Summary:

- Amazon reported better than expected Q3’24 earnings, driven by strength in e-Commerce, but especially in Cloud.

- Amazon beat both top and bottom-line earnings by wide margins. The biggest take-away from the earnings report was that AWS-related operating income is surging.

- The firm’s guidance for Q4 is solid. The fourth-quarter includes shopping events like Black Friday as well as the Christmas holidays which should lead to a boost platform spend.

- Shares of Amazon are the most expensive in the big tech group, but have potential for top line and operating income growth.

- I see a long term (FY 2027) fair value of $325 per-share, driven by growth in Amazon Web Services.

AdrianHancu

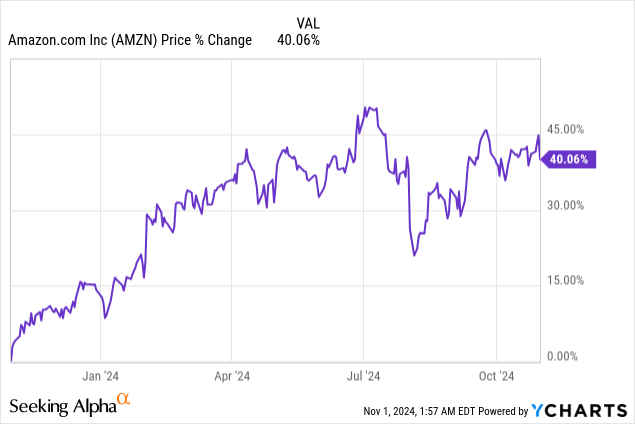

Shares of Amazon (NASDAQ:AMZN) soared 6% and closed in on $200 after the e-Commerce and Cloud company reported better than expected third-quarter results on Thursday. I was especially impressed with Amazon Cloud segment which is seeing strong (operating income) growth and I see considerable upside potential if Amazon keeps performing at its current level. Shares, although they have delivered strong returns so far in the last year, could revalue higher on incremental operating income gains and strength in consumer spending which would chiefly benefit the e-Commerce business. Amazon’s guidance calls for up to 11% top line growth year-over-year in Q4’24 and shares have considerable upside revaluation potential.

Previous rating

I rated shares of Amazon a strong buy in my last work on the retail giant in August — This Is The Time To Be Greedy — due to its dominant position in Cloud and an impressive overall performance in e-Commerce. I believe that AI opportunities are going to define the direction of Amazon’s shares going forward, and the company is well-positioned to utilize AI technology in its Cloud business to help corporate customers achieve their productivity goals. I also see a strong case for operating income upside, especially in Amazon Web Services. With a strong holiday season likely on the horizon, I expect shares of Amazon to advance to new highs in the coming months.

Amazon beat Q3’24 expectations, Amazon Web Services on track to achieve $50B in operating income in FY 2025

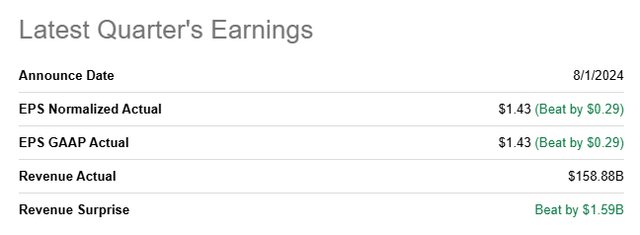

Amazon beat top and bottom-line expectations for its third-quarter on Thursday by big margins: the retail and Cloud company reported adjusted earnings of $1.43 per-share for Q3’24 which beat the consensus estimate by $0.29 per-share. The top line came in at $158.9B, beating the average prediction by $1.6B.

