Summary:

- Amazon’s success in Brazil highlights its ability to replicate this growth in other emerging countries, benefiting from favorable economic conditions.

- The welcome interest rate cut in America should create conditions for other central banks in the world, such as those in emerging countries, to do the same, benefiting the businesses.

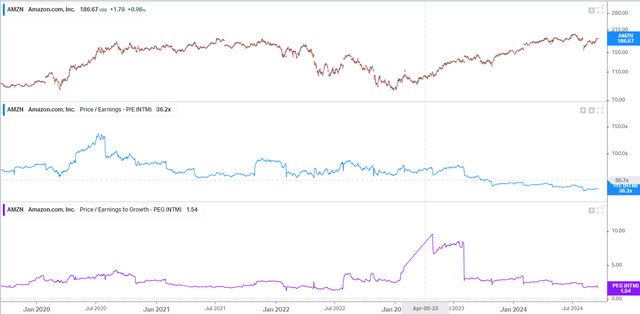

- Trading at low valuation levels compared to the last 3 years, Amazon shares could be a good opportunity.

hapabapa

Investment Thesis

I recommend buying Amazon.com, Inc. (NASDAQ:AMZN) shares, and I want to bring a completely different perspective on the company’s business. Amazon has approximately 23% of its revenue coming from abroad, and one of those countries is Brazil.

I want to present the company’s growth history in Brazil, its position in the market, and how this can be replicated for other businesses abroad, especially in emerging countries.

But what is the purpose of this? Brazil is one of the countries with the greatest potential for retail growth and can serve as a model for the company’s growth in other geographies.

Additionally, the Fed has started the interest rate cut cycle in America, and this could be the beginning of a process of interest rate cuts in several countries, which historically benefits retail companies.

Sector Scenario

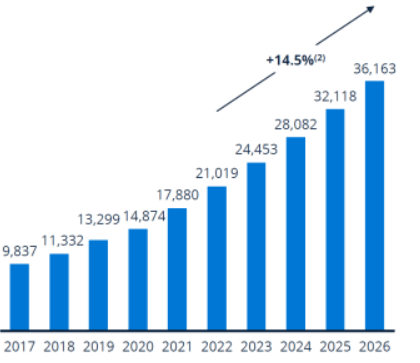

Global B2B e-commerce is expected to grow at a CAGR of 14.5% through 2026 to surpass $36 trillion. The Asia-Pacific region remains the most relevant region, but the greatest growth in B2B commerce is expected to be seen in regions such as the Middle East and Latin America.

Global B2B Ecommerce GMV in Billion US$ (International Trade Administration)

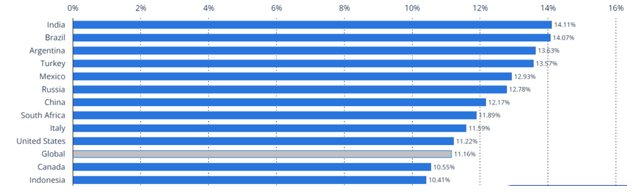

Amazon is a global e-commerce player and is attentive to markets with growth potential. It is noteworthy that the markets with the greatest growth potential are India, Brazil, and Argentina, as we can see below.

Compound Annual Growth Rate (International Trade Administration)

In this report, I intend to show how Amazon entered Brazil and how its successful growth strategy can be replicated in other geographies. But before we talk about that, let’s take a look at Amazon’s business.

Business Model

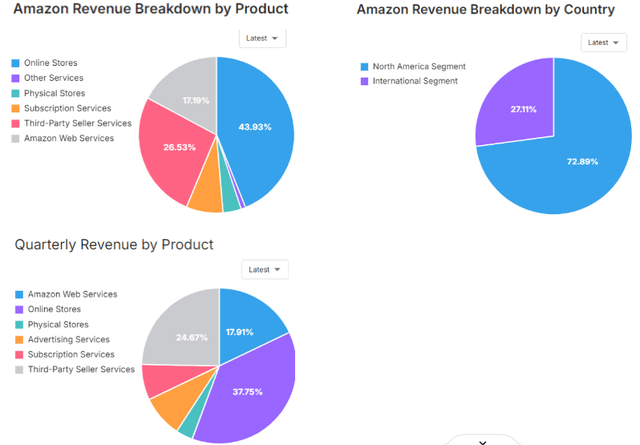

Amazon has an extremely diversified business model, which brings resilience to its results. With net revenue of over $600 billion in the last 12 months, the company founded by Jeff Bezos has several business lines in addition to a good diversification between local and foreign revenues, as we can see in a very segmented way below.

