Summary:

- Amazon reported a strong first quarter as it beat both its revenue and earnings estimates.

- The ecommerce market is going through a cyclical decline but studies indicate many retail categories such as clothing and food still have low online penetration and thus huge potential.

- AWS has announced a series of AI-related products such as Bedrock, an ML model service and CodeWhisperer; I believe this will enable AWS to compete against Microsoft effectively.

- Its operating cash flow increased a rapid 38% to $54.3 billion for the trailing 12 months.

HJBC

Amazon (NASDAQ:AMZN) has a laser focus on customer experience and providing low prices for consumers across e-commerce and the cloud. This recipe isn’t always popular with Wall Street in the short term, but long term it has proven to pay off. Amazon reported a strong first quarter as the company beat both its top and bottom-line growth estimates. The company still has a long way to go for a full recovery, but given many retail categories (such as clothing, food and furniture) still have fairly low e-commerce penetration, there is still a long growth runway ahead. In addition, the Cloud industry is also still in its early stages given 80% of companies still have their IT infrastructure on-premises, according to Amazon CEO Andy Jassy, in his letter to shareholders. Advertising also has the potential to be a “cash cow” for Amazon which reported strong growth of 23% in Q1,23. In this post I’m going to break down Amazon’s first-quarter financials, before revealing my valuation model and forecasts for the stock, let’s dive in.

Strong First Quarter Results

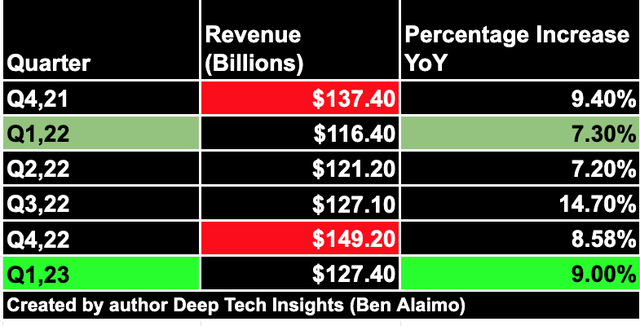

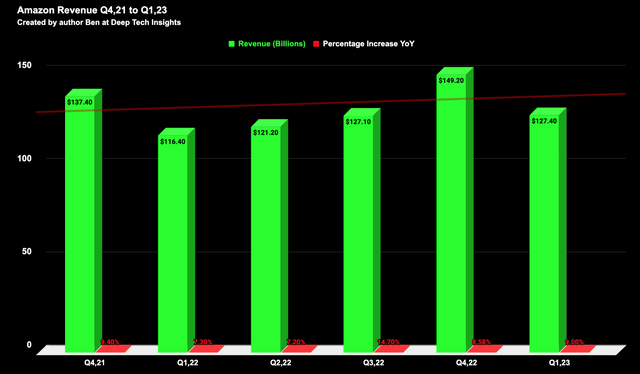

Amazon reported strong financial results for the first quarter of 2023. Its revenue was a staggering $127.4 billion, which rose by 9% year over year or 11% on a constant currency basis. This was a faster growth rate than the 7.3% YoY growth rate reported in Q1,22 (shown in light green) and even faster than the 8.58% growth rate reported in Q4,22. Therefore this could be a signal a recovery in its e-commerce business especially.

On the above table, I have highlighted Amazon’s peak revenue levels for the fourth quarter, which is expected due to the strong holiday shopping season for e-commerce, this was also up year over year, which is a positive sign. On the below chart I have created you can see a graphical version of the table, for easier pattern recognition.

Amazon Revenue (Created by author Ben at Deep Tech Insights)

North America was a strong performer with its revenue increasing by 11% year over year to $76.9 billion. International revenue looked to have achieved slow growth of just 1% year over year to $29.1 billion. However, this was mainly driven by the strong U.S. dollar relative to most other currencies. On a constant currency basis, international revenue rose by 9% year over year, which was solid. Breaking down the e-commerce segment in detail, on its earnings call, Amazon reported consumer “shifts” to lower price categories, while also experiencing “healthy demand” in its everyday essentials category. Discretionary item spending experienced moderated demand which was expected due to the “recessionary” environment. A positive is Third-party sellers have continued to grow to 59% of overall unit sales in Q1,23 up from 55% in the equivalent quarter last year.