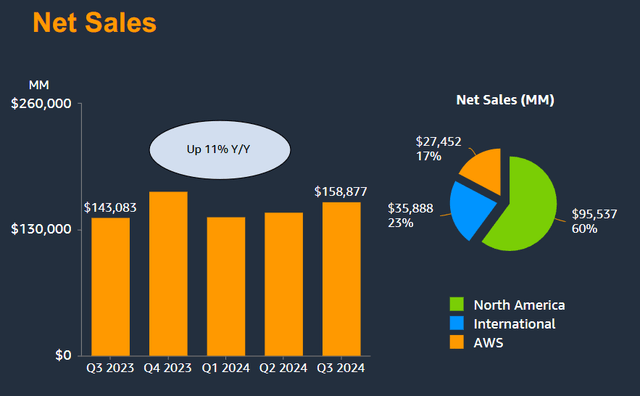

Amazon delivered very satisfying results in both the e-Commerce and the Cloud business. In total, the e-Commerce giant reported revenue of $158.9B, showing 11% top-line growth and a 1 PP revenue growth acceleration compared to the second-quarter. Amazon also out-performed its Q3’24 revenue guidance of $154.0-158.5B by approximately $400M. Amazon benefited from strong growth across its business segments, with Amazon Web Services growing the fastest (+19% Y/Y), followed by International e-Commerce (+12% Y/Y) and e-Commerce North America (+9% Y/Y).

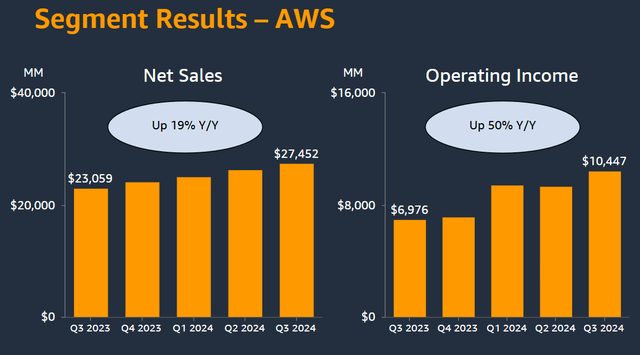

Amazon Web Services is crushing it right now in terms of revenue and operating income growth. In the third fiscal quarter, Amazon generated $27.5B in revenue from its Cloud offering, showing 19% year-over-year growth. Compared to the year-earlier period, Amazon saw a 7 PP growth acceleration here. This segment benefits from a growing customer base as well as enhanced service offers that include the use of AI technology.

The most important take-away from the earnings release was that the segment’s operating income is growing almost two-and-a-half time as fast as its top line, which is boosting Amazon’s total consolidated operating income growth. In total, Amazon earned $17.4B in operating income in the third-quarter, showing 55% year-over-year growth and the majority of this growth comes from Amazon Web Services.

Amazon Web Services’ revenue and operating income trends looks like this:

|

in $ billion |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

|

Revenue |

$23,059 |

$24,204 |

$25,037 |

$26,281 |

$27,452 |

|

Y/Y Growth |

12% |

13% |

17% |

19% |

19% |

|

Operating Income |

$6,976 |

$7,167 |

$9,421 |

$9,334 |

$10,447 |

|

Y/Y Growth |

29% |

38% |

84% |

74% |

50% |

(Source: Author)

On an annualized basis, Amazon Web Services is set to achieve $110B in revenues. With the current growth that the segment is experiencing (~20%), Amazon Web Services could generate $125-130B in revenue in FY 2025.

Amazon’s growth in AWS is also extremely profitable: in the September quarter, the segment’s operating income margin reached 38% compared to 30% in the year-earlier period. If my revenue target for FY 2025 is valid ($125-130B) and Amazon maintains its current margin profile, then Amazon could be on track to achieve $47.5-49.5B in operating, just from Amazon Web Services.

Guidance for Q4’24

Amazon expects to earn $181.5-188.5B in revenue in the fourth-quarter, implying up to 11% growth. Since the fourth-quarter includes shopping holidays like Black Friday, I believe Amazon has a good chance of out-performing even the top-end of its guidance.

