Summary:

- Amazon remains a buy due to its structural position in long-term portfolios, driven by innovation in cloud, AI, and robotics.

- Amazon’s diverse growth opportunities include robotics, international expansion, autonomous transportation, and partnerships with Big Tech, though regulatory and competitive risks exist.

- Amazon at $220 is less compelling, with a $2.32T market cap and a P/E of 31x for 2026, but still offers upside and long-term growth potential.

CHUYN/iStock Unreleased via Getty Images

“Be fearful when others are greedy” is one of Warren Buffett’s great phrases. I believe this quote is a good illustration of how I feel about Amazon (NASDAQ:AMZN) at the moment and what I’m going to cover throughout this analysis.

The truth is that it’s hard for a stock to be very popular and very undervalued at the same time and in recent weeks Amazon has gained (even more) recognition among investors and reached its all-time high after some announcements such as Apple (AAPL) using Amazon’s chips, such as Graviton, and the positive news about Black Friday/Cyber Monday.

Despite the good news, the $220 mark makes Amazon stock a little less attractive, decreasing the margin of safety that used to be more obvious. Still, I remain optimistic about Amazon and understand that it is practically a structural position for a long-term equity portfolio due to its many opportunities to capture growth, making it still a buy.

Innovation Powers Amazon’s Future

As the example at the beginning of this analysis already shows, having Amazon in the portfolio is no longer about exposing yourself to e-commerce or retail. Apple is using custom AI chips from AWS, and this shows the continued strength of the Cloud segment. This segment has not only been one of the pillars of Amazon’s profitability, enabling huge growth and subsidizing new investments, but it still has very high prospects, based on a CAGR of ~21% for the cloud market size, and it still has opportunities such as partnerships with Big Techs and potential new trends that drive this growth.

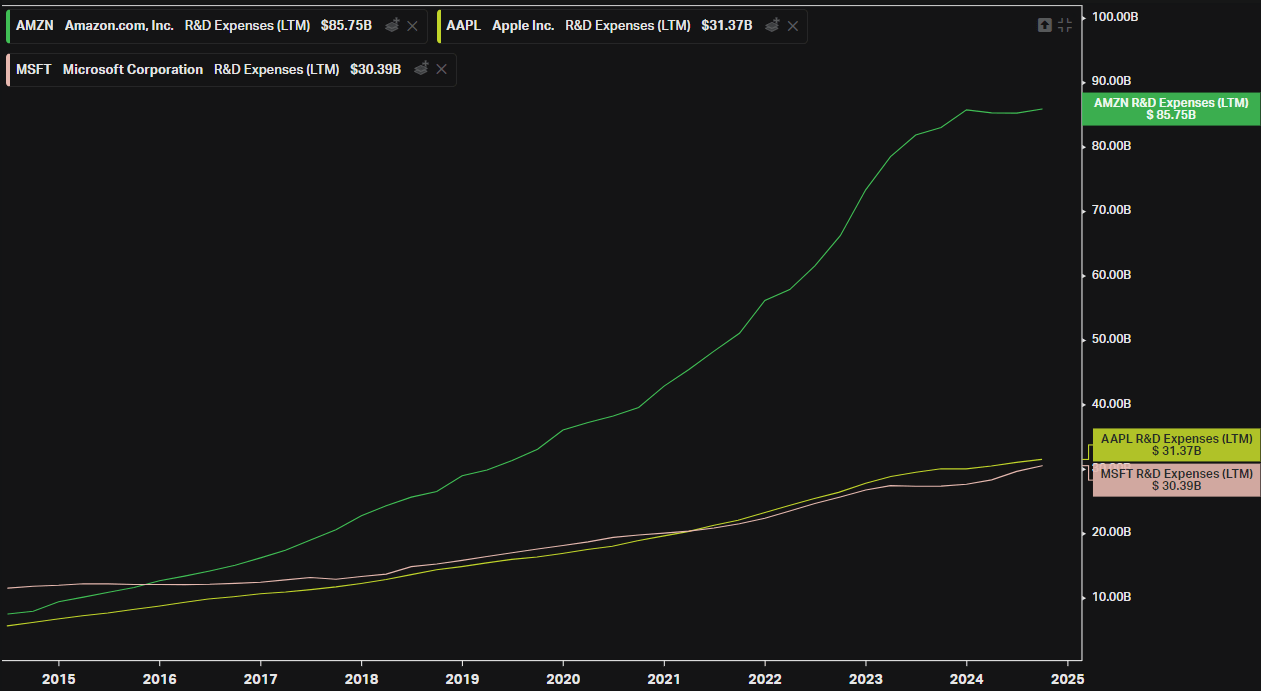

A few years ago, it was hard to envision that AI would unlock tremendous growth for cloud companies. Even without estimating it, Amazon’s share has benefited, since the company is a leader in this segment, is constantly innovating, has a good allocation of capital, and is focused on future returns. Evidencing the company’s efforts, in the last 12 months, Amazon’s R&D expenses were more than Apple’s and Microsoft’s (MSFT) combined.

