Summary:

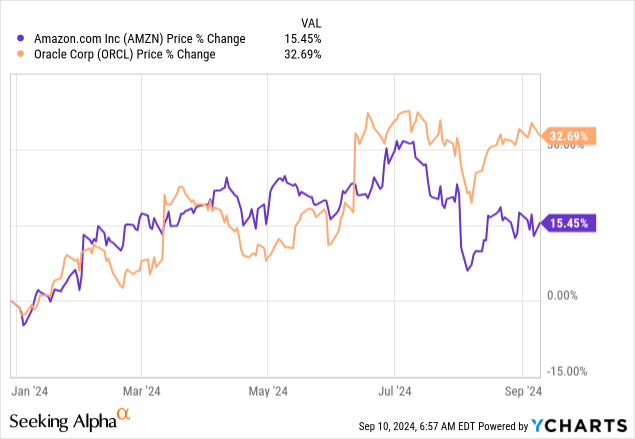

- Amazon.com, Inc.’s share price performance continues to disappoint relative to the broader equity market and other growth stocks.

- As revenue growth slows down, the market is repricing the stock to be more in-line with the achieved profitability.

- Pure-play companies in the cloud space are likely to remain a far better choice for investors.

georgeclerk

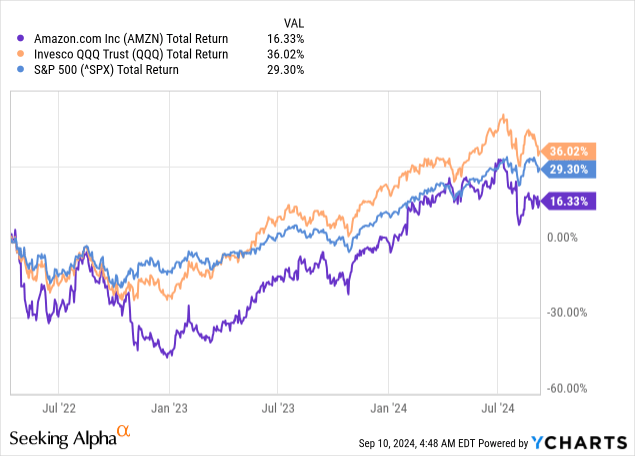

After years of spectacular returns, Amazon.com, Inc.’s (NASDAQ:AMZN) stock is no longer the exciting growth story that delivers above-market returns. Since April 2022, AMZN delivered a total return of only 16% while the S&P 500 and the Invesco QQQ Trust ETF (QQQ) had total returns of around 30%.

Although it is one of the largest enterprises in the world, AMZN is also significantly more exposed to market downturns. A very recent example of that was the bear market of 2022 when a wide performance gap opened between AMZN and the QQQ.

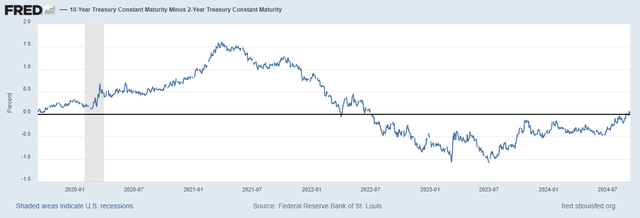

As of today, AMZN shareholders are once again faced with significant risks related to the broader equity market and the macroeconomic environment. The risk of a recession is by far the most important one, as the yield curve has already un-inverted.

I covered this risk in further detail in a recent thought piece on the Invesco NASDAQ 100 ETF (QQQM), where I laid out my bearish thesis for growth stocks more broadly.

Although this is a major risk that is likely to influence returns over the coming months, it is not the main reason why I remain skeptical on AMZN and am reluctant to rate the stock with a Buy rating.

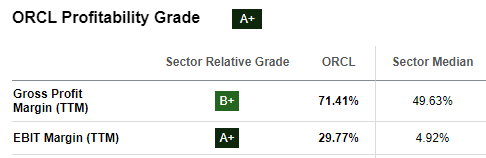

The business model cantered around the e-commerce business has been a significant advantage for the company, but could easily turn into a major drag for AWS, which is the reason I prefer to stick to pure-play companies like Oracle (ORCL). More importantly, Amazon now appears to be on a path to become a mature company, and this has important implications for shareholder returns going forward.

