been with AWS since 2006 and has been on top level positions since 2013. This means that he has been an important part of the AWS team that made the company the largest cloud player in the world.

Valuation analysis

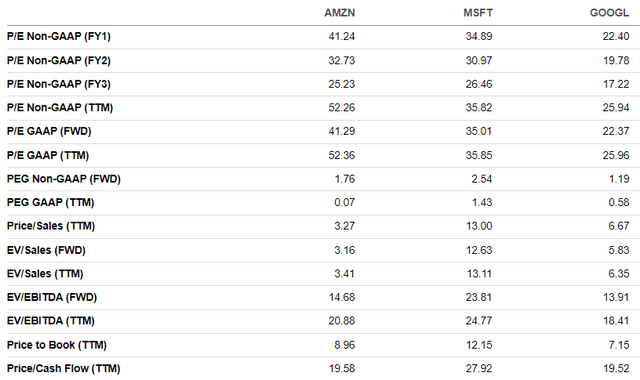

It is quite difficult to conduct peer ratios analysis for Amazon because the company does not have peers. There is no other company that holds rock-solid leadership in two large and emerging industries. However, I can compare Amazon’s multiples with its closest rivals in cloud business: Microsoft (MSFT) and Google (GOOG)(GOOGL).

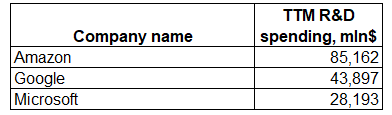

Amazon looks attractively valued compared to peers if we look at Price/Sales and Price/Book ratios. The company’s TTM Price/FCF ratio also is in line with Google and notably lower compared to Microsoft. AMZN’s P/E ratios are substantially higher than peers’, but readers should not be misled by it. Amazon is well-known for its aggressive investments in R&D, which weighs on the bottom line but is one of the reasons why the company commands undisputed market leadership in the cloud. On a TTM basis, Amazon invested in R&D almost two times more than Google, and about three times more than Microsoft. Therefore, comparing P/E ratios might be misleading in our case.

Compiled by the author

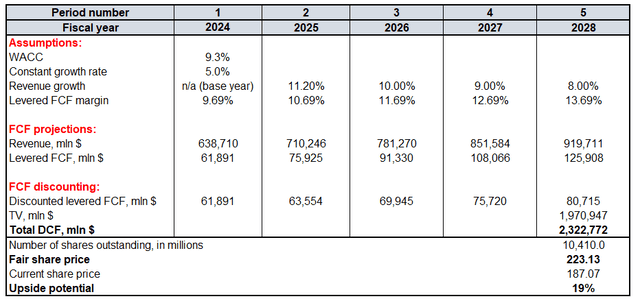

Conducting a discounted cash flow (‘DCF’) analysis will help me calculate AMZN target price and the upside potential. Amazon’s cash flows will be discounted using a 9.3% WACC. For FY 2024-2025 revenue, I rely on analysts’ consensus estimates. For the years 2026-2028, I expect a steady natural growth deceleration. I use a 5% constant growth rate for stocks with strong AI exposure, and my reasoning is explained in details in my recent analysis of Super Micro Computer (SMCI). I use 9.69% TTM levered FCF margin for the base year and expect that Amazon will convert around 10% revenue CAGR into at least 100 basis points FCF expansion per year. According to Seeking Alpha, there are 10.4 billion AMZN shares outstanding.

The fair share price is $223, according to my calculations. This is 19% higher than the current share price, indicating a compelling upside potential. The updated target price is higher than my earlier $208 estimate. The upgrade is explained by the notably improved TTM FCF margin, which also affected FCF projections for the years 2025-2028.

Mitigating factors

Having dominating positions in e-commerce and cloud not only gives AMZN strong strategic positioning, but also means the company faces substantial antitrust risks. For example, the U.K. Competition Market Authority (‘CMA’) has recently announced an inquiry into the partnership with Anthropic, raising questions about potential adverse effects on competition within the U.K. market. It is difficult to assess the magnitude of this risk currently, but it is unlikely that the partnership might be disrupted by antitrust scrutiny. However, dealing with this scrutiny might mean higher legal and consulting costs for AMZN, which are likely not budgeted.

Microsoft and Google continue gaining market share in cloud, posing risks to AWS’s leadership. The risk is remote because the gap between AWS and Azure in terms of market share is still wide, six percentage points. However, the YoY dynamic indicates that competitors expanded their market shares and AWS shrank. In Q1 2023, Azure had a 23% and Google Cloud had a 10% market share, both lower compared to Q1 2024 (last quarter’s market shares of key vendors highlighted in a screenshot for my fundamental analysis). The changes are not dramatic and, but the trend indicates the fact that AWS faces fierce competition.

Conclusion

Given several positive developments surrounding Amazon, particularly its flagship AWS, I believe the company’s fundamentals have further improved compared to my initial analysis. My DCF model suggests that there is still around 20% upside potential, and this looks like a compelling investment opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.