Koyfin

Although these very high expenses put pressure on shareholder value generation in the short term, it is what makes these great partnerships possible, an example of which is not only with Apple but also with Meta (META) and Nvidia (NVDA), which chose the AWS infrastructure for its R&D supercomputer. The cloud market has very significant barriers to entry, but it still faces competition from Microsoft Azure and Alphabet’s Google Cloud (GOOGL), so securing these partnerships, and good relationships with the big techs, is very important for the sustainability of value generation.

Innovation is not just for the cloud segment, but also for other business lines, such as generative AI to help customers (AI shopping guides and the like), color Kindle, and robotics. I believe that robotics will be one of the main pillars of value generation in the coming years, helping mainly in margin expansion, but also indirectly in increasing the top line through better conversions, since in addition to lower cost to serve, robotics also generates better and faster service. In the earnings call, management mentioned that the newest robotics inventions simplify processes such as stowing, packing, picking, and shipping, and are being implemented in a fulfillment center in Louisiana. To paraphrase management, it’s too early to tell how much automation Amazon will have in the fulfillment network.

Though we believe we have more expansive automation and robotics than other retail peers, it’s still early days in how much automation we expect in our fulfillment network.

– Andy Jassy, Amazon’s CEO

Amazon’s Diverse Growth Opportunities

In addition to these initiatives and Amazon’s characteristics, there are even more opportunities that are a little less correlated with the core of cloud or e-commerce in North America. International expansion is one of them, with not only Amazon’s penetration into new regions generating revenue growth, but also the optimization of existing operations improving margins.

Other optionalities can also be mentioned, such as Amazon Pharmacy, which has an interesting value proposition of low prices and automatic refills being delivered to your door, and Zoox, an Amazon investment focused on autonomous transportation. In addition, there are divisions such as Amazon Prime Video, which helps with cross-selling as well as advertising revenue, smart home products, and various other initiatives.

It seems that a significant portion of the sectors in which Amazon is present could become even more concentrated (‘one player takes it most’), building barriers to entry so high that Amazon and a few other big players will be left behind, as is the case with e-commerce, where there is significant competition in some regions, but Amazon is still present and competes with more regional players such as Mercado Libre (MELI) and other Asian players, as is the case with cloud, where the market is concentrated in the big 3.

Thinking about all these trends, I hardly think Amazon is “priced to perfection”. There could be so many positive surprises that it’s practically impossible to estimate and calculate all the opportunities, nearly guaranteeing a premium valuation for the company in my view.

Amazon’s Key Risks

Even with all this quality and prospects for growth on the top line, it is still necessary to monitor some risks. As the section above mentioned, some markets can be characterized as an oligopoly, and could possibly become even more concentrated in the future. This could be positive for Amazon and its shareholders, but it is clouded by regulations. The Chrome case highlighted this.

In addition to antitrust issues that can affect long-term structural growth, competition is also relevant. Amazon is a wide-moat company and is unlikely to be disrupted by another e-commerce player like Mercado Libre, especially in the regions where it is already the leader. Even if we believe that it is possible for Amazon to gain a share of the market in countries where there is stiffer competition, this is still a factor that could hinder growth. For example, even if Amazon increases its market share in Singapore and countries with a similar situation, its competitors can limit its growth and also limit gains in scale, and therefore efficiency.

These two factors don’t seem so relevant in relation to the quality of the company and the other two sections detailing Amazon’s prospects, but they become more relevant with valuation. Although Amazon stock is not expensive in my view, it needs to be able to continue growing sustainably at an acceptable rate, and still expand margins, so that it can generate a relevant amount of net income in relation to its market cap.

From Compelling to More Reasonable: Amazon’s Valuation

In my last article, I mentioned that Amazon below the $2 trillion market cap was a compelling buy opportunity. Since then, not much has changed, I still think it’s a buying opportunity, but with the ~$2.32 trillion market cap it becomes less ‘compelling’.