Ecommerce still has growth potential

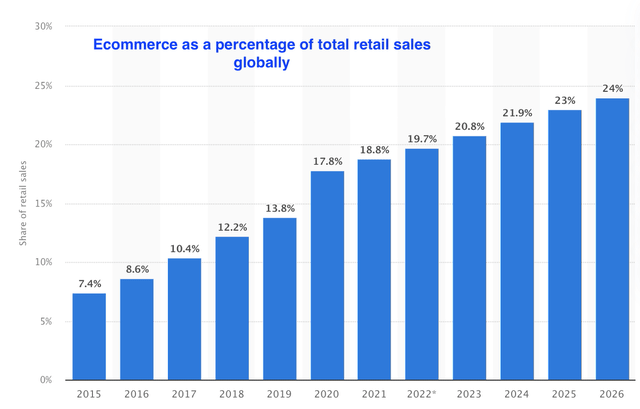

Overall, I believe e-commerce demand will return in full post 2023 and the industry trends still favor online shopping. According to the shareholder letter by CEO Andy Jassy published in April 2023, approximately “80%” of global retail still occurs via physical stores. Therefore to the surprise of many e-commerce looks to be in the early innings. Data from Statista backs up this claim with 20.8% of sales coming from e-commerce, as of 2023. This figure is forecast to grow to 24% by 2026.

Ecommerce Amazon (Statista data with author edits)

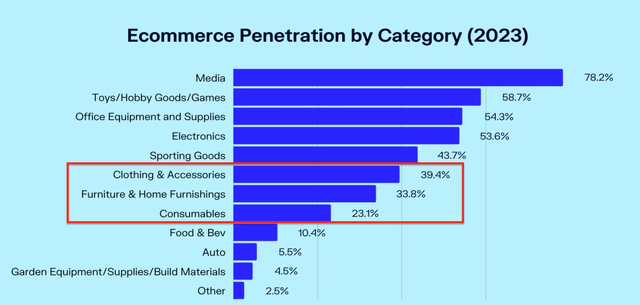

I personally see no reason why global e-commerce couldn’t reach 30% over the next decade. From the chart below, you can see Clothing & Accessories, is one of the categories that is still in the “early innings” of the ecommerce revolution with 39.4% penetration as of 2023. This category is expected to reach 46% penetration as of 2027. Amazon is aiming to help accelerate this and has recently integrated new “marquee” fashion brands including Rent the Runway and “The Drop” collections by Harlem Fashion Row. The Drop offers consumers special access to exclusive limited-edition clothing which should help to drive unique demand for Amazon.

U.S Ecommerce penetration by category (Cowen and Oberlo data)

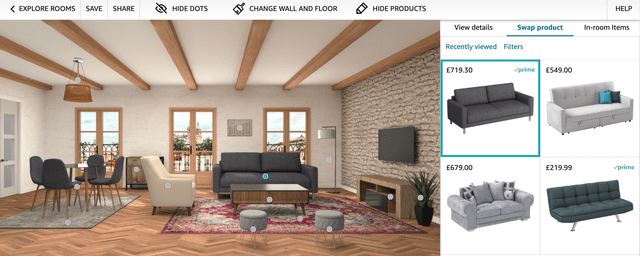

Other categories with low e-commerce penetration include Furniture and Home furnishings at 33.8% as of 2023. This is forecast to reach 42% penetration by 2027. Furniture has always had a hard time on e-commerce websites due to the size of the items and it being such a substantial purchase. Many people love to sit on a couch to try it out and are also concerned about how it will look in their home. Luckily technology is helping to solve some of these issues with Augmented Reality [AR] being a popular way to help visualize furniture in a space. In 2020, Amazon launched Room Decorator, a feature that enables a consumer to view multiple pieces of furniture in a space. This is similar to Amazon’s Showroom feature which enables an entire room to be designed, as you can see on the image below.

