Summary:

- Amazon’s stock has rallied by almost 17% in the past three months, outperforming the broader market.

- The company’s strong position in the cloud industry and focus on innovation are key factors in its continued success.

- AMZN’s e-commerce business is poised to benefit from the growing trend of digital commerce, with significant potential for growth.

- My valuation analysis suggests that the stock is more than 30% undervalued.

Drew Angerer/Getty Images News

Investment thesis

My previous bullish thesis about Amazon (NASDAQ:AMZN) aged well as the stock rallied by almost 17% over the last three months, outpacing the broader U.S. market significantly. Today I want to reiterate my “Strong Buy” rating for AMZN as I see several positive trends in recent developments and my valuation analysis suggests that the stock is still cheap. Despite intensifying competition from Microsoft in the cloud business, Amazon continues to be the by far number one player in the hot cloud industry. I like that the management addresses the competition risk with a consistent focus on innovation as AWS is rolling out new capabilities and features every week and some recent news suggests a strong focus on generative AI. Profitability continues improving and the valuation is still very attractive. All in all, I reiterate my “Strong Buy” rating for Amazon.

Recent developments

In my previous analyses of Amazon, I have consistently emphasized the company’s leadership in cloud, e-commerce, and historically strong ability to unlock new revenue streams after substantial reinvestments in the business. Therefore, today I want to look at recent developments through the prism of the company’s strengths and how the management works to protect these advantages. But first, let me review the latest earnings report briefly.

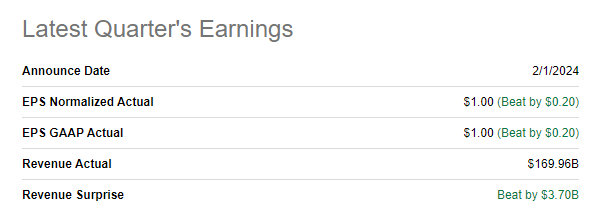

The latest quarterly earnings were released on February 1 when AMZN topped consensus estimates with a solid EPS beat. Revenue grew by 13.9% on a YoY basis, the third straight quarter of double-digit top line growth. Revenue improvement has led to expanded operating margin, from 2.34% to 7.52%, another bullish sign.

Seeking Alpha

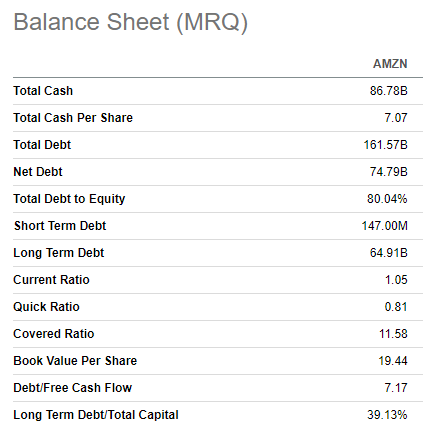

The improved operating margin allowed AMZN to generate $9 billion more in levered FCF during Q4, which is a 45% increase on a YoY basis in relative terms. To add context, SBC grew only by 14.5% over the same period. Generating strong cash flows allowed AMZN to significantly improve its financial position. The net debt position decreased to around $75 billion by the FY2023 year-end, a $27 billion improvement compared to September 30, 2023. Improving balance sheet means AMZN improves its financial flexibility to be ready to invest in new opportunities once they emerge.