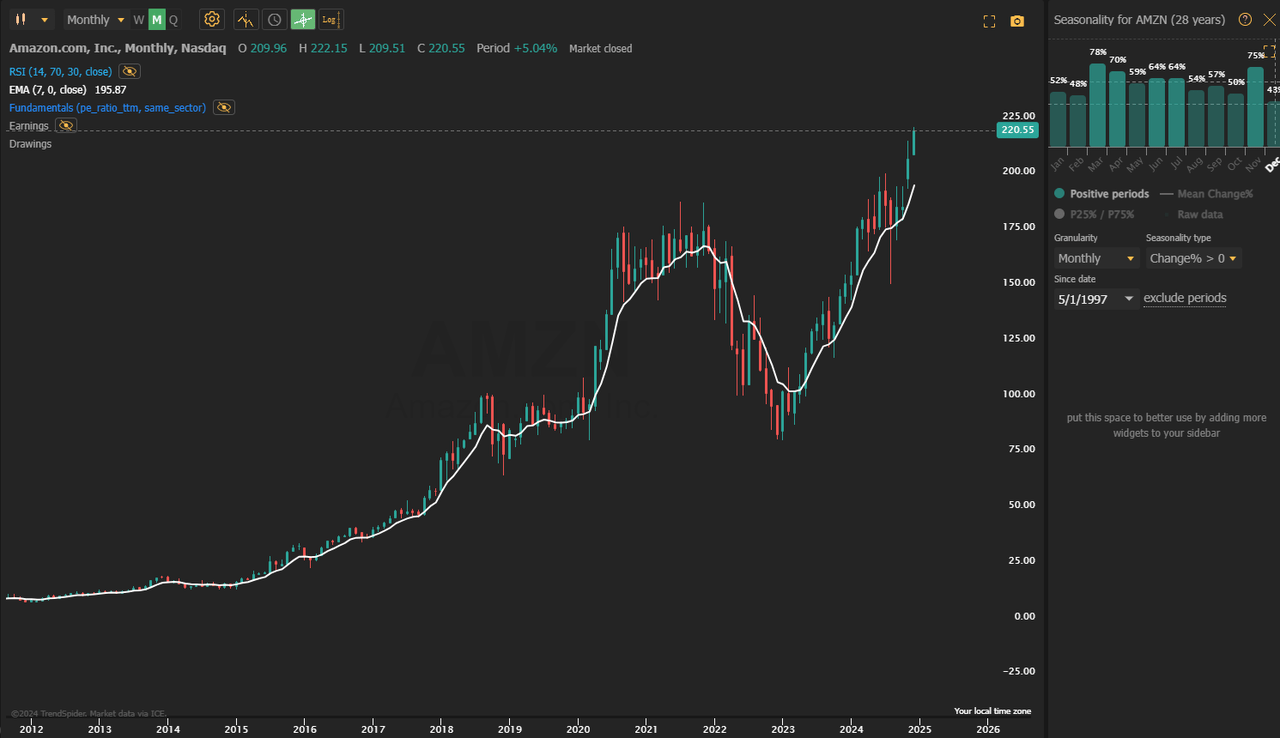

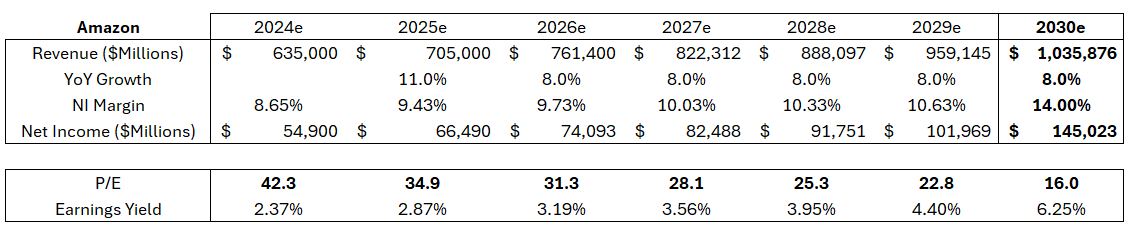

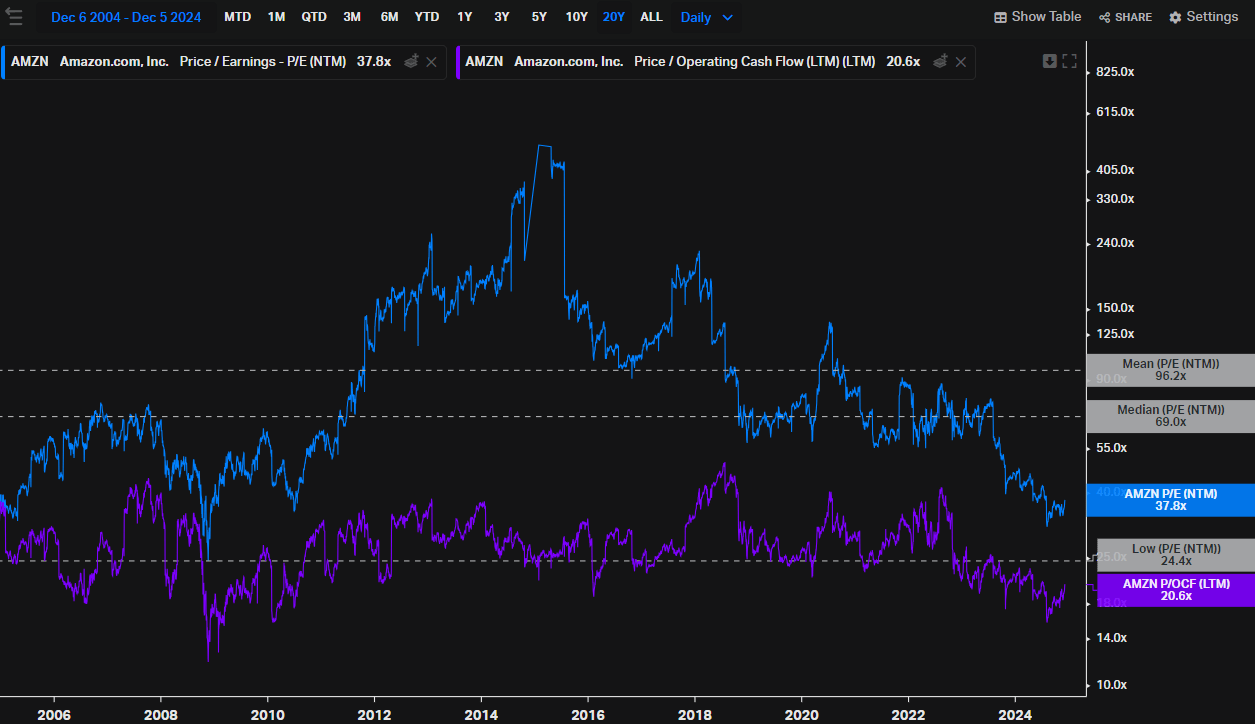

This current market cap, with projections in line with the consensus for 2024 and 2025, and from then on with reasonable assumptions, implies a P/E still of ~31x in 2026, it’s an okay level, but even if it’s far from its median of 69x in the last 20 years, it’s not a huge bargain. It’s a valuation that still depends on growth prospects being clear even in 2026 and market sentiment still being positive (which I think is likely).

It’s still possible to see an upside in the short term (slightly less than when the company was trading at less than $2 trillion). Trading at $2.5 trillion means an upside of 8%, and the company would still have a P/E of 37x for 2025, a rational level given the trends mentioned.

For the long term, the outlook for returns may be better if we consider more optimistic scenarios. If the assumptions of ~8% revenue growth by 2030 are adopted, with a terminal net income margin of 14%, a price-to-earnings ratio of 16x is found. This level implies an earnings yield of over 6% for Amazon, a very attractive level that has never been seen before, given that its low P/E NTM was 24x.

Author (Kênio Fontes)

In order to achieve a net income of ~$145 bn, the company would have to be able to capture the efficiencies mentioned, perhaps reduce R&D expenses or greatly exceed the estimated sales growth, but it’s far from impossible.

One factor that adds further comfort to this valuation is cash flow. Net income is still much lower than operating cash flow, due to depreciation and SBC (which is a factor that must be considered due to dilution), so Amazon’s P/OCF is much more interesting, currently standing at 20.6x.

Koyfin

Technical Signals Suggest Caution

One factor that supports a more cautious view of Amazon stock is some technical analysis indicators. On the monthly candlestick, Amazon is trading well above its 7-day EMA, is at an All-Time High, and also has a worse seasonality for the month of December, which together with the corrosion of the margin of safety, leads me to believe that it may be better to wait a bit before setting up large positions. Although smaller buys are completely acceptable even in this scenario, given Amazon’s quality and structural exposure to secular trends.

The Bottom Line

Putting all the pieces together, Amazon is still a compelling thesis to have in your portfolio. The company encompasses different secular trends and has a lot of value to unlock in the medium term, and could still surprise positively in the coming decades through its good capital allocation, efficiency, and innovation.

However, this doesn’t mean that Amazon Stock is still as compelling as it was a few months ago. I still consider it a buy due to the risk-mitigating qualities of the valuation, which already prices in a certain amount of growth and possible risks, but caution should be exercised with large additions to Amazon Stock due to the reduction in the margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.