Amazon Showroom (Author Research/Amazon)

I believe if similar features were combined with VR headsets which are becoming increasingly popular this could help accelerate the adoption of products in this category, especially given the growth trends forecast for the Metaverse.

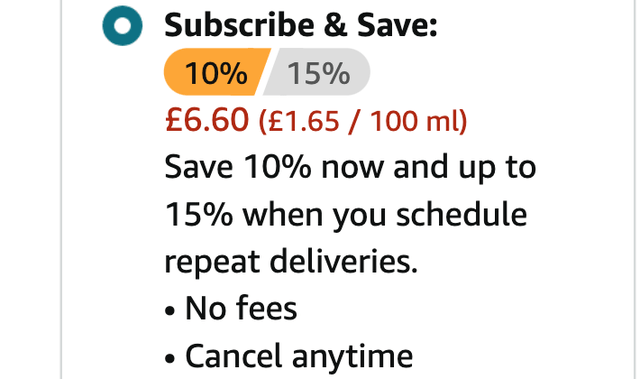

Consumables is another area with low e-commerce penetration at just 23.1% in the U.S. Amazon is also helping to accelerate this with its “Subscribe & Save” feature effectively creating an automated purchase and delivery loop.

For example, I saw this feature is available on categories such as toothpaste which can be automatically delivered once per week or month. This has multiple benefits as it saves the consumer time purchasing products, while also “locking in” the product purchases, which generates more revenue for Amazon and helps to protect the company from competition (both physical stores and online).

Subscribe and Save (Author research/Amazon)

Finally, the food and beverage market has just 10.4% ecommerce penetration in the U.S. Therefore this also offers huge potential for the company as its services such as Amazon Fresh continue to gain traction. Amazon has also partnered with supermarkets in the U.K with Food delivery companies such as Grubhub, which offers a hands-off way to enter this market. I personally prefer this style by Amazon, as opposed to its physical store locations and the acquisition of Whole Foods for a staggering $13.7 billion back in 2017. There is a method in this madness though as the majority of food shopping is still done in physical stores. I would like to see Amazon convert some of its physical stores to a more experience-like service, which also doubles up a fulfillment center. Amazon has introduced an area in some of its stores where returns can be dropped off for free, but I believe the company could go much further. I believe Amazon could take inspiration from Alibaba (BABA), which offers similar “fresh” stores but with an experience focus. You can read about that more in my Alibaba post under the subtitle “Fresh Store Opportunity”.

The Cloud Cost-Cutting Strategy

For the regular readers of my posts, you will know that the “Cloud” is one of my favorite business models and I believe AWS is the growth engine for Amazon. In fact, I previously did an in-depth post on why I believe Amazon should Spin-Off AWS.

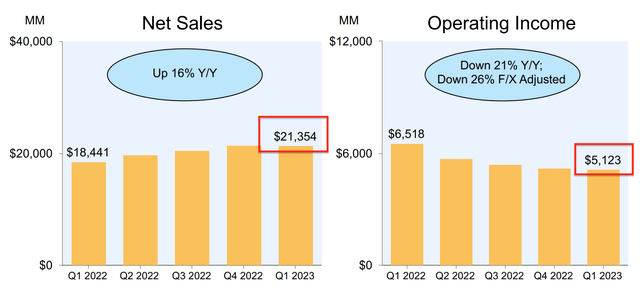

Either way, AWS has continued to perform strongly with $21.35 billion in sales as of Q1,23 up 16% year over year. Now it should be noted that this growth rate has slowed down from the 20% level reported in Q4,22, at $21.4 billion in revenue. Effectively this means its growth has been close to flat sequentially. This may ring alarm bells for most investors, but I believe context adds clarity.