Revenue Breakdown (TickerGate)

Finally, with this background, I will talk about Amazon’s operations in Brazil, the second geography with the highest annual growth potential in the world, and I intend to answer questions such as:

When did operations begin? What strategies has the company used? How is it positioned against its competitors? How can it replicate this business model in other geographies? These answers and other information will be in the next chapter.

The History Of Amazon In Brazil

It is interesting to note that Brazil has a unique retail market, as there are large local players (including those with shares traded on the Brazilian stock exchange) such as Magazine Luiza, Casas Bahia, and Americanas. These local players face competition from street retailers, Asian companies (Alibaba Group Holding Limited (BABA) and Shopee, a subsidiary of Sea Limited (SE) also operate in Brazil), and Amazon.

Amazon began operations in Brazil in 2012, at which time the company sold books, e-books, and Kindle. In 2014, it began selling physical books, and in 2019 it began a major expansion, currently having 12 distribution centers in Brazil.

And how can it stand out in a country with double-digit interest rates, high household debt, and such strong competition from retail? According to the president of Amazon in Brazil, success comes from focusing on operational excellence and customer experience.

It is interesting to note that Amazon learned a lot at the beginning of its operations about how to make deliveries in Brazil, and is now a reference, in addition to serving customers with local payment methods and several other challenges.

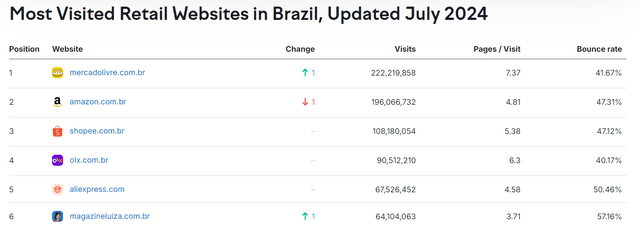

Amazon is behind its competitors in the number of distribution centers. However, the company already occupies the second position in the number of most searched retail sites in Brazil.

Most Visited Retail Websites in Brazil (Semrush)

It is important to note that MercadoLibre, Inc. (MELI) began its operations in Brazil in the 1990s, while Amazon began operations 15 years later, and yet it still ranks 2nd in terms of most visited websites.

But How Did Amazon Scale Its Operations In Brazil So Quickly?

In my opinion, there is a combination of factors. In logistics, opening its own distribution center in the city of Cajamar was extremely important for the company to understand delivery times, one of the demands of Brazilian consumers, and in a short time, the company has already expanded the number to more than 10.

Another assertive strategy was the introduction of FBA (Fulfillment by Amazon) and DBA (Delivery by Amazon), which allowed small and medium-sized sellers to use the company’s infrastructure to sell their products efficiently. Today, more than half of Amazon’s marketplace sales in Brazil come from these sellers.

The culture of customer obsession was another trigger. Prime is increasingly popular among Brazilian consumers, with fast shipping and access to services such as Prime Video, making the company’s ecosystem more robust.

The adoption of local peculiarities was decisive. Amazon was able to customize its offers for Brazilian payment methods, such as Pix and bank slip. Finally, the use of data! Amazon can personalize its offerings based on user preferences and search history.

Amazon is the 2nd most accessed marketplace in Brazil, operating in the country for less than 15 years, while local players themselves (which have been operating for much longer) have fallen behind. This makes me believe that the company has the background to understand other markets and replicate the strategy in other geographies, which corroborates my thesis.

Amazon Fundamentals

Next, I will do a financial analysis of Amazon, an American retail giant, against MercadoLibre (a Latin American retail giant), Alibaba (a Chinese retail giant), and Sea (a Southeast Asian retail giant).

| Ticker | AMZN | SE | BABA | MELI |

| Country | USA | Singapore | China | Argentina |

| Market Cap | $1.96T | $46B | $197B | $107B |

| Revenue Estimated | $635B | $15B | $142B | $20B |

| Revenue Growth 5 Years [CAGR] | 19% | 62% | 18% | 57% |

| EBITDA Margin | 17.2% | 2.6% | 18.6% | 17% |

| Net Income Margin | 7.3% | -1.4% | 7.4% | 8.1% |

| ROE | 22% | -2.9% | 5.7% | 47% |

It is interesting that Amazon, despite its size, has indicators that are very similar to those of much smaller companies, and that it has the potential to be even more agile in its operations.

