Summary:

- In this article I would like to explain my bull cases on two stocks I already own and that I am monitoring closely.

- In the first part of the article, I will show the most important aspects of my bull case on Amazon.

- In the second part of the article, I go over the main points of my bull case on Stellantis and why I think the stock is absurdly cheap.

duuuna/E+ via Getty Images

Introduction

As we start a new investing year, many investors are thinking about their portfolio and what could be the best picks for 2023. In this article I would like to explain why I am getting ready to increase my positions in two stocks that, pay attention, I don’t think will be market winners in 2023, but that will trade for at least some time at such an interesting price that I believe they will turn out to be very good investments from 2024 on. Let me say this again, just to be clear: I am not writing about two stocks that will necessarily outperform in 2023; I am rather writing about two stocks that will be very good buys in 2023 for the long-term. These stocks are quite different one from the other. We are talking about Amazon (NASDAQ:AMZN) and Stellantis (NYSE:STLA). While the former is known to everybody, I still see that, even on Seeking Alpha, not every reader is aware of what the latter is and why it is seen as one of the most undervalued stocks in the market. In this article I would like to share why I will buy more of both of them.

Portfolio strategy

First of all, I am in my early 30s and I am investing whatever money I save every month. Considering emergency and unplanned expenses, I have a high yield savings account where I hold enough money to pay for one year of my family’s current lifestyle; though some people consider this too much, I feel comfortable knowing that, in case I lose a job I will have plenty of time to find another one without impacting directly my family. At the same time, this is where I take the money for unplanned expenses. But when I use it, it becomes my first priority to refund the account up the level I said.

My portfolio is long-term oriented and I plan not only on using it during retirement but also on passing it along as part of my legacy to my kids. Around 85% of my portfolio is centered on dividend growers. However, the most important aspect of these companies is that they compound well and that they have high returns on the capital they invest up to the point that they generate so much free cash flow that they end up having a lot of excess cash they don’t know how to employ. This leads them to return excess cash to their shareholders. I like these kinds of companies because I feel they do for me most of the job of aiming at high returns on the investments they make. The other 15% of my portfolio is where I have my higher-risk bets, with investments in companies whose growth seems promising to me.

I started this portfolio in January 2021. At the moment, it is down 6%, not counting dividends. The portfolio currently yields around 4%, so I consider myself to be almost flat so far. I am not extremely satisfied by this result, but I know I can’t complain either.

As far as my focus on what companies to pick goes, it is not the current dividend yield the metric I care about the most. In fact, I am focusing more and more on companies whose profitability is high and that can have a return on the capital they employ above 12.5%. In other words, I look for compounders that employ so well their capital up to the point that they have so much cash that they need to return part of it under the form of a dividend.

I buy companies with low multiples as well as ones with high multiples, the criteria being not the multiples per se but if I deem the price reasonable for what I am buying. Thus, I have in my portfolio quite a few stocks with a single-digit PE, but I also hold Amazon and Costco (COST), whose PEs are high.

So far, Stellantis makes up 11.89% of my portfolio, while Amazon accounts for a 2.69%. I am willing to increase Stellantis’ weight to 15% while I am targeting a 5% portfolio weight for Amazon.

I share these data because I think they explain why I am not entering 2023 with the need to realize gains during this year (of course, I like gains!), but with the goal to build up new positions and increase the ones I have whenever I think I am before a good opportunity. As I expect the market to be rather volatile at least for two more quarters as it assesses the impact of interest rate hikes and looks at the upcoming quarterly reports to see any sign of a recession on profits and margins, I am getting ready to use these next months to deploy some cash. Usually, I contribute to my portfolio with $500 per month. However, I got myself ready to contribute up to $1,000 per month for the next 6 months.

My bull case for Amazon

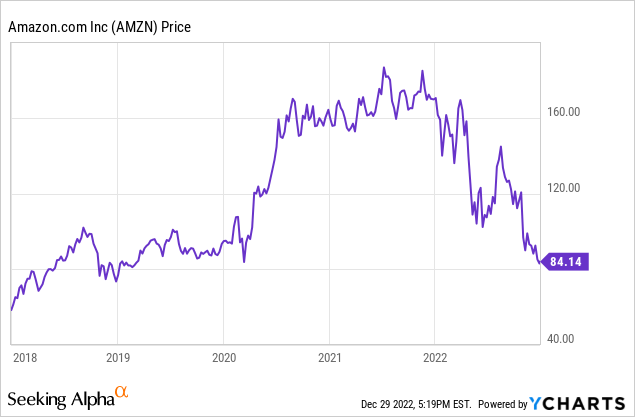

The main idea behind me buying more Amazon is quite simple: Amazon, as the graph below shows, trades at the same price it had at the beginning of 2019.

