Summary:

- Amazon.com, Inc. will be reporting its Q2 results after the market close on Thursday, August 3.

- The Street seems to be underestimating its prospects.

- Amazon seems set to beat the Street’s estimates and rally going forth.

HJBC

All eyes will be on Amazon.com, Inc. (NASDAQ:AMZN) when it reports its Q2 results after market close on Thursday, August 3. A few of its industry comparables have topped the Street’s revenue estimates, and investors are hoping that Amazon also does the same. But, in addition to tracking its headline sales, investors may also want to keep tabs on its segment financials, other income, margin profile, and its management guidance for the next quarter. A lot of investors are bearish on Amazon’s prospects, but there are reasons to believe it makes for a good buy ahead of its Q2 earnings. Let’s take a closer look at it all.

Financial Expectations

Let me start by saying that we’re in the midst of a recessionary period and most companies are experiencing a sales slump of late. Although green shoots of recovery are starting to appear, we’ll gain full clarity around Amazon only after examining its financials in detail. For this, we can start by looking at the e-commerce giant’s segment financials and gain insights about how each segment is recovering from the macroeconomic slowdown across the globe.

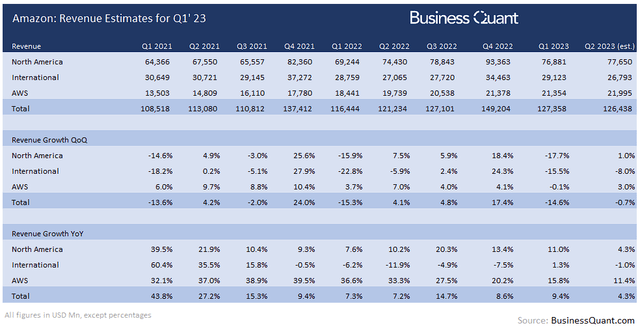

For the uninitiated, Amazon classifies its revenue in 3 reportable segments, namely, North America, International and AWS. Its AWS (short for Amazon Web Services) division contributed just 14.5% to the company’s total sales last quarter, but it has been the growth driver for the company as a whole. It practically pioneered the field of cloud computing in its heyday but its pace of revenue growth slowed down considerably during Q1. This has fueled bearish concerns that, perhaps, Amazon’s days of rapid growth are over.

I had detailed in a prior article, by showing examples, that the entire cloud industry saw growth declines in Q1 as enterprises across the globe cutback on their discretionary spending. I expect this dynamic to play out in Q2 as well, as interest rates remain elevated and the cost of capital remains high for companies across the globe. At the same time, Alphabet (GOOGL) aka Google just reported that its Cloud revenue, after practically stagnating in Q1, reached an all-time high of $8 billion during Q2. This suggests that green shoots are starting to appear for the cloud industry in Q2. So, I’m estimating that AWS’ revenue will grow 3% sequentially and amount to nearly $22 billion for the said quarter.

(Read – Amazon: Rally Is Just Getting Started.)

Next, Amazon’s North America segment accounted for over 51% of the company’s total sales last quarter, and any fluctuation here can materially impact the company’s overall financials. The segment comprises of all the non-AWS sales in the North America region. This segment saw a sharp sales slump in past few quarters as rising interest rates and recessionary pressures weighed down on personal disposable incomes in the U.S. But the chart below indicates that personal disposable incomes have been on the rise. So, I’m anticipating Amazon’s North America segment to report sequential sales growth of 1% during Q2, with its revenue figure equating to $77.6 billion.

Lastly, Amazon’s International segment may be hit the hardest. Several major markets have already entered recession and a few others are reportedly on the verge. So, I estimate that Amazon’s International revenue will remain subdued at $26.8 billion, declining 8% sequentially in Q2.

This brings us to a company-wide revenue estimate of $126.4 billion. For the record, this is higher than the Street’s estimates that are currently spanning from $114.8 billion to $120.5 billion. This variance leads me to believe that the Street is underestimating Amazon’s prospects and that the company is poised to beat analyst estimates in its upcoming Q2 earnings report.

But having said that, let’s now shift attention to some of the other important items that investors should be monitoring as well.

Other Items to Track

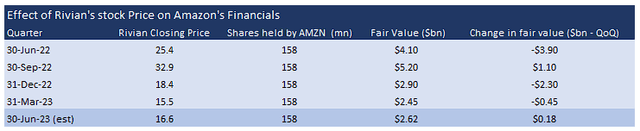

Having said that, we’ve got to also take note of Amazon’s “other income.” The e-commerce giant owns 158 million Class A shares of Rivian Automotive (RIVN). The strategic investment made a lot of sense at the time, considering that Rivian makes electric trucks that can significantly lower the fuel (and delivery) costs for Amazon’s e-commerce operations. But as the Fed started to hike rates last year, stocks of nearly all the unprofitable technology companies started to tank, Rivian included.

