Summary:

- Amazon investors are lining up for a potentially decisive breakout move, as investors accumulated following its remarkable Q3 results.

- AWS’s strategic positioning in AI and custom chip adoption has bolstered its market leadership.

- AWS’s ability to drive operating leverage growth through its massive CapEx investments could entrench its market leadership.

- AMZN’s forward adjusted PEG ratio of 1.78 isn’t excessive compared to MSFT’s metric.

- I argue why investors anticipating a further rally in AMZN should capitalize on its potential breakout move.

FinkAvenue

Amazon: Getting Closer To The Breakout Point

Amazon.com, Inc. (NASDAQ:AMZN) investors have performed well, notwithstanding the market pullback since its near-term peak in early October 2024. Therefore, the e-commerce juggernaut has outperformed the S&P 500 (SPX) (SPY) since my AMZN pre-earnings update, as I underscored its robust buying opportunity.

Therefore, AMZN buyers have helped lift the stock close to its July 2024 peak, although further buying advances have encountered a stiff resistance zone. Despite that, a lack of selling intensity (“B+” momentum grade) corroborates AMZN’s bullish thesis, as the Andy Jassy-led company demonstrated the strength of its market-leading hyperscaler business.

Arch-rival Microsoft (MSFT) has seen its stock struggle as the market reassessed its ability to monetize the surge in its AI growth CapEx. Notwithstanding the notable improvement in Azure’s revenue acceleration in the recently reported fiscal quarter, MSFT faces a potential slowdown, as telegraphed by its updated guidance.

Don’t Understate AWS’s Significant Profitability

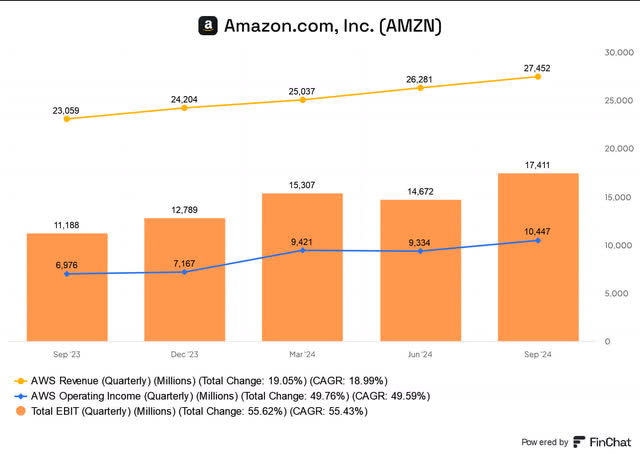

Amazon segment metrics (FinChat)

On the other hand, Amazon Web Services has upped the ante against its peers, demonstrating its massive scale, which has significantly increased its operating income. As seen above, AWS’s operating income accounted for 60% of the corporate operating income base. Amazon’s cloud computing business also showcased its ability to deliver substantial operating leverage. Accordingly, AWS posted an almost 50% surge in operating income, even though revenue increased by less than 20% YoY.

As a result, I’m not surprised by the robust performance of its cloud computing business. Although the growth profile of its US and International e-commerce business remains tepid, its advertising business has continued to shine. However, I assess that AWS has likely alleviated the market’s worries, which were previously concerned about whether it could compete with Google (GOOGL) (GOOG) or Microsoft in proprietary LLM developments.

Accordingly, AWS has astutely positioned it as a platform of choice for customers and developers seeking to utilize several AI models in their business. Microsoft’s decision to expand GitHub copilot’s offerings with more models from Google and Anthropic has likely validated Amazon’s strategic roadmap.

In addition, AWS’s massive scale across global data center regions positions it well to utilize custom chips widely, encouraging adoption by its customers. Amazon reported that over “90% of its largest EC2 customers utilize its custom Graviton CPUs.” In addition, management also highlighted the confidence in its custom AI chips, as the upgrade of Tranium2 is expected to provide improved TCO for its customers. Hence, the flexibility offered by Amazon Bedrock has likely convinced the market that the company has a comprehensive and competitive suite of hardware and platform services to help customers achieve improved performance and cost efficiencies.

Given the anticipated surge in costs required to set up massive AI clusters as training requirements become increasingly complex, AWS seems to have gained a timely competitive edge. Therefore, the growth inflection in AWS’s operating income is expected to underpin its structural advantage over its smaller cloud computing peers.

Consequently, I assess that the acceleration in AWS’s growth is expected to continue. The company’s ability to achieve a “triple-digit” percentage growth in AI revenue should propel it into a multi-billion dollar business moving ahead. Notwithstanding AWS’s annualized revenue run rate of $110B in Q3, its ability to capitalize on its scale to drive further growth through AI is remarkable. Therefore, I assess that it should sustain Amazon’s significant CapEx outlook of $75B for FY2024, validating its market-leading scale over its smaller peers. Management also highlighted its confidence that its AI revenue could experience a similar growth trajectory as AWS in the early days, corroborating the market’s bullish sentiments. Andy Jassy articulated:

The same was true with AWS. If you looked at our margins around the time you were citing, in 2010, they were pretty different than they are now. I think as the market matures over time, there are going to be very healthy margins here in the Generative AI space. (Amazon Q3 earnings conference)