AWS Revenue and Operating Income (Q1,23 data with author annotations )

AWS operates with a flexible “pay as you use” model for its compute, storage, and other services. Therefore during a “recessionary” environment with lower demand, revenue will be lower. However, that is one of the unique selling points of the cloud and Amazon is actively helping its customers to execute cost savings.

I first became aware of this a few months back when I was offered a contract by AWS to help the company reduce costs and improve efficiency for its customers. This can be done in a variety of ways by optimizing pricing plans, or switching customers to more efficient services tailored to their workloads. For investors, helping customers to “spend less” may seem crazy, but in the long term, I believe this builds greater trust and will ensure customer “lock in” for the long term. This “customer centricity” is built into the DNA of Amazon, as its “earned trust” principle which is a core leadership principle. This philosophy also matches Amazon’s “Scale Economics Shared” process in which the company gives back its scale cost savings to customers.

When the “good times” roll back around AWS will be poised to benefit from the huge surge in demand. Given the cloud industry is forecast to grow at a rapid 17.9% CAGR up until 2027, AWS is poised to benefit as the market leader.

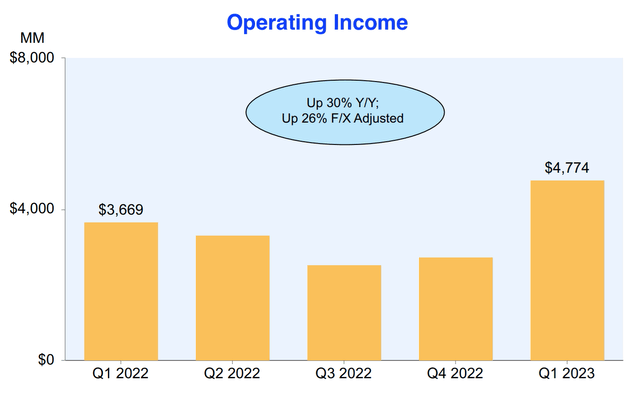

AWS operating income did decline by 21% year over year to $5.1 billion due to the aforementioned reasons. But keep in mind, this contributed to over 100% of the $4.774 billion generated in total business operating income as of Q1,23.

AI Tailwinds

AWS has been criticized by many as “missing the boat” when it comes to Artificial Intelligence [AI] after the major acceleration of ChatGPT, which received a $10 billion investment from Amazon’s rival Microsoft (MSFT). However, AI and machine learning has been a key part of Amazon’s business since “Day One”. This technology powers its e-commerce recommendation engine and AWS has many AI technologies such as the popular SageMaker Machine learning platform.

The company has also been developing its own custom machine learning chips called “Trainium”. Amazon also recently announced “Bedrock” which is a managed foundational model service. This enables customers to effectively access foundational Machine Learning models for a variety of applications from Text Generation to Search and Chatbots. The USP of this service is unlike ChatGPT, companies don’t give away their IP. For example, let’s say a “Quant” at JPMorgan is using ChatGPT to summarize code for a secret trading system. Open AI then effectively can use the data uploaded to train future models. So then let’s say a competitor Goldman Sachs, aims to create a similar system on say GPT-4 (the newest model), it could effectively access the IP of its competitor indirectly. AWS also launched its “CodeWhisperer” service which basically acts as a copilot for developers to help them be more productive.

Operating Income Rebounds

Moving onto operating income, Amazon reported $4.8 billion in operating income which increased by a solid 30% year over year. This was driven primarily by AWS and a boost in North American profit from negative $1.5 billion in Q1,22 to $0.9 billion by Q1,23.