Seeking Alpha

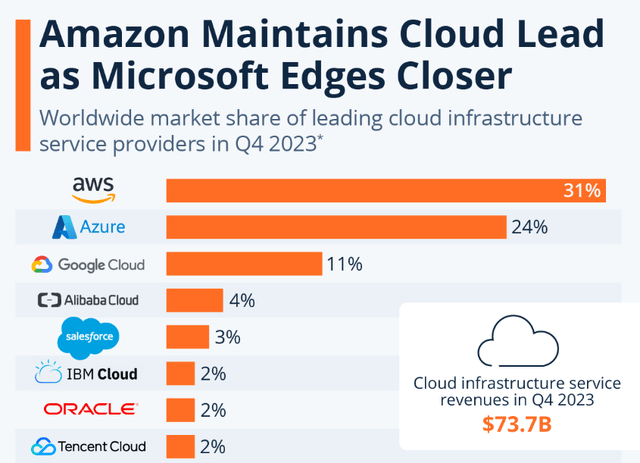

Now let me move on to recent developments beyond the financial reporting. According to Statista.com, Amazon maintained its undisputed leadership in cloud infrastructure business. The company is seven percentage points ahead of the second place, Microsoft (MSFT) and I consider it a significant gap. For example, seven percent is a combined market share in cloud of such giants as Alibaba (BABA) and Salesforce (CRM). It is crucial here that AWS is constantly evolving, and the company’s R&D team regularly add new features and capabilities to the service.

There is an AWS blog, that aims to inform the public with new AWS capabilities as they roll out every week. To me, this indicates a strong commitment from the management and engineers to innovate and preserve the company’s dominating position in the cloud industry. While most of the innovations look sophisticated to me as a person with no IT background, there are two headlines that look crucial to me as an equity analyst. Both are related to the generative AI topic.

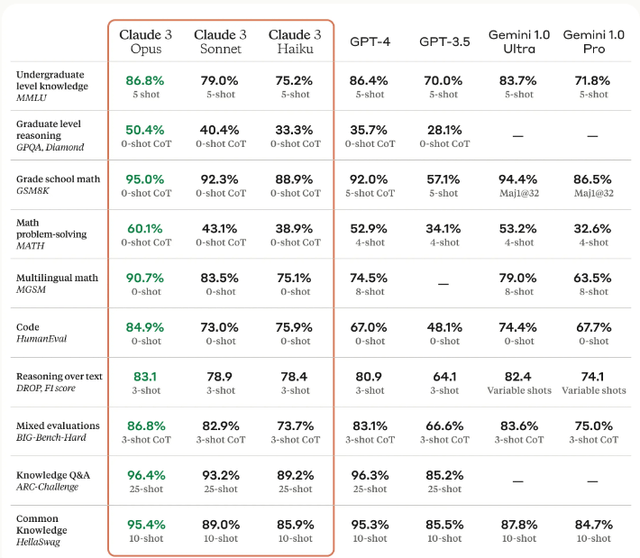

First, Amazon Bedrock is now integrated with Anthropic’s Claude 3. Considering the above screenshot, where we can see comparison of Claude versus its major rivals from the technological perspective, I think that this step makes AWS better positioned to compete with the ChatGPT-powered Azure. Second, during the recent GTC2024 conference, it was announced that AWS and NVIDIA (NVDA) are expanding their collaboration in generative AI. I consider this as another strong sign indicating Amazon’s bright prospects in the generative AI field. We all know that NVDA is one of the hottest AI companies, and I believe that Jensen Huang will make great efforts to sustain this positioning. Therefore, I think that NVDA is very selective in choosing strategic partners in the AI domain and the partnership expansion with Amazon is evidence that NVDA’s management sees a formidable partner in AWS. Amazon’s focus on generative AI is crucial to sustain its cloud leadership. According to techcrunch.com, the cloud infrastructure market grew at fastest ever pace in Q4. And the generative AI capabilities expansion is called as the major growth acceleration catalyst.