However, I believe that, since then, the company has improved a lot, at least under some metrics. In addition, I may lack imagination, but I really can’t think that ten years down the road the world will be with less Amazon around; on the contrary, I actually believe Amazon will be an even larger part of our lives in the years to come.

Having said that, let’s get to some numbers in order to support my view with real data.

Revenue breakdown

Amazon will probably reach a 2022 revenue above $500 billion (half a trillion!). However, it seems like the company will be barely profitable with a net income just above $10 billion, while being cash flow negative.

This is why I want to look at the different sources of revenue to understand where future profits can come from.

I took the data from 2016 to 2021 and then, to make a forecast about FY 2022 I took the data from the last quarterly report in order to have the nine months results and add to them my forecast for Q4.

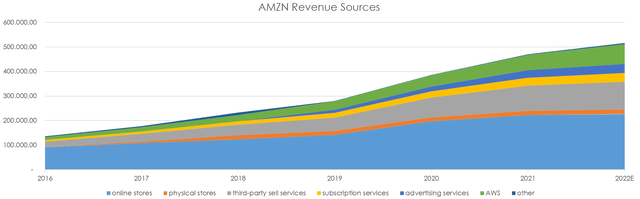

Amazon earns its revenue from seven different sources: online store, physical stores, third-party sell services, subscription services, advertising services, AWS, other.

As we can see from the graph below, there are a few sources that are growing more rapidly than others: third-party services, subscription services, advertising, and AWS.

Author, with data from Amazon Annual Reports

Now, I don’t want to spend a lot of words on subscription services, since I have already shared how I view it in a recent article (The Influence Of Costco On Amazon Prime). The key concept is that every Prime member has a lifetime value that is far greater than the fee it pays Amazon for the membership.

If you also want to have some fun understanding the power of subscription for Amazon, you can read two of the articles I enjoyed most writing:

- The Value Of The Lord Of The Rings Series For Amazon

- Amazon Stock: The Value Of The Lord Of The Rings Series (Update)

But now, I would like to spend a few words on third-party services, advertising, and AWS. Let’s start with some numbers:

| in USD billion | 2016 | 2022E | CAGR |

| third-party sell services | 22.99 | 113.38 | 30.47% |

| advertising | 2.51 | 36.68 | 56.36% |

| AWS | 12.22 | 81.22 | 37.12% |

Here we see a very rapid growth. But what I really care about is that these segments are the ones with higher margins. This is where Amazon will find its real earnings and this is where it will generate billions in free cash flow.

Third-party sell services

As Amazon states in its Annual report:

Generally, we recognize gross revenue from items we sell from our inventory as product sales and recognize our net share of revenue of items sold by third-party sellers as service sales.

This means that the actual money that is spent on Amazon’s online store for third-party products is much greater than what we see reported. In the last quarter, third-party sellers and their products made up 58% of total paid units sold.

Now, as third-party merchandise grows on Amazon, so does the company’s negotiating power with independent sellers. In fact, the amount of goods sold becomes itself a moat that prevents other online retailers from stealing significant market share from Amazon. In addition, the more third party sales grow, the more I believe Amazon will find protection against monopolistic charges because it will be able to argue that it enables high competition for every single product. Finally, third-party sales generate higher margins and are thus more valuable for Amazon. It is commonly accepted that Amazon’s margins here are around 20% against 5% for its typical retail sales. Hence, the fact that this segment keeps on growing at a fast pace is quite meaningful for Amazon’s profitability.

Advertising

I believe that, from a certain point of view, Amazon’s advertising business is even stronger than Google’s because it happens within a platform where users spend their time once they have already decided to look for something they need to buy. This makes advertising a lot more effective. Not by chance, it is the one segment that has been growing the most. Here the consensus is that Amazon’s margins may be somewhere above 30%. Though it may be less considered, I believe advertising is set to generate very good profits for the company. Looking at the expected 2022 advertising revenue, we could be before a cash cow that has an operating margin of something like $11 billion this year alone. With a CAGR above 50%, even if this segment slows down to a 20% growth, or even a 15% growth over the next few years, we are still before a business that alone is enormously profitable.