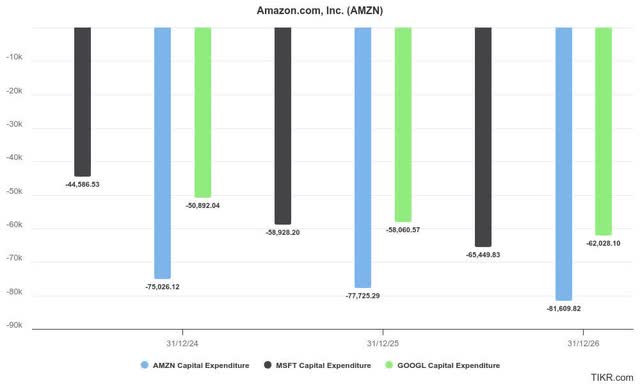

Consequently, I assess that the market has raised its optimism that Amazon is increasingly well-primed to leverage its IaaS scale to compete more effectively with its peers. It should also afford more opportunities for Amazon to invest more aggressively in its core e-commerce business, even as it faces an increasingly competitive landscape. Given the recent regulatory headwinds, PDD’s (PDD) Temu has intensified its rivalry with Amazon as the Chinese e-commerce leader seeks to renew its growth commitment in the US. Moreover, the resilience of the US economy has likely bolstered the confidence of AMZN investors, bolstering consumer spending as we step closer to the year-end holiday season. Hence, Amazon seems to be firing on all cylinders, even as it anticipated an upgrade to its CapEx outlook in 2025. Despite that, the market seems convinced that AWS has demonstrated its ability to enhance its operating leverage while seeking increasingly profitable opportunities to monetize AI.

Amazon’s CapEx Scale Helps Underpin Its Operating Leverage Growth

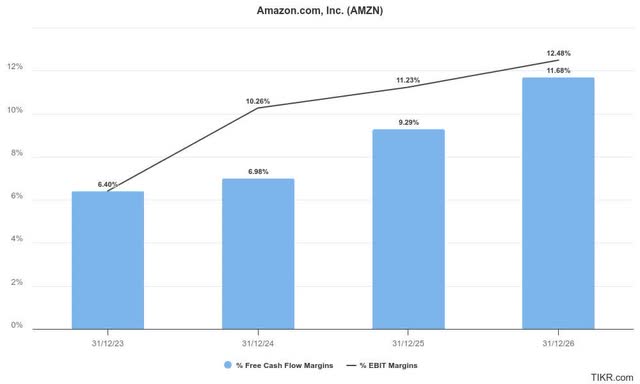

Amazon profitability estimates (TIKR)

Wall Street’s estimates on AMZN have been lifted, corroborating the market’s optimism. Therefore, the growth inflection in several of its pivotal operating income growth vectors (AWS, advertising) is anticipated to continue juicing Amazon’s corporate profitability profile.

Amazon and peers CapEx estimates (TIKR)

It should afford the company even more flexibility to invest ahead of its hyperscaler peers, solidifying its market leadership position as it extends its scale further. Hence, it should provide robust valuation support for AMZN investors as they assess a potential acceleration in its free cash flow margins trajectory over the next few years.

Given AMZN’s “A-” growth profile, it is clear that investors who considered it too expensive likely didn’t give enough weight to its growth-adjusted valuation metric. Given the improved clarity of its profitability trajectory, I assess that AMZN’s forward adjusted PEG ratio of 1.78 isn’t aggressive.

While it’s more than 10% over its sector median, AMZN’s rock-solid profitability (“A+” profitability grade) and robust growth profile have convinced me it deserves to trade at a relative premium. Moreover, the premium doesn’t seem aggressive and remains well below MSFT’s 2.39 metric. Hence, I assess that AMZN buyers are likely accumulating, anticipating a decisive breakout, potentially attracting momentum buyers to add more aggressively.

Is AMZN Stock A Buy, Sell, Or Hold?

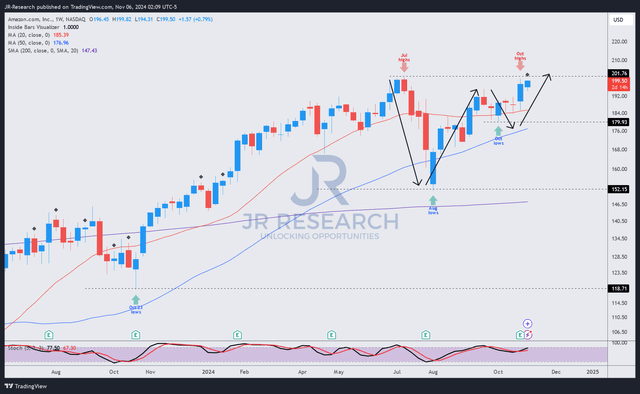

AMZN price chart (weekly, medium-term) (TradingView)

AMZN’s incredibly bullish price action is validated by the stock’s “B+” momentum grade. However, AMZN overcame a significant dip in August 2024, an astute bear trap.

The recovery and subsequent pullback in September was well-supported over its 50-week moving average (blue line), underpinning the market’s confidence in its bullish thesis. In addition, AMZN has outperformed the S&P 500 since its August 2024 lows, corroborating my thesis of a potentially decisive breakout once the July 2024 peak is taken.

The series of higher-lows and higher-highs price structures have afforded a high level of confidence that the resistance zone just under the $200 level is expected to be breached, providing a buy-on-breakout opportunity for high-conviction investors.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, PDD, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!