Amazon lumps these paper losses to its marketable securities, under its “other income/losses” within its income statement. So, naturally, when Rivian’s stock price started collapsing, it dragged Amazon’s net income lower along with it even though they were unrealized losses. However, the tables have turned now and Rivian’s stock price has appreciated from the last quarter. So, I expect the Rivian-overhand to vanish and estimate that it’ll instead contribute $180 million to Amazon’s other income during Q2.

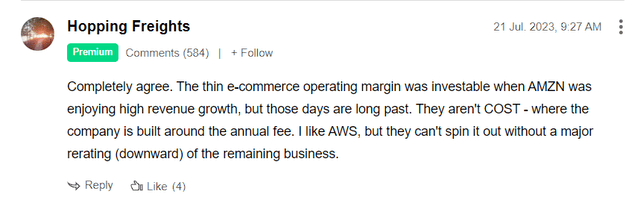

Next, we’ve to also watch Amazon’s operating margin profile. The cost of funds has risen for companies across the globe with rising interest rates, and companies are under pressure to cutback on discretionary spending, run a lean operation and focus on returning value to shareholders if they can’t deliver breakneck growth rates anymore.

Here’s one such comment from an SA reader:

However, given the business recovery across all 2 of its 3 segments, as discussed in the previous section of this article, I expect that Amazon’s utilization rates will improve across the board. Its AWS segment will see enterprises resuming their cloud spend, while its North America segment will see heightened e-commerce activity that will drive up revenue without significant increases to its fixed costs (warehouses, trucks, support personnel etc.). So, my guesstimate is that Amazon’s operating margins will improve sequentially for North America and AWS segments in Q2.

The pace of margin expansion is likely to be 100 bps to 300 bps. This won’t be a drastic improvement by any stretch, but it’ll at least signal to the Street that Amazon’s recovery has begun and better times are yet to come. It’s International operating margins are unlikely to improve in Q2 due to distressed major international economies.

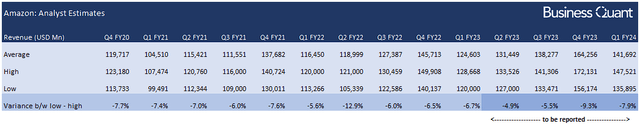

Lastly, pay close attention to Amazon management’s revenue guidance for the quarter ahead. I compiled a table below, containing the Street’s revenue estimates for Amazon in its upcoming few quarters. Note how the variance between low and high-end revenue estimates surges in Q4 FY23. This suggests that the community of professional analysts is extremely divided about the state of the global economy as well as about Amazon’s near-term prospects. In this situation, Amazon management’s encouraging revenue outlook can help calm the nerves of investors, reduce a bit of overhang on the stock price and even trigger a rally in the name.

Final Thoughts

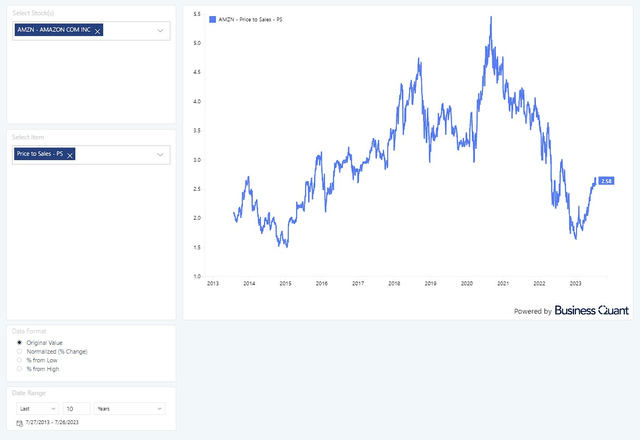

Amazon’s shares have rapidly rallied in the past few weeks, but even then, they’re still trading at about 2.6-times its trailing twelve-month sales at the time of this writing. This is quite modest on a standalone basis and its Price-to-Sales multiple is far below its pre-COVID levels. This suggests that the stock is oversold and is pricing in a lot many risk factors at the current levels.

Besides, as we saw earlier in this article, I expect the e-commerce giant to outperform the Street’s revenue estimates in Q2. At its currently distressed valuation, even the slightest of positive news can spark a major rally in the stock. Therefore, I believe that Amazon is a good buy heading into its earnings. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.