Amazon has the highest revenue among its competitors, and yet its revenue growth is higher than Alibaba. When it comes to margins, the company competes on equal terms with MercadoLibre, which stands out for its efficiency.

Finally, the company boasts a strong ROE of 22%, showing how profitable its operations are. These numbers, combined with the case study I mentioned in the previous chapter, show the company’s resilience and management capacity and corroborate my buy recommendation.

Valuation – An Opportunity

Another piece of information that caught my attention is the company’s valuation indicators. Given Amazon’s size and the many types of businesses it does, I believe it would be interesting to make a comparative assessment of the company against its own historical P/E and PEG, and we will do so below.

The company is trading at the lowest multiples of the last 3 years, and if we consider that it returns to trading at 50x earnings, a conservative average of the last 3 years, we would have a potential appreciation of over 30% of the shares, which corroborates my buy recommendation.

An Extra Boost

The Fed has finally begun the process of cutting interest rates in America, something that has not been seen since the pandemic, and this should cause major changes in the American and global markets.

Trends of this type may improve the flow of foreign capital into emerging countries, which should strengthen the currencies of emerging countries, which, together with better credit scores, should benefit the businesses of large retailers around the world, another point in favor of a positive outlook for Amazon.

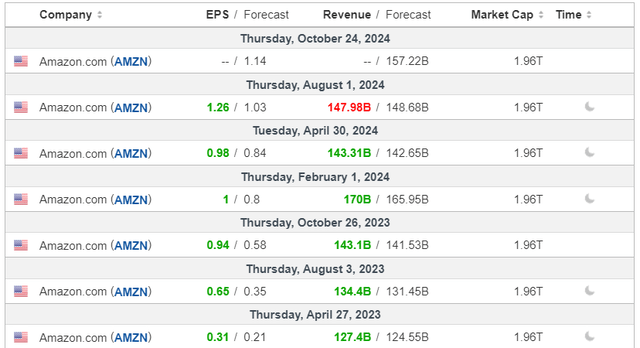

Latest Earning Results

When we analyze Amazon’s latest results from a macro perspective, the company has been consistently beating market estimates, as we can see below.

However, when we look at the 2nd quarter results, although the company beat the market consensus in AWS business and earnings per share, the estimated growth in the company’s total revenue was below expectations, which raises an alert, and makes me go into the risk chapter, to make other additions to the investment case.

Potential Risks To The Bullish Thesis

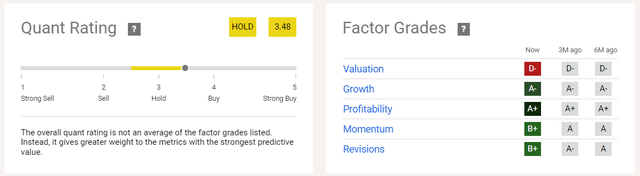

Additionally, it is important to highlight that my thesis is not the consensus. Seeking Alpha Quant’s tools indicates a recommendation to hold the shares, since the valuation grades are quite poor, as we can see below.

Quant Rating and Factor Grades (Seeking Alpha)

Still, on the subject of valuation, the company’s shares may appear to be expensive depending on the valuation metric used. And although I believe that the current price offers an opportunity (as I explained in the valuation chapter), the main metrics used by the Factor Grades in “valuation” indicate the opposite.

The thesis is extremely complex due to the businesses having extremely different growth prospects, and investors should be cautious when choosing to invest in the company’s shares.

The Bottom Line

In this report, I intended to show investors a side of Amazon that is little explored by analysts: its retail business abroad. Through practical examples of growth in the Brazilian market, such as its own distribution centers, understanding of local behaviors, agility, and customer focus, I showed you the efficiency of the company’s managers.

Another tailwind for the company’s revenue growth was the start of interest rate cuts by the Fed, which should trigger a process of interest rate cuts in several emerging countries, bringing in foreign capital and creating an even better environment for Amazon, which, in my view, is trading at a very attractive valuation compared to the history of the last 3 years.

Based on this analysis, I recommend buying Amazon shares. In my view, investors should focus on the quality of the company, agile and strategic management, in addition to its shares trading at reasonable multiples given the embedded growth. In my opinion, the risk/return ratio is attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.