Road to $325

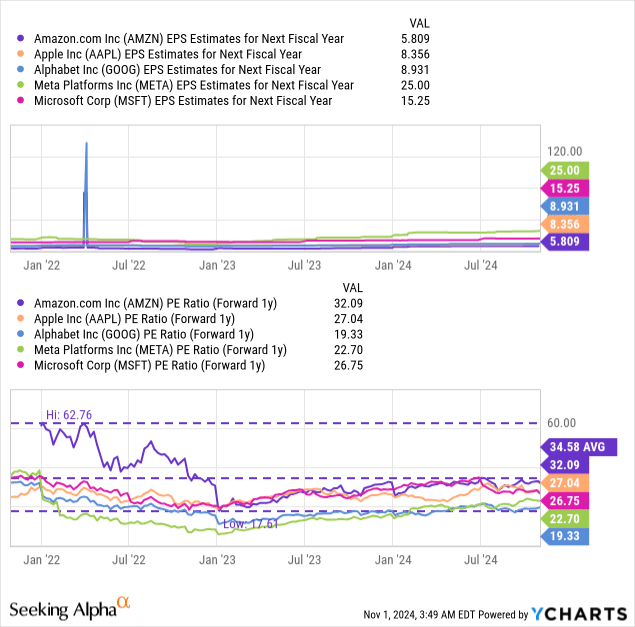

Shares of Amazon have seen a sharp revaluation to the upside in the last year and are therefore not cheap. In fact, Amazon is the most expensive big tech stock that investors can buy (excluding semiconductor companies).

Amazon is delivering actual, real-world operating income and earnings growth that can sustain further valuation gains, in my opinion. Amazon is currently valued at a forward P/E ratio of 32.9X, which is above the big tech group industry average of 25.5X. Now that we are in the fourth-quarter, typically a very good one for retail companies, I believe shares of Amazon could benefit from sustained valuation growth. Inflation has declined massively in the last several months, freeing up consumer spending that could especially help Amazon’s e-Commerce business.

In my last article, I stated that I calculated a twelve-months price target of $202 per-share for Amazon due to the company’s consistent growth in both its e-Commerce and Cloud business. This fair value target, which was based off of a fair value P/E ratio of 35X, has almost been reached (Amazon’s share price currently is $198). In the longer term, however, I expect Amazon’s shares to head significantly higher.

If Amazon grows its EPS at an average annual rate of 25% in the next three years, the e-Commerce company could be on track to earn ~$9.25 per-share in FY 2027 (calculated off of a base year FY 2024 estimate of $4.74 per-share). Applying a 35X fair value P/E ratio — which is about in-line with Amazon’s long-term average P/E ratio — implies a fair value of $325 per-share and a fair value market cap of $3.4T. The main catalyst that could lift Amazon’s shares to this valuation level, by the end of FY 2027, is the firm’s excellent operating income growth in Amazon Web Services.

Risks with Amazon

Amazon is focused on e-Commerce and Cloud operations, but e-Commerce still represents the biggest chunk of revenues (83%) for the company. So while the growth drivers of Amazon Web Services (growing demand for Cloud applications and workloads) seem to be intact, e-Commerce will continue to dominate Amazon’s revenue mix. A down-turn in the economy could therefore suppress Amazon’s EPS growth and potentially remove a potent valuation catalyst for Amazon’s shares.

Final thoughts

Amazon delivered an excellent earnings sheet for its third fiscal quarter on Thursday, and the company beat its own revenue projection (as well as consensus estimates). Amazon Web Services did especially well, making much progress in terms of growing its operating income. Amazon Web Services is crushing it here as the segment expanded its operating income margins to a massive 38% in Q3’24. Amazon could be on track to achieve $125-130B in annual revenues in Amazon Web Services next year, in my opinion, which, assuming a stable operating income margin of 38%, would calculate to operating income converging upon $50B annually (and likely more in the years that follow). Shares are not cheap, but I see a long-term revaluation case for Amazon, with operating income (margin) growth being the single biggest catalyst for the e-Commerce and Cloud company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOG, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.