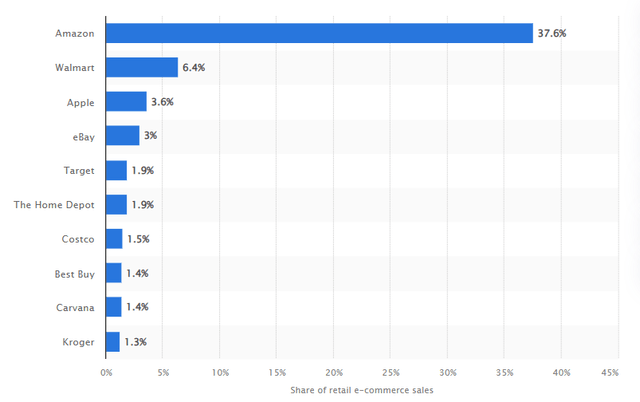

Now let me move on to the e-commerce business, where Amazon is an undisputable leader across the developed world. I consider the trend of shifting to digital commerce as secular and recent news suggest that I am likely right. In the U.S. the penetration of electronic commerce has expanded in 2023 to 22% compared to 21.2% a year earlier. According to the same source, this is a notable penetration acceleration since between FY 2021 and 2022 e-commerce penetration levels expanded by mere 20 basis points. The penetration levels acceleration is a bullish sign to me, but I also want to emphasize that e-commerce is still below even quarter of the total commerce in the U.S, the most technologically advanced country in the world, in my opinion. That said, there is still vast potential for the industry to grow and expand in the U.S. and globally. According to chainstorage.com, the global e-commerce market is expected to hit record $3.6 trillion in 2024 and the 15% growth is projected for the U.S. e-commerce market. These are the big tailwinds and as an undisputed leader, Amazon is poised to capture all the favorable industry developments.

I also recently saw an interesting information from IBM (IBM), which recommends six e-commerce trends to watch in the nearest future, where AI is the number one such trend. Given Amazon’s dominance in cloud and focus on AI, its e-commerce business is positioned to benefit from the expertise of the AWS team to leverage unmatched online shopping experience for the marketplace users. And it seems to me that AWS can also benefit from having an e-commerce “brother”. According to IBM’s article, “AI algorithms can analyze vast amounts of customer data, including browsing history, purchasing behavior, and demographic information to deliver personalized product recommendations and tailored shopping experiences”. Considering that Amazon’s e-commerce business has more than 300 million users and around 10 million merchants, the platform indeed has vast amounts of data which can also help to improve the quality of AWS’s tools as well. Therefore, I see a big synergetic potential between the e-commerce business and the AWS.

Valuation update

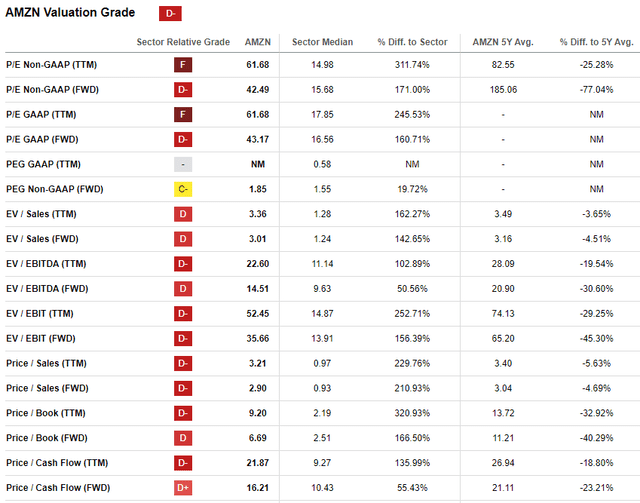

AMZN rallied by 82% over the last twelve months and has solid +18% year-to-date. Valuation ratios are still below historical averages across the board, indicating that current share price is attractive from the perspective of ratios. I recommend ignoring comparison of AMZN’s ratios to the sector median because the company’s strategic positioning, blend of assets, and scale are unmatched. Therefore, the stock will likely be inherently far more expensive than the sector median.