AWS

In Q3 2022, AWS’ net sales increased to $20.5 billion in Q3, up 28% YoY. This is why the Amazon is getting close to an annualized sales run rate of $82 billion. What I consider highly valuable about this business is that it locks in customers that have very high switching costs once they sign up for this service. Amazon, however, has made it one of its business culture key points to be customer centered and not take advantage from its strong positions by raising arbitrarily prices. It knows that keeping customers happy is the best way to extend their lifetime value. This is why it was particularly interesting reading that Mr. Olsavsky, Amazon’s CFO, explained how Amazon itself is helping its customers improving in better controlling their AWS costs thanks to its chip technology:

With the ongoing macroeconomic uncertainties, we’ve seen an uptick in AWS customers focused on controlling costs. And we’re proactively working to help customers cost optimize, just as we’ve done throughout AWS’ history, especially in periods of economic uncertainty. The breadth and depth of our service offerings enable us to help them do things like move storage to lower-priced tiers options and shift workloads to our Graviton chips. Graviton3 processors delivered 40% better price performance than comparable x86-based instances. And our teams across AWS continue to work relentlessly to expand that breadth and depth, including recent launches of new EC2 machine learning training instances in AWS IoT fleet-wise. And we continue to expand the AWS infrastructure footprint to support customers with the launch of the AWS Middle East region in August and the recent announcement to launch AWS Asia Pacific region in Thailand.

I think this is a further example of how Amazon has indeed been inspired by Costco to some extent: whenever it develops something that cuts costs, it is able to return at least part of the money that is saved to the customers, instead of keeping it to increase its margins.

Going back to customer lock-in, one of the aspects I like a lot about AWS is that the company has contracts signed for future services down the road. This makes Amazon well aware that in the future there are even greater revenues coming. As of December 31, 2021, the company reported that

For contracts with original terms that exceed one year, those commitments not yet recognized were $80.4 billion as of December 31, 2021. The weighted average remaining life of our long-term contracts is 3.8 years. However, the amount and timing of revenue recognition is largely driven by customer usage, which can extend beyond the original contractual term.

I am eagerly waiting to read the 2022 annual report because I am suspecting that this time, the long-term commitments may already be around $100 billion. These are massive numbers, especially when we consider that in the first nine months of the year the operating margin is at 30%.

Why is FCF negative?

But the question is: if Amazon owns very profitable businesses, why is it FCF negative? The answer is simple: over the past three years, it has increased massively its capex. While in 2019 Amazon spent just $16.86 billion in capex, at the end of 2021, capex reached $61 billion and it could be around $67 billion once we will read the 2022 annual report.

Why is that? Amazon has poured a lot of money during the pandemic to build best-in-class logistic infrastructure especially through new warehouses.

Amazon is still very aggressive when we consider the way it invests because it wants to build almost unbeatable moats. I believe that we are still not pricing in the fact that Amazon will soon own such a network of warehouses and such a deep-understanding of logistics that it could make FedEx run out of business.

However, the company has realized that investors started to be a little concerned about this massive deployment of cash and, as tight economic conditions are expected, the company has started to cut on its workforce while reviewing its costs. This was dealt with in the last earnings call by Mr. Olsavsky:

Turning first to our North America and international segments, during the quarter, we generated over $1 billion in operations cost improvements driven by higher leverage of our fixed cost base and continued productivity improvements in our fulfillment and transportation networks. This represents a solid improvement in productivity quarter-over-quarter, though not quite as much as we had planned. We are encouraged by the progress made during the quarter, but we recognize there’s still a lot of opportunity to continue to improve productivity and drive cost efficiencies throughout our networks. We have identified initiatives that the teams continue to work hard on, and we expect to see further improvement in the quarters ahead.

Valuation

What I see is that, even though Amazon’s PE is still in the 70s, I think this metric may be misleading as Amazon is still keeping its earnings very low because of how it is spending its money. It wouldn’t take much for Amazon to just pause its investments in order to see a massive spike both in EPS and FCF. Given the numbers we have seen, we are talking about a net income that could go up 5 to 10x from the actual $11 billion. As per free cash flow, it is enough that Amazon ends funding new warehouses that we will see an improvement of at something like $50-60 billion. It is with these numbers in mind that we need to give some multiples.

Amazon has about 10 billion shares outstanding. With a net income of $11 billion, we have the 2022 EPS at $1.11. If net income were to become just $40 billion, we would have a potential EPS of $4. This is a 21 fwd PE which the company can achieve without many efforts.

Let’s look at price/free cash flow. Once Amazon ends its massive investments (as it seems it is already doing) we can assume at least $50 billion of annual free cash flow. This means that the free cash flow per share could be $5 (a price/free cash flow of 17) against the -$2.59 reported for the TTM.

Very conservative investors could argue that with these forecasts Amazon seems just rightly priced right now. But my view is that Amazon will generate way more profits than what I have assumed here.

I am long Amazon for the very long term, as this could be another of the holdings I could hand down to my children.