Growth Is Slowing Down

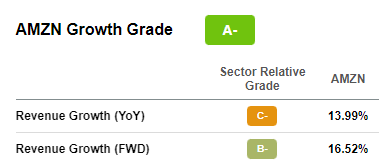

About two years ago, in June 2022, I wrote a balanced view on Amazon where I reconciled both bullish and bearish views on the company. Back then, AMZN was expected to grow at an annual rate of almost 17%.

Seeking Alpha

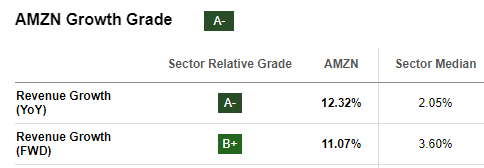

Growth expectations, however, have been normalizing in recent years and the company is now expected to grow at a much lower rate of 11%.

Seeking Alpha

Although it is still an impressive double-digit growth rate, it highlights the fact that many technology companies are finding it more difficult to grow at the rates, we have gotten used to during the 2020-21 period.

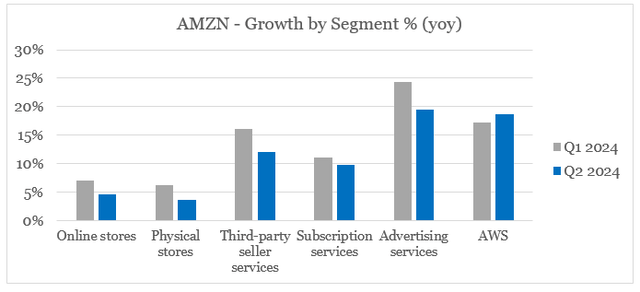

On a segmented basis, we could see that AWS continues to be the key revenue growth driver, alongside advertising services. Despite all the hype around the ad business, however, its quarterly year-on-year growth has slowed down meaningfully during the second quarter of 2024, while growth at AWS has gone in the other direction.

prepared by the author, using data from SEC Filings

Topline growth at online and physical stores has fallen below 5% which, in my view, is a cause for concern as the U.S. consumer spending remains healthy for now and inflation is still elevated. That is also the reason pure-play cloud players like Oracle continue to deliver better returns, and AWS could soon find itself at a major disadvantage over its peers.

Political risk for Amazon shouldn’t be ignored either, as Alphabet (GOOGL) (GOOG) now faces the risk of a break-up over its monopoly in several areas, including advertising.

Seeking Alpha

Not Getting A Higher Multiple

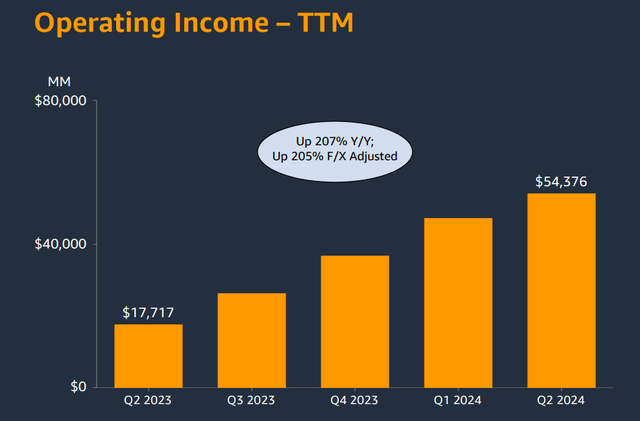

The good news for shareholders has been that Amazon was able to offset its declining top-line growth with improved profitability, and this could ultimately be beneficial for long-term investors.

Quarterly growth in AMZN’s operating income on a 12-month rolling basis has been very impressive, with profits exceeding $50bn.