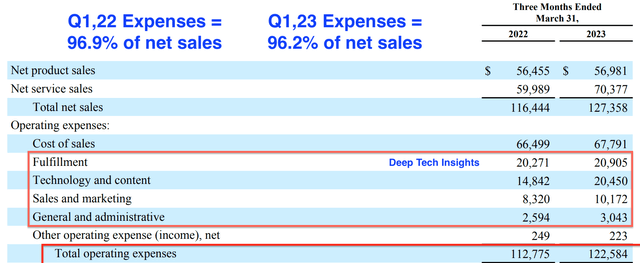

Interestingly enough Amazon’s total operating expenses rose by 8.7% year over year to $122.6 billion. However, as a percentage of sales this actually dipped from 96.9% in Q1,22 to 96.2% as of Q1,23. Therefore this indicates operating leverage, which is a positive sign for future margins.

Expenses (Income statement with author annotations)

Net income was $4.29 billion which was down 80% year over year from the $21.4 billion reported in Q4,21. This may seem atrocious but keep in mind this includes a $5.6 billion loss related to Amazon’s investment into EV maker Rivian (RIVN), compared to a $4.2 billion gain as of Q1,22. Therefore really this is more of a “paper loss” as opposed to a real cash loss, unless Amazon sells the stake at the lows. Long term there is a good chance Rivian could bounce back as it has mainly been impacted by the secular decline in the EV industry and the “growth stock” category. Amazon recently reiterated its commitment to buying a staggering 100,000 Rivian EV delivery vans by 2030 and thus the company is in a solid position. There are also rumors Amazon and Rivian may end the exclusivity part of the deal which I believe will actually be a positive for Rivian (and Amazon as an Investor). EV vehicles aren’t inherently unique and don’t contribute to Amazon’s competitive advantage and thus I believe opening up these sales to other companies would make tremendous sense.

Valuation and Forecasts

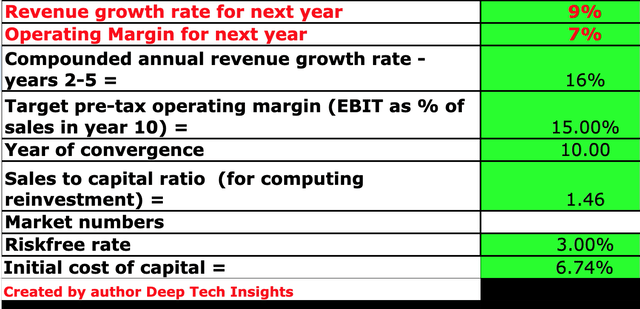

In order to value Amazon, I have plugged its latest financial data into my discounted cash flow valuation model. In reference to my prior post, I have revised up my prior growth rate estimate from 8% for “next year” or the next four quarters in my model to 9%, given the better-than-expected 9% growth rate achieved as of Q1,23. I have increased my operating margin to 4.7% for “next year” or 8% with R&D expenses capitalized, up from 7% reference prior. This improvement is driven by Amazon’s operating leverage improvements highlighted previously and improved cost efficiencies.

In years 2 to 5, I have increased my forecasted growth rate from 15% to 16%. I forecast this to be driven by the huge potential still left in the e-commerce market driven by categories I have outlined, which have minimal online penetration, as I discovered in the chart data outlined in the prior section.

Amazon stock valuation 1 (Created by author Deep Tech Insights)

Note: All figures in the table above include an adjustment with R&D expense capitalized.

Long term I have also increased my pre-tax operating margin expected from 14% to 15%, driven by continued growth in AWS, improved customer loyalty, and new AI-focused services. In addition, I expected improved margins and vertical integration benefits from Amazon’s custom Graivton and Trainium chips.

For extra information, Amazon has a fortress balance sheet with $64.3 billion in cash, cash equivalents, and marketable securities. In addition to long-term debt of $67 billion, which is manageable as it is “long term” by nature and not due within the next two years.