Stellantis: buying a dollar for less than a dollar

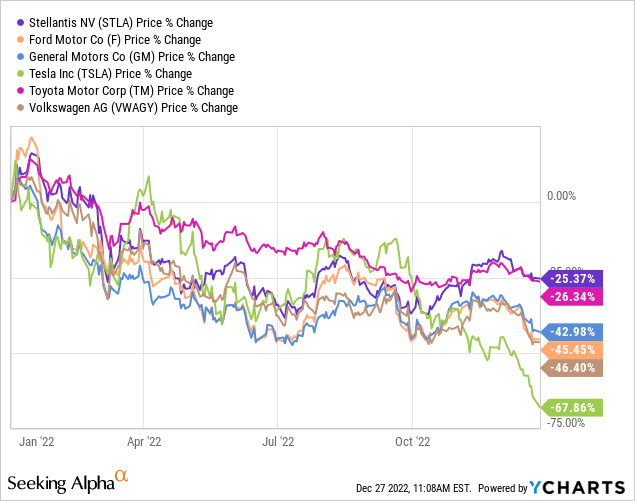

Automakers have traded down with the general market, with Tesla (TSLA) that is experiencing a strong sell-off recently. However, if we consider the major automakers we see that Stellantis (STLA) was the best performer and, even though it was down 25% in 2022, it has been able to hold up better than peers such as Ford (F) and General Motors (GM).

So far, I have shared my research in two articles that focused on two different aspects:

- Stellantis Is Swimming In Cash. In this article, I pointed out at Stellantis’ strong balance sheet that gives it a net cash position and makes the company stronger than all its peers. I also showed how new synergies will support the balance sheet without deteriorating its cash position, leaving the company with huge room to deploy its capital for investing activities and shareholder return.

- Stellantis: Its Undervaluation Is Harder And Harder To Justify. In this article, I went over my previous analysis updating it with the first half results the company published. The result was that Stellantis is executing much better than its peers and is silently becoming one of the EV leaders, while achieving best-in-class profitability.

- Understanding the Stellantis Bull-Case: A Look At Its Profitability. In this article I wanted to point out how Stellantis’ profitability is ahead of its peers and that it is even comparable to Tesla. This is because Stellantis has high synergies that are making the company save several billions. In addition, Mr. Tavares, Stellantis’ CEO, has already proven once he led PSA that he is one of the best top managers when a company has to achieve high efficiency and great scalability.

- Stellantis: High Efficiency And Profitability, Top Management, Big BEV Player. As the company reported its Q3 sales and shipments, I was once again struck that Stellantis was beating competitors such as Ford and Volkswagen. In fact, it was able to increase its shipments by 13% YoY, with revenues up 29%, showing that it is more and more able to manage both pricing and volume mix.

My bull case

My most important consideration is that Stellantis share price is absurdly cheap. Not only it is proving that it is executing better than its competitors, generating results that, sooner or later, will be crystal clear and that will lead the stock a re-rating, but also, Stellantis’ balance sheet is extremely strong

During the earnings report, we came to know that Stellantis currently holds €47 billion in cash ($49 billion). In dollars, this is equal to $15.09 per share, which is higher than the current share price of $14.64 at the time of writing. Let’s subtract the debt per share of $9.4. The net cash per share is $5.69. This means that we are actually paying $14.64 but we own $5.69, which means that we are actually paying $8.95, which is just 1.6x the expected 2023 EPS of $5.50. Furthermore, the company has a payout ratio of 14% and it distributes once a year (usually in March or in April) a dividend that, last year was $1.09. This year, given the strong free cash flow generation, I am expecting the company to return something like $1.25 per share which would be a dividend yield of 8.5%. But the real question is: what does Stellantis do with all its cash? Is it able to use it properly or not? As a shareholder, do I want the company to keep so much cash or do I want more returns? If we look at its profitability scorecard, we see that its return on total capital is 27.57% which makes me very confident that Stellantis will be able to use its liquidity to generate further profits for me that will eventually be reflected in the stock price.

Valuation

I consider that Stellantis is actually trading at 1.6 fwd PE. Even in case of huge slowdowns, the company has higher margins compared to its peers and it has a stronger balance sheet so it will be in a better position to withstand economic turmoil. In addition, during crisis, I believe cash is king and Stellantis has plenty of it. I am not saying that Stellantis needs to trade at a double digit PE. However, I think that if Stellantis were to trade just at a 4 PE it would already be a 33% upside from now and I don’t believe it would be a very generous multiple for a company that I expect to execute better than its peers in the next years. This is why I keep on saying that Stellantis will eventually trade in the $20s, with a good chance that it could reach the $30s without looking too expensive.

Disclosure: I/we have a beneficial long position in the shares of AMZN, STLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.