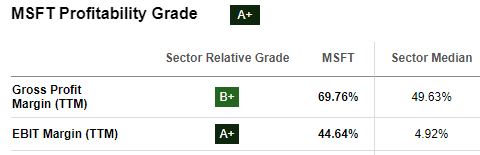

On a company-wide basis, this results in an operating margin of only 9% which shows that AMZN still has a long-way to go before it could match the profitability profile of peers, such as Microsoft (MSFT) and Oracle.

Seeking Alpha Seeking Alpha

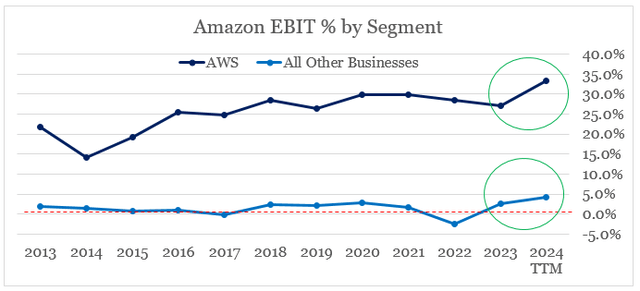

Provided that we do not experience a major economic slowdown over the coming year (a low probability scenario in my view), the next few quarters will be critical for Amazon’s profitability. The company would need to prove that record-high margins at AWS could be sustained and that all other businesses combined could deliver satisfactory profitability.

So far, profitability imbalances within AMZN remain a cause of concern as AWS continues to do the heavy-lifting. The recent jump in AWS margins is also likely to be unsustainable, as the rush to build generative AI models has created temporary supply demand issues that will gradually be resolved.

prepared by the author, using data from SEC Filings

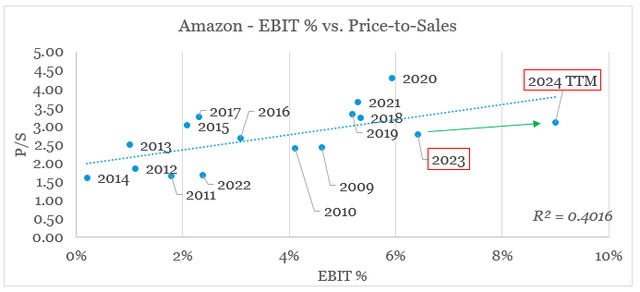

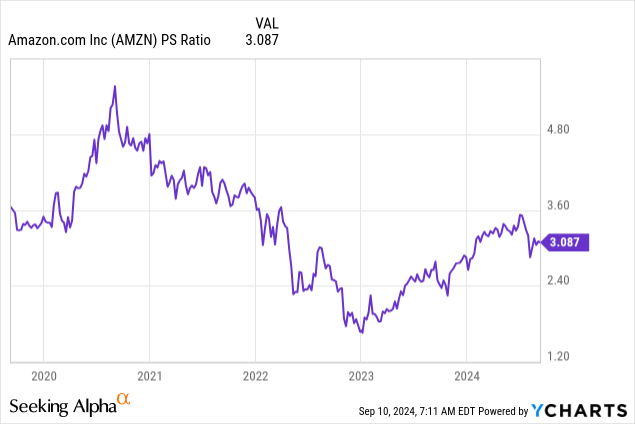

The market is also unimpressed with the recent jump in profitability, as it didn’t reward the stock with a notably higher multiple. This could be seen on the graph below where we could see operating margins increasing from FY 2023 to the current period and yet, the price/sales multiple has not changed much.

prepared by the author, using data from SEC Filings and Seeking Alpha

This leads us to one of the main problems that investors of Amazon are faced with — the limited potential for a multiple repricing. At the end of calendar year 2022, AMZN’s price/sales multiple hit rock bottom and shareholders needed operating margins to increase from 2% in FY 2022 to as high as 9% currently. What this shows is that unless growth accelerates once again, AMZN investors would need to assume continued improvements in profitability to justify above-market returns.

Conclusion

As Amazon’s business model matures, investors would need to be prepared for a change. Shareholder returns are likely to suffer as margins become the leading driving factor rather than topline growth. The recent improvement in profitability is a good starting point, but the market does not seem impressed, and for a good reason. Even if we put the risks for the economy aside, the Amazon stock is unlikely to outperform the market going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the technology sector?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.