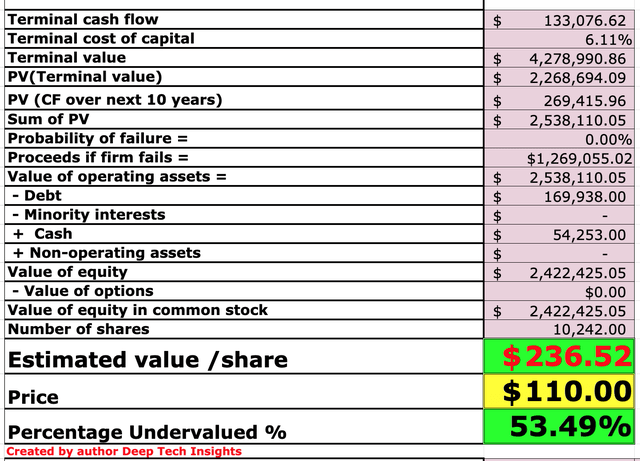

Amazon stock valuation 2 (Created by author Deep Tech Insights)

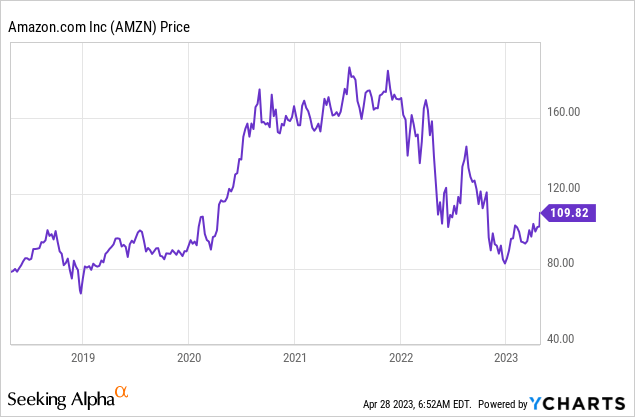

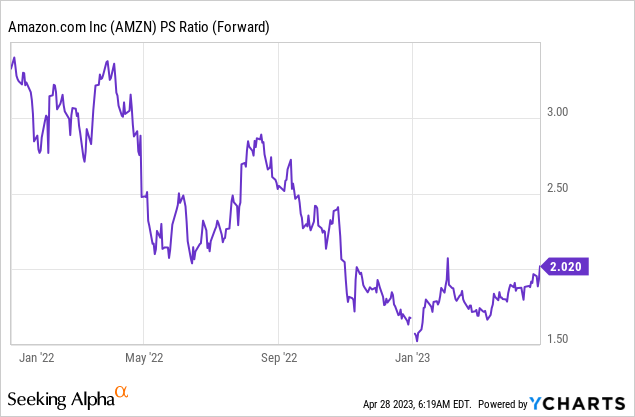

Given these factors I get a fair value of $237 per share, the stock is trading at ~$110 per share at the time of writing and thus it is ~53.49% undervalued. The stock also trades at a forward price to sales (P/S) ratio equal to 2, which is 37% cheaper than its 5-year average.

Risks

Competition

Amazon is facing fierce competition on the cloud front from Microsoft Azure, which I have discussed in my prior post has generated similar revenue to AWS (if we include its server revenue). In addition, we have Google Cloud (GOOG) (GOOGL) and niche cloud providers such as Cloudflare (NET) and even Oracle (ORCL) who have carved out a unique place in the data localization market. On the e-commerce side, I recently covered Temu which has become the fastest-growing application in the app store and offers cheaper prices than Amazon across many products, due to its direct shipping from China. Again, I discussed this company in greater depth in my post on PDD Holdings. Temu doesn’t have the scale advantage or U.S. fulfillment infrastructure of Amazon but it is still an interesting one to watch.

Final Thoughts

Amazon has begun to claw back its profitability and experienced a revival in its top-line growth. The company still has a long way to go given many analysts are forecasting a recession and the e-commerce market is relatively depressed. However, I believe the customer-centricity and long-term thinking of the company should continue to pay dividends (not literally). Given my valuation model and forecasts indicate the stock is undervalued intrinsically at the time of writing, I will reiterate my “Buy” writing for Amazon. It is still “Day One” for the company given the trends in the cloud, e-commerce, and even virtual healthcare (One Medical acquisition). Therefore I will sell the stock when it’s “Day Two” or it becomes egregiously overvalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.