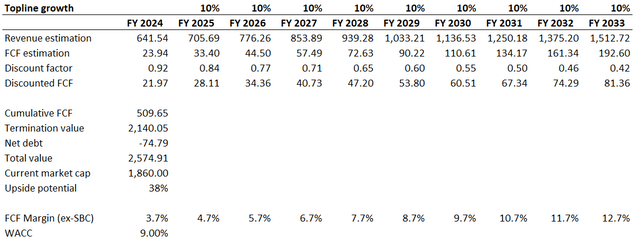

However, looking at multiples is not enough for me in figuring out valuation reasonableness. To get more conviction I must simulate the discounted cash flow [DCF] model, as I did previously. I use the same 9% discount rate as I did in December 2023 because the expected three rate cuts by the Fed were already incorporated in my previous DCF. I use a $641.5 billion revenue for the first year, FY 2024, according to consensus estimates. For the base case scenario, I project a 10% long-term revenue CAGR. This is approximately in line with long-term consensus. The biggest improvement here is the free cash flow [FCF] margin ex-stock-based compensation [ex-SBC]. I reiterate the 100 basis points yearly expansion, but the upgrade is related to the base year. I usually use a TTM metric for the base year and last time it was 2%, while considering the latest quarter it improved to 3.7%.

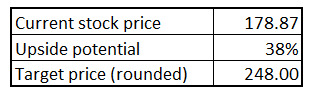

Under my base-case scenario, the business’s fair value is around $2.6 trillion. This is 38% higher than the current market cap, indicating a substantial upside potential. Therefore, I upgrade my target price from $186 to $248.

Author’s calculations

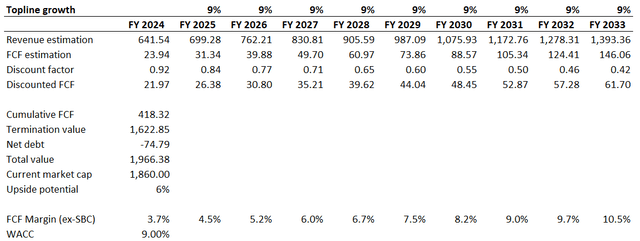

I also want to emphasize that the stock is undervalued even under less optimistic assumptions. For instance, if I downgrade the next decade’s revenue CAGR to 9% and FCF expansion rate to 75 basis points, the fair value of the business is still slightly below $2 billion. Therefore, I believe that the margin of safety is solid at current share price levels.

To conclude, I think that both valuation ratios and the DCF approach demonstrate that AMZN is attractively valued. The stock is undervalued even with pessimistic growth and FCF improvement assumptions, which suggests solid margin of safety.

Risks update

The AI frenzy continues fueling the stock market rally and the S&P 500 (SPX) has hit new all-time highs multiple times this year. While I do not consider the current situation in the stock market as a bubble, history teaches us that corrections after relentless rallies are inevitable. According to the Fear & Greed indicator from CNN, we are currently not very far from the “Extreme Greed” which indicates that the stock market is highly likely overbought. That said, the probability of the correction is elevated and since AMZN is not in the vacuum, the stock is likely to follow the broader market in case of a temporary drawdown.

Having a number one position in cloud business does not mean that AWS is free from competition. The company’s cloud business is pursued by giants like Microsoft (MSFT) and Google (GOOG), which are formidable competitors. And if Google’s Cloud business is lagging notably in terms of the market share, Microsoft is closing the gap and gained 2% market share in Q4 2023. You should not be a generative AI guru to understand that ChatGPT is by far the most widely spread name among all the peer chatbots. Thanks to its partnership with OpenAI, Microsoft is in the pole position of using ChatGPT’s algorithms and integrating them with its products, including the Azure cloud service. While Anthropic’s new chatbot release, which I mentioned in “Recent developments” suggests that it is comparable with ChatGPT across key technological metrics, there is a great extent of uncertainty whether its Claude solution will become as popular as ChatGPT became within just few months. The competition risk in cloud is elevated, but I like that Amazon is addressing this risk with innovation, which I described above. Moreover, the seven percentage points gap between Amazon and Microsoft in terms of cloud market share is quite wide and dethroning AWS does not look feasible considering the management’s focus on AI.

Bottom line

To conclude, I reiterate my “Strong Buy” rating for AMZN. The company continues focusing on innovation to protect its leadership in cloud and e-commerce and both these lines of business are highly likely to benefit from the generative AI capabilities expansion. I see great synergetic potential for both segments and my valuation analysis suggests that the stock is deeply undervalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.